It was always fun to prepare for our annual Outcomes conference at Express Scripts. What research did we have? Who would it surprise? How would it impact us or clients? Anyways, all of these presentations and even some audio are on the website (2004, 2005, 2006, 2007). I pulled a few slides / graphs with some key points below.

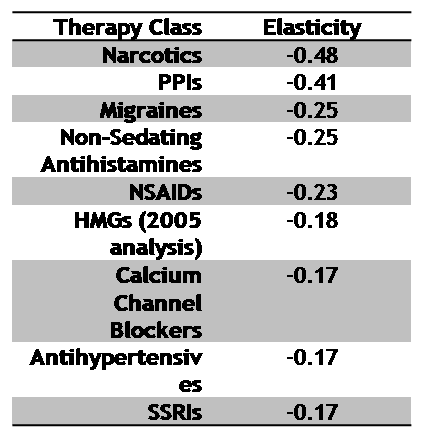

Is there compliance elasticity with prescription drugs? Of course. The research team replicated a published study and found results that were much less dramatic and echoed prior research supporting the following. (elasticity in this case meant that for each 100% increase in the cost of the drug what was the decrease in utilization of the drug)

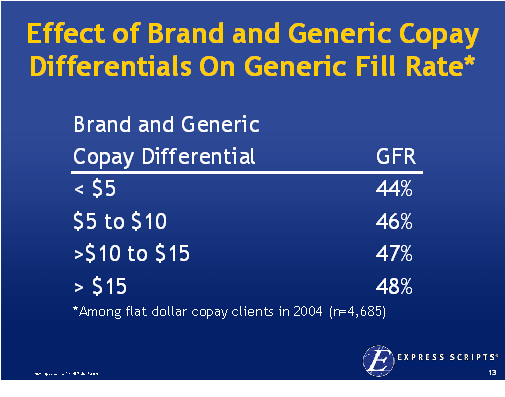

The differential between your brand and generic copays makes a difference in your generic fill rate (GFR). The data supports the null hypothesis that would say that the greater the difference (i.e., the more the patient saves) the higher the use of generic drugs.

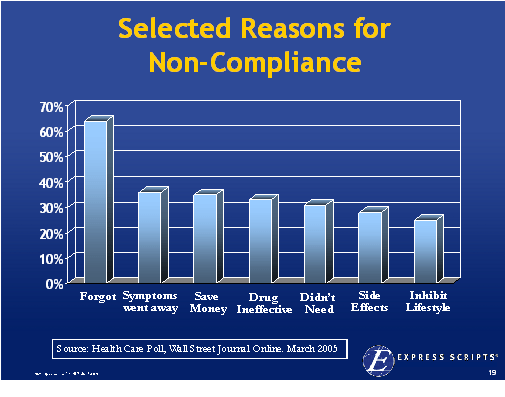

Why are people non-compliant (actually from the WSJ)?

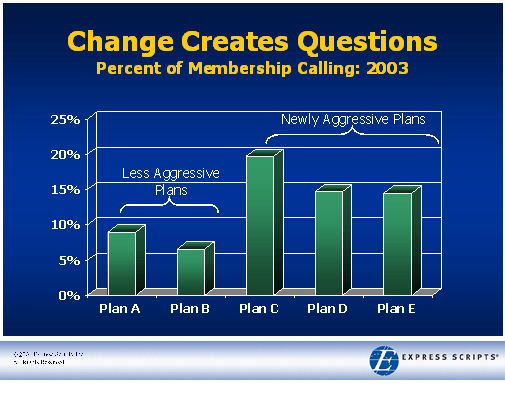

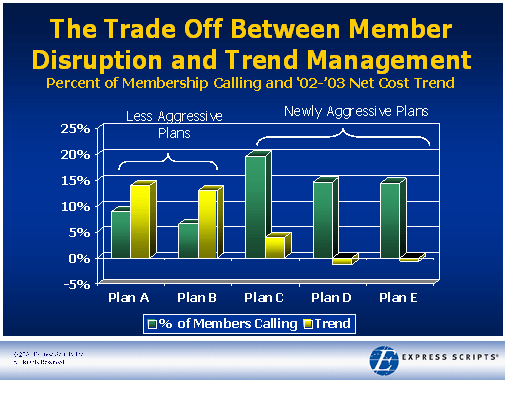

A question I often hear is what percentage of people call into the call center. Obviously this varies by population, but as shown below, it also greatly matters by how aggressive the plan design is and how many changes they are making.

The next question should be whether disruption (measured by the proxy of inbound call volume) is worth it. So, the slides show the trend versus the call volume.

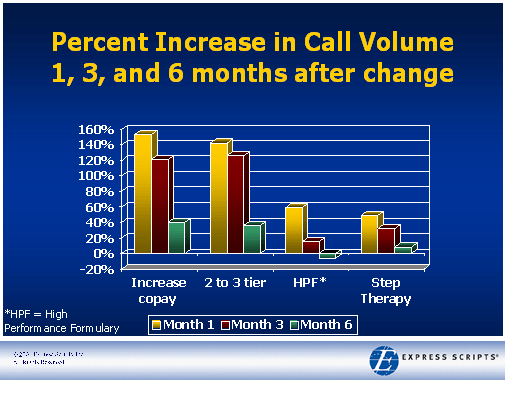

Sticking with the theme, the question is how long does the disruption last. Not too long.

It is never easy to get information out to patients in a timely and effective manner, but the question that also had to be asked is whether they wanted the information. From a 2002 Express Scripts survey:

- 74% “feel more valued” when they understand the rationale behind their benefit design.

- 85% “want information” about how to save money on their prescription drugs.

- 80% feel “more in charge” when they understand choices

December 13, 2007

December 13, 2007

Trackbacks/Pingbacks

[…] they have learned from their data. I have talked about Express Scripts research and reports (here, here, and here) and Medco’s report (here). [Note: For simplicity sake, I am not going to put all […]