First CVS Caremark began offering mail order (90-day Rxs at lower cost) at retail stores (aka Maintenance Choice), and now with Specialty Connect, they are doing the same thing in specialty pharmacy.

Specialty Connect was a pilot program that won the PBMI Innovation Award this year. What it does is to allow consumers the choice of getting their specialty medications at either the CVS Caremark specialty pharmacy or picking them up at a local store. This is a change since: (1) many pharmacies don’t typically stock specialty medications; (2) many PBMs require use of a specialty pharmacy (i.e., mail); and (3) specialty medications typically require some addition handling and counseling which may be difficult to do at a local store level.

But, this is a very consumer friendly solution, and it has had some positive initial success. Here’s a quote and some data from their press release: (some additional data in the original PBMI document)

“Specialty Connect helps specialty patients with these critical therapies by helping to eliminate common challenges they had often faced and by offering them flexibility and choice,” said Alan Lotvin, M.D., Executive Vice President of Specialty Pharmacy for CVS Caremark. “The program makes it easier and more convenient for patients to submit and receive their specialty prescriptions either through CVS/pharmacy or by mail. What’s more, it increases medication adherence, improves outcomes and lowers overall health care costs for specialty patients and payors.”

Specialty Connect has demonstrated high levels of patient satisfaction as well as improved adherence for specialty pharmacy patients. In fact, pilot program results demonstrated a 13 percentage point increase (from 66 to 79 percent) in patients who were optimally adherent to their medication. Early program results also show that the program is improving upon the patient experience and reducing traditional barriers to getting started on medication, with 97 percent of patients successfully starting on therapy after only their first interaction at a CVS/pharmacy store. In addition, more than half of patients, many of whom were existing mail service pharmacy customers, chose to pick up their specialty medications at CVS/pharmacy.

Hopefully, this and many of the other CVS Caremark successes will make people wonder why they ever wanted to break the company up into different business units. As I’ve said for years on the blog, in the press, and to many Wall Street analysts, the integration of the business units can offer huge value once the synergies are realized and the consumer experience is integrated.

The other interesting things that I thought about when reading about Specialty Connect were:

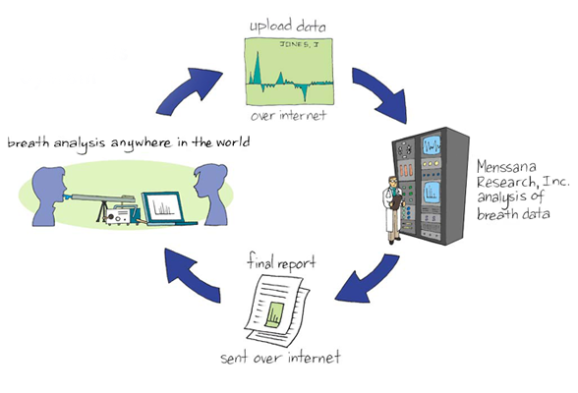

- It’s great to offer a centralized call center to support specialty but will that be enough at the local store level? Will patients want some type of higher touch local presence? Can that be achieved through a telemedicine or kiosk type solution?

- I remember about 5 years ago when most specialty people thought they had to treat patients with specialty diseases differently. I kept trying to argue that they are just like other consumers. You should think about the experience across channels and at the patient not just condition level. This seems to signal a movement towards this. They are using SMS (text messages) and other channels to communicate with them which was a foreign concept a few years ago.

May 31, 2014

May 31, 2014