Prime Therapeutics is a PBM owned by the Blues. Several years ago, they insourced their specialty pharmacy operations from Walgreens. This has been part of their transformation which was a result of new leadership under Eric Elliott who used to run Cigna’s PBM.

As a PBM that’s owned by the Blues, I’ve talked about them before as an interesting cross of a standalone PBM (ala Express Scripts) and an integrated PBM (ala Humana Rightsource).

As everyone in the industry knows, the shift in pharmacy has moved from innovator drugs in the traditional space to innovation in the specialty or biopharmaceutical space. This includes both branded products and biosimilars. This is critical path for employers, payers, and PBMs.

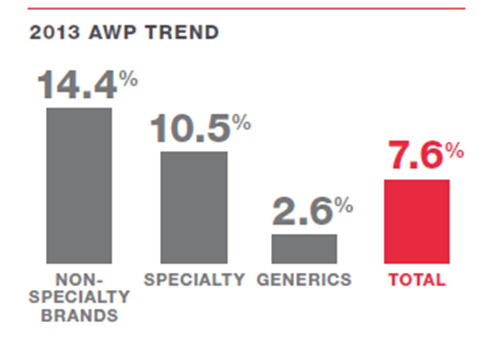

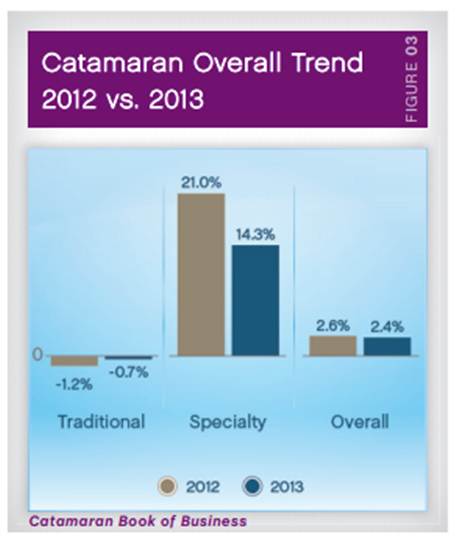

A traditional strategy of promoting generic drugs and mail order or preferred pharmacies just doesn’t cut it anymore. Although specialty drugs are still only used by about 1% of the population, they are the fastest growing area in healthcare. According to Prime Therapeutics Drug Trend Report, their clients saw a 19% increase in specialty spending last year. And, specialty drugs now account for over 30% of all the drug spend.

If you look at the drug pipeline, this is going to continue to explode. I just met with a series of specialty pharmacies to discuss their offerings and strategies. There are several drugs coming that claim to “cure” some of these specialty conditions are at least meaningfully impact the patient outcomes in ways that weren’t even envisioned years ago. And, I think we all know that’s not going to come cheap!

So, tomorrow (10/10/13), Prime is releasing a new report – “Specialty: Today & Tomorrow” which highlights Prime’s specialty drug trend over the past year and recommends strategies that high-performing plans use to manage the steady rise in these costs. [My comments in brackets.]

1. Bridge the benefit divide: use combined pharmacy and medical benefit data to see the full scope of specialty spending and seek solutions. [Critical. IMO – No one is doing this well yet, but this is something that everyone’s trying to figure out.]

2. Focus on the biggest issues: use combined data to target the most urgent issues and focus on the areas that can provide the greatest return on investment. [I’d expand this to be an integrated set of data – medical, pharmacy, lab, patient reported, EMR, etc. This has to then be integrated with tools for depression screening and others to make sure the patient is supported.]

3. Narrow the specialty network: use cost-effective distribution channels and limit the number of distributors to secure lower prices. [Fairly obvious. I think many people are doing this. I would expand on this to include looking at site of distribution for savings.]

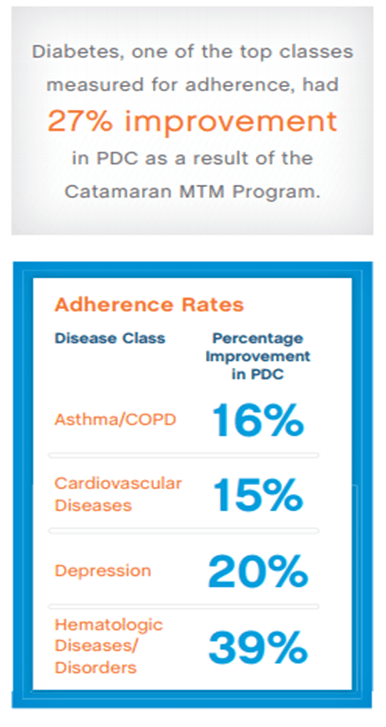

4. Embrace a management mindset: make sure the right specialty drugs are used properly by those who will benefit the most. [Agree. I’ve talked about this before. Some of these drugs still have huge adherence issues which limits their effectiveness leading to massive cost issues. This is why some people are using only 14-day fills.]

5. Promote preferred drug use: build plans that encourage desired behaviors. [I think we’re finally at a point where we’ll see specialty formularies, more rebating, and with bio-similars there may be more utilization management programs.]

6. Protect members from high costs: limit members’ out-of-pocket costs and use available tools to reduce the burden on highly vulnerable members. [Critical. The specialty pharmacy has to help the member limit their financial exposure.]

7. Pick the right partner: select a trusted advisor with comprehensive capabilities and deep connections to help anticipate and address specialty drug challenges. [Agree. An aligned philosophy and strategy to work with these critical patients is fundamental. This small group of patients drives most healthcare costs.]

A copy of the specialty report is now available on Prime’s website and short videos about each of the seven steps can be found on Prime’s You Tube channel. This new report is the first specialty-focused report published by Prime. It follows Prime’s 2013 Drug Trend Insights infographic released in May. Visit the Industry Insights of Prime’s website for more drug trend information.

February 17, 2015

February 17, 2015