One of the big issues in healthcare communications which is a rate limiting factor on health engagement is the language we use with patients. Here’s my attempt to talk about diabetes using different frameworks to drive home why this is important.

A clinical discussion:

You have diabetes mellitus. Because of that, you’re at increased risk for multiple co-morbidities including atheroscelerosis, hypertension, periodontal disease, retinopathy, neuropathy, and renal disease. Diabetes is considered a progressive disease. As our first line, I’m going to start you on monotherapy. Based on comparative effectiveness, this has the best clinical end points and lowest DUR issues. You will also need to maintain glycemic control and modify your physical activity level and caloric intake to minimize the long-term probability of getting ESRD and to lower your risk of myocardial infarction.

A mHealth discussion:

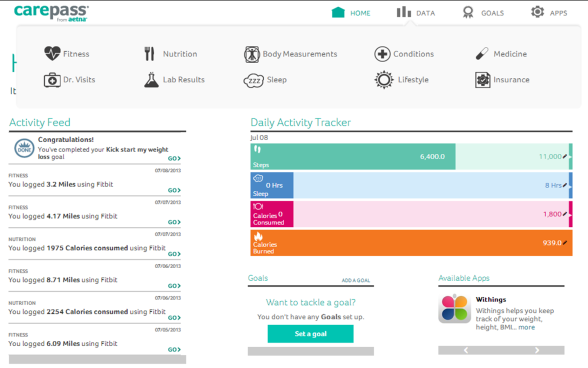

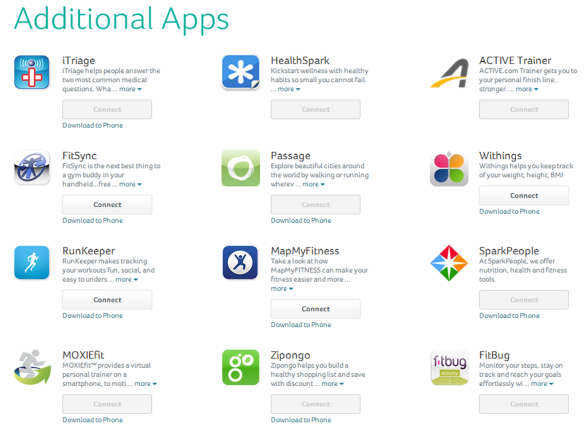

Based on our predictive algorithm and quantified self-tracking, I’m 90% confident that you have diabetes. To manage your diabetes, there are numerous widgets for assessing your risk along with online tools leveraging embodied conversational agents to support your efforts to self-monitor your condition. There are also apps which you can download which use gamification and location based services to address your intrinsic motivation to change. These tools will leverage the Trans Theoretical Model to understand your readiness for change and tailor messaging to you. Additionally, there are clinical staff available to help address your symptoms post-encounter.

A plain language discussion:

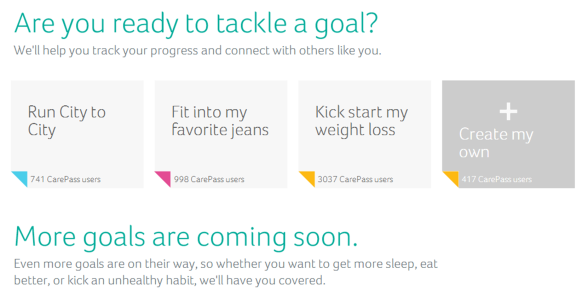

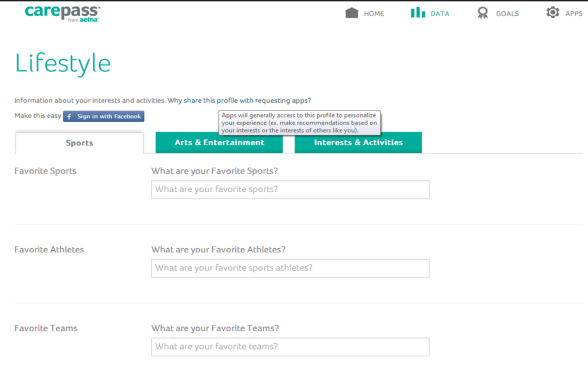

As you know, diet and exercise are important to maintain a healthy lifestyle. The test I had you take confirms that you have diabetes. Diabetes is a manageable disease, but it can lead to other health problems including gum disease, high blood pressure, and problems with your heart. We are going to start you on a prescription called metformin which will help to manage your diabetes, but you will still need to make some lifestyle changes. There are lots of technology tools on the Internet and your smart phone that can help you. I’d be happy to show you a few. They will help you track your calories, your exercise, and provide you with reminders about taking your medication. They can also help you learn about diabetes and answer some of your questions.

(And the above is at 7.8 grade level which is still too high for Medicaid and many programs.)

Here’s a summary from the CDC on Health Literacy…

What is Health Literacy?

The Patient Protection and Affordable Care Act of 2010, Title V, defines health literacy as the degree to which an individual has the capacity to obtain, communicate, process, and understand basic health information and services to make appropriate health decisions. This definition is almost identical to Healthy People. The only difference is the addition of “communicate” to the legislative definition.

Why Does Health Literacy Matter?

Every day, people confront situations that involve life-changing decisions about their health. These decisions are made in places such as grocery and drug stores, workplaces, playgrounds, doctors’ offices, clinics and hospitals, and around the kitchen table. Obtaining, communicating, processing, and understanding health information and services are essential steps in making appropriate health decisions; however, research indicates that today’s health information is presented in ways that are not usable by most adults. “Limited health literacy” occurs when people can’t find and use the health information and services they need.

- Nearly 9 out of 10 adults have difficulty using the everyday health information that is routinely available in our healthcare facilities, retail outlets, media and communities.1

- Without clear information and an understanding of the information’s importance, people are more likely to skip necessary medical tests, end up in the emergency room more often, and have a harder time managing chronic diseases like diabetes or high blood pressure.2

What Needs to Be Done to Improve Health Literacy?

We can do much better in designing and presenting health information and services that people can use effectively. We can build our own health literacy skills and help others—community members, health professionals, and anyone else who communicates about health—build their skills too. Every organization involved in health information and services needs its own health literacy plan to improve its organizational practices. The resources on this site will help you learn about health literacy issues, develop skills, create an action plan, and apply what you learn to create health information and services that truly make a positive difference in people’s lives.

References

1 Kutner, M., Greenberg, E., Jin , Y., & Paulsen, C. ( 2006 ). The health literacy of America’s adults: Results from the 2003 National Assessment of Adult Literacy (NCES 2006-483). Washington, DC: U.S. Department of Education, National Center for Education Statistics.

2 Rudd, R . E., Anderson, J . E., Oppenheimer, S., & Nath , C. (2007). Health literacy: An update of public health and medical literature. In J. P. Comi ngs, B. Garner, & C. Smith. (E ds.), Review of adult learning and literacy (vol . 7) (pp 175–204). Mahwa h, NJ: Lawrence Erlbaum Associates.

September 2, 2014

September 2, 2014