After Aetna, Cigna, and Wellpoint all moved into different PBM relationships with CVS Caremark, CatamaranRx, and Express Scripts, it certainly marked the end of much of the debate on whether a captive PBM (i.e., owned and integrated with the managed care company) could compete with the standalone PBMs. There are really only a few big integrated models left including Humana, OptumRx (as part of UHG) and Kaiser with Prime Therapeutics having a mixed model of ownership by a group of Blues plans but run as a standalone entity. Regardless of where the latest Humana rumors take them, it made me think about what the market has become with these new relationships.

- Scale matters. All of these relationships and discussions show that there are clear efficiencies in the marketplace.

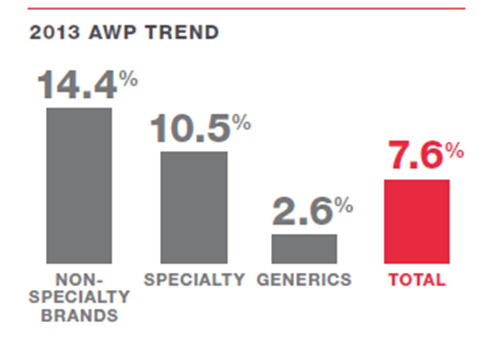

- Drug procurement (i.e., negotiating with the manufacturers (brand and generic) and the wholesalers)

- Pharmacy networks (i.e., getting the lowest price for reimbursement with the retail pharmacies)

- Rebating (i.e., negotiating with the brand and specialty drug manufacturers for rebates)

- Outcomes matter. If scale was all that mattered, there be no room for others in the marketplace. But, we continue to see people look at this market and try to make money. That means that “outcomes” matter in different ways:

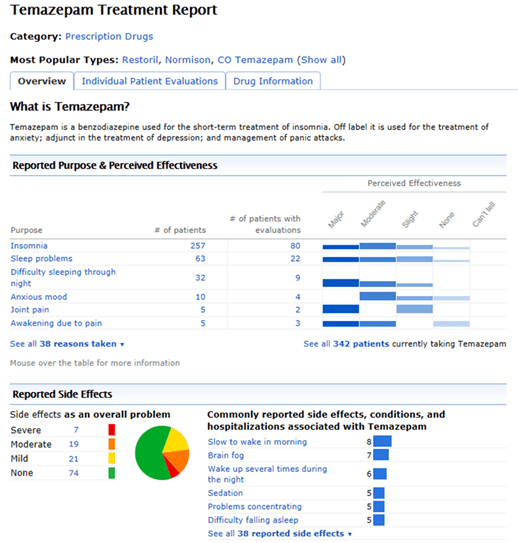

- Clinical outcomes (i.e., does the PBM have clinical programs or intervention strategies that improve adherence and/or can demonstrate an ability to lower re-admissions or impact other healthcare costs?)

- Financial outcomes (i.e., does the PBM have innovative programs around utilization management (step therapy, prior authorization, quantity level limit) or other programs like academic detailing that impact costs?)

- Consumer experience (i.e., does the PBM’s mail order process or customer service process or member engagement (digital, call center, etc) drive a better experience which improves overall satisfaction and overall engagement…which drives outcomes?)

- Physician experience (i.e., does the PBM engage the physician community especially in specialty areas like oncology to work collaboratively to drive different outcomes?)

- Data (i.e., does the PBM use data in scientifically valid but creative ways to create new actionable insights into the population and the behavior to find new ways of saving money and improving outcomes?)

While I’ve been beating the drug of the risks of commoditization to the market for years, I’m going to make a nuanced shift in my discussions to say that there is still a risk of commoditization and driving down to the lowest cost, but we may be quickly approaching that point. What I’m realizing is that there can be a two tier strategy where you commoditize certain areas of the business and let the other areas be differentiated. And, that this can be a survival tactic where you either outsource the core transactional processes to one of these low cost providers or figure out how to be one of them while creating strategic differentiation in other areas.

Maybe you can eat your cake and have it too!

June 27, 2014

June 27, 2014