Dr. Kraft (@daniel_kraft) recently spoke at FutureMed and talked about the prescribing apps era. I’ve talked about this concept many times, and I agree that we are rapidly moving in that direction. And, there’s lots of buzz about whether apps will change behavior and how soon we’ll see “clinical trials” or published data to prove this.

From this site, you can get a recap, but here are the key points that he made:

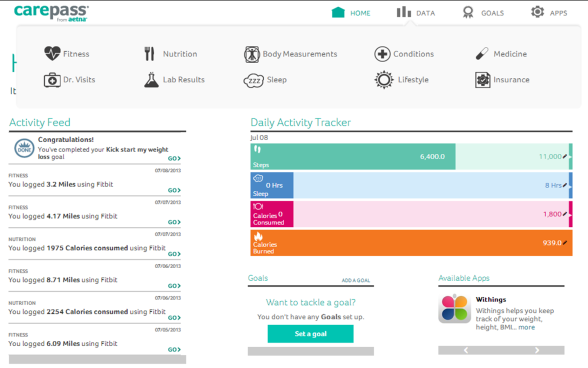

1) Mobile Phones (quantified self) are becoming constant monitoring devices that create feedback loops which help individuals lead a healthy lifestyle. Examples include; monitoring glucose levels, blood pressure levels, stress levels, temperature, calories burned, heart rate, arrythmias. Gathering all this information can potentially help the patient make lifestyle changes to avoid a complication, decrease progression of a particular disease, and have quality information regarding his physical emotional state for their physician to tailor his treatment in a more efficient manner.

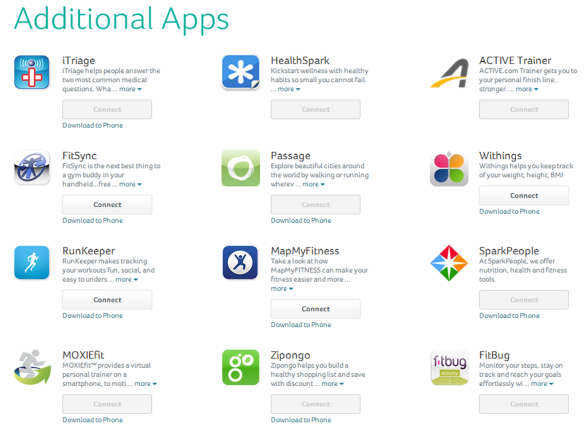

2) The App prescription ERA: Just as we prescribe medications prescribing apps to patients will be the future. The reason why this is important is that apps created for particular cases can help the patients understand their disease better and empower them to take better control.

3) Gamification: using games in order to change lifestyle, habits, have been mentioned before. A very interesting concept was that created in the Hope Labs of Stanford. The labs created a game in which children would receive points after there therapeutic regiment, once points were optioned they could shoot and attack the tumor. Helping with the compliance rate of the treatments

4) Lab on a chip and point of care testing

5) Artificial Intelligence like Watson and its application in medicine.

6) Procedure Simulation: Several procedures done by medical professionals follow (not 100%) a see one, do one teach one scenario. Probably very few people agree with this concept and that is why simulation has great potential. In this case residents, fellows in training can see one, simulate many and then when comfortable do one.

7) Social Networks and Augmented Reality

At the same time, a recent ePocrates study hammered home the point that while this is taking off physicians don’t have a mechanism for which ones to recommend and why.

According to the Epocrates survey, more than 40 percent of physicians are recommending apps to their patients. In terms of the apps being recommended, 72 percent are for patient education, 57 percent are lifestyle change tools, 37 percent are for drug information, 37 percent are for chronic disease management, 24 percent are for medical adherence and 11 percent are to connect the patient to an electronic health record portal.

Physicians also have several different sources for identifying which apps to recommend to their patients. According to the survey, 41 percent get advice from a friend or colleague, while 38 percent use an app store, another 38 percent use an Internet search engine, 23 percent learn of an app from another patient or patients, and 21 percent use the app themselves.

That said, the survey also notes that more than half of the physicians contacted said they don’t know which apps are “good to share.”

As I’ve discussed before, this is somewhat of the Wild West. Patients are buying and downloading apps based on what they learn about. They’d love for physicians, nurses, pharmacists, and other trusted sources to help them. But, those clinicians are often not technology savvy (or at least many of the ones who are actively practicing). There are exceptions to the norm and those are the ones in the news and speaking at conferences.

IMHO…consumers want to know the following:

- Which apps make sense for me based on my condition?

- Will that app be relevant as I move from newly diagnosed to maintenance?

- Should I pay for an app or stick with the free version?

- Is my data secure?

- Will this app allow me to share data with my caregiver or case manager?

- Will this app have an open API for integration with my other apps or devices?

- Is it intuitive to use?

- Will this company be around or will I be able to port my data to another app if the company goes away?

- Is the information clinically sound?

- Is the content consumer friendly?

- Is it easy to use?

- Is there an escalation path if I need help with clinical information?

- Will my employer or health plan pay for it for me?

- Is my data secure?

And, employers and payers also have lots of questions (on top of many of the ones above):

- Is this tool effective in changing behavior?

- Should I promote any apps to my members?

- Should I pay for the apps?

- How should I integrate them into my care system?

- Do my staff need to have them, use them, and be able to discuss them with the patient? (Do they do that today with their member portal?)

September 2, 2014

September 2, 2014