I found this Hewitt data in a presentation by UHPS (United Healthcare Pharmaceutical Services) which is the subsidiary of United Healthcare that manages the Medco relationship (they still outsource their pieces including mail and claims adjudication) and the RxSolutions (former Pacificare PBM). It was from a slide deck given by their National Sales Director at an AeA Seminar on 9/20/07.

[On an interesting side note, UHPS recently won a 1M life competitive contract for PBM services which I believe is one of their biggest wins as a PBM selling outside their existing base.]

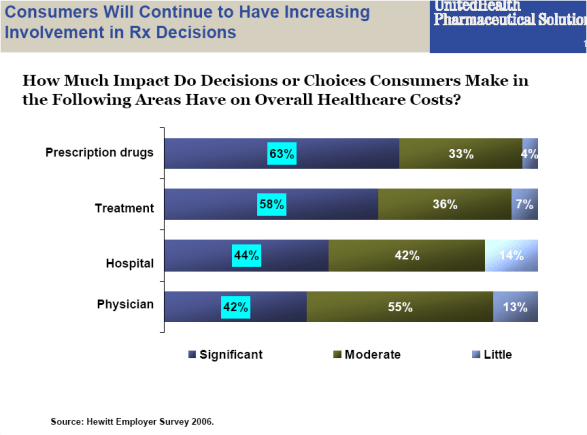

I think the key point from this image is that patients have the most influence over the drugs they utilize. With multiple drugs for any therapy and lots of information out there, patients can have an intelligent dialogue with their physician about their choices. This becomes much harder for certain medical situations.

If you get fascinated by the space, they talk about a few of their differences:

- A different formulary strategy – evidence based, real-time changes, place drugs on any tier (e.g., generic on 3rd tier if appropriate)

- They recommend a $35 differential between Tier 2 and Tier 3 (which probably means that their clients are price neutral if the patient chooses Tier 3…they may even be better off as the rebates to be at Tier 2 are probably much less than $35)

- They recommend a 2.5x to 3x multiplier for mail order (i.e., take your 30-day copay and multiply it by2.5 or 3 to determine your 90-day copay). This probably means very little mail adoption, but that patients that use mail will save the payor money on brands. They probably save on generics no matter what.

It is interesting to see the different models emerging in the PBM space. For a while the companies were highly clustered and faced with a price path. Now, you have a few key differences:

- CVS / Caremark has the play of integrating retail and mail

- Medco is going down the path of disease state differentiation

- Express Scripts latest presentations have focused on consumers and engaging them

- United is talking about their different approach along with the benefit of an integrated data set and captive PBM working with the managed care entity. If they figure out the evidence-based strategy and convince their clients of the value of this, they may be able to get a jump start on the market from a clinical perspective.

The one constant for all of them is communications and engaging the consumer. Interesting. A friend of mine who works with benefit consultants told me that that is the hot topic he hears everywhere today. They want to know how to engage them, what the value is, and how to prove it.

February 7, 2008

February 7, 2008

No comments yet... Be the first to leave a reply!