[Note: I’m republishing a few Deloitte blogs that they are no longer hosting as part of the new website.]

Published Date : September 29, 2016

Author: Deloitte

Categories : Health care providers, Health IT, Value-based care

Hispanics are a large and fast growing segment of the US population. As of 2014, there were over 55 million Hispanics in the US with the population projected to grow to 119 million by 2060. From a health care perspective, they’ve often been underrepresented and underserved. As the Hispanic population grows and ages from their current average age of 29, health plans and prescription benefit managers (PBMs) should consider learning more about their expectations, needs, and challenges.

In an effort to engage with Hispanic consumers, many health plans offer language lines or interactive voice response options in Spanish and translate printed materials. However, consumers often complain that translations are too literal and would prefer something more conversational. Though studies show that language barriers can be linked to worse health outcomes, having the same language doesn’t mean that all Hispanics share a common history, health care experience, or even the same risk of a condition like diabetes. For example, while Hispanics are nearly two times more likely than non-Hispanic whites to have diabetes, there are variances across the subpopulations with 18.3 percent of Hispanics of Mexican decent having diabetes versus 10.2 percent for Hispanics of South American decent. But since lifestyle and prevalence of conditions like diabetes varies within the Hispanic population, it’s important for health plans and providers to understand these differences and nuances in order to effectively engage them and their families.

Beyond language and economic constraints, there can also be cultural barriers for Hispanics using the US health care system. Our recent 2016 Consumer Priorities in Health Care Survey found that surveyed Hispanics valued two key interactions relative to non-Hispanic whites:

1. A health care provider who gives helpful updates on their condition or status to family during and after a procedure and

2. A doctor or health care provider who helps them and their family create a care plan or wellness plan that fits with their lifestyle.

Health plans should consider these types of cultural differences to better understand ways to engage with Hispanics around their health care.

Additionally, as we dug into the data from the Deloitte Center for Health Solutions 2016 Survey of US Health Care Consumers, we found several insights that health plans should consider in meeting the needs of their Hispanics members or attracting new members from this growing group. For example, surveyed Hispanics are more likely to use alternative care settings and providers:

• Hispanics are 40 percent more likely than non-Hispanic whites (45 percent versus 32 percent) to use a retail clinic for a non-emergency health issue if their physician was not available, and

• Hispanics are twice as likely as non-Hispanic whites (12 percent versus 6 percent) to see a pharmacist for treatment information.

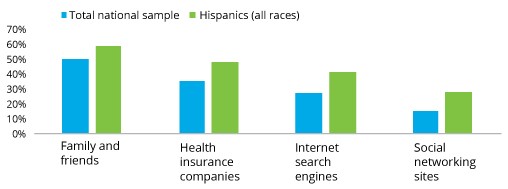

Not only do Hispanics often use the system differently, they also reported trusting certain sources of information more than other groups; notably their friends and family and information found through social media.

** From the Deloitte Center for Health Solutions 2016 Survey of US Health Care Consumers

Hispanics also use available tools for navigating health care more often.Seventy one percent of Hispanics own a smartphone (compared with 61 percent of whites), and they tend to be much more likely to use technology for health care purposes.

** From the Deloitte Center for Health Solutions 2016 Survey of US Health Care Consumers

As we transition from a fee-for-service health care system to a value-based care environment, these issues of cultural differences, health literacy, information sources, and technological engagement are increasingly important. Value-based care and population health strategies sometimes revolve around self-care, wellness and better adherence, so figuring out the most effective strategies to engage different populations makes sense.

Moreover, expansion of health insurance coverage has brought many Hispanics to the private insurance market for the first time. They are still figuring out how to shop for, use, and evaluate plans. According to our survey, thirty two percent of Hispanics reported switching plans in the past 12 months (versus 21 percent of non-Hispanic whites). If health care companies don’t consider the unique needs and expectations of this population, they likely risk cutting themselves out of a real opportunity for growth over the next decade.

To get started, health plans should begin with these basics:

1. Capture ethnicity and/or language preference in your member data;

2. Understand how different segments and sub-segments (e.g., Cuban versus Mexican) typically use the health care system, respond to different channels and messaging, and have different needs;

3. Hire staff and writers that can engage Hispanics in person, on the phone, and in writing; and

4. Embrace digital solutions for providing and capturing information.

As we celebrate National Hispanic Heritage Month, consider evaluating your current market share, share of wallet, and strategies to reach this growing demographic.

February 13, 2021

February 13, 2021