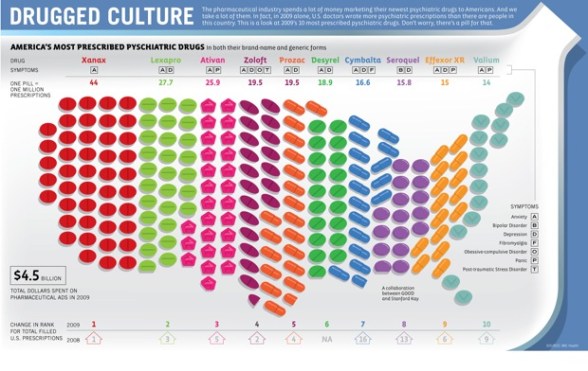

I can’t seem to find a lot of infographics on pharmacy (which is surprising to me since I find the space so fascinating). Here’s one I found in a Fast Company article.

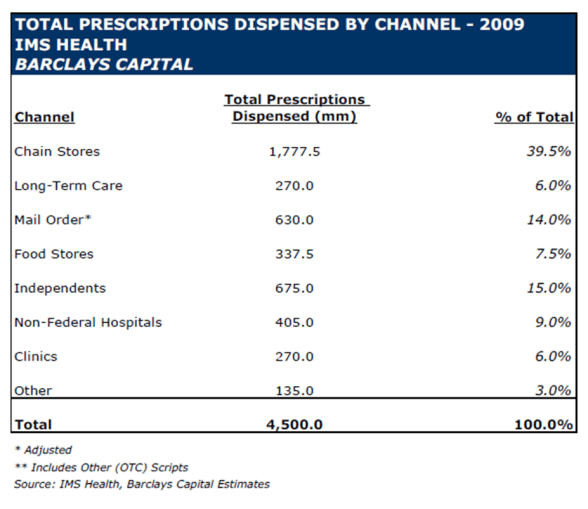

Total Prescriptions Filled In 2009 By Channel

Here is a chart from Barclays Capital based on their analysis and IMS Health data on prescriptions filled by channel last year.

Auto-Refill (Part II)

A few weeks ago, I posted my thoughts on the auto-refill solution that various pharmacies are implementing. After talking with a reporter about the topic, I posted it in a discussion group to get some additional thoughts. As a proponent of the solution, I was surprised by a few of the comments and questions which were more skeptical.

With that in mind, I thought I would post some clarifications to the issues raised in the discussion group.

- Is the auto-refill solution the same for retail, mail, and specialty?

Generally, it is retail pharmacies and mail order pharmacies that are implementing this type of program for maintenance drugs. You wouldn’t want to implement this on controlled substances (even if it was legal). You wouldn’t want to implement it for drugs where patients frequently change strengths (i.e., titrate). You wouldn’t want to implement it when a patient was new to therapy in case of side effects or other issues. Once they are stabilized on a maintenance medication, this makes a lot of sense. - Is auto-refill a solution for adherence? Aren’t there many other issues?

People are non-adherent for numerous reasons. The most common reason in many studies is “I forgot”, but there are significant issues around health literacy. There are also cost barriers, side effects, and belief or cultural issues.

Obviously, auto-refill won’t address all of those issues, but it can help with the people who say they forget to refill. It can also help minimize the gaps in care which exist (i.e., I run out of pills a few days before I pick up or receive my new prescription). - Does auto-refill lead to accumulation of drug supply?

Anything can lead to accumulation if the patient is not using their medication but refilling their drug on a regular basis. [How many patients do that…the drugs cost money.]

This concern can be addressed in two ways: (a) setting the auto-refill trigger to be after 85-90% of the days supply last dispensed should have been used AND (b) reaching out to the consumer to see if they are ready for their next fill. - Isn’t the best strategy for adherence to use “live” agents?

Of course, we’d all love the luxury of talking to every patient at length around their therapy (imagine a world where commercial MTM was economically sustainable). This would be ideal, but in general, this “live” interaction is best for the initial diagnosis and new start of a script.

Plenty of studies have shown that automated calling technology compares very favorably to nurses, agents, and other professionals in driving consumer behavior (at a much lower cost). Speech recognition technology creates a conversational tone with the consumer and can employ best practices such as personalization, motivational interviewing, behavioral sciences, and linguistics in a systemic way.

At Silverlink, our studies have shown significant lift in improving refill rates and closing gaps-in-care around adherence through the use of automated calls. - What about “auto-refill reminders”?

This is exactly what I advocate. It’s much like the “choice architecture” that Express Scripts talks about in their Consumerology positioning around mail order. You’re more likely to get someone to refill a medication (typically appropriately) when asking them to opt-out of the refill than asking them to opt-in to the refill. And, neither I (or anyone I know) would advocate having a patient enroll in an auto-refill program and simply keep getting their medication shipped to them to simply drive up revenues and false adherence metrics. - What about health literacy and education?

This came up several times. An understanding of their disease, why the medication is important, what the medication will do, and other issues are critical for a patient to be engaged and “own” their condition. This is a systemic issue that begins with the lack of time for discourse at the physician’s office and runs throughout the entire process. We have to address these things. The more you can personalize adherence communications to reflect personal barriers and proactively address them during the interaction with the patient the better. Some of that can automated, but yes, some it has to be “escalated” to a “live” interaction. - At the retail pharmacy, doesn’t this increase returns to stock?

Again, I think this is in how you implement the program. Since I recommend that clients implement it with a reminder to the patient to tell us if you don’t need it refilled yet, I think you can avoid some of this. You might also be able to embed some system logic into your system (i.e., you could look for other therapeutically equivalent new starts within the same therapy class in the past 30-days to identify patients that may no longer be on the original drug).An example of the process might be:

- Patient X fills their 4th fill of a maintenance drug on 3/17.

- Patient X receives an offer to enroll in the auto-refill program.

- Patient X receives an automated call on 4/10 stating “This is your pharmacy calling. Is this Patient X? As requested, we are calling to let you know that we are ready to refill your medication. If you are no longer taking the medication or you have more than 7 days supply left, please call us at 800# to let us know. Otherwise, your medication will be ready for you to pick it up in 2 days.” [Note that this would have to follow certain HIPAA guidelines.]

You can see more dialog on this at The Pharmacy Chick blog or in this article from last year.

“Steven Friedman, VP of pharma services at PDX-Rx, notes that the company’s dispensing and adjudication software, when engaged for auto-refill, has been shown to add as much as two additional months on therapy (i.e., two more months of adherence) in a six-month period—a substantial improvement both in adherence and in pharmaceutical sales.”

What’s the net of all this (IMHO)…

- Adherence is a huge issue.

- We need to try lots of things to address it.

- People forget more than they are likely to admit.

- Auto-refill (renewal) isn’t for everyone but is a nice service when implemented right.

- It will drive up more Rxs but no one’s going to pay for (and/or pick up) scripts they don’t need.

- I support it.

Increasing Flu Shots – Several Views

Let’s start with a few facts:

- Health officials are recommending that everyone get a flu shot except those under 6 months and those with egg allergies.

- Last year’s H1N1 killed 13,000 and made 60M sick in the US.

- This year’s vaccine protects against the 2009 swine flu (H1N1) and two other flu strains that are out there this year.

- 60% of Americans are viewed as susceptible to H1N1 (still).

- There are 165M doses slated for use in the US.

- At least 10% of the US is estimated to have trypanophobia (fear of needles).

Retailers (and likely others) are trying different things to drive flu shot volume:

- Walgreens and CVS have their flu gift cards. (Seems like a great going away to college gift.)

- CVS has launched a large promotion of a free flu shot program.

This year, the competition for administering flu shots will be aggressive among retailers:

Walgreen says it administered 7.5 million H1N1 and seasonal flu shots last season, up from 1.2 million the year before. Walgreen’s figures represent about half of all the retailer-administered flu shots, says Mr. Miller, the analyst. He estimates retail pharmacies could administer 20 million to 30 million flu shots this season. Rite Aid, which doled out 250,000 shots last year, said it has ordered a million doses for this year.

Grocery chains with pharmacies also are pushing flu shots harder. Supervalu Inc., operator of the Jewel, Shaw’s and Albertson’s, says it expects to deliver 50% more flu shots this year in its 800 pharmacies. Kroger Co., the second largest food retailer by sales, says it will have flu vaccines available in all of its 1,900 pharmacies. (From WSJ)

The logical question would be why would the pharmacies care. Money. Flu shots are a profitable business and as long as you can administer them without disruption to your workforce…then your variable costs are limited. But, that also makes me wonder why everyone is taking a general marketing approach. There is lots of marketing, but very little targeted marketing that I’ve seen around flu shots (from the retail community).

On the flipside, managed care companies have a totally different reason to drive flu shots – it’s a HEDIS measure. [And, BTW…HEDIS is a big part of the STAR Ratings that CMS is using to pay incentives to Medicare plans.] They want to limit sickness, hospitalizations, and other medical costs.

This is one where everyone is aligned so that employers also want to drive flu shots to avoid absenteeism from sick employees. This article puts the value of a flu shot to the employer at $46.50. Since flu shots cost less than $30, why wouldn’t employers just give everyone a free flu shot. They’re getting a 50% return on their investment.

A more interesting debate is whether to mandate flu shots in certain cases. The biggest one which is debated is healthcare workers (although I would also lump in teachers and day care staff). The last thing you want is someone who is already at risk and sick to be exposed to the flu when they go to receive care.

Last January, a CDC survey found that just 37% of health care workers received swine flu vaccine and 35% received both seasonal and swine flu shots. On average, flu vaccination rates hover under 50%. (USA Today article)

So, I guess my net-net here is that flu shots are going to be pushed this year. I would think pharmacies and employers and pharmacies and MCOs would pair up to drive shots to specific locations. I think the general marketing and news will increase awareness, but the question is how to you reach the at risk population and drive them to your location and get them to get the shot early before they get exposed. I don’t think a build it and they will come strategy will “win” here.

[BTW – Every Google search I did around flu shots, brought back a Walgreens link at the top of the page.]

And, if you’re interested in what we’re doing or could do around flu shots at Silverlink Communications, let me know. (Here’s an old article on results.)

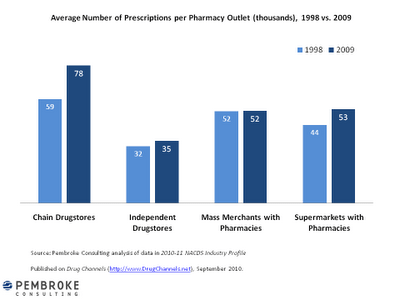

Pharmacy Productivity (Rxs / Yr / Location)

I found this on the DrugChannels.net blog. A good visual of the data showing how “productivity” has improved per location by different types of pharmacies.

What I think is interesting is that mass merchants have stayed flat. With Target’s original couponing strategy and Wal-Mart’s $4 generics, you would have assumed those had an impact that would show up here. I’m guessing the lift at independents could be explained away with increased utilization so the same number of patients go to the stores with just more scripts.

I’m not sure I have the time (or if the data is even available), but it would be interesting to look at patients per location and Rxs per pharmacist (and per pharmacy tech) by type of pharmacy.

When Should You Ask About Auto-Refill?

Auto-refill for prescriptions is all the focus lately. Everyone from the big PBMs to the local pharmacies are encouraging this. It helps with adherence (or at least with adherence calculations since you can’t force someone to take the pills just because they have them). It addresses one of the common patient reported issues with adherence which was that they forgot. They ran out of pills or didn’t know to refill the medication. In some cases, a few days of pills may not be a big issue, but in other categories, this could be a problem.

In general, professionals consider taking medication 80% of the time (or 80% medication possession ratio) to be adherent.

So, what is auto-refill? You sign up to have your medication refilled when it’s time for a new bottle and then mailed to you or ready for you at your retail pharmacy.

One question is whether this includes auto-renewal. To most consumers, renewal means nothing, but it does in the pharmacy business. When you get a script, it is only good for 12-months. That could be twelve 30-day fills or four 90-day fills. When you’re done, you need a new prescription from your physician. That is called a “renewal”. To most consumers, we just think of it as we ran out of refills. So the critical question here is whether you include renewals in the auto-refill process. I certainly advocate for yes. If I run out of medication and expect my prescription to be refilled (because I signed up for auto-refill), I would want my pharmacy to reach out to my prescriber proactively. Or, even if I’m just planning on refilling, I’d like my pharmacy to let me know in advance that I need a renewal or new Rx since I don’t have any refills remaining. That can delay the process so without doing that you can create a gap in care.

That gap-in-care is one of the reasons why patients drop out of mail (which may happen to me). In my case, I waited until I was down to 5 days supply of my medication imagining that my pharmacy would call me to remind me to refill. They never did so I called to refill, but I was out of refills so a renewal is needed. Getting in touch with my prescriber could take a few days so now I’m not sure what might happen. Ideally, I would get a confirmation from them on when it’s coming, and I could go to a local pharmacy and get a 3-day “bridge supply” for a minimal fee. We shall see.

But, what I recently found interesting (that took me down this path) was some research from CVS Caremark that was recently presented saying that

According to Keller, new research by CVS Caremark seeks to address the fact that many healthcare decisions unnecessarily are complicated by the lack of clear and plain language. In addition, choices for such programs as automatic refill of prescriptions or generic alternatives can be overlooked because those options are not readily transparent to the consumer, Keller noted.

“Through this research we are testing options presented through four different communications channels to see how consumers react to different scenarios,” Keller said. “One of our preliminary findings looking at consumers on the Web shows that if we reach out and present a decision to choose automatic refill in advance of renewing a prescription, they sign up at twice the rate of those who were passively presented an opt-in choice after receiving a prescription.”

For those of us in the communication space, this is interesting. How you present information…when you present information…the language you use…All of these things are important as demonstrated here.

Pharmacy Factoids From Old SWOT Analysis

I found this on the Internet while looking for something else. It’s a SWOT analysis (from about 2007) about Walgreens. You can tell it was written by someone who doesn’t understand all the industry dynamics. There’s no mention of mail order as a threat. There’s no discussion of PBMs. There’s no discussion of the value of specialty pharmacy. It’s pretty focused on the pure play retail strategy. Frankly, I’m pretty disappointed…BUT

What I did find interesting were some facts about the industry:

- Walgreens fills an average of 256 Rxs / day per store (in 2006) versus 100 Rxs / day per independent and 180 Rxs per day per chain.

- Walgreens (at the time) had drive-thru pharmacies at 80% of their stores and 30% of stores were open 24-hours per day.

- Free-standing stores generate 30% more in sales than pharmacies located in strip malls.

- 64% of Walgreen’s sales are generated by Rx (2005 analysis).

- A customer spends 10 minutes in the store if including an Rx purchase; 8 minutes if no Rx purchase.

- Only 30% of shoppers make impulse purchases.

- The average non-pharmacy store purchase in 2001 was $19.38.

- The average American visits a grocery store 2.2x per week but a drugstore once a month.

In case you don’t know what a SWOT analysis is…

NCPDP Nov 2010 Event: The New Economy And …

On November 2nd, NCPDP is hosting an educational event called “The New Economy and It’s Impact on Healthcare, Pharmacy, and the Patient.” Sounds pretty cool! It’s a topic we all talk about.

What does the new sense of frugality mean? What will new forms of insurance mean? How will pharmacy evolve? Will MTM work? Will MTM become a product for commercial? How is the consumer’s behavior changing relative to information and compliance?

The agenda includes yours truly along with people from:

* Kaiser

* Walgreens

* AARP

* Sanofi-Aventis

* North Carolina Association of Pharmacists

* Eaton Apothecary

* American Society of Consultant Pharmacists

* RegenceRx

Express Scripts Drug Trend Highest Among Trend Reports

I am sure there is a project at Express Scripts right now to figure out how to position this in the industry. I personally would go for claiming better adherence drives up drug trend (see prior post).

With five major drug trend reports out (Express Scripts, CVS Caremark, Medco, Walgreens, and Prime Therapeutics), there is only one more that I expect – SXC. I’m sure someone else could come into the market with a report, but it’s a lot of work.

The trend numbers so far are:

- 3.2% for Walgreens

- 3.4% for Prime Therapeutics and CVS Caremark

- 3.7% for Medco

- 6.4% for Express Scripts

Does anyone really care? Should they?

On the one hand, it’s a good marker, but the companies each have different mixes of clients (Medicare, Medicaid, Employer, Managed Care, Government). They also have different mixes of clients by geography. All of these things matter.

I would personally argue that we need a different key metric for the industry. The one challenge Express Scripts faces is that they really drove this metric for years and were able to set the standard. Now, they may be caught up in that legacy.

Some of the metrics that are used to compare PBMs:

- Generic fill rate – this is meaningful in that traditional PBMs make more money on generics but definitely subject to client mix

- Mail order penetration – this is meaningful in that it drives several other metrics and is where PBMs make money

- Drug trend – this is relevant in a traditional PBM sense that lower trend is better

- Cost share – this has held pretty flat for years while the absolute value has gone up

- Mail order satisfaction – this is generally a measure that everyone has as high and touts

- Client retention – it seems like everyone has high marks here while clients obviously move around

- Mail order fill accuracy – everyone’s at 99% plus so you get to differentiate at the six sigma versus two sigma level (which in scale matters)

I personally think average client cost per claim processed is a better measure. It takes into account drug mix (brand / generic). It takes into account rebates and rebates provided to clients. It takes into account retail mix (30 / 90 day) and mail order. It takes into account plan design.

I also think creating an average MPR (medication possession ratio) would be a relevant metric that more closely mapped to health outcomes and would still be within the PBMs sphere of influence. They can drive awareness and help with adherence programs thru the consumer, the pharmacy, and the prescriber.

I’m also a big fan of key metrics like:

- 1st call resolution

- Average inbound calls per claim processed (mail versus retail)

- Web utilization – # of registrants AND average visits per registered member per year

PBM Data – Apples and Oranges

When I first saw the data below from AIS’s quarterly pharmacy benefits survey (2Q 2010), I was excited. I hadn’t ever seen a breakdown of claims filled by tier across multiple PBMs. But, I was disappointed as I dug in.

| Percentage of Claims Processed per Tier, per PBM, as of 2nd Quarter 2010 | |||

|

% of Claims Processed |

|||

| Company |

1st Tier |

2nd Tier |

3rd Tier |

| 4D Pharmacy Management Systems |

78 |

16 |

7 |

| ACS, Inc. |

36 |

50 |

14 |

| Aetna Pharmacy Management |

64 |

20 |

16 |

| BioScrip |

50 |

39 |

11 |

| Burman’s Specialty Pharmacy |

90 |

8 |

2 |

| CIGNA Pharmacy Management |

67 |

26 |

7 |

| Envision Pharmaceutical Services, Inc. |

70 |

25 |

5 |

| Factor Support Network Pharmacy |

95 |

5 |

– |

| First Health Services Corporation |

48 |

37 |

15 |

| FutureScripts |

66 |

18 |

16 |

| HealthSmart RX |

48 |

41 |

11 |

| HealthTrans |

69 |

16 |

16 |

| Maxor National |

40 |

55 |

5 |

| National Pharmaceutical Services |

78 |

17 |

5 |

| Navitus Health Solutions |

68 |

28 |

2 |

| Northwest Pharmacy Services |

54 |

37 |

9 |

| OncoMed The Oncology Pharmacy |

90 |

10 |

– |

| Partners Rx Management |

72 |

19 |

9 |

| PBM Plus, Inc. |

60 |

35 |

5 |

| Prescription Solutions |

55 |

25 |

20 |

| Prime Therapeutics |

68 |

20 |

12 |

| RegenceRx |

73 |

15 |

12 |

| RESTAT |

71 |

17 |

12 |

| SXC Health Solutions/informedRx |

70 |

24 |

6 |

| United Drugs |

64 |

29 |

7 |

| Walgreens Health Services Division |

55 |

30 |

15 |

Where is the data from Express Scripts, Medco Health Solutions, and CVS Caremark? I’m sure someone chose not to participate, but I don’t think they would be hurt by these numbers.

Why are the numbers so different across companies?

- 1st tier ranges from 36% to 95%

- 2nd tier ranges from 5% to 55%

- 3rd tier ranges from 0% to 20%

What do I do with this? Do they all define tiers the traditional way (i.e., 1st tier = generics, 2nd tier = brand formulary, 3rd tier = non-formulary brands)?

Are they all even in the same business (i.e., a specialty only company might not have any generics)?

Do they serve similar populations (i.e., Medicaid is very different than commercial)?

Now, I could certainly drill in one by one. For example, if I pull out the companies that I believe have similar diversified clients, I get a few more focused questions:

|

1st Tier |

2nd Tier |

3rd Tier |

|

| Aetna Pharmacy Management |

64 |

20 |

16 |

| CIGNA Pharmacy Management |

67 |

26 |

7 |

| Envision Pharmaceutical Services, Inc. |

70 |

25 |

5 |

| FutureScripts |

66 |

18 |

16 |

| Navitus Health Solutions |

68 |

28 |

2 |

| Prime Therapeutics |

68 |

20 |

12 |

| RegenceRx |

73 |

15 |

12 |

| SXC Health Solutions/informedRx |

70 |

24 |

6 |

| Walgreens Health Services Division |

55 |

30 |

15 |

Now, I see some distinct clustering that maps closer to what I would expect. I would expect a PBM to have 65-70% generic (1st tier) utilization); 25-30% brand formulary (2nd tier) utilization; and 5-10% non-formulary brand (3rd tier) utilization.

The two things that jump out for me here are then:

- Why does Walgreens have such low 1st tier utilization? My general perception is that they do a good job at driving generic utilization and have incentives in place for their pharmacists to do that.

- Why does Navitus have only 2% third tier utilization? Do they have a closed formulary (i.e., no 3rd tier drugs are covered without some medical exception)?

In the same issue of Drug Benefit News (DBN 8/13/10) and the same survey, there were a few other data points:

-

The total number of claims processed by PBMs increased by 9.97% over the past year to 2.56B.

- Does that mean that the remaining ~600M claims are cash?

- Does that equate to a 9.97% increase in utilization or is that just more covered lives or more concentration of business among the PBMs that respond to the survey?

-

Average copays were:

- $9.98 for the 1st tier

- $23.69 for the 2nd tier

- $36.93 for the 3rd tier

IMHO (in my humble opinion), I think these copays show a problem…not with the data but with plan design. Generics should definitely be below $10 so we’re alright here although I would probably shoot for $8. A difference of $14 between tiers 1 and 2 is too low. $15 should be the minimum and $20 is probably better. The same goes for the $13 difference between tiers 2 and 3.

My ideal plan design would be $8, $25, and $45 (or the equivalent average using percentage copays).

Choices: Grande Skim Mocha With Whip @ 140 Degrees

Choices. We can all become overwhelmed with them. As several studies have shown, more choices are not better…they paralyze us and limit our ability to make a decision.

So what do we do with this. Choice is a double-edged sword. On the one hand, you want to offer choice to everyone. On the other hand, this can make implementation very difficult.

Like my Starbucks example. I can customize almost everything off a pretty basic menu…even the temperature. (BTW – they suggested using 140 degrees rather than saying kiddy temperature) But that makes it more difficult to standardize and should increase the risk of error. Imagine doing this efficiently and in scale.

Mass customization has been a challenge for years.

People can have the Model T in any color – as long as it’s black. (Henry Ford)

While technology allows this to a certain degree, it all has to be moderated. Let’s take communications. I could let every consumer tell me their preferences and other facts about them.

I want you to send me automated calls unless the information is clinical in which case I want a letter than I can share with my physician. I’d like the calls made to my home number between 5-7 pm or on Saturday’s between 10-4. I’d like you to leave a message and don’t call back unless I don’t act for seven days. If I interact with the call, please text me the URL or phone number for follow-up. I like to be addressed by my first name. I’m an INTJ so please use that as for framing the message.

You get the point. Where do you stop? And, do you really think that I know what’s best. I tell almost everyone to e-mail me, but depending on when it comes in, it could be days before I respond or even read the e-mail. That’s if it passes the spam filter.

I’m sure if I asked 10 people whether they wanted automated calls then 7 of them would say no, BUT you know what…good calls work (voice recorded, speech recognition, personalized). The vast majority of people interact with good, automated calls (some for 10+ minutes). Most people think about those annoying robocalls that use TTS (text to speech) we all get around the elections. But, good technology with a relevant message from a relevant party get people to care. It’s all about WIIFM (what’s in it for me). The other half of the equation is being able to coordinate the multiple modes. (e.g., I missed you so I’m sending you a letter. Let me text you the URL.)

So, should I let the consumer pick their preferences? Sure for certain things. But, what about a drug recall (for example)? Do I have to wait a week to get a letter? What can I personalize versus what should the company own. I pay for them to “manage” my health. Why don’t I let them?

There is no perfect system. You need a series of things to be successful.

- A database to track consumers – demographic data, claims data, preferences, interaction history, …

- A workflow engine with embedded business rules to manage communication programs with rules about what to do when certain situations arise

- Reporting to track basic metrics

- Analytics to understand and analyze programs

And, of course all this requires expertise to interpret and leverage the data for continuous improvement.

Are you doing all that? I doubt it…but you can be.

No “Pay-to-Delay” For Pharma

The Senate Appropriations Committee approved adding language to restrict this practice to a spending bill. Will it ultimately pass? I’m not sure.

What is it? The way a generic drug comes to market is that generic manufacturers (e.g., Teva) will wait for a patent to expire and/or challenge the patent. They do this by filing an ANDA (Abbreviated New Drug Application). Manufacturers obviously want to enjoy the exclusivity of their patent(s) as long as possible.

My understanding is that “pay-to-delay” is when:

- The brand manufacturer knows that someone is going to challenge their patent and try to get a generic to market before the patent expires. They pay the generic manufacturer not to do this and in return might allow them to offer an “authorized generic” before the patent expires.

On the one hand, my reaction to this potential legislationis a “finally”. On the other hand, this is a defeat for creative capitalism. Does a company have to launch a product?

If Ford wanted to pay Toyota to delay the launch of a new car such that they both made more money, would the government step in and tell them they had to launch it. Perhaps that’s apples to oranges.

The problem here is that while the brand manufacturer made more money and the generic manufacturer made money for doing nothing (other than getting the right to launch it) the public (i.e., consumers) and payers lost since they had to wait to save money.

Back To The Future: The Role Of The Pharmacist

Between the focus on differentiation and the focus on adherence, we have seen (and will continue to see) greater use of them as a strategic asset. CVS Caremark is leveraging them in their Pharmacy Advisor solution. Walgreens continues to leverage them at the POS. Medco is using them in their Therapeutic Resource Centers. And, the independent pharmacists have stressed this story for years.

In Medicare, the Medication Therapy Management (MTM) process begins to recognize the power of pharmacists and actually rewards them for their efforts. I was quoted in Drug Benefit News today about this topic. Here were a few quotes:

“The pharmacist is an under-utilized resource today,” George Van Antwerp, vice president of the Solutions Strategy Group at Silverlink Communications, tells DBN. “They go to school to work with patients and often end up simply filling bottles.”

While the benefits of pharmacist intervention are undeniable, Van Antwerp says, the challenge is finding the right balance of face-to-face interaction and automation. Issues also include getting a good return on investment for such services by condition and the fact that only an estimated 60% of the people picking up prescriptions are the patients themselves. In addition, “the staffing model right now would be stressed if pharmacists were spending significant time on cognitive services,” he maintains.

Aetna To Outsource PBM Functions To CVS Caremark

While the market seems more mixed on this than me, I see this as a good thing for CVS Caremark. If played right, this could be a huge factor for 90-day retail and/or Maintenance Choice since Aetna (as the payer) will have huge incentives to take advantage of this.

I was a little surprised since most of the rumor had been that Medco was going down this path with Aetna and that this was what they had pitched to Wellpoint prior to the Express Scripts acquisition of the pharmacy business.

And, for those of you that have been around this space for a while, you might remember that Aetna did outsource some of their PBM business up until about 6 years ago when they insourced in from Express Scripts. I’d be interested to understand what changed (which might simply be in the finer points of this new agreement which doesn’t appear to sell assets but to leverage CVS Caremark’s scale).

It clearly points out that there are scale efficiencies in the PBM business something that I think will come to end in the near future (as predicted in my white paper a few years ago). So, I think the question a lot of people are asking is whether this move will accelerate different models to get to scale:

- A roll-up strategy of smaller PBMs by the large PBMs.

- A consolidation of smaller PBMs into coalitions and buying groups.

- Smaller PBMs contracting with larger PBMs for core services.

Let’s look at some of the PBM functions to think thru what makes sense to consolidate and leverage (IMHO):

- Sales – independent

- Marketing – independent although some physician or consumer marketing could be consolidated

- Implementation (Client Set-Up) – independent

- Research – drug trend, research studies, and analytics could be consolidated

- Plan Design – could be consolidated but not likely large efficiencies

- Drug Acquisition – consolidation would drive the majority of value

- Procurement – consolidation could add value

- Rebating – another big opportunity for consolidation but requires coordination on formulary (P&T) and other areas

- Mail Fulfillment – should offer consolidation benefits

- Call Center – should offer consolidation benefits

- Claims Processing – limited but possible consolidation benefits

- Clinical Reviews – easy to consolidate but minimal savings

I think given Express Scripts and NextRx and now CVS Caremark and Aetna (although different relationships) that this puts the spotlight back to Medco for the next move. I think the likely focus areas would be on Cigna and Prescription Solutions (part of United Health Group). After those two, there are other less likely targets – Prime Therapeutics, Walgreens (PBM), and MedImpact.

DMAA Client Presentations

We (Silverlink Communications) are very excited to see three of our clients get selected to present at DMAA this year. That is a tribute to all their hard work, creativity, inspiration, and willingness to leverage technology to improve outcomes.

Here are the presentation summaries from online:

Reducing Blood Pressure in Seniors with Hypertension Using Personalized Communications

CONTINUUM OF CARE SERIES

Wednesday, Oct. 13, 1-2 p.m.

- Examine how an integrated communications program that utilizes remote monitoring and interactive voice response components combine for an easily scalable, cost-effective solution to reduce hypertension.

- Review a program where 18 percent of participants transitioned their hypertension from out-of-control to well or adequate control.

- Identify best practices for how personalized, automated, interactive communications can be leveraged to control hypertension in a scalable manner.

- Evaluate how high blood pressure readings alerted patients with immediate feedback and education to help them better manage hypertension.

Improving Statin Adherence through Interactive Voice Technology and Barrier-Breaking Communications

Wednesday, Oct. 13, 2:15-3:15 p.m.

- Examine how interactive voice response (IVR) and barrier-breaking communications can measurably improve statin adherence.

- Review key barriers to statin adherence, including several barriers that are more significant than cost.

- Identify best practices for using IVR technology to improve statin adherence by addressing specific barriers.

- Evaluate how continuous quality improvement processes were used to drive higher response rates to IVR prescription refill reminder calls.

Addressing Colorectal Screening Disparities in Ethnic Populations

Thursday, Oct. 14, 12:30-1:30 p.m.

- Examine how interactive voice response (IVR) technology and personalized messaging improves the rate of colorectal cancer screening for different populations.

- Review the impact of ethnic-specific messaging on colorectal cancer screening rates and how this differs by ethnicity.

- Examine how engagement is influenced by the gender of the voice in communications outreach.

- Identify how to use predictive algorithms to project race and ethnicity to support tailored communications.

Caremark iPhone App – Will Others Follow?

CVS Caremark announced today that they were releasing a Caremark iPhone application. First, I think it’s about time (for some PBM to do this). I would think the other PBMs will follow suit.

Second, I think this is a great opportunity for an expanded CVS Caremark iPhone application which expands the functionality of the app and is like Maintenance Choice in that it offers a benefit of the integrated company.

Today’s application is PBM centric and focused on ordering refills (I assume at mail only); checking prescription order history (I assume mail only); viewing prescription history; requesting a new prescription (retail-to-mail I believe); checking drug cost; and finding a nearby network pharmacy. Checking drug cost could be the coolest feature since it would give patients what they don’t have today – an ability to check the cost while they’re at the physician’s office. Finding a network pharmacy is an important tool if companies were to promote limited networks, but it’s only a nice to have if all the pharmacies are in the network.

So, of course the question that I would have is when will they add the retail components to request retail refills (at CVS stores or all locations); check status of prescriptions (e.g., prior auth required); request a renewal of an Rx; request a lower cost alternative; find a CVS with a MinuteClinic; or identify opportunities to save money (e.g., a generic alternative).

There are lots of other things to push out via the application, but I agree with the strategy of focusing on the core applications first. Caremark (or other PBMs) could push clinical suggestions; send adherence reminders; do satisfaction surveys; collect barrier data (why not adherent); and collect information (why not using generics). I also see it as a great way to push tools – e.g., 5 questions to ask your physician when you get a new Rx.

It would be interesting to see the statistics in a year – how many downloads of the app; how frequently is it used; patient satisfaction with the Caremark for those with the app (vs those without); adherence for those that use the application; what functions work best; savings versus other modes of communication; and effectiveness of their appliction versus other health applications.

ADHD Drugs – Long Term Effect

Given the frequency of use of medications in our society today, I think there is much to learn once we see what happens when people are on medications for chronic conditions for their entire life.

Although this study only looks at 10 years and was funded by drug manufacturers, I think it’s a promising study that shows that kids that take stimulants for ADHD may have an initial slowing in weight and height, but that over 10 years there was no difference.

Retail Rxs Filled By State (Sorted by Volume)

I found this 2009 data at the Kaiser Family Foundation site and downloaded it to sort it by state and show the percentage of scripts that are filled within the state (versus the total US script count). You should note that this is limited to retail claims (i.e., doesn’t include mail order Rxs).

| United States | 3,679,671,222 | |

| California | 312,440,433 | 8.5% |

| New York | 255,792,543 | 7.0% |

| Texas | 248,655,283 | 6.8% |

| Florida | 225,312,255 | 6.1% |

| Pennsylvania | 168,218,628 | 4.6% |

| Illinois | 156,310,649 | 4.2% |

| Ohio | 149,100,021 | 4.1% |

| North Carolina | 127,081,439 | 3.5% |

| Georgia | 119,238,095 | 3.2% |

| Michigan | 119,163,703 | 3.2% |

| Tennessee | 109,127,463 | 3.0% |

| New Jersey | 99,570,267 | 2.7% |

| Missouri | 92,754,941 | 2.5% |

| Massachusetts | 92,658,258 | 2.5% |

| Virginia | 90,704,636 | 2.5% |

| Indiana | 82,549,426 | 2.2% |

| Alabama | 80,669,107 | 2.2% |

| South Carolina | 75,527,841 | 2.1% |

| Kentucky | 73,756,811 | 2.0% |

| Washington | 66,329,432 | 1.8% |

| Wisconsin | 66,188,884 | 1.8% |

| Louisiana | 66,142,285 | 1.8% |

| Arizona | 61,297,786 | 1.7% |

| Maryland | 58,080,852 | 1.6% |

| Minnesota | 55,105,935 | 1.5% |

| Oklahoma | 48,972,975 | 1.3% |

| Arkansas | 48,242,080 | 1.3% |

| Mississippi | 47,735,160 | 1.3% |

| Iowa | 47,418,431 | 1.3% |

| Connecticut | 46,489,823 | 1.3% |

| Oregon | 40,342,008 | 1.1% |

| Colorado | 38,093,247 | 1.0% |

| Kansas | 36,214,744 | 1.0% |

| West Virginia | 34,432,644 | 0.9% |

| Nevada | 26,050,153 | 0.7% |

| Nebraska | 25,239,082 | 0.7% |

| Utah | 24,844,262 | 0.7% |

| Maine | 19,087,484 | 0.5% |

| New Hampshire | 18,033,822 | 0.5% |

| Idaho | 15,939,958 | 0.4% |

| New Mexico | 15,454,444 | 0.4% |

| Rhode Island | 14,723,946 | 0.4% |

| Hawaii | 14,249,708 | 0.4% |

| Delaware | 11,388,995 | 0.3% |

| Montana | 11,136,885 | 0.3% |

| South Dakota | 10,051,942 | 0.3% |

| Vermont | 9,682,741 | 0.3% |

| North Dakota | 8,404,232 | 0.2% |

| Wyoming | 5,991,536 | 0.2% |

| District of Columbia | 5,185,455 | 0.1% |

| Alaska | 4,488,495 | 0.1% |

5 Keys To Health Plan Survival

I thought I would re-post these from the Corporate Research Group.

Bertolini outlined five keys to surviving reform: 1. Payment reforms that shifts incentives from volume to outcomes; 2. Information technology that improves quality, lowers cost; 3. Wellness: engaging consumers with incentives and decision-support tools; 4. Transparency tools that provide information and improve accountability; 5. Revamped benefits and plan designs.

These seem pretty logical and echo some of the things I brought up in my pharmacy white paper last year.

1. The need to better engage the consumer in understanding their benefits and ultimately responsibility for their care;

2. The effort to automate and integrate data across a fragmented system and across siloed organizations; and

3. The shift from trend management to being responsible for outcomes.

Pay For Full Service

In several industries (e.g., travel), you pay when you access a customer service representative. That forces you to use the self-service options of the Internet and/or the automated call line. Could this work in healthcare?

I doubt that people would be so directive as to penalize people for talking to a representative or a clinical person especially on such a sensitive and personal a topic as healthcare.

BUT, on the other hand, a disproportionate amount of calls are for mundane issues or questions would could be solved using other channels. The fact is that these channels have to be efficient and easy to navigate (which they aren’t always today). But, technology continues to become more ubiquitous so it’s not unreasonable to expect people to self-service more often.

One idea that I tried to sell years ago at Express Scripts was more around incentives for self-service. Why not offer large employers a discount if their use of the call center decreased? They have some opportunities to influence this. They could put a link to the website on their intranet. They could leverage their e-mail network to push out messaging. They could encourage people to use the PBM (or health plan) website.

On thing that several CFOs told me years ago was that they would frame the problem differently for their employees. It wasn’t about just saving money to reduce cost, but it was about re-directing funds to cover more things. For example, one company had to cut $10M in expenses. They were looking at plan designs to accomplish some of that. But, they also thought they were going to have cut on-site daycare. We looked at one strategy that might save them $15M so they could achieve their savings and actually grow both the daycare program and their 401K matching program.

What great positioning to the employees! Here are two things we are going to give you…all you have to do is help us shift costs from point A to point B by taking the following actions.

Is Specialty Pharmacy Management Frozen?

Someone asked me an interesting (but I suspect somewhat rhetorical) question last week. They asked if I had seen meaningful innovation in specialty pharmacy management in the past 5 years beyond simply increased automation. It immediately made me think of this picture of Hans Solo frozen in time.

I had to say no.

Specialty has been focused on leveraging the PBM lessons from the past decade and implementing them. How to manage spend? How to get rebates? How to push generics? How to implement technology? How to distribute drugs more efficiently? What are the right plan designs?

Do you disagree?

I think the one area where you could easily argue is around pharmacogenomics. This is an interesting one since it will have a big effect on specialty medication and you have two of the big 3 PBMs (Medco and CVS Caremark) who have embraced it while you have Express Scripts talking a little about it. They seem to be taking a wait and see approach until it is clear how they make money in this space.

Wal-Mart Whitepaper on Restricted Pharmacy Networks

Of all the companies that might put out a restricted network whitepaper (PBMs, retail chains, consultants), I will admit that Wal-Mart is a surprise to me. It’s not that they haven’t been trying different strategies to increase market share – $4 generics, direct-to-employer contracting, but in general, I don’t see them doing a lot of marketing or selling in this space. They participate at one industry event, but their booth is very stark compared to other pharmacies.

But, that being said, the whitepaper makes the key points that anyone would make (i.e., I agree with the framing of the opportunity) with a slight twist of focusing on member savings versus payer savings.

Some of their key points from the whitepaper are:

- You should treat pharmacy negotiations like buying any widget. There is more supply than demand.

- Today’s model encourages all pharmacies to offer a rate that doesn’t get them kicked out of the network.

- Today’s model doesn’t encourage consumers to pick one pharmacy over another.

- There’s 5x more pharmacies than McDonald’s in the US…and no one would argue that it’s difficult to get a Big Mac.

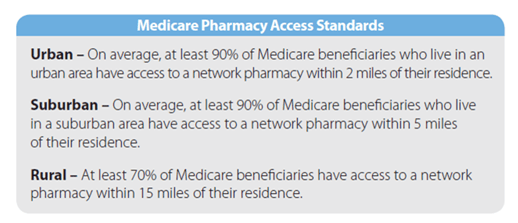

- They quote the Medicare pharmacy access standards to make the point about what access you can survive with. They reference an Express Scripts analysis that says the Medicare access standard can be achieved with a national network of less than 20,000 retail pharmacies (compared to the 60,000 in most networks).

While limited retail networks are not a new concept, they haven’t been widely adopted historically (<10% of clients). PBMs have always offered this type of plan design to payers – “If you remove a few chains from your network, you’ll get a lower rate from the other chains in return for increased marketshare.”

With the integration of CVS Caremark and their offer of Maintenance Choice, we’ve obviously seen the focus on this increase. And, the recent public negotiations with Walgreens highlighted that this is seen as a viable model for the future.

The question now is whether this will accelerate adoption of some type of limited network. If it goes forward, there are lots of questions to answer:

- How small will the network be – regionally, nationally?

- Who do you build the network around – CVS, Walgreens?

- What does this mean for mail order?

- What rates do the retailers have to match to participate?

- Does it include 90-day?

- Does the network start to look like a formulary where you have preferred pharmacies at one copay and non-preferred at another copay or is it either in-network or out-of-network?

- Does this increase or decrease power for the independents that have to be in certain places?

- Will anyone really test the national access standards and go to a 20,000 store network?

- What will consumers say and do?

- Does this accelerate adoption of cash cards and cash business for generics?

But, again, I struggle to see Wal-Mart as the chain that you build around unless the whitepaper is a thinly veiled attempt to push the direct-to-employer model (i.e., Caterpillar) which has saved the employer lots of money, but isn’t a simple to implement program (IMHO).

Here are some marketshare numbers for Walgreens, CVS, Rite-Aid, and Wal-Mart for the top 30 MSAs. Only 9 of those markets have Wal-Mart share above 10% and none are higher than 14%. For the other three, you have markets where they have a much higher concentration around which you can build.

Someone was asking me the other day if I saw the PBMs essentially partnering up. I’m not sure I do since there are markets where you would want to build a limited network with Walgreens and markets where you would want to build a limited network with CVS. At least for now, I don’t see Medco and Express Scripts just picking one dance partner although they might just based on who’s willing to play with them.

The other thing that becomes important here (tying this back to my Silverlink work) is communications. You have to identify who will be affected in moving to a limited network. You have to communicate with those people and help get them to the preferred pharmacy. You have to help them understand why you are doing this (savings) and WIIFM (what’s in it for me).

It creates some great dialog between the head of benefits and the CFO. We can save $X…BUT we will have to ask Y% of our employees and their families. Will they care? Do they know their pharmacist (unlikely)? Will it be an issue of convenience? Will they complain (of course…change is hard)? Will they ultimately care (unlikely as most disruption becomes accepted after 3-6 months)?

DBN Article on Adherence

In today’s Drug Benefit News, I was quoted several times on the issue of incentives and adherence. Here’s one of the quotes along with one of the quotes from Bob Nease from Express Scripts.

Article: Should Patients Be Paid for Adherence? Strategy Could Yield Savings or Cost Hikes

Author: Renee Frojo

Medication nonadherence is recognized by most payers as a major driver of pharmacy costs, but nobody can get their hands on a foolproof solution to the problem. As a result, PBMs and health plans are experimenting with a new method that some critics view as a last resort: paying people to take their drugs appropriately. “There is no silver bullet when it comes to adherence, because it’s not that straightforward,” George Van Antwerp, vice president of the Solutions Strategy Group at Silverlink Communications, tells DBN. “However, it is an issue where everyone is aligned because there are a lot of potential savings.”

“Some plans will do whatever it takes to get patients to be adherent to their therapy or engaged in better behaviors,” Bob Nease, Ph.D., chief scientist and vice president of marketing at Express Scripts, Inc., tells DBN. While the PBM hasn’t launched its own program yet, Nease says it will be following the trend closely. “The use of lotteries is very interesting and it has potential,” he adds.

Don’t Take OTC Drugs (Cold Medicine) and Drive?

Why don’t we all just stay home or set up a massive public transportation system across the US. Since over 50% of consumers take a maintenance drug, I can only imagine the percentage of people who take either a maintenance prescription drug or an over-the-counter (OTC) medication.

And, now the government wants to issue a warning about driving while taking medication and throw that in the same bucket as illegal drugs, driving drunk, and texting while driving. Do they have any studies here? Don’t medications that make you drowsy require labeling (not that anyone reads it or follows it)?

I guess I’m just confused at someone coming out and making broad statements like this.

Washington (CNN) — Add driving while on drugs — even it’s just cold medicine — to the list of distractions behind the wheel to which authorities are giving special attention.

National Drug Control Policy Director Gil Kerlikowske, a former police chief in Seattle, said drivers need to know they might be impaired if they have taken prescription or over-the-counter drugs, just as with illegal drugs.

“Drugs adversely affect driver judgment, driver reaction time, their motor skills and their memory,” said Kerlikowske, telling reporters the effects can be similar to those of driving under the influence of alcohol.

Does Age Matter in Adherence?

Certainly age could be a confounding factor for many reasons – health literacy, length with a condition, co-morbidities, number of medications, tolerance for side effects – but I like this chart that the people at Vitality (aka GlowCaps) (www.rxvitality.com or www.roseology.com) just put out.

Of course, like any survey, there is sample bias so I would hesitate to extrapolate this, but I would say something like…

“for people who have and use a refill reminder device in their homes for hypertension medications, older people are more likely to be adherent.”

Of course, I’d love to know their MPR (medication possession ratio) before using the device. Which had the higher lift?

Guest Post: Why Pharmacy Technicians Must Be Certified

I get lots of press releases or opportunities to speak with people sent to me. Ashley sent me a request to post an entry on my blog. I gave her a topic that I thought would be interesting, and she followed up with a story. Here it is.

We’ve all seen and interacted with pharmacy technicians more than a few times; they’re the people in the drug store who fill out your prescription and work behind the scenes at the pharmacy. Because certification is not a necessity in a few states, some pharmacy technicians are able to gain employment based on their experience or willingness to learn quickly on the job. They work under a licensed pharmacist and are not allowed to advise patients regarding their medication or any other aspect.

But more often than not, they do interact with patients and offer solicited advice and answer any question they’re asked. It’s no big deal as far as the patient is concerned, unless of course, something goes drastically wrong. If there’s a mix-up with the drugs or if a dispute arises as to the nature of advice given (the patient may misunderstand what the technician says, disregard any words of caution given, or just be careless in following instructions), then the fat is in the fire. And if the pharmacy technician in question is not certified, the problem magnifies exponentially.

Pharmacy technicians must be certified because although experience does count, it is more valuable when built up on the foundation of education and the certification process which teaches them the right way to do things. Certified pharmacy techs have an advantage in that they are aware of the legal ramifications of their job and are able to act accordingly when it comes to dealing with patients in the absence (or presence) of a licensed pharmacist. Also, if anything goes wrong and a patient sues the pharmacy, certification helps to prove the credibility of the technician and holds more water in a court of law. Also, in some states, even though certification is not really necessary to work as a pharmacy tech, there must be one certified technician on duty in the absence of a licensed pharmacist.

Although there are only a few states that require pharmacy technicians to be certified, others will be soon following suit because employers are increasingly looking to hire only techs that are certified and because it’s easier to standardize the quality of patient care provided at pharmacies when all the employees are certified by an accrediting board. As of now, Louisiana, Wyoming, Utah, Virginia, New Mexico and Texas require pharmacy techs to be satisfied. Illinois and Florida will soon pass requirements for certification within the next year. And Kansas, Georgia, Maine, North Carolina and Tennessee require the presence of at least one certified technician if there are more than three or four pharmacy techs at work.

To become a certified pharmacy technician in the USA, you must have a high school diploma, GED or a foreign equivalent, and clear the examination administered online by the Institute of Certification of Pharmacy Technicians (ICPT) or the Pharmacy Technician Certification Board (PTCB). The ICPT offers the ExCPT exam while the PTCB allows you to take the Pharmacy Technician Certification Exam (PTCE), the only pharmacy tech exam endorsed by the American Pharmacists Association.

You must complete 20 hours of continuing education every two years to keep your pharmacy technician certification status, and at least one of those hours must be in pharmacy law. Also, you are disqualified from certification if you have any felony or drug-related convictions or are under any restrictions from your State Board of Pharmacy.

By-line:

This article is contributed by Ashley M. Jones, who regularly writes on the subject of Online Pharmacy Technician Certification. She invites your questions, comments at her email address: ashleym.jones643@gmail.com.

CVS and Walgreens Reach Resolution

I’ve tried to stay out of this since my initial posts on this, but it has certainly added some excitement to the industry over the past couple of weeks. I can’t remember one topic stirring so many reporters, analysts, sales people, and other potentially affected constituents.

As I’ve predicted from the beginning, both CVS Caremark and Walgreens came to resolution. It was in their mutual interest. I know there are a few sales people at the other PBMs that are disappointed as they hoped for this to be a wedge in several open RFPs. I think it may actually work against the other PBMs depending on the terms.

We know that Walgreens wanted higher reimbursement rates that other pharmacies. My question is whether they were acting like the UAW with the Big 3 auto companies. The UAW would reach agreement with two of them and then strike the 3rd one. Did the other PBMs give Walgreens higher reimbursement rates and then CVS Caremark finally draw the line in the sand? If so, does CVS Caremark have better rates and will they be even more aggressive around pricing in the sales cycle this year?

On the other hand, I know people at the other PBMs that were hoping for either a validation of the limited network concepts that have been around forever with limited adoption or to see them come to terms and hope that they can draw a line in the sand similar to CVS Caremark. For those outside the two companies, it was a win-win scenario while it was a lose-lose scenario for the two players if they didn’t reach resolution.

So, what happens now?

Will there be a Maintenance Choice offering with Walgreens in the network for 90-day scripts? I’m not sure here. Retailers have always struggled to over mail reimbursement rates at retail especially with less foot traffic, but I have to imagine that CVS and Walgreens have similar buying power.

Does this validate the concept of a retailer owned PBM (which as I’ve pointed out before is not unique to CVS)? I’ve talked many times about my support of this concept and think it’s only those with something to gain who are keeping this concept an issue. The independent pharmacies who are losing to mostly chains but also mail and the other big PBMs especially Express Scripts that had made a bid for Caremark before CVS bought them.

Lottery For Taking Your Medicine

Adherence is the big focus these days. It’s an issue where everyone is aligned – payer, pharmacy, PBM, pharma, patient, MD. And, there are certainly lots of savings to be gained both hard dollars (less ER visits) and soft dollars (less absenteeism).

BUT, COME ON…

There are lots of issues around adherence. Getting people to fill the script after they leave the doctor’s office. Making the script affordable. Getting them to take the medication. Remembering to take it over time. Dealing with side effects. Dealing with differences in cultures, conditions, health literacy, etc.

Now, people are paying you or giving you a chance to “win” money every day just for taking your medication (see NYT article). So, in my mind, this eliminates the issues of affordability (i.e., you already have the drug) and side effects (i.e., you’re not going to take something that has a meaningful side effect just for money). So, why do I have to pay you. Does the dentist pay you to brush your teeth? Of course not. Does your auto insurance company pay you not to speed? Does your life insurance company pay you to not drive drunk? NO…In all these cases you either pay more money if you do this or your service gets discounted if you don’t.

If you have a chronic illness, can afford the medication, and have no meaningful reason to not take it, you should be doing your best to take the medication. Otherwise, you’re driving up the costs of healthcare for you and your friends and your kids. You do have some social responsibility to try and get better OR you should pay more for your healthcare. We all have a choice (see the 1,000 pound woman).

Won’t paying people just create a long-term “dependency” where I only want to take my pills when I’m getting paid? Probably…we certainly used to see that incentives at the call center drove up success rates, but once they went away the success fell below the baseline.

Will this create an incentive simply to open the pillbox to get paid even without taking the medication? No one is there making sure it goes down my throat so I’m sure some people will game the system. (A sentiment shared by John Mack at the Pharma Marketing Blog.)

For the people that are adherent, will you just be wasting money? Yes…and why should my neighbor get paid for forgetting…I’m going to want the same thing.

Don’t get me wrong. I’m a fan of incentives, but reward me for the right things otherwise we end up with situations like Enron. Incent me for managing my BMI, my A1c value, my blood pressure. I can take medication, work out, or diet to achieve those.

Give me tools and information. Help me to understand my drug. Help me to afford my drug (e.g., value based insurance design or patient assistance programs). Educate me on my condition. Have a talking pillbox or medication bottle. Call me to remind me to refill. Sign me up for auto-refill.

I just can’t get on board with this latest twist. I guess the proof is in the pudding so we’ll see if it makes a difference. I’d love to be proven wrong here and see us throw money at people and change the healthcare cost curve.

2010 Medco Drug Trend Report

I can’t believe it’s taken me a few weeks to catch up on my notes from a conference call with David Snow and Dr. Rob Epstein from Medco Health Solutions about their 2010 Drug Trend Report. I captured some of Dr. Epstein’s comments in a quick blog post, but I have a lot of respect for David Snow and wanted to capture a few of his comments here and pull out some of the interesting data from the Drug Trend Report.

David Snow mentioned a few things:

- Reform has to address all three legs of the stool – Access, Quality, and Cost. Right now, it’s focused on access.

- Of the $2.4T we spend in the US on healthcare, $1T of it was unproductive.

- One of the big issues in the system is poorly designed systems for the people that deliver care.

- Pharmacy is ahead of the curve since it’s already wired and uses evidence-based care.

- We have to focus on the chronic conditions. 96% of the pharmacy spend and 75% of the medical spend is here.

- Prescriptions are used as first line solutions 90% of the time. (See my comments on why trend shouldn’t matter.)

- $350B of the waste is due to poor management of chronic solutions.

- We still have to address medical liability and defensive medicine.

He also answered questions. A few of my notes from the Q&A:

- Patent expiration doesn’t fully explain the increase in brand pharmaceutical costs. (Traditionally these drug costs go up once the patent expires.) You can correlate the tax on pharma (in reform) to the increase in prices. (Not dis-similar to the increases around Part D if memory serves me.)

- Adherence is a key issue. The Therapeutic Resource Centers (TRCs) are their answer to this. They drive adherence in the classes that matter and we report to clients on this. (While I think a lot of people viewed the TRCs as marketing strategies when they first came out, I believe they have demonstrated a clinical focus with some case studies and clinical leads over the past 18 months.)

- The pathway to biosimilars is very fair to the innovator.

- Class competition in specialty is increasing.

His most interesting comment which I’ll repeat from my earlier post was that if the FDA really understood true adherence they might make different decisions on approving drugs whose effect is tied to a person staying on a medication over time.

I won’t repeat some of the core data elements from my prior post, but here are some new ones from reading the document:

- Mail order penetration was 34.2% (which I believe is industry leading for the PBM sector with only Walgreens showing a 90-day utilization number that’s higher).

-

Interestingly, they show trend for clients with over 50% mail use (and clients with less than 50% mail use). [Most PBMs would love to have any clients with over 50% mail use.]

- 0.1% for those with over 50% versus 5.3% of those under 50%

Reported trends are based on 2 years’ data on pharmaceutical spending. Drug trend percent includes 201 clients representing approximately 65% of consolidated drug spending. The sample comprises clients who offer integrated (mail-order and retail) pharmacy benefit options for members. Clients with membership enrollment changes > 50% were excluded from the analysis. Plan spending is reported on a per-eligible per-month (PEPM) basis, unless otherwise specified. An “eligible” is a household, which may include multiple members who are covered under the same plan. Plan spending comprises the net cost to plan sponsors less discounts, rebates, subsidies, and member cost share. Generic dispensing rates and mail-order penetration rates represent the total consolidated Medco client base.

- Diabetes is obviously a critical category for everyone. I found it interesting that they saw fewer patients filing claims for diabetes but more drugs per patient in 2009.

- Respiratory therapies (driven by those <19 years old) jumped in contribution to trend from 8th to 2nd.

- In patients aged 35 to 49, antiviral drugs are the greatest contributors to cost – 8.3% of plan pharmacy costs. [Some of this driven by flu although this is not the at risk age group.]

Antiviral drugs (Formulary Guide Chapter 1.8) include oral treatments for HIV/AIDS, influenza, herpes, hepatitis C, hepatitis B, and injectable treatments for respiratory syncytial virus (RSV), and cytomegalovirus.

- Utilization growth for ADHD drugs for those age 20-34 grew 21.2%. [Is this for people not diagnosed as kids, people who have adult-onset ADD (if that exists), or just an over-diagnosis of the condition?]

- Specialty drugs…I’m always surprised that all the PBMs still have to caveat the fact that they only adjudicate some of the claims since some specialty drugs are filled and billed under the medical benefit. That seems like something that should / could be fixed, but I know it’s been tried and is hard since people are making money off them being billed elsewhere.

-

Cancer is already a huge driver of specialty costs AND:

- Much of the spending is still under medical;

- Most drugs approved in the past 4 years costs over $20,000 for a 12-week course; and

- There are over 800 drugs in the pipeline.

Spending growth has outpaced spending for nonspecialty, or traditional medications because:

- A high proportion of newly approved drugs are designated as specialty.

- Unique manufacturing processes make specialty drugs expensive to develop.

- Fewer drugs within a therapeutic category limit competition.

- There may be only one specialty treatment for an orphan condition.

- Few drugs are therapeutically equivalent to others in the category, reducing interchange and related cost savings opportunities.

- It is more difficult to transition existing patients from one specialty drug to another preferred specialty drug because often these drugs are large, unique proteins that are not considered interchangeable.

- Most small-molecule specialty drugs are relatively new with few generic alternatives.

- No defined approval pathway exists for follow-on biologics (also known as biosimilars).

- Drugs used to treat cancer represent a large portion of new drugs in both the pipeline and marketplace; most are specialty drugs and some can cost more than $20,000 for a 12-week therapy course.

- It was the first time I noticed anyone caveating the specialty trend. They proactively addressed different calculation methods to point out that their method yielded a 14.7% specialty trend, but if you did things differently (as I assume others must), then their trend would have been 12.1%.

- Trend in children exceeded trend in other age groups for the second year in a row. (I think this is an interesting perspective and a scary indicator for the future health of our country.)

-

They provided some examples of drugs that had new indications for younger patients approved:

- WelChol, Crestor—for low-density lipoprotein cholesterol (LDL-C) reduction in children aged 10 to 17 with heterozygous familial hypercholesterolemia.

- Atacand—for hypertension in children aged 1 to 17.

- Axert—for acute treatment of pediatric migraine.

- Protonix—for erosive esophagitis in patients aged 5+.

- Abilify—for irritability associated with autistic disorder in children aged 6 to 17.

- Seroquel—for schizophrenia in children aged 13 to 17, and for acute manic episodes in children aged 10 to 17 with bipolar I disorder.

- Zyprexa—for schizophrenia and for acute mania (bipolar I) in children aged 13 to 17.

- WelChol, Crestor—for low-density lipoprotein cholesterol (LDL-C) reduction in children aged 10 to 17 with heterozygous familial hypercholesterolemia.

- An interesting perspective that I’ve talked about many times (without the research capabilities to analyze) is the correlation between sleep and chronic disease. They looked at this across states based on drug utilization and found a correlation (not necessarily causation).

So what do they say to watch:

- Continued inflation in brand drug prices.

- Majority of trend will come from specialty – oncology, orphan conditions.

- Personalized medicine.

- Biosimilars.

- Generic pipeline.

- Obesity epidemic.

- They bring up an interesting issue relative to OTC (over-the-counter) product which is DUR (drug utilization review) which looks for drug-drug type interactions. They talk about the Medco Health Store integrating that data to monitor patients. [Do plans care? Do patients care? Should retail OTC purchases be integrated? How great are the interactions?]

-

They talk a little about obesity although I would love to understand more about how a plan sponsor should manage this.

- 68% of adults are overweight; 34% obese

- 32% of children are overweight; 17% obese

- Medical spending on obesity related conditions is $147B

- 19.5M adults (24-85) have diagnosed diabetes and other 4.25M are undiagnosed

- Diabetic medical claims are forecasted to grow from $113B to $336B over the next 25 years.

- I’m not going to spend a lot of time on personalized medicine here. (A recent post of mine on this topic.) They’ve been very active in this space for years talking about it. I think one of their interesting points in the Drug Trend Report is how Comparative Effectiveness will dovetail with Personalized Medicine.

- Almost 2/3rds of people at risk for CHD in the next 10 years and eligible for lipid lowering drugs (e.g., Lipitor) were still not using them. (A common gap-in-care program run by many companies is to target these people (e.g., diabetics).)

- Only 29% of patients treated for high cholesterol reach their cholesterol goal.

- They have a section on wiring healthcare which David Snow has talked about for a while. It’s a critical area to address and has lots of opportunity.

- They also talk about the concept of collaborative care (aka medical home…aka accountable care organizations).

- I’m a big believer that poly-pharmacy creates issues (as does poly-physician). I don’t hear much talk about it. I was glad to see them talk about a study they did which identified poly-pharmacy issues, talked to MDs, and ended up with 24% of cases where medications were changed.

A Medco survey reported that 81% of participants with a new diagnosis, who received services at a traditional retail pharmacy, either did not receive counseling or were dissatisfied with the prescription drug counseling they received. When given the opportunity to speak with a Medco Specialist Pharmacist, 75% of these patients accepted the offer of immediate telephone support.

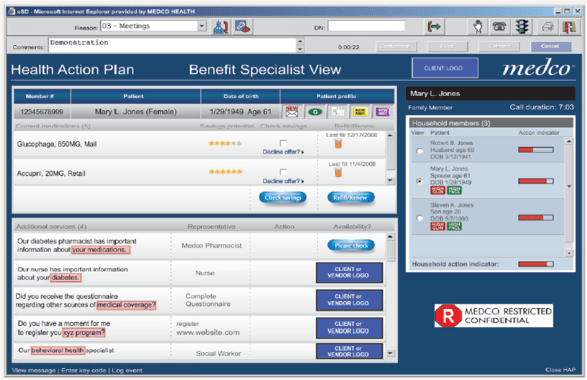

- I thought it was really interesting to see a screen shot of their application used by the TRCs to create their Health Action Plans for consumers.

- I was also interested in their focus on women’s health and some data on caregivers and the gender differences in healthcare. One of their TRCs is dedicated to addressing these differences.

September 21, 2010

September 21, 2010