Well. I am back from vacation. I grabbed a WSJ on my way home from Orlando and was surprised to see an article about Wal-Mart potentially going into the PBM business. Not a surprise that they would go into the business, but a surprise that they would build it organically. (Although I don’t believe they have confirmed their exact intent.)

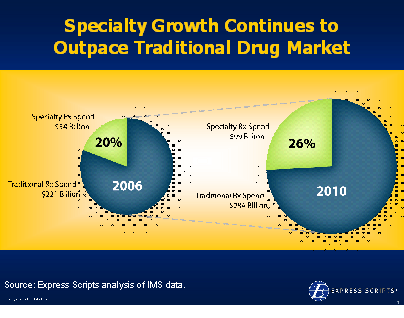

Of course, pre-stock market correction, the PBM stocks (Medco, Express Scripts, and Caremark) were all very expensive, but there are numerous smaller PBMs which could be bought and give Wal-Mart the adjudication systems, logic, and other processes to jumpstart the business.

Logically, Wal-Mart is strong at many of the core PBM functions – supply chain management, cost management, and distribution. But, this is not a retail play. There is no efficiency per square foot to compare to other functions. And, you are selling primarily to the payor not the individual. And, face facts, Wal-Mart hasn’t traditionally been recognized as the healthcare friendly company for many of its million workers. Would employers face backlash trying to convince their employers that they were simply containing costs or actually engaging Wal-Mart to educate and help employees make good health decisions?

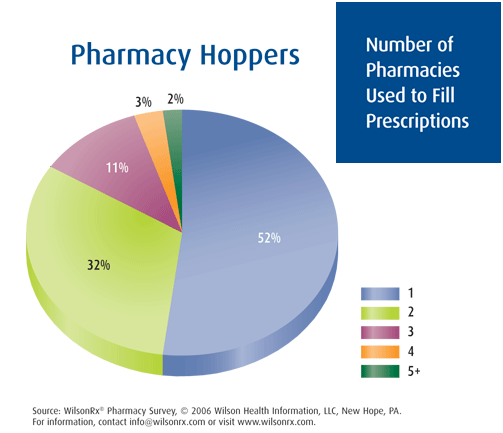

So, it bears the question of whether they see a broader trend. Could consumerism spell the end of the traditional business-to-business PBM and drive a business-to-consumer PBM? Since the Wal-Mart Bank idea never took off, could they get into the space through healthcare. [The convergence of Health and Wealth has been written about numerous times.]

Obviously, CVS saw a strong play in the PBM space with its purchase of Caremark. Walgreens already has their own PBM. And, with Wal-Mart being the third largest retailer, it would seem like a logical trend to build out their PBM functions. [I think they have some PBM services that they provide today, but mostly for their own employees.]

January 25, 2008

January 25, 2008

use that to compel the legislators to act but doesn’t it seem strange to have an end customer comment about the supply chain relationship of two entities. What am I talking about?

use that to compel the legislators to act but doesn’t it seem strange to have an end customer comment about the supply chain relationship of two entities. What am I talking about?

Getting back to the article…He offers several good examples of sticky messages which are primarily what I would call rallying calls for organizations. In healthcare, the key is to find these simple messages that compel people to act. So, bottom lining it, he gives six basic traits:

Getting back to the article…He offers several good examples of sticky messages which are primarily what I would call rallying calls for organizations. In healthcare, the key is to find these simple messages that compel people to act. So, bottom lining it, he gives six basic traits: [By the way, as I have previously disclosed, I own no ESRX stock or other stocks individually. I only invest in mutual funds…and do very well with it.]

[By the way, as I have previously disclosed, I own no ESRX stock or other stocks individually. I only invest in mutual funds…and do very well with it.]

In

In

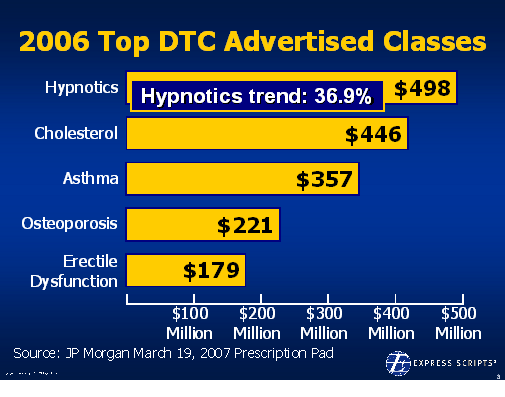

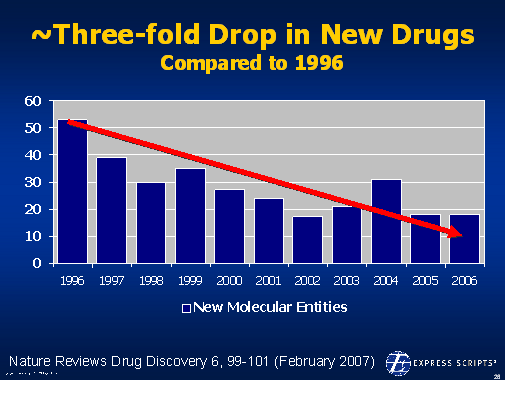

On 12/6/07, the

On 12/6/07, the  1800s in terms of the framework for developing drugs. Obviously, this has been the driver for biotech where the drugs are made of proteins and there is no generic competition.

1800s in terms of the framework for developing drugs. Obviously, this has been the driver for biotech where the drugs are made of proteins and there is no generic competition.