Here are my highlights from Medco Health’s 2009 Drug Trend Report:

- Overall trend was 3.3%. (1.3% excluding specialty drugs.)

- Specialty trend was 15.8%.

- Their generic fill rate was 64.1%.

- Interestingly, they broke out trend to show that clients with over 40% mail use had a trend of -0.7% while those with less than 40% had a trend of 5.8%.

- I do like the generic distribution chart below although it is for 2008 Q4 while their 64.1% number is for the average of 2008.

- They point out that utilization growth was negative 1.1% last year which was the first time in a decade. What I was surprised at is that they didn’t “blame” the economy for this. Most surveys I have seen say or imply that people are taking less medications because of the increasing cost burden while their overall wealth is decreasing.

- Medicare costs increased 6.8% for their PDP (prescription drug plans).

- I think it’s interesting in helping companies focus their management efforts when they project that “in the next 3 years more than 85% of drug trend will be driven by drugs in six categories: cardiovascular, endocrine/

diabetes, central nervous system, musculoskeletal/rheumatology, respiratory, and oncology”. - In a brief section about the unwired state of healthcare, they share some scary statistics:

- A review involving the medical records of 41 million Medicare patients identified $8.8 billion in error-associated costs and 238,837 preventable deaths. Moreover, a large subset of these errors are medication errors.

- An estimated 1.5 million preventable serious medication errors occur each year, with $217 billion (2006 dollars) in associated costs.

- Since people are always asking for quantifiable value around adherence, I liked the chart below which showed the survival rates over years based on adherence vs. non-adherence.

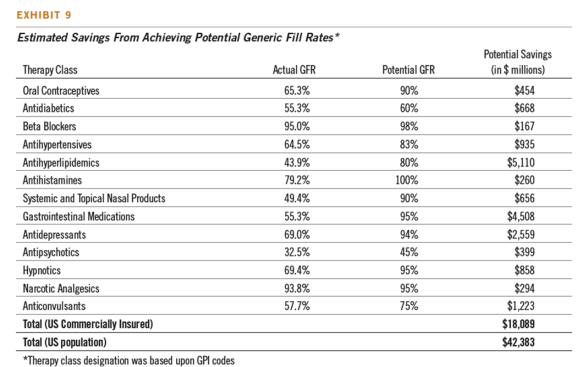

- They introduce a new metric – Generic Opportunity Score (GOS). It takes into account both chemical and therapeutic opportunities for generics to be used.

- They also provide some details on a brand-to-generic $0 copay waiver program which had a 14% success rate. That’s pretty good from what I have seen.

- Here is a breakout of the specialty pharmacy categories:

- Now, where they do credit the economy is with improving generic fill rate, mail order utilization, and client’s use of trend management programs.

- They show trend by age group with the lower age groups growing faster. They also showed a nice graph of utilization by state.

- Below is their chart on where trend growth in the future is projected to occur (which should tell you where to focus preventative action).

May 25, 2009

May 25, 2009