Medco‘s Trend Report recently came out for 2008 (which looks back at 2007). Here are some of the graphs and information from it.

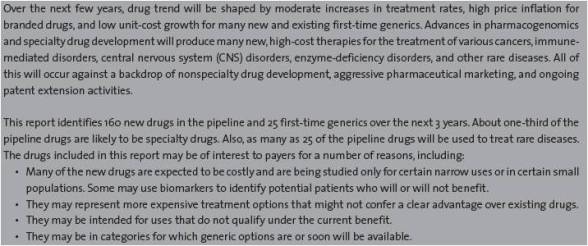

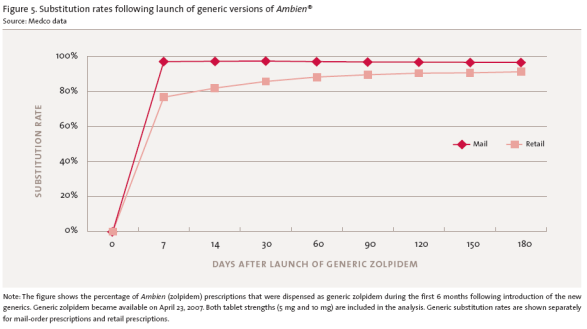

“Generic drugs have been a tremendous asset in controlling runaway health care costs,” Medco Chairman and CEO David B. Snow Jr. said. “Generic cholesterol medications have helped contain our drug trend to a new all-time low of 2.0 percent. Patients and our clients are reaping the benefits of generics as we enable them to hold down costs and make prescription drugs one of the few areas where spending trails overall health care inflation.” (Source)

- Drug trend was 2.0%.

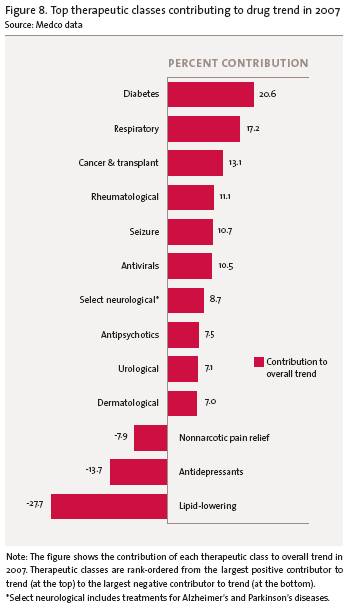

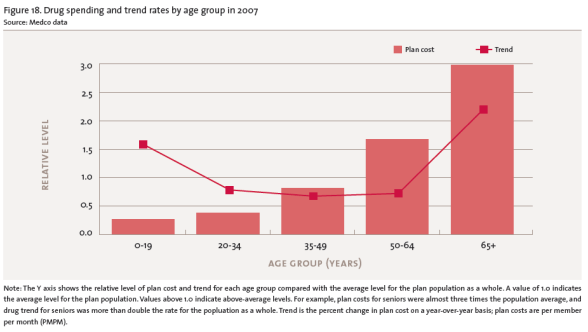

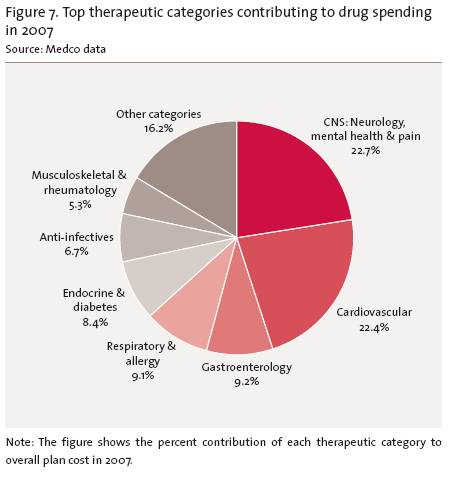

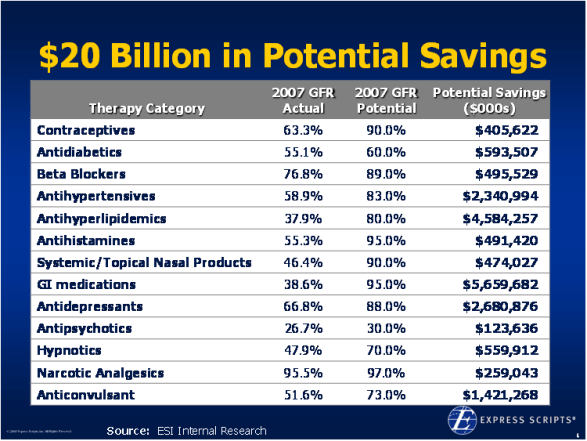

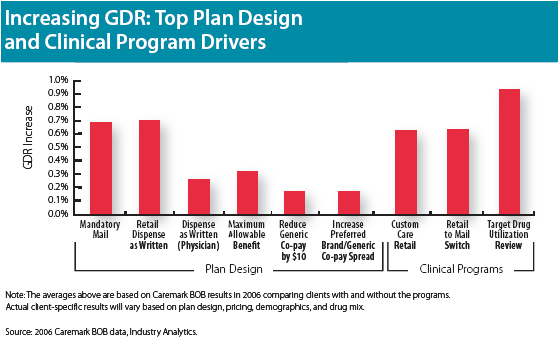

- They talk a lot about what drives trend by class.

- It shares a lot of tables and charts. (I pulled out those below that most interested me.)

- They talk about legislative and technology issues / opportunities such as e-prescribing.

-

They talk about consumer driven health plans (CDH):

- Lot of plans offering them; low adoption (2.6M members)

- Mail order use is only 1.2% higher and generic use is only 1.0% higher (so much for easy ways of saving money)

-

They talk about the rapid growth of people using social networking tools to learn about diseases and medications.

- Which presents risks and opportunities

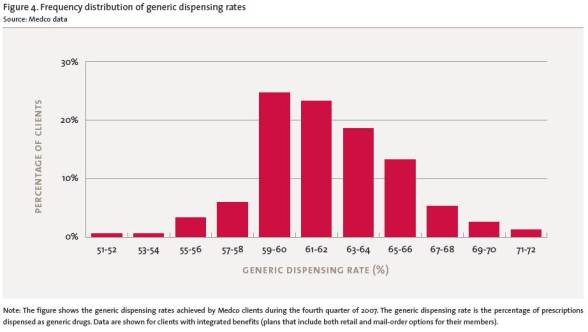

- They introduce a new metric…the Generic Opportunity Score.

- They introduce a new topic to me which is “adjunct therapies”. The key to this topic here is whether plans should consider coverage of over-the-counter (OTC) drugs that are prescribed for use with prescriptions to treat a condition.

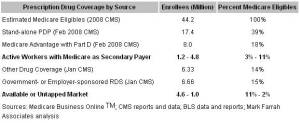

- They talk about Medicare driving a focus on quality.

- They talk about coverage for the uninsured.

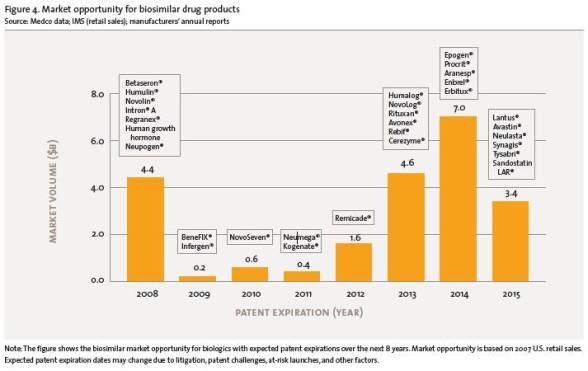

- They talk about biosimilar drugs (aka – biogenerics).

- The talk about genomics (i.e., personalized medicine).

- They talk about BTC (behind-the-counter) and OTC (over-the-counter) trends.

- They talk about nanotechnology.

I didn’t read it word for word, but it seems to cover the landscape well and give good easy to read metrics with lots of charts.

May 22, 2008

May 22, 2008

Someone asked me if I thought pharmacists would be allowed to prescribe medication to patients. I’m not familiar with any legislation on this topic (although there well might be some).

Someone asked me if I thought pharmacists would be allowed to prescribe medication to patients. I’m not familiar with any legislation on this topic (although there well might be some).