When I think of the current generation that is coming into the workforce, I think of people who:

- Grew up with social media all around and are less concerned about privacy

- Grew up with the ubiquity of technology having an iPod always on and being in constant communication with their mobile phone

- Grew up with the US in a constant state of war – 9/11, Iraq, Afghanistan

- Grew up with the idea of constant stimulus – portable video games, TVs in the car

- Grew up with periods of market instability – technology bubble, 9/11, housing bubble

- Grew up with a likelihood of living at home after college [and think that’s ok]

- Grew up with more global awareness via CNN and the Internet

- Grew up with allergies and general paranoia – no more leaving home as a kid and coming back when the sun set or eating peanut butter at school

I think the more typical perception of many of them is an overly privileged generation who can’t focus on one thing, expect everything (money, position, title, responsibility) regardless of whether they deserve it, don’t follow basic protocols (like a thank you after an interview), have been coddled their whole life, and have no respect for what others have done. But I think every generation thinks that of the next generation.

I guess the official definitions are: (see good presentation)

- Traditionalists – born before 1946

- Baby Boomers – born btwn 1946 and 1964

- Generation X – born between 1965 and 1981

- Millennials – born 1982 to 2000

The Millennials are also called Generation Y, GenNext, the Google Generation, the Echo Boom, or the Tech Generation and are 76M strong. With immigration they are likely to surpass the Baby Boom generation in the 2010 census. [Note – Comments derived from reading an exerpt of The M Factor by Lynne Lancaster and David Stillman in the May 2010 Delta Sky Magazine.]

Their book – The M Factor – is focused on this generation. They talk about the fact that this generation is talking about and searching for “meaning” in their work. They’ve been raised by working parents that struggled with life balance and want more out of work for their kids. They see how work has become so engrained in our lives with Blackberries and other tools.

More than 90% of US Millenials said having opportunities to give back thru their company was somewhat to very important when considering joining an organization.

51% of young workers surveyed as part of the Kelly Global Workforce Index were prepared to accept a lower wage or lesser role if their work contributes to something “more important or meaningful”.

The question that a lot of this drives at is how do you leverage the passion and tech savvy Millenials as part of your workforce. They are going to drive changes. They are going to be innovators. And, they’re not going anywhere. Here’s a good blog on Generation Y.

It reminds me of some mock interviews I did a few years ago at my business school. I was stunned by some of the accomplishments of these people. They had founded companies and businesses. They had volunteered in the community. They were well read and had passion for things that I didn’t care about at their age. I was glad to have made it thru school with my peers. But, on the flipside, I talked with my friends who are the Dean of the School and run the Career Center to point out that not one of those people wrote me a thank you or sent me an e-mail. None of them ever asked me to help them find a job leveraging my network.

The article talks about this Millenial generation growing up at a time when the divorce rate had dropped and parents spent more time with their kids and transformed from authority figures to mentors and friends of their kids. This whole concept of “helicopter parents” has been explored in other areas and still amazes me. [Are you a helicopter parent test.] For example, 11% of US Millenials said they would feel comfortable involving their parents in salary negotiations. [If I had the option legally and a parent showed up with their kid for a salary negotiation, I would rescind the offer. If they can’t do that by themselves, how can I trust them to drive my business in pressure situations?]

In healthcare, the best example I always use for a company focusing on this generation or the “Young Invincibles” is Tonik Health which is a Wellpoint brand. I’m always surprised how few people know them. Take a look at their website (below) – the colors, the words, and the positioning is all so different than how most of us think about our health insurer. Here’s a good blog entry on the “millennial patient“.

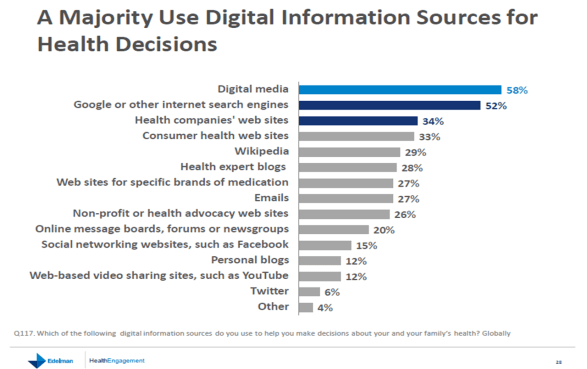

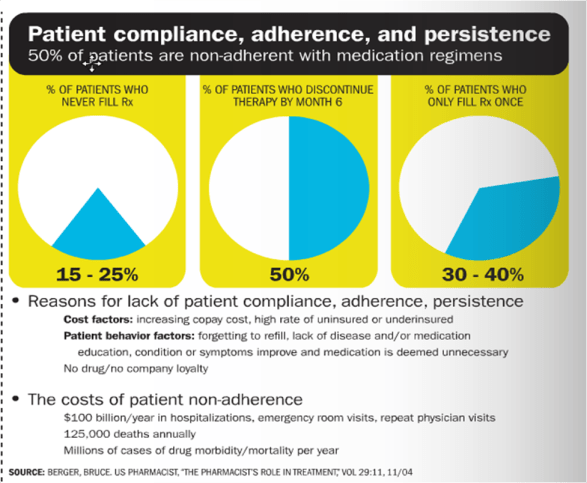

Why is this relevant to my healthcare communications blog – because segmentation is so key to effective messaging. You have to understand this generation and how to engage them and drive them to take care of their health. Traditional language, modes, techniques, and messages may not work. The article (from the book) talks about their focus on feedback and scoring. They are used to constant [positive] stroking and having a score to evaluate success. They grew up being rewarded for everything. How does that manifest itself in a wellness system that tracks their good deeds (exercise, diet, preventative actions), provides them with rewards, frames their effort as contributing to the greater good, and integrates technology (e.g., connect devices)?

Only 3% of the people they surveyed said that Millenials handled negative feedback well. They haven’t been allowed to fail. This makes me think about one of my favorite quotes from IDEO – Fail Often To Succeed Sooner. You have to understand how to try, fail, learn, and try again to make improvements.

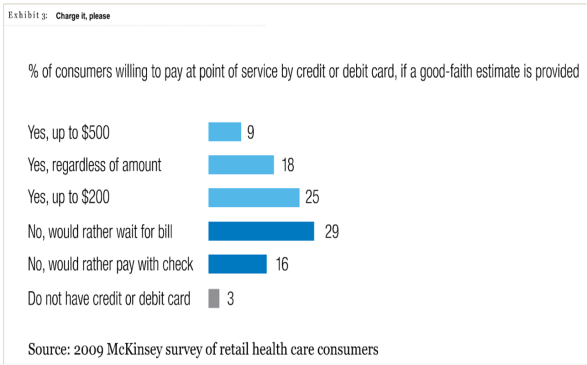

Here’s some recent research we’d done at Silverlink on the “young invincibles” and “Why I Have Health Insurance”:

May 18, 2010

May 18, 2010