On my vacation, we took the kids on a Disney Cruise. We also went last January.

For the first time, I think I can actually differentiate between very good and excellent on the survey. I always struggle with that and tend to grade down. In general, we love the Disney experience and the cruise is very well run. We are already booked for next year and will be going with several other families.

Anyways, on the boat, you go to a different restaurant each night and your wait staff follow you. This year, they were attentive. No food was messed up. They were polite. They did magic for the kids each night at the table. They engaged us in conversation. It was very good service. Better than almost any restaurant.

BUT, since we were there last year, we had a very high expectation. Last year, the wait staff learned each day. After day one, they knew what drinks my kids liked and had them waiting for them when we arrived for dinner. By day three, they knew my son was a picky eater and had one of his favorite foods on the table. And, they knew that my daughter wanted some snack other than the typical appetizers and they had that waiting. Basically, they learned, adapted, personalized, and acted proactively. The difference was amazingly clear within very tight parameters.

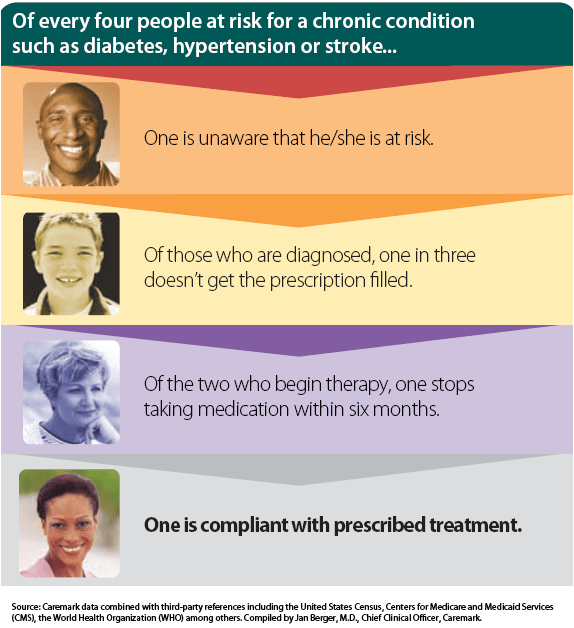

Of course, it took someone else to point out to me that this was an example to share since this is the key point for my healthcare companies. You need to learn from your communications. You need to adapt to today’s technology and your patient’s expectations. The patient experience has to be personalized (in scale) to be in a message they respond to, in a channel they like, at a time that is convenient to them, and based on previous interactions. And, you have to act proactively. The patient doesn’t always know when to act.

Since traditional differentiators are basically null (i.e., network size, plan design), it becomes all about communications and service. How do you drive the patient experience? It is worth looking at the Forrester data on customer experience index. Healthplans score incredibly low in terms of usefulness, ease of use, and being enjoyable. The highest (that they looked at) was Kaiser at 63% with the lowest being Aetna at 49%. [60-69% meant that the customer had an “okay” experience with the company.]

February 11, 2008

February 11, 2008