The new report is out. I haven’t read it yet, but here’s the teaser graphic from the website.

Specialty Rx Offerings Not Rxs Only

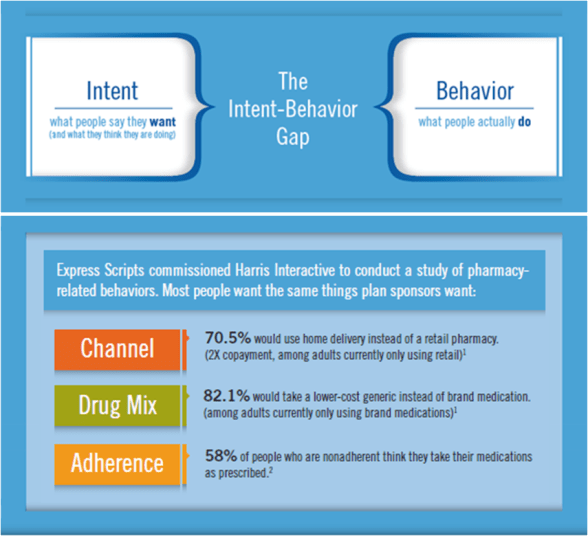

I’ve spoken about this for a while, but I was pleasantly surprised to hear one of the Chief Medical Officers in the industry make this point to a large number of manufacturers. He was talking about lots of the changing dynamics in the industry from personalized medicine to new research. He talked about the challenge of adherence and how we needed to think differently. He even suggested that pharma should start talking with payers much earlier in the pipeline so that their research tracked metrics that the payers cared about.

At the end, one of his summary perspectives was that they should stop thinking about just bringing a drug to market and think about how they bring an offering for the condition to market which centers around a drug. This goes back to what the book BLUR presented years ago. You have to blend products and services to create offerings.

In the case of specialty, you have a very sick patient who often has a symptomatic condition that they are living with everyday that might affect their ability to live or potentially debilitate them. It affects their family. And, there may be additional co-morbidities associated with the condition.

Right now, there are solutions that try to engage these patients especially in clinical trials or when a drug is first launched, but over time, that “energy” decreases. It’s important to think about these specialty patients from an experience perspective.

- Diagnosis – What happens after they’re diagnosed? How much do they really remember from the physician encounter? Do they understand the drug they’ve been prescribed? Do they know where to go to find more information? Do they understand what resources are available to support them?

- First Fill – Do they understand the drug’s side effects? Do they believe that this is going to help them? Do they know how to get the prescription? Do they understand how to use the specialty pharmacy?

- Ongoing Therapy – Do they continue to refill the medication? What are their barriers (cost, convenience, literacy, beliefs, side effects)? Can they afford the medication? What support is there (financial, education, counseling) and how do they access it? Does their physician understand the disease? Have they gotten engaged with a community or support group?

- Changes In Condition – As they progress, what should they expect? How do you monitor these changes? Do these changes have an impact on the drug or strength? How does adherence affect this?

This creation of a solution blending services and pharmaceuticals creates some new ways for a manufacturer to differentiate themselves in the marketplace. Imagine the power of going to the physician, pharmacy, or PBM and telling them that you have a solution which does the following:

- Provides a highly effective drug (cue traditional data)

- Improves awareness and understanding of the condition for the patient

- Decreases the likelihood of abandonment

- Helps the patient with their out-of-pocket costs

- Increases the patient’s likelihood of refilling

- Helps the patient become an e-patient and engages their support system

- Provides ongoing monitoring of changes in their condition

Interested? I have some ideas if you’re a brand manager.

The Changing Specialty Drug Pipeline

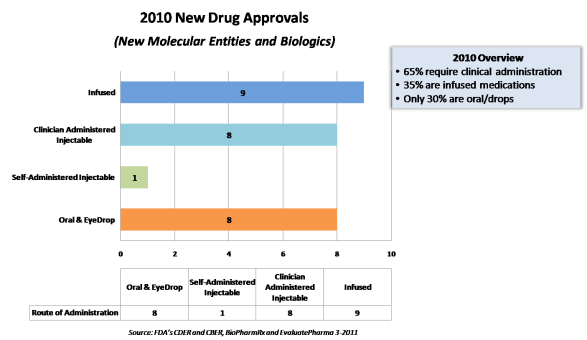

In 2010, only 30% of the specialty drugs were oral solids or eye drops. 65% required clinical administration. Only one was a self-injectable drug. (Summary data and chart below c/o BioPharmRx Consulting.)

This is important since it changes the PBM and pharmacy paradigm as we know it. If increasingly specialty drug spend is managed by the PBM, this creates a greater need for a relationship between the PBM and/or the pharmacy and the provider. Or, it requires infusion services as several specialty companies provide.

It’s expected that this trend will continue, and specialty will quickly become the focus in the payer world (from a pharmacy management perspective). You’ll have low cost generic drugs for most common conditions and high cost biologics for the more rare conditions.

I’ve heard several projections now that specialty will move from ~15% of spend today to about 40% of spend in the next 5 years (from a PBM perspective). You combine that with generics making up 80-90% of all non-specialty prescriptions in that timeframe, and you have a very different world.

On a related note…Will that change the manufacturer to PBM relationship? Maybe. I personally believe that the PBMs will get closer to the pharmaceutical manufacturers in the specialty space like they used to be with the manufacturers when branded drugs were the majority of prescription drug spend. Given the detailers (i.e., feet on the street) that the manufacturers have versus very small academic detailing teams or even the provider relations teams that payers have, there will be a need to figure out how to interact with the physician in new ways. And, with the cost of these drugs averaging $1,800 per month and running into the $100,000s, there is a lot more money to be spent on supporting the patient.

A Few Points On Generics

I’m sharing a few quotes from the recent Drug Benefits News on generics here:

“Despite the fact that generics use has long been mainstream, a recent survey we conducted found nearly one-third of Americans still do not know or believe that generics have the same active ingredients and effectiveness as brand name drugs,” Brian Solow, M.D., senior medical director for clinical services at Prescription Solutions, the PBM subsidiary of UnitedHealth Group

It would be interesting to look at that data based on age, gender, number of prescriptions used, physician, geography, and several other factors. That 1/3rd is similar to what I’ve seen in terms of skeptical physicians which would then make a lot of sense as patients of those physicians would be skeptical of generics.

“We are advocating an increase in the differential between generic and brand name copays,” David Lassen, Chief Clinical Officer at Prime Therapeutics LLC says. “Right now the average differential between Tier 1 generics and Tier 2 preferred brands is about $15. We think this difference should be bigger. We’ve seen research suggesting consumers need to save an average of $25 in order to select a generic over a brand name drug.”

An interesting point on copay differentials that a friend of mine recently made is what is the actual differential after grandfathering and formulary overrides which happen.

Cured After The First Fill!

I was at a presentation recently where a Chief Medical Officer from one of the PBMs was talking about a survey they did on statin users and why they didn’t refill. Amazingly, he said that 21% of people said they thought they were cured after the first fill. Talk about a problem.

This data reminds me of a barrier survey from a statin adherence program that we did where 37% said they didn’t know they were supposed to refill their medication.

This topic then reminded me of a study that was published in the Archives of Internal Medicine in 2006 which looked at the frequency with which physicians did certain things when talking with patients. So, how often did they explain the duration of therapy to the patients – 34%!

Sometimes, we spend so much time trying to solve the complexities of adherence when there are baseline activities which can make a huge difference.

Trust As The Foundation For Healthcare Communications

Trust improves medical outcomes. It is the number one predictor of loyalty to a physician’s practice. Patients who trust their doctors are more likely to follow treatment protocols and are more likely to succeed in their efforts to change behavior. (Introduction of The Trust Prescription)

I just finished reading The Trust Prescription For Healthcare by David Shore. I would recommend it. It definitely framed things in a differently light. I also had a chance to talk with David on the phone and pick his brain a little. He sounds like a great speaker, and I’m looking forward to his new book coming out around building trust as an intermediary (i.e., managed care company or PBM).

A few of my highlights from the book are:

- Trust can be a differentiator.

- Trust is good business.

- The physician to patient relationship is where the baseline of trust exists today. Although he brings up the question of whether that trust erode as you get more and more time pressure. [I don’t remember the book specifically addressing the pharmacist – patient trust relationship although one would assume it is a similar foundational element.]

- Trust is critical in healthcare because you’re asking a vulnerable patient to believe you can help them.

- Profits may be negatively correlated with trust in healthcare (but not in other industries).

- He pointed out the fact that it’s ironic that while pharmaceutical companies do so much good they get such a bad rap.

- It was the first time I had seen someone introduce the issue of how healthcare entities are portrayed in TV shows and how while this is generally neutral that managed care organizations in the early 2000’s were portrayed negatively (and probably still are).

- He talks about the concept of “response shift” which I think it an important phenomenon about how our expectations change over time and the effect of expectations on trust.

- He talks about how two things happen when trust erodes – government intervention and consumer activism. [Hey…that’s where we are today!]

-

He uses two examples many times which are very relevant:

- Volvo is known for safety not specifically for making cars. They make sure this is consistent in their branding (e.g., not funding NASCAR races). It gets to the core of defining who you are. [This concept also made me think about the new Dawn campaign about saving wildlife.]

- You can build trust equity like Johnson & Johnson did which helps you when you have issues. [The question is how long they can draw on this given their current issues.]

- He holds out a few healthcare power brands but says there are very few – Mayo Clinic, Cleveland Clinic, BCBS, Kaiser, Massachusetts General.

- He talked about the concept of a Brand Architecture which made me think about some of the recent rebranding efforts at United Healthcare.

- He talks about how consumer understanding and communications are key to building trust.

Communication in healthcare typically runs into a series of obstacles related to listening, clarity, and confidence.

Some of the interesting research data was [noting that this was a book from 2005]:

- 56% of consumers say they will pursue something simply because it was made by a company they trust. (Macrae and Uncles 1997)

- About half of people agree that “doctors are not as thorough as they should be” and “doctors always treat patients with respect”. (National Opinion Research Center 1998)

- Race was a highly significant variable in trust correlation even when researchers controlled for other variables. (Corbie-Smith, Thomas, and St. George 2002)

- Patients are more likely to take a drug that they have requested than a drug with which they are unfamiliar. (Handlin et al 2003)

It book made me think of some interesting questions:

- Does transparency build trust with consumers?

- Does concierge medicine build trust overall?

- Does the use of technology by physicians enable or erode trust? [I believe he said that a lot of physicians didn’t think so.]

- Do non-profit systems have more consumer trust?

- What does all the news about drug problems, medical errors, and other issues do to the overall trust of the system?

- What are the trust queues for consumers by type of healthcare entity? (For example, a dirty bathroom at a hospital might make you worried. What’s true for insurers, PBMs, pharmacies, etc.?)

One key point to pull out that he makes is that

Without branding, healthcare becomes a retail industry, and in retail, as in residential real estate, the three most important factors are location, location, and location.

The Changing Pharmacy Marketplace

I had the opportunity to listen to a few executives talk about how the marketplace is changing. While I don’t think any of it was surprising, it did bring up some interesting discussion points.

The discussion focused on five themes:

- The fact that the small molecule market is essentially going generic and will be a low cost market.

- The fact that biologics is the focus and is where innovation and the spend will be.

- The challenge of wiring healthcare to get that last mile to the physician.

- The unknown implications of health reform and exchanges.

- The continued focus on the consumer as central to healthcare.

I thought it was very interesting that several people talked about this evolution from brand to generic to biologics as the “circle of life” where there was a natural redistribution of cost.

I thought the discussion around personalized medicine was interesting especially as it dealt with the non-biologics and looking at where there were still opportunities to differentiate in the small molecule world.

One of the more interesting discussions was on whether bio-similars were really a “generic” type strategy or a new type of innovation. Given the clinical work and other hurdles that are imagined for bringing bio-similars to the market, it isn’t expected that you’re going to see massive price drops. And, if they aren’t therapeutically equivalent, then they become another option within the category. As one person pointed out, the likely scenario is more of a step therapy strategy where if the bio-similars (or bio-betters as one person called them) are less expensive that the original biologic AND there is no difference in likelihood of success with an initial patient then you would simply require patients to start with the bio-similar.

There was some interesting discussion on the use of biologics from a prevention perspective which was only touched on.

One person talked about the blurring of the brand and generic manufacturer demarkations, but I think Teva’s already done that over the past few years.

There was some discussion of current state tactics around copay cards and how they are used. The question being whether this is to drive lower consumer costs, avoid switching, or avoid generic substitution. This led to the classic debate of patient – physician versus payer.

The biggest thing that scared me was some of the discussion around how DC and politics can play a role in determining care versus allowing for evidence-based standards of care to drive decisions. As I was taught in consulting, you should make your decisions based on facts not on opinions.

CMS Treatment Of Generic Samples Offers False Hope

It’s interesting but irrelevant that CMS is now proposing that Part D plans can treat generic samples similar to OTC drugs. Who cares?

Why do I say that?

- Generics represent more that 80% of the non-specialty drugs dispensed in many cases.

- The technique doesn’t work.

At Express Scripts, I ran a program for a year. We hired pharmaceutical representatives to detail doctors. We bought generic drugs and repackaged them. And, we tracked GFR (generic fill rate) in the six categories for a year.

Guess what?

In most cases, the GFR for the doctors with the samples barely exceeded the GFR for the doctors without the samples. In one category, it was even lower. The GFR was going up too fast in the general market. If you add in the costs, it was a money loser.

We even compared our GFR in certain geographies to the published statistics from another company doing generic sampling…our clients GFR without samples was going up faster than their GFR with samples.

If you want to give away free drugs as a “gift” to make your academic detailing program more effective, have at it, but lets keep reality in mind here. This is not going to make a difference. All it’s going to do is drive up administrative costs for PDP plans.

Using the “Placebo Effect” in New to Therapy Situations

I was reading a book about trust which pointed out the concept of “remembered wellness“. This concept is similar to the “placebo effect” in that it shows that patients who trust their physicians and their course of therapy are more likely to have better outcomes (e.g., HIV study). WOW!!

I’ve talked before about the gap that exists when patients leave their physician’s office with a new diagnosis and we all know that health literacy is a big issue.

So…what are you doing to address this? I’ve been talking a lot lately about “primary adherence” (i.e., getting people to start therapy) and about engaging patients when they first get a new prescription or a new diagnosis. This concept of trust only makes this a more pressing issue.

Here’s your worse case scenario:

- Patient is newly diagnosed with a chronic condition and given a new prescription.

- They don’t have a great relationship with the physician and/or have limited understanding of the condition (due to literacy, fear, or other issues).

- They fill the prescription once and stop taking the medication after a few days.

How can you step in here?

- You can trigger an outreach based on diagnosis code.

- You can assess their understanding of the condition and help them learn more by addressing their barriers.

- You can engage them when they fill their first script.

- You can follow-up with them after the first few days to make sure they stay on therapy.

- You can enroll them in an adherence program.

- You can enroll them in a condition management program.

But, the point here is that you need to be doing something that reinforces the decision to manage the therapy and help them to understand and believe in that course of treatment. If they don’t believe and have trust, they are less likely to get to a successful outcome.

JD Power Customer Service Leaders – Pharmacy

Understanding how top performers achieve excellence is the first step to becoming a Customer Service Champion. The rest is up to you.

This is the statement by Gary Tucker, SVP, J.D. Power & Associates at the beginning of their publication Achieving Excellence in Customer Service from February 2011.

If you’ve never read their reports, you should understand that they look at five areas – people, presentation, price, product, and process. Interestingly, they use several examples from pharmacy to make their points about these five categories:

- Proactive communications

- Private space for consultation

- Clear information about how to save money

- Auto-refill

Another interesting thing they look at is whether the gap between high performing and low performing company has increased or decreased over time. In the product industries, the gap has decreased due in many ways to quality improvements. In the service industries, the gap has increased…WHY?

First, advances in technology have created new expectations among customers, resulting in new challenges for services. For instance, customers expect multi-channel service delivery and expect to choose whether to interact with their service provider in person, via the phone or e-mail, through online chat, or via Web-based self-service, among others. More challenging is that they expect the same level of service across communication channels. With ever-improving technology, it has been difficult for companies to keep all systems up to date and to remain equally effective in each.

They are preaching to the choir here. This is exactly what I tell clients all the time.

One of their examples that I’ve used for years is around the power of communications. They show satisfaction with auto insurance based on whether your premium stayed the same or increased. For those that it increased, they look at whether you were pro-actively informed and whether you had the option to discuss it. What group do you think had the highest satisfaction?

- Decreased premium

- Increased premium, pro-active notification, and chance to discuss

- No change

- Increased premium, pro-active notification

- Increased premium, no notification

Worried about satisfaction or churn? Have lots of changes to plan design? Here’s why you communicate.

In this report, they call out 40 companies as exceptional out of the 800 that were ranked. 7 of those 40 were pharmacies:

- Good Neighbor

- Health Mart

- Kaiser Permanente

- Publix

- Veteran’s Administration Mail Order

- Wegmans

- Winn-Dixie

How To Select What Pharmacies Are In Your Network?

This seems to be the “meta-question” that everyone is talking around.

- Should every pharmacy be in the network?

- Should mail be allowed? Should I do mandatory mail?

- How do I design a limited network? Is it ok?

- What about any willing provider? [should that just be about cost]

Let’s start with the basics…You want a network that meets access standards, has high quality, improves outcomes, keeps members happy, and offers you the best price.

So, how do you build your network to decide who is in or out (ideally)?

- Select the minimum number of local pharmacies required to meet access standards for acute medications (this is your baseline)

- Look at your best price to add more pharmacies into the network – who will meet your price for generics, brands, 90-day, specialty

- Evaluate your tradeoffs – will you get a lower price if you exclude certain pharmacies? will that impact access? will that impact care? will that impact satisfaction? can you manage the disruption?

- Look at difference in satisfaction between pharmacies – should you take a lower priced pharmacy if the satisfaction is less?

- Look at difference in outcomes between pharmacies – should you take a pharmacy that has a lower generic fill rate (on an adjusted population) or a lower adherence rate (on an adjusted population) at the same price?

Network design should look like formulary design. You have to look at the value versus the cost. You might include a higher priced pharmacy in the network if it gives you access, better outcomes, or lower net cost (i.e., better GFR). You might exclude a lower priced pharmacy if it can’t prove any of this or if consumers who go there are dissatisfied.

At some point, I would think we’ll see more metrics beyond price be used to measure pharmacies – discounts, GFR, safety (quality), medication possession ratio, satisfaction. That would make this a lot easier with some standards.

This would make it easier to have discussions about access in NY (for example) as PCMA is doing. It would make it easier to have discussions about the Department of Defense (for example) as NACDS and NCPA are doing.

The DoD is a good example here…Since the military (government) buys drugs better than anyone, I can’t imagine how much better some of these metrics would have to be to justify paying the additional costs at retail for fulfillment. The base pharmacies and the mail order pharmacy all get their drugs from the government contracts. At mail, the supply is managed separately so that they are replenished under those contracts. I bet the cost is $10+ on average more for a drug at retail (non-replenishment) than it is elsewhere. How do you justify that? In my mind, retail should figure out how to replenish and segregate their inventory to stay in the network rather than fighting the shift away to mail.

Who’s Your HOL For Improving Engagement

Following up on my post earlier today, I went to an article in PharmaVOICE from January 2011 called Engaging the Empowered Patient by Carolyn Gretton. It has lots of interesting statistics and quotes. Here’s a few:

- There are 99M US adults identified as being “e-empowered” consumers (per Manhattan Research’s Cybercitizen Health US Study (see a few slides here))

These consumers have done at least one of the following based on finding information online:

- Challenged their doctor’s treatment or diagnosis

- Asked their doctor to change their treatment

- Discussed information found online at a doctor’s appointment

- Used the Internet instead of going to the doctor

- Made a healthcare decision because of online information

I’ll have to drill into the report because I’d love to know how many have done the first two things, what the physician response was, and (ideally) if it impacted their outcome in any way.

40% of online consumers engage with social media on health sites either by reading or posting content, though frequency of engagement varies widely. (based on a survey from Epsilon and eRewards)

That last part is where the issue is (IMHO). Consumers do use lots of these tools BUT sustaining their interest and engagement over time is difficult.

The Epsilon report – A Prescription For Customer Engagement: An Inside Look at Social Media and the Pharmaceutical Industry – pointed out that consumers use healthcare social media for:

- Support

- Sense of intimacy with others with a similar experience

- Foundational information about their condition and symptoms

- Information about drugs and supplements

- Health news

Many of the individuals who are highly engaged in social media feel better equipped to manage their health. (Mark Miller, SVP, Epsilon)

I was really surprised that the Epsilon study said that consumers viewed product sites to be as important as healthcare provider interactions. I could argue both sides here. Obviously, the product site is going to have some bias. On the other hand, given the complexity of treatments and therapies these days, it has to be close to impossible for the provider to stay up on all the latest information.

Not surprisingly, the author of the article talks about people having mixed feelings about the product managers participating in a social media site. BUT, I think everyone would agree that with proper disclosure and the right person, this can work very well.

The article introduces a new term (for me) here – HOLS or Health Opinion Leaders. It talks about them becoming active parts of the pharma brand team. That sounds like an interesting role.

It was also interesting that they talked a lot about gaming as an engagement mechanism. It’s not something I’ve spent as much time with, but it keeps coming up (even more than incentives). They talk about several examples:

- HealthSeeker – a Facebook game developed by the Diabetes Hands Foundation

- Didget blood glucose monitoring system from Bayer for Nintendo DS

- Silence Your Rooster game for Sanofi-Aventis’s Ambien product

They also bring up an older game as a cautionary tale – Viva Cruiser – which riled critics for trivializing ED.

At the end of the day, it’s the same old challenge – how to get the consumer to act and stay engaged?

CalPERS and Medco

Those of you that follow the industry are certainly aware of this news story. It was definitely a surprise this past week when CalPERS announced that they were dropping Medco as their PBM based on allegations of improper behavior.

For an industry where transparency has replaced years of opaqueness, this will be an issue. Whether Medco is guilty or not-guilty, industry foes will use this to taint the perception of the PBMs. I am sure some people cheered when this came out thinking “finally we may have found something” while the rest of us shook our heads in disbelief.

PBMs and Star Ratings

Finally, I’m hearing more talk about PBMs and their role in Star Ratings for Medicare. It seemed like this was a subtlety at the end of last year when I raised it as a 2011 priority.

Drug Benefit News had a story about it in their March 4, 2011 edition with examples from HealthTrans and PerformRx.

In general, there are opportunities to help impact Star Ratings by:

- Blending pharmacy and medical data

- Helping monitor patients on long-term medications

- Increase cholesterol screening

- Increase use of flu shots

- Controlling blood pressure

- Addressing physician communication gaps

- Improving Customer service

- Prior authorization process

- Churn

- Time on hold

- Appeal process

- Accuracy of information provided by customer service

- Managing complaints

- Helping with access issues

- Timely information about the drug plan

- Monitoring use of drugs with a high risk

- Making sure diabetics us hypertension drugs

Since pharmacy is the most used benefit, it can have a very direct impact on the overall satisfaction. It can drive calls. It can be complicated. It can affect perception. And, it can lead to churn.

PBMs need to be working to proactively engage consumers. They need to use data to personalize the experience. They need to use clinical data to identify gaps in care. They need to drive adherence.

I personally hope that the Star “concept” becomes a more normal set of metrics outside of Medicare for measuring success and ultimately leads to a performance-based contracting framework.

Should The State Board Of Pharmacy Govern PBMs?

Mississippi has introduced legislation that would move the oversight of PBMs from the State Insurance Commissioner to the State Board of Pharmacy. From a clinical care perspective, there seems to be some logic here, but from a business perspective, it doesn’t work. Right now, the State Boards are generally made up of local pharmacists with an occassional PBM pharmacist on the board.

Since that group negotiates with the PBMs for rates, it would seem to create a major conflict of interest. PCMA has honed in on this and is actively fighting it.

I guess that’s like saying that hospitals should govern managed care organizations.

Improving Your Call Center Without Just Adding People

In today’s economy, the last thing we want to do is scale up a company by simply adding people. Technology has to play a central role in allowing you to grow your company more efficiently.

At the same time, you want to grow without dropping your level of service. You want to improve the consumer experience.

And, to further complicate matters, you have to manage quality both to make sure that you comply with regulatory oversight and achieve goals around first call resolution. With our rapidly changing healthcare environment and legacy systems in many places, finding, training, and retaining good staff that can continue to keep up with the changes and understand the semantics between plan designs isn’t easy.

So, how do you do that? You’re in a balancing act between cost, quality, and experience.

This is one of the big areas where I’ve seen Silverlink Communications play a role. (Note: There are certainly other efforts which you can undertake in terms of single desktop and process reengineering, but I usually refer in some people I trust for those projects.)

Some people call our technology a “smart dialer”, but there is a difference. If you ever get a call at home from a call center using a dialer, you hear that silence after you say “hello”. The technology is looking for an agent to connect you with. On the flipside, if you’re an agent, you’re being connected with someone or even an answering machine that might not be the right person. That’s what a dialer does.

In our case, Silverlink is using mass personalization, voice detection technology, and speech recognition technology to screen the recipient for the call center. You hear the message right after you pick up the phone. It’s a message that has been carefully crafted using behavioral sciences and health literacy. It asks for you by name and identifies who’s calling for you. It then confirms your identity, and depending on what information is being used in the call, it may have to use multiple forms of authentication to verify who you are. Once we’ve assessed who you are (based on your responses), we’re able to deliver a personalized message to you about your healthcare. That personalized message is scripted in such a way to engage you in a conversation. During that conversation, we can then determine:

- Are you interested in learning more?

- Is this a good time for you to talk?

- Would you like to talk to an agent or hear more now?

- Would you like us to send you information in an e-mail, SMS, or snail mail?

- Would you like a URL to go to for more information?

Occasionally, people ask about authentication. When you send a piece of direct mail, it’s a federal offense to open it if you’re not the intended recipient, but you have no proof that they did that unless your “nanny cam” picks it up. When you call someone, you have a record of when the call was made and what they person who picked up the phone said to authenticate themselves. This certainly seems better to me than any other channel.

Of course, this begs the question of recording all the calls. I’ve heard a few people tell me that they do this with other companies. I find that hard to believe since 12 states have consent laws which would require people to consent to being recorded when they were called. That would limit the effectiveness of the program, or if you didn’t do it, it would open you up to a big lawsuit.

So, how does Silverlink add value to a call center:

- Improving agent productivity. Automating standard questions. Connecting with the right person at the right time.

- Improving consumer engagement. Using behavioral sciences and health literacy to engage people and route them to the right agent based on skill set.

- Improving quality and consistency of experience. Personalizing the experience to engage the consumer but doing it in a way that addresses the clinical guidelines, regulatory requirements, and custom client requests in a consistent manner.

- Improving agent satisfaction. Your agents would rather talk to pre-qualified people or people who have an issue.

- Learning new information. In some cases, patients feel judged when people ask them questions (why aren’t you taking your medications). They may reveal more or other information in an automated environment.

Of course, automated calls aren’t the answer for everyone (although they work better than any other mode other than people…and sometimes beat them also). But, multi-channel coordination is a post for another day.

Rules Based Communications

After working with data warehouses, configuration engines, and workflow management systems, I’m a big believer in embedding rules into a process. Communications is no different.

Let’s look at a few rules:

- Don’t communicate with someone more than X times per week.

- Don’t call these people.

- Use Spanish for people with that language preference.

- Send a text message to people who have provided their mobile number and opted in to the program.

- When applicable, use a preferred method of communication for reaching out to someone.

- If a caregiver is identified and permission is on file, send the caregiver a copy of all communications to the patient.

- Call the patient if the amount being billed for their prescription is greater than $75.

- For patients between these ages, use the following messaging.

- If the patient hasn’t opened the e-mail after 48 hours, then call them.

- For clinical information, use this channel of communications.

- For John Smith, only call them on Tuesdays between 5-6 pm ET.

- For Medicare recipients, use this font in all letters.

- For Hispanic consumers, use this particular voice in all call programs.

- If the patient doesn’t respond after two attempts, send a fax to their physician.

- For patients with an e-mail on file, send them an e-mail after you leave them a voicemail.

- For patients who are supported by Nurse Smith, only call them when she is on duty and use her name in the caller ID.

I could go on. But, the point is that communications, like healthcare, is a personalized experience. We have to use data to become smarter (historical behavior, segmentation, preferences). We have to use customization to create the right experience. AND, probably the most difficult thing for lots of companies, we have to coordinate communications across modes (i.e., e-mail, direct mail, SMS, automated call, call center, web).

Ultimately, I believe consumers will get to a point where they can help set these rules themselves to create a personalized profile for what they want to know, how they want it delivered, and ultimately provide some perspective on how to frame information to best capture their attention.

To learn more, you should reach out to us at Silverlink Communications.

Why Aren’t There More Collaborative Practice Agreements?

Collaborative practice agreements (aka collaborative drug therapy management) are legal documents between a specific pharmacist and physician to allow the pharmacist to have more direction in the care of the patient relative to their medications. Given the challenge of the physician to keep up with all the mediations and their lack of access to plan design information and full drug history, I’m surprised that these documents haven’t become more popular.

My guess is that the logistics of a one-to-one legal document around standards of care is complex to scale (see how to set up). But, I always think about how easy this could be for addressing formulary management. The physician could agree to which drugs they considered therapeutically equivalent. They could then tell the pharmacist to choose the drug which was lowest cost for the patient.

Online Company Looking For Pharmacy Partner For Customer Acquisition

A friend I met years ago when I looked at the Duane Reade pharmacy kiosk is now at Everyday Health. He recently asked if I new anyone in the pharmacy area (independent, chain, mail, specialty) that might be interested in partnering with them to drive new customer acquisition based on their online content.

I figure there are several people that might be interested. I asked him to write up a brief note and provide some contact information. Here it is for anyone who’s interested.

Everyday Health is online health network that connects more than 27MM monthly users to in-depth medical content for health condition prevention and management, as well as lifestyle content in pregnancy, diet, fitness, and much more. Our network of 25 sites consists of our flagship, everydayhealth.com, in addition to many well-known health brands such as What to Expect When You’re Expecting, South Beach Diet and Jillian Michaels.

Everyday Health is currently exploring the local health frontier and trying to determine how our organization can better leverage relationships with local doctors, dentists, pharmacies and hospitals. For pharmacies, we’re wondering if there is any value in driving Rx’s to a given storefront and whether there would be economic upside for doing so.

We’d like to connect with people with experience in marketing acquisition of patient Rx’s and/or anyone who can help clarify the above opportunity. Email Dan Wilmer in Everyday Health Business Development at dwilmer at everydayhealth.com.

Congressional Statements Regarding MTM

In the new Medication Therapy Management Empowerment Act of 2011, there is a nice summary at the beginning of why this is important:

Congress finds the following:

- Medications are important to the management of chronic diseases that require long-term or lifelong therapy. Pharmacists are uniquely qualified as medication experts to work with patients to manage their medications and chronic conditions and play a key role in helping patients take their medications as prescribed.

- Nonadherence with medications is a significant problem. According to a report by the World Health Organization, in developed countries, only 50 percent of patients with chronic diseases adhere to medication therapies. For example, in the United States only 51 percent of patients taking blood pressure medications and only 40 to 70 percent of patients taking antidepressant medications adhere to prescribed therapies.

- Failure to take medications as prescribed costs over $290,000,000,000 annually. The problem of nonadherence is particularly important for patients with chronic diseases that require use of medications. Poor adherence leads to unnecessary disease progression, reduced functional status, lower quality of life, and premature death.

- When patients adhere to or comply with prescribed medication therapy it is possible to reduce higher-cost medical attention, such as emergency department visits and catastrophic care, and avoid the preventable human costs that impact patients and the individuals who care for them.

- Studies have clearly demonstrated that community-based medication therapy management services provided by pharmacists improve health care outcomes and reduce spending.

- The Asheville Project, a diabetes program designed for city employees in Asheville, North Carolina, that is delivered by community pharmacists, resulted over a 5-year period in a decrease in total direct medical costs ranging from $1,622 to $3,356 per patient per year, a 50 percent decrease in the use of sick days, and an increase in productivity accounting for an estimated savings of $18,000 annually.

- Another project involving care provided by pharmacists to patients with high cholesterol increased compliance with medication to 90 percent from a national average of 40 percent.

- In North Carolina, the ChecKmeds NC program, which offers eligible seniors one-on-one medication therapy management consultations with pharmacists, has saved an estimated $34,000,000 in healthcare costs and avoided numerous health problems since implementation in 2007 for the more than 31,000 seniors receiving such consultations.

- Results similar to those found under such projects and programs have been achieved in several other demonstrations using community pharmacists.

The Cost Of Chronic Pain

The March 7th edition of Time Magazine has a whole section on chronic pain including a fascinating timeline of how pain has been managed over the years. It’s just in recent history that pain has moved from being a side effect to being a condition to be management.

An article by Dr. Oz provides some statistics on pain:

- The annual price tag of chronic pain is $50B.

- Lower-back pain is one of the most common complaints affecting 70-85% of adults at some point.

- 7M people are either partially or severely disabled because of their back pain.

- Lower-back pain accounts for 93M lost workdays every year and consumes over $5B in costs.

- 40M Americans suffer from arthritis pain.

- 45M Americans suffer from chronic headaches.

- People with chronic pain are twice as likely to suffer from depression and anxiety.

One of his key suggestions – if you’ve worked with your physician for six months and its not resolved – go see a specialist.

He also points you to the American Chronic Pain Association for communication tools in helping you verbalize your pain.

In his article and in the other articles, it talks about stretching as a way to alleviate pain. Obviously, there are medications that can help with pain relief although some of them can be abused and addictive. And, both Dr. Oz and the other articles mention acupuncture as a potential solution.

You can also go to the American Chronic Pain Association to learn more.

From a management space, one of the areas where chronic pain is a big area of focus is in Worker’s Compensation. For more about this space, you can follow Joe Paduda’s blog. You can also follow some of the Worker’s Compensation PBMs such as:

Pharmacy Benefit Data From PBMI

I had a chance to read through the new 2010-2011 Prescription Drug Benefit Cost and Plan Design Report that PBMI puts out and is sponsored by Takeda Pharmaceuticals. Here are some of my highlights:

-

Percentage of the pharmacy claims costs paid by the beneficiary

- Retail = 25.3%

- Mail = 20.1%

- Specialty = 15.9%

-

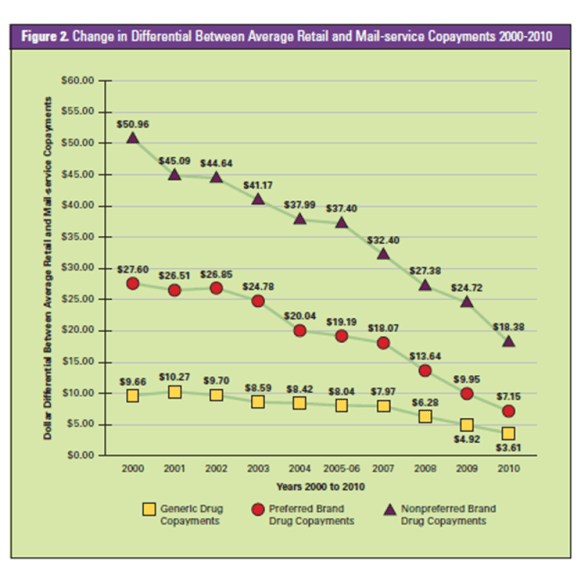

Average difference between retail and mail copayments (see chart):

- Non-preferred brands = $18.38

- Preferred brands = $7.15

- Generics = $3.61

-

5.1% of employers are covering genetic tests to improve drug therapy management

- 68.8% of them are covered under the medical benefit

- 43.0% of employers are restricting maintenance medication dispensing to select pharmacies (retail or mail) [much higher than I expected]

-

They give examples of the percentage of respondents using the following value-based tools:

- 31.7% – reduced copayments in select classes

- 19.7% – incentives to motivate behavior change

-

I was surprised to see a significant drop in the percentage of clients requiring specialty medications to be dispensed at their PBM’s specialty pharmacy.

- 2009 = 53.8%

- 2010 = 40.0%

- There was a similar drop from 15.7% to 11.5% of employers restricting coverage of specialty drugs under the medical plan.

- Given all the focus on medication adherence, I was disappointed to see that only 24.2% of employers were focused on maximizing compliance in specialty. [Maybe they haven’t seen all the studies on this topic.]

- They have some nice comments on Personalized Medicine and the critical questions to address.

- I was also surprised that less than 1% of employers were using onsite pharmacies or pharmacists.

-

They provided the following data on average copayments for 3-tier plan designs with dollar copayments:

- Generics at retail = $9.45

- Generics at mail = $19.06

- Preferred at retail = $25.93

- Preferred at mail = $53.63

- Non-preferred at retail = $46.43

- Non-preferred at mail = $98.25

-

The average pharmacy discounts (based off AWP) were:

- Retail brand = 17.5%

- Retail generic = 46.6%

- Retail 90-day = 19.8%

- Mail brand = 23.3%

- Mail generic = 53.5%

- Specialty = 18.7%

- The one number that seemed off to me was the Rxs PMPM which they had as 2.29 for active employees. That would mean 27.48 PMPY which seems closer to Medicare. [I typically use 12 Rxs PMPY for commercial and 30 Rxs PMPY for Medicare as a quick proxy.]

-

For the first time, they showed the percentage of employers excluding coverage of non-sedating antihistamines (e.g., OTC Claritin) and proton pump inhibitors (e.g., Prilosec OTC). Both classes have had lots of blockbuster drugs go OTC (over the counter) so it makes sense to exclude coverage.

- NSAs = 44.7%

- PPIs = 30.6%

- They provide a nice summary of how employers are using UM (utilization management) tools.

The report has tons of data on different scenarios, different plan designs, rebates, and many other topics. I’d encourage you to go online and read thru it.

BTW – The respondent group of employers included 372 employers representing 5.8M lives including both active and retired. The average group size (active only) was 9,736 which is a decent size employer group. And, 12% of the respondents were part of a union bargaining agreement.

Mail Order Savings Continue To Go Down

One of the questions I often get is why don’t consumers move to mail as much as they used to. There are several reasons why, but I think this chart from the PBMI 2010-2011 Prescription Drug Benefit Cost and Plan Design Report does a good job of summarizing one issue – less savings. This shows how the savings of moving from retail to mail has gone down over the past 10 years.

CatalystRx Engaging Patients With Avatars

Last week, I got to see one of the more interesting presentations I’ve seen in a while. CatalystRx presented on some of the work they are doing with a mobile application to be released later this year. The application uses an avatar (well technically an “embodied conversational agent“) to engage with the consumer. I’m not sure how well that will work with a senior population, but the technology (shown in a video demo) was very cool.

Last week, I got to see one of the more interesting presentations I’ve seen in a while. CatalystRx presented on some of the work they are doing with a mobile application to be released later this year. The application uses an avatar (well technically an “embodied conversational agent“) to engage with the consumer. I’m not sure how well that will work with a senior population, but the technology (shown in a video demo) was very cool.

The application is based on lots of research (and designed by the people who made Happy Feet). For example, they talked about:

-

-

- The importance of finding the right balance between too cartoonish and too human. They referenced some Disney research about size of the eyes versus the size of the head which creates a positive memory trigger due to similarities to baby’s faces.

- Creating a “trusted advisor” for the patient (using David Shore’s book – Trust Crisis in Healthcare).

- The importance of the face and how it shows emotion (both human and avatar).

- How small talk engaged the consumer and builds trust even when it’s an avatar telling first person stories.

-

Some of the research comes from Chris Creed and Russell Beale’s work.

Recent research has suggested that affective embodied agents that can effectively express simulated emotion have the potential to build and maintain long-term relationships with users. We present our experiences in this space and detail the wide array of design and evaluation issues we had to take into consideration when building an affective embodied agent that assists users with improving poor dietary habits. An overview of our experimental progress is also provided.

The application helps patients to:

- Make decisions

- Identify pharmacies

- See prescription history

- Get reminded about refills

- Get information about generics and formulary compliance

- Receive personalized interventions

Obviously, mobile solutions as a way to engage patients using a secure environment for delivering PHI is a holy grail (for those that download and stay engaged). This was an interesting and promising variation on some of the solutions out there. I look forward to learning more and seeing it once it’s fully available.

(Community) Pharmacy 101

The NCPA blog talks about educating Congress about their value. They also share their slide deck .

I’m not sure I see how this is community pharmacy specific, but I agree that this is a good educational deck of what pharmacists do (retail, mail, specialty).

- It’s more than counting pills.

- Immunizations.

- Address adherence.

- Educate patients and serve to support patient centered care and address MD shortage.

- Medication management

I was surprised at the low numbers of non-Rx discussions they have per day and the low number of physician discussions. It would be good to benchmark those based on average store volume.

Social Networking For Pharmacists

Drug Store News has partnered up with Skipta to form a pharmacists social networking site. Interesting.

1. Why Skipta versus some other forum? [Personally I prefer less places to log in not another one]

2. Will pharmacists use it? [TBD]

3. Is it good to have a private social networking location? [Probably if used appropriately]

4. Wouldn’t it be great to use this to facilitate pharmacist and MD dialogue on key topics – adherence?

I’m not sure what else to say on this yet. Obviously, pharmacists have the same issues as doctors – do you friend your patients, what liability do you have for what you say in these channels, is it considered medical advice, etc.

NCPA Twisting Reality Again

I continue to be frustrated by NCPA (National Community Pharmacists Association). While I agree that the pharmacist – patient relationship is important, they continue to blatantly misrepresent the facts to make their point. On Tuesday, they sent a letter to Kathleen Sebelius, Secretary of HHS, stating the following:

While we strongly support your efforts to provide the states with measures to drive pharmaceutical program costs down, we respectfully disagree with the statement that mail order is a potential cost-savings program strategy. Experience has shown that mail order pharmacies almost never deliver the savings they promise and are often ultimately more expensive than community pharmacies. In 2009, retail pharmacies drove a 69% generic dispensing rate (GDR) while the three dispensing services of the largest PBMs – Medco Health Solutions, Inc.; Express Scripts, Inc.; and CVS Caremark – had GDRs under 58% for the exact same time period – leaving potential savings on the table resulting from increased brand usage.

Either they are naïve or they think HHS is. You can’t compare the GDR at retail pharmacies to the GDR at mail order pharmacies without significant adjustment for acute medications and seasonal medications that aren’t appropriate for mail order. Historically, those medications have had higher generic utilization than other conditions (e.g., antibiotics).

On the other hand, maybe they aren’t a history fan. The only independent study that I’ve seen comparing the two channels specifically on this issue was published in 2004 by Harvard in Health Affairs. It looked at claims from 5 PBMs across both channels, made the adjustments, and concluded that while retail had a slightly better GDR than mail, it had a lower generic substitution rate. It also pointed out that the majority of the different was attributed to the statin class which was over-represented in the mail order channel (and at the time was mostly brand prescriptions).

Or, maybe they haven’t looked at the chain GDR versus the independent GDR…In this presentation, you see what I would expect – chain GDR > independent GDR. Combine that with the percentage of scripts dispensed (i.e., weighted average) and the normalized GDR from the Health Affairs study probably would favor PBMs over independents.

Since PBMs make over 50% of their profits on generic at mail, it wouldn’t make sense for them to sub-optimize this area. Given the changes in drug mix over the past 7 years (i.e., more generics), I would hypothesize that if this study were done again you would see mail order matching or exceeding retail GDR especially GDR for independents.

Growing Mail Order Pharmacy Utilization

A common topic which I discuss with PBM clients is how to improve their mail order utilization. Since more than 50% of their profits come from generics at mail order, this is a critical process. And, while the industry average is 13% utilization (on an adjusted script basis), there are many companies (especially outside of the big 3 PBMs – CVS Caremark, Medco, and Express Scripts) that have much lower utilization and therefore huge value in upside.

Today, I got the chance to speak to investors on this topic courtesy of Barclays Capital. I structured the discussion around three topics:

1. Why is mail order important to the PBM?

2. How do you improve mail order utilization?

3. What are the challenges to improving mail order utilization?

Attached are the slides which I used on the call.

Coupons From Manufacturers

I’ve talked about this a few times. It’s an interesting topic. Are coupons for prescriptions a good thing or a bad thing?

Let’s look at a few perspectives and considerations…

Manufacturer:

- Do they improve my marketshare?

- Do they protect my marketshare from new entrants?

- Do they protect my brand versus generic competition?

- Do they improve adherence (as measured by refill rates)?

- Per point of marketshare, is it cheaper to rebate a drug or offer direct-to-consumer coupons?

- Are coupons more effective than samples? (They are clearly less expensive to produce and distribute.)

- I’d be interested in feedback, but I haven’t found any conclusive data. BUT, I think manufacturers are smart marketers. They wouldn’t be doing this if it didn’t work.

Payor:

- Do the coupons support my formulary? (I would generally think no…otherwise why use them.)

- Do the coupons improve adherence? Are they creating waste?

- Are the coupons changing physician or patient behavior? Is this costing me money (e.g., less generic starts)?

- Is this impacting my total drug spend since the consumer is no longer as price sensitive to copay differentials?

- Do claims processing using the coupons still show up in the patient history such that drug-drug interactions and other safety checks can be conducted?

Customer:

- Am I saving money? [Yes]

- Is the coupon easy to use and understand? [I would think generally yes.]

- They should be asking about their total cost of the drug over time since depending on the condition they may be less likely to convert to a lower cost drug (typically generic) when the coupon is no longer offered. Or, switching drugs may require them to visit the physician or have lab work done that will cost them money.

- They should be asking…if others use this coupon, which means that they are filling a more expensive drug, what does that decision cost me (shared cost)?

As far as I know, there are very few limitations on couponing.

- The state of MA doesn’t allow their use at all.

- There are lots of restrictions about their use in Medicare and Medicaid such that those consumers are usually excluded from using the coupons.

This is generally a topic where there is little known about the answers to these questions (as far as I know).

There was an article in last week’s Drug Benefit News about this topic where I was quoted and built upon a few comments I made about Lipitor earlier:

“Payers are concerned that copay cards incent consumers to use higher-cost drugs,” George Van Antwerp, general manager of pharmacy solutions for Silverlink Communications, tells DBN. “The consumer no longer sees the penalty of using a more expensive drug.”

Pfizer, who declined to comment for this article, has given some indication that it will continue the $4 copay card only until November, when a generic version hits the market, but Van Antwerp says he’d be surprised if the company did not extend the offer. “Back when Zocor went generic, Merck actually made the brand drug cheaper than the generic drug,” Van Antwerp recalls. “United and a few other payers ended up putting brand name Zocor into the generic tier on their formulary.”

Paper Prescriptions Helpful – Duh

I love when someone presents a basic idea as some “new” blockbuster idea. I was just looking through a webinar from last week where it addressed a key point which is increased abandonment of prescriptions at the pharmacy. The presentation referred to a study by CVS that showed that abandonment is higher for e-prescriptions than paper prescriptions. I’ve talked about this before. That physical document (paper prescription) serves both as a reminder, but it also provides the patient with information (drug name, dose, etc) which is an important take away from their visit. BUT, this isn’t new. When I worked with the e-prescribing vendors in 2001, they knew this and offered services where a printout was created for the patient while the prescription was sent to the pharmacy.

Then the presentation talked about actually placing “advertisements” on these printouts. Imagine the ability of the manufacturer to directly message the patient at the time of prescribing with messages about “consider my drug”. This seems to defeat many of the value propositions of e-prescribing which are about pushing plan design information to the physician during the encounter with the patient. Not to mention the disruption to me as the prescriber…imagine the following:

- The MD writes for Drug A which is a generic.

- The MD goes to meet with another patient and tells the current patient to pick up a paper prescription at the counter as they pay their copay.

- When the patient gets their paper prescription, they see messaging around a copay coupon for a branded alternative.

- They then ask to see the MD again to discuss alternatives right then.

Is this really just shifting that discussion from happening later to now or will it lead to a spike in this discussion and pushing it to face-to-face versus on the phone?

April 6, 2011

April 6, 2011