PBMI puts this out each year with funding support from Takeda. It is another one of those great annual reports full of lots of trend data for you to digest. Let me pull out a few of the things that stood out to me, but I recommend you read the entire thing yourself:

- Use of 4-tier plans grew by 25% in 2011.

- Specialty copays increased by 37% (to $84).

- Plans continue to offer 90-day mail at a lower copay multiple than 90-day retail.

- Nearly 60% of plans allow 90-day retail prescriptions. [Wow! This was a shocker to me.]

- 30% of respondents require specialty medications to be filled by their PBM. [Which seemed low to me.]

- Only 5% of respondents said they give their PBM responsibility for plan design.

- 18% of plans have mandatory mail (although the statistic is 26% for respondents who have pharmacy provided as a carve-out).

- 21% of plans have a limited retail network.

- 36% of plans have copay waivers.

- 7% of plans cover some form of genetic testing.

- In general, there was an equal view of all the forces impacting benefit plans.

- 64% of plans are focusing on member education to help them control costs. [exactly what we do at Silverlink everyday!]

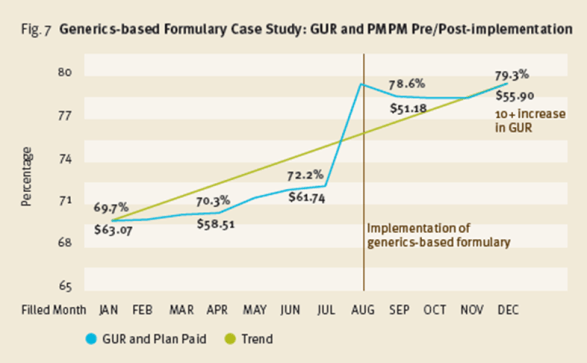

Here’s a key chart on average copays for 3-tier plan designs.

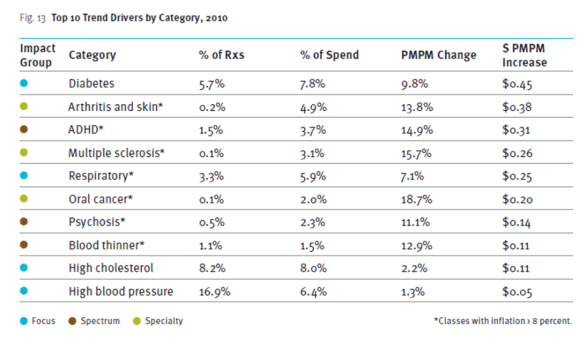

Another summary they show from some external research is below:

Adam Fein recently pointed this out, but the use of MAC pricing at mail is pitifully low at 18% versus 42% for 30-day retail. (More from Adam on the report.)

I’m always interested in the overall use of programs by plans which is summarized here. Interestingly, there were three areas which carve-in did much less than carve-out – outbound phone calls, retro DUR, and therapeutic substitution.

They also include a summary of several research studies on adherence with a quote from me:

“In working with healthcare companies around adherence, our focus is always on how to best use data and technology to personalize interventions in a scalable way,” said George Van Antwerp, 2011-2012 Prescription Drug Benefit Cost and Plan Design Report Advisory Board member. “Medication adherence is a multi-faceted issue. While there is no silver bullet, technology can help deliver different messages to consumers based on the complexity of their condition, specific medications, and their plan design (for example). But, while technology can provide the initial nudge, the care team has to work together to address health literacy and build an understanding of the condition, the medication, and value of adherence.”

Another data point that I often use from here is the average number of Rxs PMPM:

November 7, 2011

November 7, 2011