Rebecca from ProjectHEALTH closes #results2010 with a remarkable talk on this crucial program; they work with 5,000 families/year.

Reid Kielo, UnitedHealth: 93% of members validated ethnicity data for HEDIS-related program using automated telephony #results2010

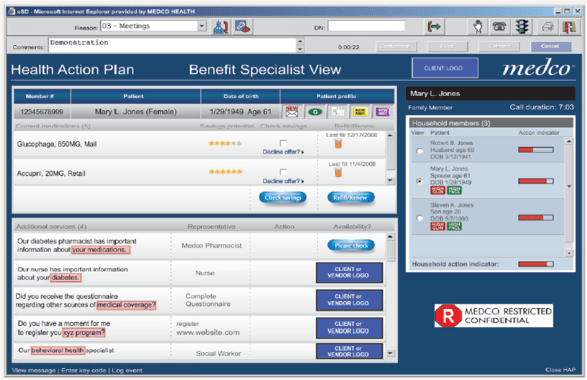

25% of Medco pt take a drug with pharmacogenetic considerations. Robert Epstein, CMO Medco #results2010

Bruce Fried: the “California model” of physician groups facilitate efficiencies that improve delivery; an oppty for M’care #results2010

Bruce Fried on Medicare: 5 star ratings have strategic econ. importance, med. mgt. and cust serv. key #results2010

Fred Karutz: members who leave health plans have MLRs 2 standard deviations below the population. #results2010

Fred Karutz: Market reform survival – retain the young and healthy #results2010

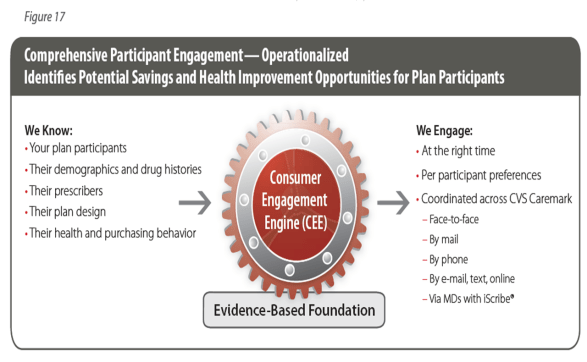

Poly-pharmacy has negative impact on adherence. #cvscaremark

Poly-pharmacy has negative impact on adherence. #cvscaremark

#results2010

1 in 3 boys and 2 in 5 girls born today will develop diabetes in their life. SCARY! #results2010

20% of all HC costs associated with diabetes. #results2010. What are you doing to manage that?

Messages to prevent discontinuation of medication therapy far more effective than messages after discontinuation. CVS #results2010

25-30% of people who start on a statin don’t ever refill. #CVSCaremark

25-30% of people who start on a statin don’t ever refill. #CVSCaremark

#results2010

Maintenace of optimal conditions for respiratory patients increased 23.4% with evidence-based plan design. Julie Slezak, CVS. #results2010

Value-based benefits help control for cost sensitivity for medications; every 10% increase in cost = 2% – 6% reduction on use. #results2010

Pharmacists who inform patients at the point of dispensing are highly influental in improving adherence. William Shrank #results2010

The game of telephone tag in HC is broken. Pt – MD communications. #results2010

37% of Pts were nonadherent because they didn’t know they were supposed to keep filling Rx. #results2010

Last mile: 12% of Americans are truly health-literate; they can sufficiently understand health information and take action. #results2010

Only 12% of people can take and use info shared with them. #healthliteracy

#results2010

#DrJanBerger.

We need to improve the last mile in healthcare… clear, effective conmunication. Jan Berger #results2010

#McClellan used paying drug or device manu based on outcomes as example of “accountable care”. #results2010

72% of those with BMI>30 believe their health is good to excellent; as do 67% of those w/ chronic condition. #McKinsey

#results2010

Are incentive systems more likely to reward those that would have taken health actions anyways (i.e., waste)? #McKinsey

#results2010

Only 36% of boomers rate their health as good to excellent. #results2010

Only 36% of boomers rate their health as good to excellent. #results2010

27% of people believe foods / beverages can be used in place of prescriptions. #NaturalMarketingInstitute

#results2010

Why do we spend so much time on impacting health outcomes thru the system when that only explains 10%. #Dr.JackMahoney #results2010

Using auto calls vs letters led to 12% less surgeries & 16% lower PMPM costs in study for back pain. #Wennberg

#HealthDialog

#results2010

MDs are much more likely to discuss pros with patients than cons. #Wennberg

#HealthDialog

#results2010

Should physicians be rewarded as much for not doing surgery? How do economics influence care decisions? #results2010

Physicians were 3x as concerned with aesthetics than breast cancer patients in DECISIONS study. #results2010

Fully-informed patients are more risk-averse; 25% fewer of informed pts in Ontario choose angioplasty. #results2010

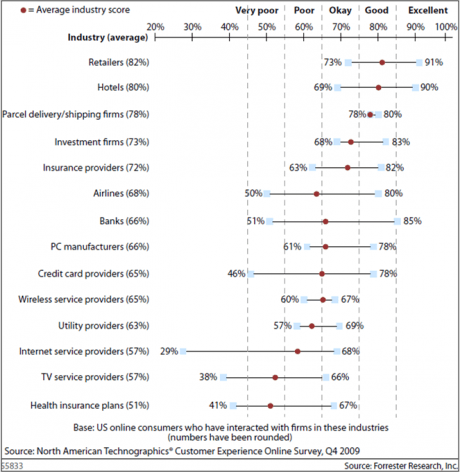

Patients trust physicians over any other source (media, social connections) but only receive 50% of key knowledge. #results2010

Informing Patients, Improving Care. 90% of adults 45 or older initiate discussions about medication for high BP or cholesterol. #results2010

What is #results2010? #Silverlink client event.

#results2010 – #Aetna Medicare hypertension program leads to 18% moved from out of control to in control using auto calls (#Silverlink) …

About 2 of 3 medicare pts have hypertension. #results2010

John Mahoney describes how he connects payors, providers, and care via research. #results2010

As information becomes commoditized in healthcare, sustainability enters the vernacular. #results2010

Segmentation innovations of today will be tomorrow’s commodities. Measurement and learning must be “last mile” IDC insights #results2010

Plans are strategically investing in bus. intel to reach wide population for wellness, not just the low-hanging fruit. #results2010

The single most significant future market success factor is measurable results. Janice Young, IDC Insights. #results2010

Knowing our attendees’ preferences could have fueled segmented, precise invitations to #results2010. Dennis Callahan from Nielsen Media.

Drivers of those sereking alternative therapies: stress, lack of sleep and energy, anxiety, inflammation. #results2010

Only 2% of people don’t believe it’s important to lead a healthy lifestyle. Their behavior could’ve fooled me. #results2010

Are purity and simplicity the new consumption? Steve French of Natural Marketing Institute explores. #results2010

Gen Y is the most stressed out generation. #results2010

Less is more. 54% say having fewer material possessions is more satisfying. Natural Mktg Institute #results2010

Loyalty is a result of a cumulative set of experiences. Individual intervention ROI is sometimes difficult. #results2010

Sundiatu Dixon-Fyle of McKinsey; understand how beliefs shape an individual’s ability to change behavior. #results2010

Don Kemper: each of 300M HC decisions made each year need to be informed. #silverlink

#results2010

Medicare Part D: 40% lower cost than projected, seniors covered through tiered coverage powered by communication. #silverlink

#results2010

Mark McClellan: Brookings is engaging private insurers to pool data to understand quality of care. #silverlink

#results2010

Mark McClellan at RESULTS2010; bend the curves, provide quality care efficiently. HC reform >> insurance reform. #silverlink

#results2010

August 5, 2010

August 5, 2010

Poly-pharmacy has negative impact on adherence.

Poly-pharmacy has negative impact on adherence.

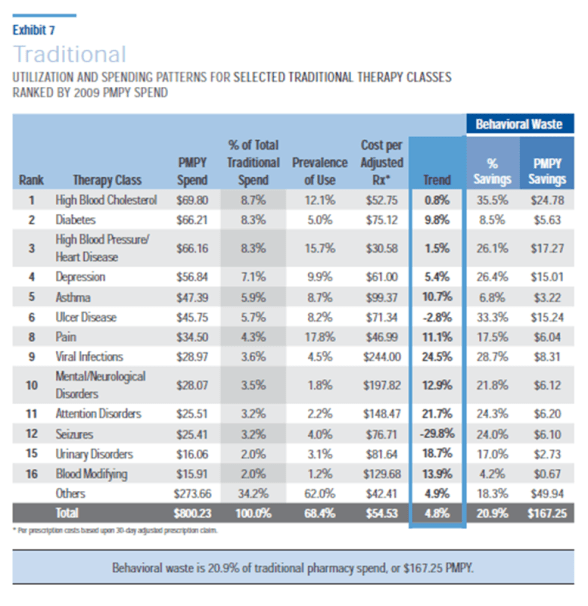

25-30% of people who start on a statin don’t ever refill.

25-30% of people who start on a statin don’t ever refill.

Only 36% of boomers rate their health as good to excellent.

Only 36% of boomers rate their health as good to excellent.