I just finished reading the Prime Therapeutics Drug Trend Report. As I highlighted the other day, their overall drug trend was 2.9%. Like in the past few years, they have jumped up to offer a report comparable with the other big PBMs. And, as we saw with last year’s report, the new management team is aggressive in using this to highlight research, their competitive differentiation, and point out why they are a competitive force in the market.

More interesting that just their success in drug trend was their “adjusted drug trend” for the other PBMs. You don’t often see this in your face marketing in this space, but they clearly want to show not only that their trend was better but that their methodology is better. (I don’t have the time to compare methodologies at this point.)

Fortunately, they don’t stake the argument on trend since as I’ve pointed out before – trend can be misleading. Sometimes higher trend is good as when it indicates better Medication Possession Ratio or better success at reducing gaps-in-care. They focus on five things in the document:

- Savings

- Safety

- Guidance

- Satisfaction

- Partnership

Their Generic Fill Rate (GFR) for 2010 was 69.2% which was lower than the 71% reported by Medco and the 71.5% reported by CVS Caremark. (I couldn’t find the Express Scripts numbers for whatever reason.)

The report focuses on some of the differences in the Prime model (client ownership, not public) and how that plays out in transparency and alignment.

They are now at 12 Rxs PMPY which to me still seems a little low. (I’ve mentioned this is prior reviews, but I don’t understand why their population usage is different.) To validate my hypothesis, I looked at the PBMI report from last year which shows PMPM utilization ranges by respondents (not industry averages).

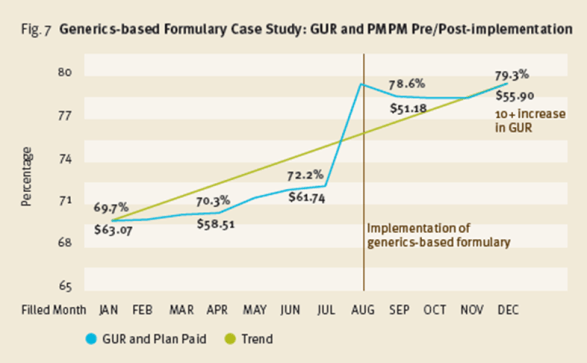

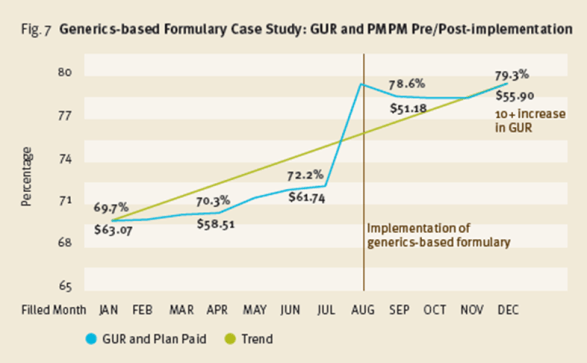

I do think their example around implementing a generics-formulary along with their new benefit plan guaranteeing cost at $47 per Rx are very interesting. They remind me of the GenericsWork product I launched at Express Scripts and should offer some clients a great way to save money. They key, as I learned, was really understanding how to manage member disruption and gain buy-in to the offering. [Amazingly, a quick Google search led me to a cached image of the PDF from my product from 2004.]

They give some good MTM numbers:

- $1.29 in return for every $1 spent

- $86 in savings to the payer over a 10 year period per MTM encounter

They also announce a new offering for 2012 which they call the GuidedHealth care engine. There’s a little information in the document, but it sounds intriguing.

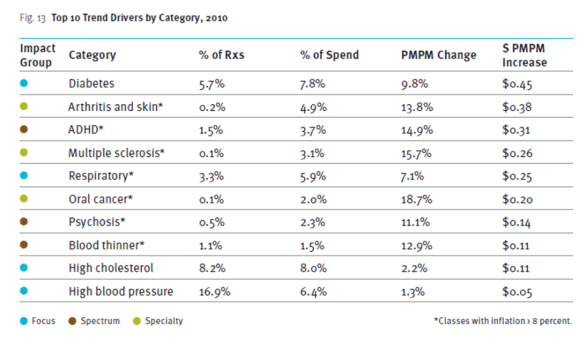

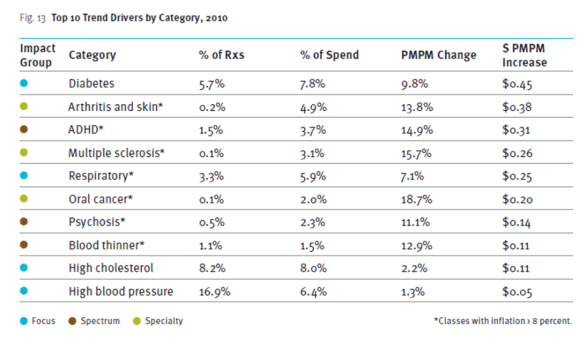

One of those typical charts that we all like to look at shows the drug classes that contributed most to driving trend.

I think their equation about overall cost…

Optimal cost = (medical cost + pharmacy cost) x health outcomes

One of my favorite charts is below which recognizes that there are two cost curves to focus on. The one for the relatively healthy which is often highly pharmacy focused cost versus the chronically ill that drive the majority of overall costs and is heavily medical and specialty medications.

Another study they share in here looks at the likelihood of hospitalization tied to adherence. Very interesting.

$7.60 PMPY savings for a limited network. Those are big numbers that they share from a case study around a client limiting their retail network by excluding one chain.

Their drug trend report looks at another hot topic – 90-day prescriptions. They share their results of a statin study looking at waste in 90-day retail and mail and 30-day retail and estimate the cost impact of the waste.

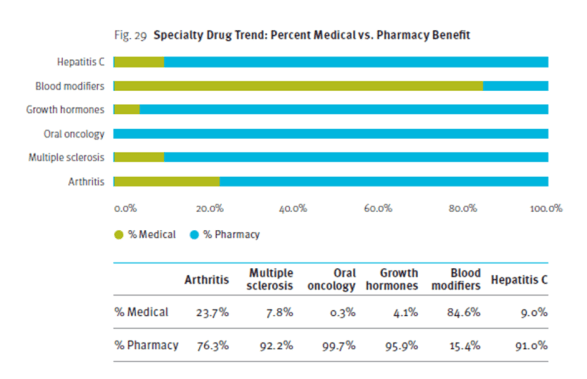

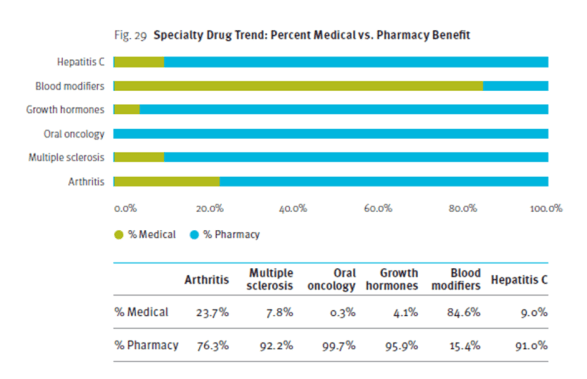

Another hot topic is the mix of specialty drug spend between medical and pharmacy. They share a chart looking at several of the large specialty drug classes.

At the end of the report, they give suggestions to clients on a spectrum of management (low to high). They also predict a few things in the next five years:

- A return to double digit trend increases after this generic wave;

- A generic fill rate in excess of 90%;

- Specialty drugs accounting for 40% of spend;

- Healthcare spending will increase 8-10% per year;

- The role of genetic testing will be validated; and

- Up to 25% of employers will drop benefit coverage.

November 30, 2011

November 30, 2011