Good deck that I found on Slideshare.net.

What’s A PAM Score?

PAMTM is the Patient Activation Measure which was developed by Dr. Hibbard, Dr. Bill Mahoney, and colleagues. It helps you gauge how much people feel in charge of their healthcare. To find out more, you can go to InsigniaHealth’s website.

Given the focus on health engagement across the industry these days, I think this is an important tool to consider. It’s been used broadly and has been validated in a lot of published studies. The questions lead people to be assigned to one of four different activation levels.

You can collect and use the PAM score for segmentation, developing customized messaging, measuring program success, and/or identifying at risk populations.

A few other interesting points from one of their FAQ documents were:

- Patients who are more activated are more likely to adopt positive behaviors regardless of plan design.

- People with higher activation levels are more likely to choose consumer directed plans.

- People with low activation often feel overwhelmed with the task of taking care of themselves.

- You increase the level of success in by breaking down change into smaller steps where the consumer has a greater likelihood of success.

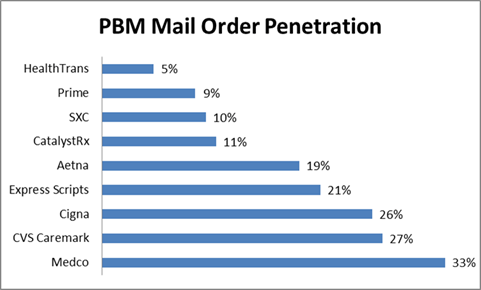

Which PBMs Have The Highest Mail Order Penetration?

I was looking at some data from earlier this year (Q1 – 2011) from the AIS quarterly survey of PBMs. I thought this was a nice summary of mail order penetration by PBM. As you can see, it identifies some areas of opportunity:

- Will Express Scripts’ mail penetration go up with the potential acquisition of Medco? Or, will Medco’s go down?

- Will anyone be able to match the Medco mail penetration?

- Will Aetna’s mail penetration go up to the CVS Caremark penetration rate?

- How will Prime Therapeutics, SXC, and CatalystRx increase their mail penetration?

Overall, the mail penetration of the industry has dropped to 16.3% which is the lowest it’s been since 2004 when it was 12.9% (according to AIS). [Note: These are based on adjusted Rxs.]

HPV Shots Are Not Just For Girls

HPV (human Papillomavirus) infects 6M people a year. Based on a chart from USA Today on 10/26/11, the annual cases of HPV-related cancers are:

- 12,200 Cervical

- 7,100 Throat / Tongue / Tonsil

- 4,200 Anal

- 1,500 Vulvar

- 500 Vaginal

- 400 Penile

About a month ago, a federal advisory panel recommended that all 11-12 year old girls AND boys should be routinely vaccinated against HPV. This requires 3 shots which cost about $100-$130 each.

Based on data from the article, only 44% of girls have received the first shot and only 27% have received all three shots. Only 1.5% of boys have historically been vaccinated according to the CDC.

You can find out more on the Kaiser site about HPV. This is an educational issue, a compliance issue, and ultimately there is a need to get people who start the vaccination process to finish the process.

Will Pfizer Strategy On Lipitor Become The Norm?

Remember Twisted Sister’s song – We’re Not Going To Take It Anymore?

That’ seems like a good summary of the Pfizer response to the typical market dynamics around patent expiration.

Here’s a summary of what they’re doing:

- Pfizer is striking deals with PBMs to offer them brand Lipitor at a lower cost (net of rebate) than the generic drugs which are coming to market during the exclusivity period.

- Pfizer is continuing to offer their $4 coupon for brand Lipitor direct-to-consumers.

- Pfizer is continuing to advertise Lipitor and talking about “if Lipitor has been working for you, stay with it”.

- Pfizer is partnering with Diplomat Pharmacy to sell Lipitor directly to the consumer through mail order.

- Pfizer is offering pharmacies additional services around adherence for helping keep patients on Lipitor.

Here’s some key questions on implications:

- If I’m the authorized generic, how do I feel? I thought I had a deal by which I was bringing a drug to market and making some money during the exclusivity period. Will this change the way that authorized generic deals get structured?

- If I’m the generic manufacturer that has the 180-day exclusivity, how do I feel? I’ve just lost a lot of my opportunity. Will this change the economics of generic manufacturers? I believe most of their profit is made during the exclusivity period.

- Will other brand manufacturers follow suit on other patent expirations?

- Will the PBM response to couponing intensify with their push into couponing when there is a multi-source generic available?

- Will this serve as a bridge until they can get OTC Lipitor approved? And, will that ever happen?

- How does this affect retailers who make more money on the generics and won’t see the increased rebate dollars?

- For PBM clients that get rebate dollars shared with them, these deals with Pfizer are probably a win (i.e., lower cost). What about those clients that don’t? How are they being made whole? What about clients of clients (i.e., employers who contract with a TPA or MCO who gets the rebates but doesn’t share them)?

- How hard does it become to transition patients off Lipitor when Pfizer stops offering the increased rebates or lower cost?

This could be a game changing moment in the industry. We’ve seen lots of shifts, and I would add this as a new phase in the industry.

- 1.0 = Traditional focus on MDs and heavy use of people to detail physicians.

- 2.0 = Shift to DTC advertising still supported with detail reps.

- 3.0 = Increased power of PBMs and focus on rebating and formulary positioning.

- 4.0 = Rise of generics and shift to specialty.

- 5.0 = DTC couponing and broader disease centric strategies.

- 6.0 = New business models??

Canadian Pharmacy Loyalty Program

Lawtons Drugs in Canada is partnering with LoyaltyOne to offer an air miles program tied to participation in an informational program on healthy behaviors.

A few of the interesting statistics:

- 69% were interested in receiving awards for incorporating healthy advice from their pharmacists into their self-management

- 58% were more likely to pick a pharmacy if it offered rewards

- 36% said they would be more likely to take care of themselves if they got rewarded

The Dynamic Video Book: Aetna Example (Specialty Opportunity)

About a year ago, I picked up a “book” at an Aetna booth at a conference. I’d shown the technology to a few clients, but I’d never had a physical example. I thought I would share it here. When you open it up, it has a video embedded into the book. The video has several different options for messaging that you can view by pressing the buttons.

The cool aspect of the book is that it can be linked up to a computer so the videos can be updated over time. It’s produced by a company called Americhip who calls it “Video in Print”.

I’m sure it’s more expensive than a typical direct mail piece, but it can be used and updated over time. My thought is that this is a great tool for specialty pharmacy. These are high cost patients. Imagine a book with the following videos that came with their first script:

- Understanding your disease

- What to expect from your medicine

- How to access support

- Refilling your medication

- The importance of adherence

The content of these videos could change over time as their condition evolves, as they change medications, or even based on different lab values.

Infographic: Are Pets Good For Your Health?

As a pet owner, I definitely agree that pets are good for your health. I’ve often wondered why their not “prescribed” more often by physicians.

Infographic was created by eBay Classifieds.

Sarbanes Appeals To FTC Regarding Lipitor

Yesterday, Congressman John Sarbanes (D-MD) asked the FTC to take action against Pfizer based on the deals they are signing with PBMs that will prevent consumers from accessing generic versions of the cholesterol drug Lipitor. (see Pharmalot story on this)

“This is a sweet deal for the drug companies at the great expense of consumers, employers and taxpayers,” said Congressman Sarbanes. “At a time when we should be doing more to slow the rising costs of prescription drugs, these types of practices should be prohibited. “

Assuming that this is about savings to the consumer which I think is what the FTC is focused on, I think he missed the point of the deals. Pfizer is rebating the drug to cost less than the generic which is then prompting PBMs (and payers) to treat brand Lipitor as a generic. The consumer would pay their generic copay (from what I’ve seen), and they can still go get Lipitor for less then their copay by using the copay card that Pfizer offers making brand Lipitor $4 a month.

This is a brilliant deal by Pfizer to extend the life of the drug (although I’d be upset if I was the authorized generic). The only potential people losing in this are payers who might not see the impact of the rebate dollars (e.g., carve-in employers). Most PBMs are sharing the majority of their rebate dollars these days. The question is how those rebate dollars flow down from there.

Reprint: Getting Aligned For Consumer Engagement

(This just appeared in the publication by Frost & Sullivan and McKesson called “Mastering the Art and Science of Patient Adherence“. It was written by me so I’m sharing it here also for those of you that don’t get that publication.)

According to the 15th Annual NBGH/Towers Watson Health Survey, employees’ poor health habits are the number one issue for maintaining affordable benefits. Since studies have shown that 50-to-70 percent of healthcare costs are attributed to consumer choices and adherence is one of those issues, the topic of how to engage consumers isn’t going away.

The challenge is getting the healthcare industry to use analytics and technology tools when engaging the consumer in a way that works for each individual and builds on their proven success in other industries. Healthcare has an enormous amount of consumer data ranging from demographics to claims and behavior data. Consequently, there is great opportunity to use this data to engage consumers in their health to improve clinical outcomes. While on the one hand, it’s like motivating consumers to buy a good, the reality is that healthcare is both personal and local which complicates the standard segmentation models.

This is a dynamic time where people are experimenting with different strategies for engagement. For instance, in medication adherence, people are trying everything from teaming those who have chronic conditions with community pharmacists to make sure they are taking their medications correctly to technology that monitors when the pill actually enters your body. But, there are still fundamental gaps in the process which can be addressed using interactive technology to complement the pharmacist interventions.

Consumer engagement in healthcare is increasingly moving to new channels with 59 percent of adults in the U.S. looking for health information online and 9 percent using mobile health applications according to Pew Research Center. Additionally, there is more and more participation in social media or peer-to-peer healthcare applications. Modes like SMS, which companies are starting to leverage in programs like Text4Baby or the diabetes reminder program recently launched by Aetna, are gaining popularity. Companies like Walgreens have also begun exploring the use of SMS and Quick Response (QR) codes for medication refills.

At the end of the day, consumers want preference-based marketing where they can elect how to best engage them, but that doesn’t mean that’s the most likely channel to get them to take action.They want you to learn from their past responses to improve your future outreach, but they are also skeptic about how their data is used. You have to put yourself in their shoes to create the optimal consumer experience. You have to deliver the right message to the right consumer at the right time using the right sequence and combination of channels.This is not easy.

So, if you’re going to optimize your resources and build the best consumer experience, you need an approach which is dynamic and personalizes each experience. For example, we found that creating the right sequence and timing around direct mail and automated calls improved results by as much as 100 percent in a pharmacy program. Or, in another case, at Silverlink Communications, we found that using a male voice in an automated call to Latinos got an 89 percent better engagement rate around colonoscopies. We also know that using a peer pressure message does not work in motivating seniors to take action in both a retail-to-mail program and a cancer screening program, but does work for those younger than 55-years-old?

You have to make simple messaging relevant to them—why should I get a vaccination, why is medication adherence important, how can you address my barriers? Only an ongoing test and learn approach to consumer insights will suffice, and those that figure this out will become critical in the ongoing fight for mindshare and trust. But, this isn’t a stand-alone opportunity. We have to partner with providers to improve engagement, adherence, and ultimately outcomes in different forms. We have to offer them a platform for engagement that is built upon consumer insights and provides a unique consumer experience to them based on their disease, their demographic attributes, and their plan design. All of these factor into their behavior and are important in “nudging” them towards healthcare engagement and ultimately, better health.

“Code Lavender” – Focusing On The Patient Experience

If you don’t know it yet, the consumer “experience” is rapidly becoming the hot topic. I’ve talked about it a lot beginning with companies like Cigna that have hired and staffed a consumer experience team and Chief Experience Officer. But, as the WSJ pointed out earlier this week in their article “A Financial Incentive For A Better Bedside Manner“, this is getting quantified in the provider world. One might argue that experience has always mattered more in the provider world since it’s easier to switch hospitals or physicians than insurance companies, but that is likely to continue to change as the individual insurance world and Medicare continue to create competition for the individual.

For payers, you can already see this individual market playing out with the growth of retail stores which is where the experience begins. In other cases, the PBMs and payers have to rely on many cases on their call centers as the front-end of the consumer experience. Additionally, with pharmacy being the most used benefit, this is another critical area. And, we know that pharmacy satisfaction is highly correlated with overall payer satisfaction.

But, let me pull a few things that caught my attention in the WSJ article:

Cleveland Clinic Chief Executive Delos “Toby” Cosgrove, a heart surgeon by training, says he had an epiphany several years ago at a Harvard Business School seminar, where a young woman raised her hand and told him that despite the clinic’s stellar medical reputation, her grandfather had chosen to go elsewhere for surgery because “we heard you don’t have empathy.”

-

The Cleveland Clinic calls their program HEART—for hear the concern, empathize, apologize, respond and thank. They also use the term “Code Lavender” for patients or family members who need immediate comfort.

I look forward to watching how this transforms over time. I know I’ve seen this play out in the dentist’s offices for my kids. The waiting rooms have video games and other things to keep them and their siblings busy, but I do agree with the article that this may unfairly bias the wealthier hospitals.

Sustained Patient Engagement Around Hypertension: Silverlink and Aetna

At Silverlink, we had a great opportunity to work with one of our clients and publicize it. This morning, Aetna released a joint press release with us about our hypertension program.

As companies continue to look at new ways to use technology to engage patients around chronic diseases, solutions like this offer companies a unique way to blend multiple channels into an overall consumer experience that improves engagement and outcomes.

From the press release:

The program also achieved high levels of engagement, with nearly 60 percent of participants continuing to actively monitor their blood pressure by using a free blood pressure monitor and submitting readings on a monthly basis. The frequency of participants’ cholesterol (low-density lipoprotein (LDL) cholesterol) screening also improved 5 percent.

“By helping our Medicare members manage their high blood pressure, we are hoping to help prevent heart disease, strokes and even deaths,” says Randall Krakauer, MD, FACP, FACR, Aetna’s national Medicare medical director. “Our nurse case managers work closely with our members and do a tremendous job providing them with the information, tools and support they need to help them control and improve various chronic conditions, including hypertension. The results of our program with Silverlink demonstrate that an automated program can further support and engage members in managing their own health conditions.”

Branded Drug Prices Up Again (c/o Barclays)

As we’ve seen over the past few years, branded drug prices continue to go up YOY (year-over-year). So far in 2011, based on analysis by Barclay’s Capital, the prices have gone up 7.2%. You can see that this is the highest it’s been.

Given that brand drugs are typically only 20-30% of the oral solid market, this effect is dampened by the generic prices which typically go down. At the same time, this can have a major impact on specialty drugs which are estimated to become about 40% of your spend by 2015.

Retail Pharmacy Mobile Applications

I’ve talked before about some of the mobile PBM efforts, but what about the retail pharmacies. You should expect that the chains will have different mobile strategies than the grocery stores or the big box retailers. And, it will be interesting to see how the independents might collaborate on a shared platform.

Here’s a few things already out there:

– Walmart new shopping application and Walmart’s page on mobile

– CVS retail application

– Walgreens has a mobile pharmacy app

– Target also has a mobile pharmacy application

So what should or could pharmacies offer consumers in terms of mobile applications:

– A refill application is a minimum

– Education or drug information is another basic

– There are certainly some geographic options such as a store locator or clinic locator

– There are options for location based check-in using Foursquare

– Scheduling MTM consultations or vaccinations are a reasonable option

– What about promoting saving thru 90-day retail or generics?

– As retail pharmacies are in the specialty business, there could be opportunities to promote this channel and offer support.

– Telemonitoring is another option (e.g., FaceTime)

– Use of QR code is another part as is augmenting the shopping experience with augmented reality

– Of course, couponing will be part of the solution, but what I’d like is someone who would download my shopping receipts (from multiple companies) and provide me with relevant savings.

– Should it include Rx coupons? Unlike the PBMs, retailers want traffic and if coupons increase adherence then why not.

– There are other options like photos and integration with social networks and tools.

I think one of the key “killer apps” is secure rules based messaging. Imagine using data to identify when you need a vaccination or identifying a potential drug-food issue or having age based triggers. These could be sent directly to the consumer in a secure environment. Of course, we’re only at about 10% adoption and the key question is whether these are the key consumer that everyone wants to attract. Are they the high utilizers? Do they buy other goods?

More to come here. This is a rapidly evolving space.

The Augmented Reality Prescription Bottle

I was watching a YouTube video on Starbucks’ augmented reality cup which got me thinking. Why not do the same with the prescription bottle?

What a great way to engage the tech savvy consumer.

Perhaps you could provide a plain language summary of information about the medication. You could give a list of side effects. Or show how to take the medication.

Perhaps it could have an embedded survey that you complete weekly.

And, it seems like an easy opportunity for someone to offer an augmented reality applications for all medications. Hold up the phone to a pill and get information on it. (maybe a little harder)

I think there is a lot more here as companies like Lamar continue to evolve.

Infographic: The United States of Drug Addicts

I’m sure some people will disagree about including alcohol or smoking on here (or maybe even medical marijuana), but I think this provides some interesting statistics especially around the abuse of prescription drugs which is an ongoing problem.

Highlights From the Takeda / PBMI 2011-2012 Prescription Drug Report

PBMI puts this out each year with funding support from Takeda. It is another one of those great annual reports full of lots of trend data for you to digest. Let me pull out a few of the things that stood out to me, but I recommend you read the entire thing yourself:

- Use of 4-tier plans grew by 25% in 2011.

- Specialty copays increased by 37% (to $84).

- Plans continue to offer 90-day mail at a lower copay multiple than 90-day retail.

- Nearly 60% of plans allow 90-day retail prescriptions. [Wow! This was a shocker to me.]

- 30% of respondents require specialty medications to be filled by their PBM. [Which seemed low to me.]

- Only 5% of respondents said they give their PBM responsibility for plan design.

- 18% of plans have mandatory mail (although the statistic is 26% for respondents who have pharmacy provided as a carve-out).

- 21% of plans have a limited retail network.

- 36% of plans have copay waivers.

- 7% of plans cover some form of genetic testing.

- In general, there was an equal view of all the forces impacting benefit plans.

- 64% of plans are focusing on member education to help them control costs. [exactly what we do at Silverlink everyday!]

Here’s a key chart on average copays for 3-tier plan designs.

Another summary they show from some external research is below:

Adam Fein recently pointed this out, but the use of MAC pricing at mail is pitifully low at 18% versus 42% for 30-day retail. (More from Adam on the report.)

I’m always interested in the overall use of programs by plans which is summarized here. Interestingly, there were three areas which carve-in did much less than carve-out – outbound phone calls, retro DUR, and therapeutic substitution.

They also include a summary of several research studies on adherence with a quote from me:

“In working with healthcare companies around adherence, our focus is always on how to best use data and technology to personalize interventions in a scalable way,” said George Van Antwerp, 2011-2012 Prescription Drug Benefit Cost and Plan Design Report Advisory Board member. “Medication adherence is a multi-faceted issue. While there is no silver bullet, technology can help deliver different messages to consumers based on the complexity of their condition, specific medications, and their plan design (for example). But, while technology can provide the initial nudge, the care team has to work together to address health literacy and build an understanding of the condition, the medication, and value of adherence.”

Another data point that I often use from here is the average number of Rxs PMPM:

Calling In Sick – A Few Statistics For You

I found a survey from MiracleWorkers.com interesting so I thought I would share some statistics from it:

- 37% of healthcare employers say that workers call in sick more often during the winter holidays.

- 28% of healthcare workers have admitted to “playing hooky” from work this year.

- Sick days are spread out by quarter with 34% being taken in Q1, 10% in Q2, 30% in Q3, and 26% in Q4.

- 14% of people are now using a text message to let their boss know they’ll be sick.

- They had some great (and unbelievable) examples of the excuses used:

- Employee’s 12-year-old daughter stole their car and they had no other way to work. Employee didn’t want to report it to the police.

- Employee said a refrigerator fell on him.

- Employee was in line at a coffee shop when a truck carrying flour backed up and dumped the flour into her convertible.

- Employee fell out of bed and broke his nose.

- Employee’s child stuck a mint up his nose and had to go to the ER to remove it.

- Employee had a headache after going to too many garage sales.

- Employee drank anti-freeze by mistake and had to go to the hospital.

- 17% of healthcare employers said they have fired a worker for calling in sick when they weren’t.

- 30% have checked up on an employee, citing the following examples:

- 80% required a doctor’s note

- 50% called the employee

- 18% had another employee call the employee

- 10% drove by the employee’s home

One Challenge Of Medicare OEP – Satisfaction

We’re in the Medicare open enrollment period right now. This is a highly competitive time for MA and PDP plans to compete for new members and to get members to switch to their plans. I’ve talked about the Star Ratings process before. I’ve talked a little about the limited network offerings before.

This time, I wanted to focus on a recent study by Medicare Today that was put out on satisfaction. It shows:

- 95% say their current Part D plan works well, with 94% saying it is easy to use.

- 82% say their Part D plan offers good value.

- 67% say they have lowered their prescription drug spending.

- 34% say they used to skip or reduce their prescription medicine doses to save money, but now no longer have to do so.

- Two of every three seniors said they are unlikely to shop around.

Did You Know PhRMA Has A YouTube Channel?

I just ran across this, and I figured I would share it. PhRMA is the Pharmaceuticals Research and Manufacturers of America. They represent they pharma and biotech companies.

Here’s a few of the videos from the site. One on Part D and one on adherence.

My Eight PBM Predictions For 2012

I recently heard one of the key CEOs in the PBM industry say that his crystal ball for 2012 was fuzzy, and he wasn’t sure what was going to happen. (Not particularly reassuring.) That being said…it’s an exciting time, and I’m going to take my pass at predictions anyways.

- The proposed Express Scripts acquisition of Medco will take place although they will be required to sell off some specialty assets. This will create a new specialty player and will also trigger further consolidation and acquisitions. You will also see many of the Medco people go to new healthcare companies throughout the industry to drive change.

- The contract dispute between Express Scripts and Walgreens will get resolved shortly after 1/1/12, but it will serve as the trigger for limited networks as multiple clients will keep Walgreens out of the network since they’ve addressed most of the disruption and achieved savings. But, you will also see several companies quickly add Walgreens back into their network.

- Star Ratings will trigger a bigger focus on adherence across the industry and begin to create outcomes-based performance measures that the commercial business starts to see in their PBM contracts linking payment to performance.

- Lipitor will be a disruptive item throughout the year with aggressive Pfizer rebating, the overhang from it potentially going OTC, and the pricing of the initial generic.

- Innovation will finally begin to shift to the specialty space with this being the primary area of concern from a trend management and clinical perspective. Clients will expect innovative ways of engaging patients and improving outcomes which will push closer links between pharma and PBMs around key drugs and complex conditions. The focus on specialty spend in medical will continue, but the increasing percentage of infusion drugs will challenge this and push specialty to look for more ways of engaging with the physician.

- The “retailing of healthcare” through storefronts will manifest itself in different ways in pharmacy with greater focus on specialty at retail, pharmacists as part of the ACO/PCMH concept, MTM, and ultimately through exchange based partnerships with large payers.

- Integration of medical, pharmacy, and lab data will be a huge focus on PBMs create targeting algorithms and databases for segmentation, targeting, and ultimately engaging consumers around specific health behaviors.

- Telemedicine in the form of telemonitoring will link into the retail pharmacy clinic strategy as they extend their pharmacy relationship from an event based relationship to an ongoing monitoring relationship around key conditions like diabetes.

Two things that I expect to continue to be areas of focus will be the development and execution of a mobile strategy and continued exploration in the area of personalized medicine and genomics.

The one outlier which I’m not sure of yet is Medicaid pharmacy. It’s been a hot topic lately, but I’m still unsure of whether that will radically change in 2012 or not.

[Interested in sharing your opinions on 2012 in a formal way? I’m going to reach out to several companies and ask their thought leaders or executives to do an “interview” with me about their predictions for 2012. Let me know if you’d like to participate.]

[And, don’t forget that you can sign up to have these posts e-mailed to you whenever I write them by signing up for my e-mail list on the right side of the blog. Thanks for reading.]

Diabetes Facts From the ADA – Total Costs in US = $174B

I found this list of diabetes fact from the American Diabetes Association in an article I was reading:

- 25.8M children and adults in the US have diabetes (8.3% of the population). This includes 7.0M who haven’t yet been diagnosed.

- 1.9M new cases of diabetes were diagnosed in people 20+ in 2010.

- 215,000 or 0.26% of all people under 20 have diabetes.

- In 2007, diabetes was listed as the underlying cause of death on 71,382 death certificates and as a contributing factor on another 160.022 death certificates.

- Adults with diabetes have heart disease death rates 2-4x higher than adults without diabetes.

- The risk for stroke is 2-4x higher for people with diabetes.

- Diabetes is the leading cause of blindness among adults ages 20-74.

- Diabetes is the leading cause of failure accounting for 44% of new cases in 2008.

- Total cost of diagnosed diabetes in the US was $174B in 2007.

No wonder this is such a focus in the Medicare Star Ratings!

Rent Your Workout Clothes

I’ve been waiting for a while for someone to invent a “bag” or something that I can put my used exercise clothes in while I’m traveling. Sometimes after a few days on the road, these can be a stinky addition to my suitcase. There must be some bag with a chemical in them that would dry them out and absorb the smell.

But, in the interim, I was intrigued to see that Fairmont Hotels and Resorts is offering their guest workout apparel and shoes. What a great opportunity for Adidas and whoever else they partner with to let consumers test drive their clothes and shoes. You pay a small fee to use them (unless your a top frequent travel with them) and you can buy them after that if you want.

Three Pillars of Adherence (NEHI)

I was digging through some adherence materials, and I stopped on the NEHI graphic from their report “Thinking Outside The Pillbox” which first quantified the impact of non-adherence at $290B (a number which everyone uses now).

I don’t remember every posting it on the blog so I’m sharing it now. I think it hits on the key topics that we all talk about:

- We have to get it right from the beginning with the drug regiment.

- Cost can be an issue so if possible address it.

- But, the biggest issues are with understanding (literacy), side effects, creating a habit, and many other things that require education and ongoing intervention and support for the patient.

[Note: NEHI has now releasesdd their roadmap on Medication Adherence which I’ll review in a subsequent post.]

Why Don’t Physicians Use More Information Therapy

My PCP is very good about giving me information to read every time I visit him. (Never mind that it sits in a pile on my desk.) But, I believe this is under-utilized in today’s information rich society.

I was reading an article this morning from PharmaVOICE about physicians not using certain medications or treatments because they didn’t have the time to spend with patients explaining them. Therefore, they default to the “easier” solution which requires less explaining. Is this prevalent? I don’t know.

The article talked about a survey from Sermo and Aetna Health which revealed that almost 2/3rds of the 1,000 MDs surveyed felt that “the current health care environment is detrimental to the delivery of care”. And, less than 1/5th felt that “they could make clinical decisions based on the what was best for the patient, rather than on what the payers are willing to cover”. Pretty scary and sad.

Imagine if the physician was using an electronic interface during the encounter. They could pre-create several information packets around certain diseases, drugs, and/or treatments. When the patient was diagnosed and a treatment plan agreed to, they could e-mail the package to the patient. It might include written information, links to websites, YouTube videos, or other assets. I would imagine this could be very powerful and address the common gaps that exist between what the physician says and the patient hears.

[The article was “Is the Business of Health Care Getting in the Way of Providing Good Health Care? by Ken Ribotsky in PharmaVOICE from October 2011.]

Candy For Cash (or Toys)

Is this what Halloween looks like at your house? A big pile of candy!

Similar to the guns for cash program that many police departments have done, we’ve developed a candy for cash program at my house. The kids can get as much candy as they want and eat a few pieces tonight. But, they then have to pick their favorite pieces and can keep about a gallon ziplock full of candy. For the past few years, we’ve actually taken the candy to ToysRUs and basically given it to the cashier as we buy something. The kids think it’s actually being used to buy the toys while we both get rid of the candy and gives them some incentive not to rot their teeth and eat unhealthy amounts of sugar for months to come.

Hospital Social Media Stats

Here’s some interesting stats from Ed Bennett that were shared in PharmaVOICE (Oct 2011) based on 1,188 hospitals that are using social media.

- 548 YouTube channels

- 1,018 Facebook pages

- 788 Twitter accounts

- 458 LinkedIn accounts

- 913 Foursquare

- 137 Blogs

- 3,952 hospital social networking sites

My one pet peeve is the “emergency room” locations that publish their wait time via Twitter. If it’s really an emergency, shouldn’t I be going in to get care not focusing on wait times? And, aren’t the wait times variable based on how urgent my need?

CMS Quote On Customer Experience

I really liked this AIS Quote of the Day and thought I would share it. It makes the point that we should strive to create a world-class experience not simply be good for our market niche.

“Our goal [with exchanges] is not to say, ‘It’s better than it was before.’ Our goal is not to say, ‘It’s pretty good for government work.’ Our goal is not to say, ‘It’s pretty good for Medicaid.’ We set a goal for ourselves that we really wanted a 21st Century customer experience…an experience that people feel good about.”— Penny Thompson, deputy director for the CMS Center for Medicaid, CHIP and Survey and Certifications, speaking at a recent AHIP meeting, “Preparing for Exchanges.”

What Does A PBM Do (Video)?

A big question is always “what is a PBM“. PCMA has developed a new video which shows some of the things that a PBM does. Here it is…

Predicting Medication Adherence

Is there a secret sauce? (Hint: past behavior)

It always important to be skeptical, but there are certainly attributes like the number of Rxs, gender, condition, copay amount, and other factors that contribute to the likelihood of a consumer being adherent.

But, one of the big discussions is around how to use other variables. FICO, the company that creates credit scores, has created an adherence score. In today’s WSJ, they shared this image about predicting adherence. Interesting…

November 26, 2011

November 26, 2011