I skimmed another IBM publication today which I thought was a great piece – IBM Healthcare 2015: Win-win or lose-lose?. (A little long at ~70 pages, but good with concise charts.) It talks about what healthcare has to do to survive and create a win-win model. It looks at it from multiple perspectives – payor, provider, consumer, and supplier. They also do a good job of describing several unique models around the world and talking about several trends here in the US.

Here are a few quotes, facts, and charts from the publication which should tempt you to go read it…(note: I am not going to show all their sources, but you can get them from their publication.)

“The United States spends 22 percent more than second-ranked Luxembourg, 49 percent more than third-ranked Switzerland on healthcare per capita, and 2.4 times the average of the other OECD countries. Yet, the World Health Organization ranks it 37th in overall health system performance.

In Ontario, Canada’s most populous province, healthcare will account for 50 percent of governmental spending by 2011, two-thirds by 2017, and 100 percent by 2026.

In China, 39 percent of the rural population and 36 percent of urban population cannot afford professional medical treatment despite the success of the country’s economic and social reforms over the past 25 years.

Approximately 80 percent of coronary heart disease, up to 90 percent of type 2 diabetes, and more than half of cancers could be prevented through lifestyle changes, such as proper diet and exercise.

Preventable medical errors kill the equivalent of more than a jumbo jet full of people every day in the US and about 25 people per day in Australia.”

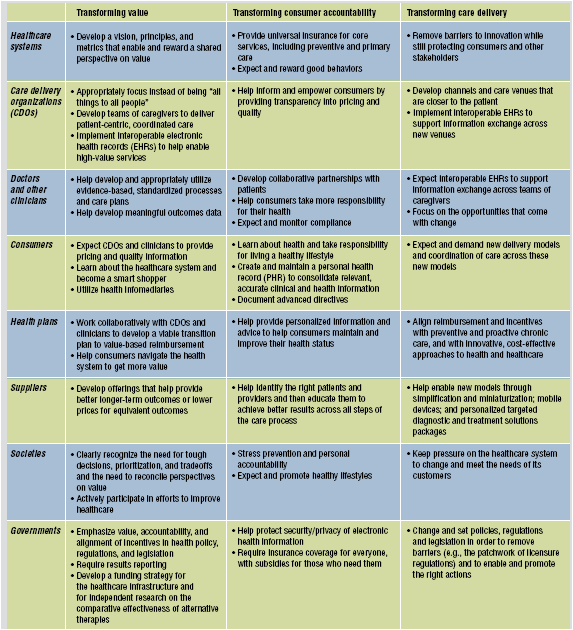

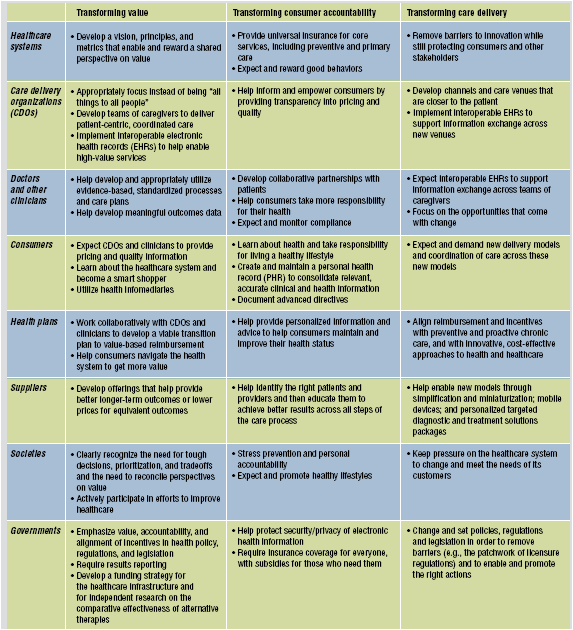

Table on IBM’s recommendations by stakeholder for what has to happen to transform to a value-based healthcare system (win-win).

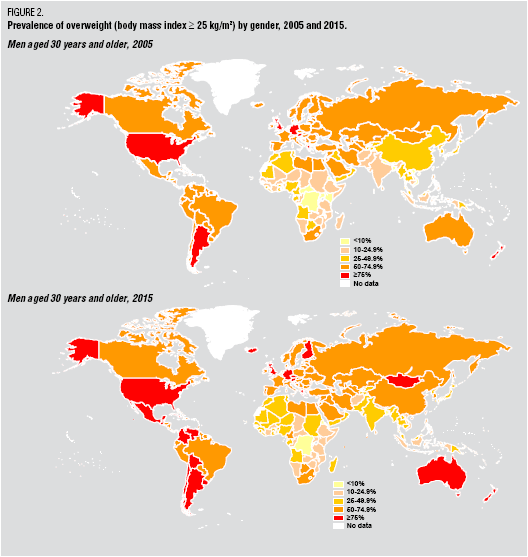

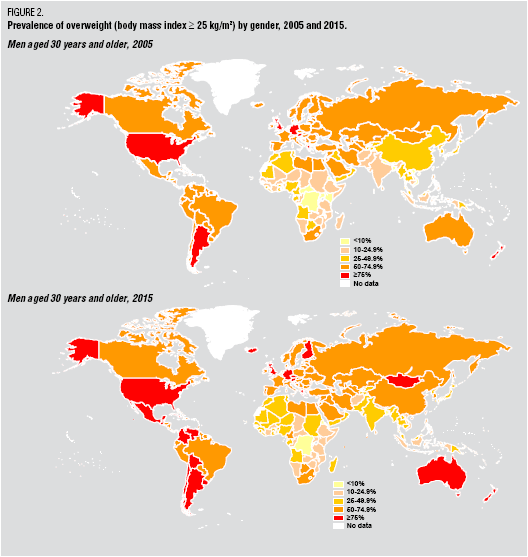

IBM chart pointing out the obesity issue’s growth

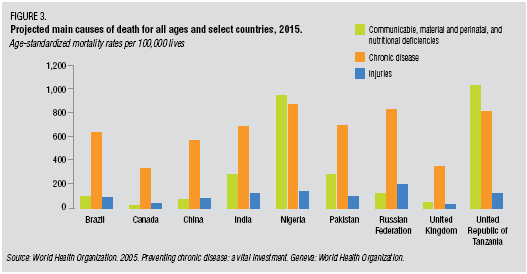

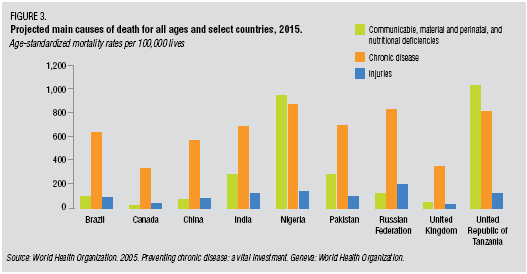

They talk a lot about the current system’s focus on episodic care while the problem is chronic disease.

You will see lots of the buzzwords we hear today (transparency, empowerment, consumerism, infomediary, value-based) throughout the article, but they are delivered with facts and anecdotes to support their perspective.

I could go on, but I will leave it with a nice adaptation of Maslow’s Hierarchy of Needs which they present around healthcare.

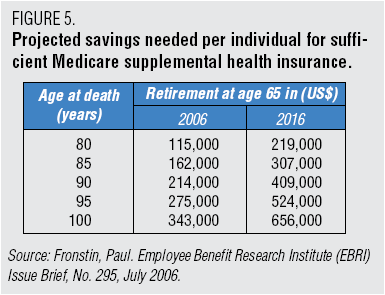

You will find information in here around telemedicine, retail medicine, health tourism, and they tee up some of the hard discussions about when is it too much. How much should we spend (individually or as a society)? What expectations should we have? A lot of it requires a different mindset for all the constituents. This would be a good read for the presidential candidates.

January 12, 2008

January 12, 2008

On 12/6/07, the

On 12/6/07, the  1800s in terms of the framework for developing drugs. Obviously, this has been the driver for biotech where the drugs are made of proteins and there is no generic competition.

1800s in terms of the framework for developing drugs. Obviously, this has been the driver for biotech where the drugs are made of proteins and there is no generic competition. I have always found

I have always found

When I got my

When I got my

+

+