I was reading the NCPA blog this morning on PBM Transparency and the CVS Caremark Conundrum (more on that another time) and had to comment. [Certainly not an unbiased blog.]

They talk about government intervention and transparency as:

“Small step toward reining in egregious and costly PBM practices like spread pricing (paying the pharmacy one price then quietly billing health plans much more) and rebate abuse (pocketing huge sums from drug makers before giving plan sponsors what’s left).”

Come on. How many PBM clients don’t know that they have spread pricing? Plus, don’t the retailers have spread pricing. I’m pretty sure that consumers don’t know the acquisition cost of their drug compared to what they pay for it. (There have been plenty of stories about the gouging at retail to cash patients using generics.) There are plenty of PBM contracts today that are pass-through pricing meaning that the payor pays the PBM what they reimburse the retail pharmacy. (I get so tired of people using arguements from the 1990’s and early 2000’s as fact.)

Then, let’s talk about rebates. How many clients of PBMs today don’t know that rebates exist and don’t get most of the rebates passed on to them? A lot of this data is available in general reports about the industry, from consultants, and thru surveys. There aren’t a whole lot of mysteries in the PBM world.

The reality is that people get bitter because the PBMs continue to make money in a bad economy. I don’t see what’s wrong with that. They make money as they save clients money.

- More generics = more client savings and more PBM profit.

- More mail order = more client savings and more PBM profit.

- Lower trend (i.e., cost increases year-over-year) = more client savings and more PBM profit.

Some PBMs even take risk to put their money where their mouth is. There have been numerous government and independent studies showing the value of PBMs. There have also been enough “transparency” contracts out there from traditional PBMs and PBAs (Pharmacy Benefit Administrators) that there is proof that transparency doesn’t save money.

I’ll talk more about why I think the CVS Caremark deal is good later.

January 14, 2010

January 14, 2010

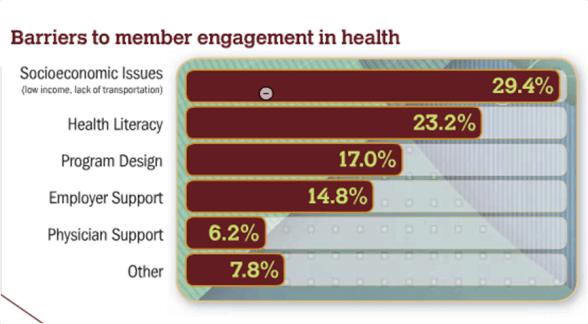

Another part of the survey had 7.8% of people saying that patients (consumers) are less interested in health and that the primary reasons for lack of engagement were:

Another part of the survey had 7.8% of people saying that patients (consumers) are less interested in health and that the primary reasons for lack of engagement were: