This article appeared in HealthLeaders (3/3/10) by two of my co-workers based on some very interesting work they’ve been doing.

It’s not what you say, but how you say it that matters. The “how” includes a number of specific voice attributes, such as inflection, rate of speech, and intonation—all of which contribute to an overall perceived “voice personality.”

Voice is a powerful lever in the ability to effectively communicate your message to ultimately motivate behavior. Would you be more apt to trust the voice of James Earl Jones or the voice of your local car dealer? How do you perceive these voices overall? Which voice personality most effectively delivers a message? The answers, of course, depend on the listener, what is being communicated, and the behavior you’re trying to motivate.

In healthcare, individuals are educated and supported in the decisions they make about their health through communications. This article highlights a recent study of the impact of voice in healthcare communications and how individuals perceive voice as it relates to health messaging.

Specifically, this research analyzes voice selection for interactive automated calls, an effective outreach channel widely used in healthcare to reach and motivate individuals.

Subjectivity in Voice Selection

If you put a small group of people in a room and ask them to describe the voice they hear, the answers will be wildly different: “This voice sounds too perky.” “That one sounds robotic.” “This voice sounds friendly and cheerful.” Reaching a final conclusion about which voice is “best” often is a highly subjective process.

While we don’t consciously listen to an individual’s voice attributes, we do subconsciously assess the voice’s characteristics and create inferences about the speaker. Over the telephone or on the radio, when voice is the focus, we paint a picture of how someone looks, what kind of person they are, their age, gender, and generally whether or not you trust them.

We’re sometimes surprised in the end at how different the person is when we meet him or her face-to-face. By itself, voice impacts our perceptions, which affect how well we understand a particular message.

In healthcare, it is a common belief that people prefer a female voice when receiving messages about their health. Perhaps this is because female voices are perceived as more nurturing and caring; and women are often the caregivers in the home.

But is a female voice equally effective when communicating to all people, of every age, in every region, and for every type of health related behavior? For instance, is a female voice as effective for people of poor health status hearing a message about an important health screening? What about seniors hearing a reminder to take their cholesterol-lowering medications?

Voice Research

To answer these questions, we created a framework to map specific voice attributes with voice personality. We conducted an attitudinal study to learn how people of different age, gender, and region perceive and respond to different voices. We surveyed 3,000 people across the country, in a statistically representative sample of the commercially insured U.S. population.

Participants heard the same short informational wellness message spoken by several different voices representing a variety of ages, gender, and unique voice characteristics. Survey responders were asked to provide their opinions on the following:

- Is the voice perceived negatively or positively overall?

- Which attributes do people generally use to describe a particular voice? (e.g., rate, volume, and age)

- Is the voice perceived as introverted, extroverted, formal, or conversational?

- Is the voice perceived as coming from someone who is more caring and sincere, or someone who is trying to sell something?

- Do people believe and trust the voice?

The survey results provide a powerful depiction of how different voices are perceived by different segments of a population.

What’s in a Voice?

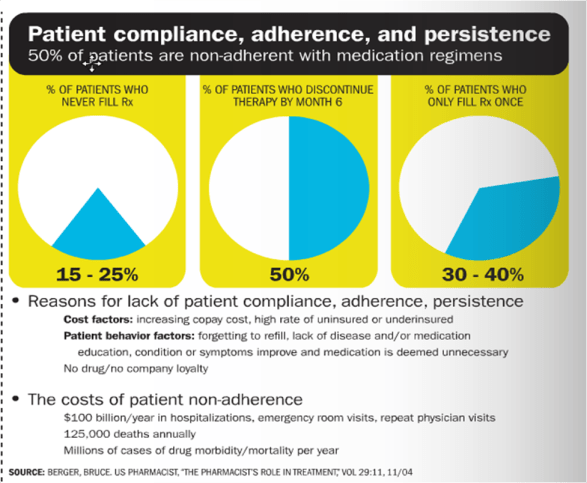

High trust and care/sincerity ratings are important factors when trying to motivate healthcare behaviors. Medication adherence, for example, is associated with the quality of relationship between the patient and the physician. When people trust the voice they hear, and feel that the person speaking to them is sincere, they are more likely to change their behavior.

There are many interesting attitudinal findings from our study including:

- Both men and women across all age groups preferred a male voice to a female voice overall.

- Voices described as fast paced, young, highly extroverted, perky, and animated rated poorly in the trustworthy and caring categories.

- Voices described as moderately paced, middle-aged, and well-spoken/educated, were rated most trustworthy and caring.

- Seniors (those 65+ years old) aren’t as sensitive to voice age as other groups and don’t perceive older voices as necessarily older sounding. By contrast, younger groups perceive “older” voices more negatively.

- Seniors aren’t as sensitive to the rate of speech as younger populations; therefore, slowing the pace may not be as impactful as was once thought for older populations.

- Younger people (18- to 34-year-olds) are significantly more sensitive to voice age and rate of speech, which means very careful selection of voices for young audiences is important to drive behavior.,/li>

- Young people showed stronger opinions overall between men and women when rating the voice gender they prefer. In other age groups, there is general agreement on voice gender preferences. Gender selection is therefore a more important factor for the 18-to-34-year-old age group.

The use of voice to motivate health decisions

The results of this study provide us insight into how people of varying gender, age, region, and health status perceive the voices they hear. Our goal is to validate how specific voices can be used as a lever to change behavior.

Voice, like other communications levers, such as messages and timing, can be selected based on the demographics, purpose, tone, and intent of communication, as well as how voice supports brand identity. By validating attitudinal voice responses against behavioral activity, voice can ultimately become a measurable behavioral best practice in healthcare communications.

While the bulk of our experience supports the conventional wisdom that a woman’s voice is more effective for healthcare communications, our voice research suggests that there are opportunities to use a male voice to measurably move health behavior. A recent outreach program to educate individuals about the importance of colorectal cancer screenings supports our attitudinal research.

The outreach asked if the individual had received a screening during the past two years, and if they planned to schedule a consultation with their doctor. The same message was delivered by a male and a female voice. All population segments, including men, women, Caucasians, Hispanics, and Asians, answered the survey at a higher rate when a male voice was used versus when a female voice was used.

Conclusion

By applying science and measurement, we can determine the voice qualities that are the most impactful for a specific health behavior and for a group of people. There are measurable patterns in overall voice preference. Communications programs aimed at driving individual behavior should include voice analysis.

By measuring and understanding perceived voice personality, our research sheds light on an objective way to effectively apply voice in healthcare communications to ultimately impacts behavior change.

Jack Newsom, ScD, is vice president of analytics at Silverlink Communications, and Ryan Robbins is voice production manager at Silverlink Communications.

June 8, 2010

June 8, 2010

Poly-pharmacy has negative impact on adherence.

Poly-pharmacy has negative impact on adherence.

25-30% of people who start on a statin don’t ever refill.

25-30% of people who start on a statin don’t ever refill.

Only 36% of boomers rate their health as good to excellent.

Only 36% of boomers rate their health as good to excellent.