DBN On Mandatory Mail

I’ve talked a few times about mandatory mail on the blog and after talking with Drug Benefit News (DBN), a few of my comments appeared in today’s publication. One of the hypotheses in the article is that mandatory mail is growing (which doesn’t surprise me in this tough economy), and Ken Malley from Medco is quoted several times in there talking about their growth in the program. He says they have 11M lives in the program which I believe would be more than anyone else. I also think the Medco program with RiteAid which is described is probably something that clients would like a lot and similar to the Maintenance Choice product that CVS Caremark is offering.

My comments in the article are mostly about the importance of communications which can ease the transition to mail. The article also quotes Claire Marie Burchill from Cigna about communications and branding. They called mandatory mail the “pharmacy of choice” which is not unusual. When I was at Express Scripts, my team changed it to “Exclusive Home Delivery” and Medco calls it “Retail Refill Allowance”. [This is the whole concept of framing which is core to communications.]

The fact is that once members start using mail pharmacy, the overwhelming majority of them like it, “but the challenge is more the inertia of getting them started,” Van Antwerp says. “They need a good boarding experience at mail around first fill, and then it becomes more automatic.” Depending on the payer, mail-order customer retention rates vary from 75% to 95%.

He adds that if more plans start implementing mandatory programs, “initially you’re going to get some disruption, because people push back against change.” However, once patients realize that they can receive 24/7 support and save money, “most people will be pretty happy,” Van Antwerp says.

All of this plays into the other benefits of mail order – faster generic substitution, adherence, convenience, and savings. The other key is aligning pricing and plan design to drive mail order which remains a challenge across the industry but is critical.

The one thing we didn’t get into in the DBN article was the science of communications and how important it is to understand consumers and what motivates them. I think this is the future of pharmacy. A good segmentation and targeting strategy allows you to personalize communications and deliver the right message at the right time to the right person using the right channel with the right message to motivate them. It’s not that easy to do, but it can be done.

One Way That Mail Order Pharmacies Are Disadvantaged

All I ever hear is complaints from retail pharmacies about the advantages of the mail order pharmacy since they are owned by the PBMs. Let’s spend a minute on one of the ways they are disadvantaged (which as a consumer is really annoying).

If a retail pharmacy wants to call a patient for a refill reminder or enroll a patient in an automated refill program or talk to a patient about their condition, they can do that. There’s no limitations put on their pharmacy-patient relationship.

When the mail order pharmacy tries to do the same thing (which by the way I believe is good patient care), they have to get approval from the PBM clients. Why? If it’s part of the standard practice of pharmacy and the retailers can do it, why can’t the mail order pharmacies?

And, yes…I had an incident yesterday that annoyed me. I tried to sign up for the auto-refill program at the mail order pharmacy that is owned by the PBM that contracts with the managed care company that the broker who serves my employer selected.

But, when I tried to sign up, they couldn’t do it. Apparently, the managed care company doesn’t believe in auto-refill (a point which I will be raising with their mgmt team shortly). I’m sure the argument is that it creates waste. I could argue against that, but I’ll save that for another time. Let’s say I concede that may be an issue. Great, then don’t push auto-refill. But, why can’t I sign up for it? It should help me be compliant. (Note that my MPR is well above 90%…but I’d like to be at 100%.)

But, the bigger issue here is why is mail disadvantaged by their PBM ownership? Their a network pharmacy with a requirement to manage me as a patient. Let them do that.

CVS Caremark, Behavioral Economics, Social Media, and Adherence

Yesterday, CVS Caremark announced an expansion on their research partnership with Harvard to include three people focused on behavioral economics and social media. The focus of both these efforts is around prescription compliance (an almost $300B problem).

The work is going to be focused on three areas:

- Providing Appropriate Incentives: Research how appropriate financial incentives – in the form of lower copays and immediate up-front rewards – motivate consumer decisions to help improve health care behavior.

- Developing education tools: Determine how education materials and programs targeting consumers can be applied to persuade positive behavior that will affect meaningful change for patients.

- Tailoring Communications: Studying how specific messages resonate with individuals to promote improved health outcomes, adherence and personal care.

Are You Using A Mystery Shopper / Caller Progam?

One of the programs we used very effectively at Express Scripts to test our call center was a “mystery shopper” program. Much like the name implies and has been used in retail for years, this process had a person calling into the call center and asking a series of questions about plan design or other aspects. This was a great way to see if training had worked and understand the experience that our members had.

I honestly don’t remember exactly how we set this up to pass the authentication process, but I believe we probably created “dummy” members in the eligibility file with a name and member ID that could be used by the mystery shopper.

Those calls were then ranked based on quality of response, consistency of response, first call resolution, and other aspects. This testing process was continued until the quality scorecard passed a certain level.

With the increasing complexity of plan design, this is something that everyone should look at.

Why Don’t All PBM Clients Save With Mail Order?

This is one of those questions that eludes many people so let me try to explain it here. It’s one of the major constraints for PBMs in terms of driving mail order volume. Most (all) PBMs select patients to target for retail to mail programs based on a win-win-win criteria.

- Does the patient save money?

- Does the plan sponsor save money?

- Does the PBM make money (net of costs of acquisition)?

In most cases, the patient will save money since the default plan designs incent mail use. Typically plans are set up to be roughly 2x the retail copay meaning that you get a 90-day supply for twice the cost of a 30-day retail supply. The only time that this sometimes doesn’t work is on generics where the mail order price could be more than the retail price. Which shouldn’t happen if you have a MAC (maximum allowable cost) list being used at both retail and mail.

BUT, the problem for clients is that over time as copays have gone up it’s possible that the copay savings they give to the patient as an incentive to choose mail could outweigh the savings they get from the PBM. For example:

- Let’s assume it’s a brand drug.

- Let’s assume that the average cost for a 30-day supply is $100 (and therefore $300 for a 90-day mail order supply).

- Let’s assume that the average discount at retail is 18% and the average mail order discount is 23%. (i.e., the client pays $82 for a 30-day supply at retail and $231 for a 90-day supply at mail)

- Let’s assume that the copays are $30 at retail for the brand drug and $60 at mail. (i.e., the client is passing on $30 of their savings to the patient)

- Therefore, in this case, the client is saving (pre-copay) $15 by moving a drug to mail order. (5% incremental discount times the $300 drug cost)

- The client saves $15, BUT they pass on a $30 copay savings to the consumer meaning that they pay an extra $15 for each of these brand scripts moved to mail. PROBLEM!

So, the question is what to do here. Well, first most PBMs or consultants should be recommending mail order copays that are 2.5x or more the retail copay. AND, they should be recommending differences in the copay multiplier based on the tier and the actual discounts received to make sure that the plan sponsor is not upside down.

At this point, you should be saying “well this seems so easy”, BUT it’s not. Plan sponsors don’t want to reduce the copay savings for consumers because it’s viewed as a takeaway or viewed as not being competitive. They are stuck with this 33% savings framework that worked when copays were $10-15. It’s a real issue which every account team within the PBMs should be focused on.

Now, on the final point…the PBM making money. I’ve already talked about this many times. The PBM makes money on generic medications at mail. This margin underwrites all the other business which is often a loss leader. [Or at least this was the model a few years ago as some people remind me.]

Communications Key To Mandatory Mail

I had an interesting question today about whether I thought mandatory mail would make a comeback. I haven’t heard much lately about mandatory mail. Rather than mandatory mail, I hear more people talking about restricted networks or programs like Maintenance Choice. The follow-up to the question was why clients don’t implement mandatory mail. It’s an easy question…they don’t implement mandatory mail because it’s disruptive.

So, how can clients make it less disruptive? Use communications. No one likes change. But, people who understand change and why change is happening are less likely to be upset. (BTW – You’ll never make everyone happy.) So, why don’t people use communications with mandatory mail? Because they see it as an unnecessary expense since those people will be forced to mail anyways. That’s old school.

If you effectively communicate with members before the plan is implemented and each time they fill a prescription at retail, you can make it an easier process. The goal should be to drive adoption of the plan and avoid point-of-sale (POS) rejects which might impact adherence.

More Adherent If You Use Mail

This was obviously a great study for the PBMs although it was a Kaiser research project. The study showed that 84.7% of patients that used mail at least 2/3rds of the time stuck with their physician’s regimen versus 76.9% who picked up the medication at a Kaiser retail location.

“While everyone knew that mail- service pharmacy made prescriptions more affordable, this new empirical evidence shows that it can also improve outcomes for patients with chronic conditions. This should be an ‘eye-opener’ for any policymaker who wants to address the chronic care crisis in America,” said PCMA President and CEO Mark Merritt.

There was nothing new about the fact that people with a financial incentive and who lived farther away from their retail pharmacy were more likely to use mail order.

The question I would have is whether there is inherent selection bias. Are people who use mail better planners and therefore simply more likely to be adherent?

The other question I would have is around Kaiser as the example. The members have to use Kaiser retail pharmacies, and I’ve heard that they aren’t always in easy to access locations like a CVS or Walgreens store and that there can be significant wait times.

50,000 Adults Die Each Year Of Vaccine Preventable Diseases

Diseases easily preventable by adult vaccines kill more Americans each year than car wrecks, breast cancer, or AIDS.

I found this article from WebMD to be both interesting and surprising. According to the article, the diseases are flu, Hepatitis B, pneumococca, meningitis, shingles, human papillomavirus, tetanus, and whooping cough.

According to the CDC survey:

Pneumococcal vaccine is used by 25% of Americans at high risk of severe illness and by 60% of Americans aged 65 and older. Hepatitis B vaccinations were completed by 32% of high-risk U.S. adults under age 50 and for 34% of non-high-risk adults under age 50. HPV vaccinations have been given to only 10.5% of American women 19-26 — and only 6% got all three shots. Tetanus shots are current for only 60% of U.S. adults under age 65 and only 52% for older adults. Flu shots are taken by fewer than two-thirds of adults at high risk of severe flu complications. Shingles vaccines are taken by only 7% of U.S. adults 60 and older.

So, that begs the question of whether consumers should be responsible for costs if they don’t take preventative measures. I’m sure there are lots of reasons why they shouldn’t be, but let’s assume that the cost of vaccines were covered AND that their healthplan communicated to them the need to go get vaccinated. In that case, if someone doesn’t get vaccinated, becomes sick, and causes thousands of dollars in cost to be incurred (which all of us pay for), is that ok?

I have no problem bearing costs for people who are uninsured and support universal coverage. I have no issue paying more if I can’t control my weight or chose to make bad decisions. I see healthcare as covering things that I can’t prevent – accidents, genomics, etc.

Walgreens to Imitate CVS

Certainly not a statement that the corporate guys would ever say, and I was pretty surprised to hear a store employee say it. But, just down the street at my local Walgreens, the clerk stated that they were getting ready to do a store redesign. With the first CVS stores opening in St. Louis, he said they were losing business and believed that store design had something to do with it. He said they were going to cut back on their number of items and reduce the height of the shelves.

True? I don’t know. It would surprise me that if this was true that it hadn’t been figured out long ago. This obviously isn’t the first time that CVS and Walgreens have competed.

The other thing that was interesting is he said that with the CVS pharmacy open 24-hours (especially on weekends) they were getting a lot more people who were frustrated and saying they were taking their business to CVS. (Never mind that fact that before you get to CVS there is a 24-hour Walgreens.) Interesting perspective from the field.

New Player – Drug Trend Report – InformedRx, an SXC Company

The list of PBMs producing drug trend reports continues to grow with InformedRx entering the research publication area. Now we have Express Scripts, Medco, CVS Caremark, Walgreens, and Prime Therapeutics.

- Their book-of-business trend for 2007 and 2008 was 0.5% PMPY.

- Their GDR was 69% (a 7.8% increase over the prior year).

- Their non-specialty trend was -0.5% in 2008. [This makes me wonder if they had become more aggressive on plan designs in that period to drive negative trend.]

- Their specialty trend was 9.6%.

- They have a list of options to mitigate drug trend. I was pleasantly surprised to see the first one was preferred or restricted retail network arrangements. (The 3rd thing was targeted member communications.)

- Their costs per Rx were: (not sure if this is AWP, client billed amount, or something else)

- Total – $52.47

- Brand – $110.82

- Generic – $18.09

- Their utilization trend was 0.3%.

- They have a brief therapeutic class section on the top 5 classes.

- 80% of the new chemical entities that are expected to reach the market in the new year will fall in the specialty category.

- They state that the goal on 4th tier (specialty) and 5th tier (life style and cosmetic) is the have an equal cost share between clients and members. [I’m not sure I understand if this means to continue the same percentage cost share or to split the costs 50/50 on that tier.]

- They mention that an approach to use is pplacing DAW penalties in place. [I can’t believe that companies don’t have this in place today…shame on an account manager who hasn’t convinced their client of the logic of this.]

- I’m a little confusioned on pg. 25 when they talk about adherence and drug cost savings. I thought that costs would go up on the pharmacy side but produce savings on the medical side.

- I was also surprised to see that they were recommending a mail copay for 90-days equal to two 30-day retail copays. I thought that this had to be closer to 2.5 retail copays to make sure the client saved money.

Overall, I think it’s a good first document. It reads easily, but I think it needs more primary research. I also think the forecast at the end has to be a little more visionary.

09-10 Prescription Drug Benefit Report

As they have for the past few years, Takeda has sponsored a study by PBMI on employers and their prescription drug plans. The report is called the 2009-2010 Prescription Drug Benefit Cost and Plan Design Report. It has some interesting data. (The survey is of 417 employers representing over 7M members and was completed in May/June 2009.)

- 87% of respondents have a multi-tier formulary. (Closed formularies are almost disappeared.)

- 97% offer access to mail order.

- 17.4% use mandatory mail. (22% of self-insured and 8% of fully insured)

- 84% allow for 60+ days supply to be dispensed at retail. [surprisingly high to me]

- 60% of employers offer a specialty benefit.

- Members pay an average of 25.2% of retail Rxs and 19.2% of mail Rxs.

- Almost 1/2 of employers have adopted a value-based design.

- Only 89.5% use a refill too soon edit. [Why not 100%?]

- One question I found very interesting was who was responsible for plan design:

- Fully insured – 49.3% rely on insurance carrier (makes sense); 25.4% HR staff; and 12.7% consultant.

- Self-insured – 56.4% rely on HR staff; 18.6% use consultants; and 7.1% use PBM.

- [Very surprised that PBM use was so low.]

- Almost 10% of respondents said that drug benefits were >50% of their job responsibility. [I didn’t realize this was true any place other than the top few employers.]

- 3.8% have a maximum annual benefit for drugs.

- 30% use their PBM as an exclusive provide for specialty, but 54% require dispensing thru select specialty pharmacies. [I think this speaks to more PBMs and PBAs which don’t own their own specialty pharmacy.]

- For employers concerned about affordability, they asked what they were doing:

- 47% do employee education – generics, mail order, network pharmacies, and preventative drugs

- 29% don’t know

- Only 3% use step therapy [really surprising]

- The average copays were:

- Retail – Generics ($9.94); Preferred ($28.18); and Non-Preferred ($47.71)

- Mail – Generics ($22.06); Preferred ($61.80); and Non-Preferred ($106.94)

- They captured low, average, and high data points for each level. Some crazy client has a $50 generic copayment. [Why bother?]

- MAC (Maximum Allowable Cost) is only used by 71% of clients at retail and 46% of clients at mail. [Every client should have MAC set up.]

- Their average pharmacy reimbursement was:

- Retail Brand – 16.4% off AWP

- Retail Generic – 45.8% off AWP

- Mail Brand – 23.7% off AWP

- Mail Generic – 57.3% AWP

- The PMPM utilization numbers are interesting:

- 1.06 active employees

- 2.05 retirees

- 58.5% of employers cover OTCs.

- Their list of utilization management tools and usage surprises me:

- 11% use academic detailing

- 20% use copay relief / waivers

- 69% use disease management

- 44% use dose optimization

- 38% use face-to-face pharmacist consults

- 16% use generic sampling

- 44% use outbound phone calls

- 29% use pill splitting

- 23% use prescriber profiling

- 81% use prior authorization

- 89% use quantity level limits

- 47% use retrospective DUR (drug utilization review)

- 59% use step therapy

- 55% do therapeutic substitution

Is Non-Adherence Waste? Should I Be Financially Responsible?

Someone was telling me last night that 50% of pharmacy spend is waste. He had several good reasons, but one intrigued me. It’s the concept around waste due to non-adherence.

If I take a statin for 7 months and then stop therapy, is that a waste? Did those 7 months of use do any good? Once I stop, my cholesterol likely goes back up. So, my employer has now paid for me to get better and essentially, I just flushed their money down the toilet.

Therefore, should I be financially responsible for that waste? I’m not likely to get billed, but I could see an aggressive plan which stopped covering my drugs until I once again became compliant. Why not? Or after I’d been adherent for a period of time then they might reimburse me for the drugs I paid for out of pocket.

Would this work? I doubt it. People would likely get their drugs and pour them down the drain just to appear adherent.

Could I be responsible? Probably not without addressing some of the root causes such as health literacy and the lack of explanation by physicians. Since some patients leave not knowing the name of the drug, the side effects, their length of therapy, or the fact that they have to call for a refill, there is a lot to be addressed systemically.

Waste…probably. Addressible…maybe not.

2 Ways to Measure MPR

MPR = Medication Possession Ratio

The common way to calculate this is to look at MPR as a calculation for a drug/patient (i.e., George had a 70% MPR for his medication(s)) or to look at MPR on average (i.e., our MPR for oncology was 75%).

The other option that I think is valuable, but I don’t hear people think about is the percentage of people with an MPR above X (typically 80% but 90% for a few conditions).

I guess the question is what value I get by getting all my patients to be slighlty more adherent compared to getting a specific number of patients to be adherent.

Should Drugs Be Free?

You hear this argument a lot especially within the context of value based design. There are two reasons that people consider dropping drug copays to $0 for a commercial population – (1) they believe it will increase adherence and (2) they believe it will incent people to move to generics or to mail order.

First, I am fundamentally against providing prescription medications for free. People have no vested interest in things that are free. And, I strongly believe that people need a vested interest in their healthcare. A temporary $0 copay or a rebate is okay, but I prefer a clear and simple message like “all generics are $4”. (Not even Wal-Mart can say that…most $4 generic programs are only for 300 or so drugs.)

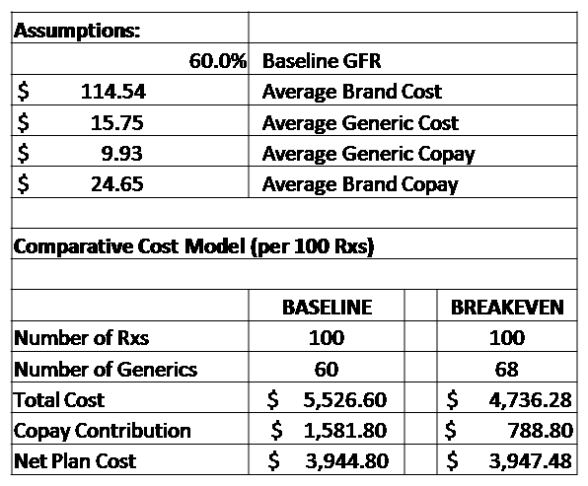

Tonight, I want to drill down specifically on using this to incent people to move to a generic drug. I don’t believe this is a cost effective solution. Here’s my quick model which says that a company with a 60% generic fill rate would have to increase their generic fill rate by 8 percentage points to breakeven. I would argue that it is too big of jump to happen (at least within one-year).

Why? Because the 60% of people that are currently paying a copay which reduces the net cost to the client stop contributing.

Is A Pharmacy Driven Adherence Program The Holy Grail?

Perhaps surprisingly to some of you, I would say yes BUT…

There are lots of issues why it isn’t. But, before I go there, what do I mean by a Pharmacy Driven program?

Ideally, the pharmacist would be a critical part of the care team for patients. They would interact with the patient to educate them on side effects, discuss drug-drug interactions, warn them about side effects, discuss trade-offs, help the patient to stay adherent, and address their barriers.

BUT..

- Less than 20% of patients know their pharmacist’s first name. (Mine is Renee…by-the-way)

- Retail pharmacists don’t have access to scripts not filled at their store / chain.

- 40% of people who pick up prescriptions aren’t the patient using the prescription.

- Pharmacists aren’t rewarded for cognitive services.

- There’s a shortage of pharmacists and you often speak with the pharmacy tech.

- Moving the “counseling window” over 24″ really doesn’t create a private environment for discussing your drugs.

Can many of those items be addressed – yes? Should they be – I don’t know.

Even if we could, we’re still missing two important things:

- You have to go further upstream to the physician – patient interaction to really address some of the issues that drive non-adherence; and

- You have to find a way to reach out and effectively engage patients to refill their medications (which isn’t cost effectively done with the pharmacy staff).

Prime Therapeutics Drug Trend Report 2009

It’s been a while since I did all my analysis on the drug trend reports last year. It’s almost time for some of them to start coming out again. Prime Therapeutics typically publishes their document at the end of the season (see press release). (see my review of their 2006 trend report)

In general, I liked the report. It was an easy read and something that I think anyone could pick up and understand.

General Notes:

-

Prime is owned by 11 Blues plans and partners with 5 additional plans.

- $8.3B in drug spend under management.

- 27% annual membership growth

- 94% member satisfaction

- Prime’s drug trend (PMPM cost) decreased by 0.5% in 2008. (Specialty trend was only 0.9%.) This is their 6th year of single-digit trend which is great. [I really want to dig in and know why – population, drug mix, plan design.]

-

Their generic fill rate was 63.7% (in December 2008). [This seems low…CVS Caremark’s for the same period was 66.3%.]

- Some of this is plan design, but I think their average age is lower than other PBMs which would drive a lower GFR with higher acute drug use…which is more likely to be generic. [I’m speculating on age, but they share that their average age is 33 which seems low.]

-

1.1% of their total Rxs were specialty drugs.

- Neither here nor there, but they are the first company I’ve seen to show ingredient costs per day for specialty. (It was $75 vs. $2.50 for traditional drugs.) Most show costs as a 30-day supply.

-

Their average costs per Rx were $61.87.

- Brand = $132.65

- Generic = $19.20

- Their Rxs PMPY remained flat at 11.5 which still seems low to me. [They state that the average number of retail Rxs per capita was 12.6…does that mean it’s actually higher once you add in the mail Rxs and adjust for days supply?]

-

Their average member cost share was 26.4%.

- 27.2% for brands

- 40.1% for generics

- 5.0% for specialty

- For Medicare, the utilization is much higher at 47.9 claims PMPY.

- Their average age was 33.3 (commercial) and 72.7 (Medicare).

- The GFR for their Medicare business went up 8.7 percentage points to 71.3% which is a huge jump.

-

I like how they break traditional drugs into two buckets – Spectrum (not my favorite name) and Focus. This allows them to show different strategies on these two (vs. specialty).

- Focus are drugs for high blood pressure, high cholesterol, diabetes, respiratory disorders, and depression.

- They say they have a GFR of 34.9% in specialty. [This seems incredible. I didn’t realize there was that much generic opportunity but maybe I’m outdated here.]

- They show a chart on page 30 around generic fill rate which seemed strange to me. It shows the best in class sometimes exceeding what they consider the theoretical maximum. I think I understand why, but I’d have to challenge whoever came up with the theoretical maximum if I already have clients exceeding it.

- They have a Generics Plus drug list which I imagine is a lot like the High Performance Formulary which we had at Express Scripts and was part of my GenericsWork solution that I launched when I was there.

- They are the first PBM that I’ve seen recommend a $5 generic copay to try and avoid prescriptions being processed for cash and losing those claims for DUR purposes. I think this is great.

- I was surprised to find out they have a generic drug alert program. [A program telling me the drug that I’m on is now available as a generic.] They might be the only PBM I know with this. From a consumer perspective, I think this is great. From a business perspective, I know that almost all of these people will get switched by their pharmacy to the generic without doing anything so the value of that mailing is pretty limited.

- I was surprised to see them quote the Harris Interactive study from March 2005 on barriers for refilling medications. I like to see their data to compare.

- They have a section on value-based plan designs and provide three types of pharmacy solutions – drug-based, behavior-based, or risk-based. Sticking with their focus on risky patients, they recommend a risk-based model. I like this concept although I’m more of a behavior based advocate myself. They other question I have is can you offer lower copays for people at risk without having any type of “equity” issue with the other employees within the same plan?

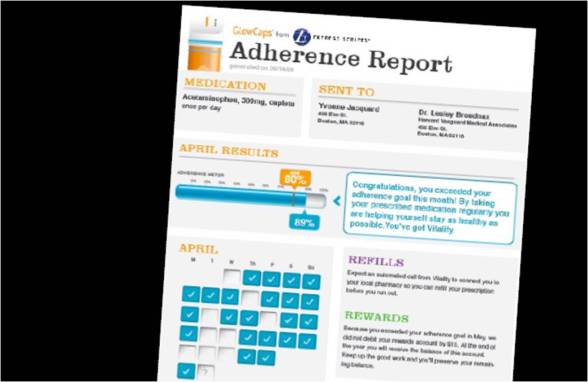

- They have an Adherence Report which conceptually I like although it only goes out every 6 months. There is research out there that says intervening after a 14-day gap-in-care (i.e., lack of adherence) is important to get people back to therapy.

- One of my favorite images that they’ve been using for a few years is the one below. It shows using a predictive model to focus on at-risk members and allows you to especially focus on those that are at risk based on medical data, but have no Rx claims. (Something they can do with the ownership by the Blues and access to medical data.) [They say these people are zero percent adherent which is a term I’ve never heard anyone use before.]

Key Research Points:

-

For high risk patients (survived a heart attack or show signs of heart disease), one heart attack can be prevented for every 16-23 members who regularly take cholesterol lowering medication.

- 3.2% membership is high risk and not on a cholesterol medication.

- Patients who receive a targeted outreach are 3x more likely to begin therapy

- Every one percent increase in GFR (generic fill rate) has the potential to reduce pharmacy expenses by 1-2%. [Walgreens also used 2% in their drug trend last year which is higher than what I’d seen before.]

- They talk about increasing generic usage as likely to increase member’s adherence. [I think Dr. Will Shrank has shown in some of his research that those that start on generics are more likely to be adherent.]

-

I’d love more detail on the case study on page 9 so maybe I’ll have to read the references…BUT what it says is significant:

-

By getting 5,000 high risk members with high blood pressure to be compliant with a statin for 1 year, they saved $2.1M in potential medical costs.

- Avoided – 44 heart attacks, 5 strokes, 20 heart failure hospitalizations, and 8 kidney failure hospitalizations requiring dialysis

-

- There are currently 183 medications in development to treat diabetes and related conditions.

- Patients with type 2 diabetes are 2.5x more likely to be hospitalized if they do not adhere to their medication therapy.

- Those who report being non-adherent to their cardiovascular medications have a greater than two times the likelihood of having a heart attack, stroke, or other cardiovascular event.

- For every heart attack avoided thru proper use of high blood pressure or cholesterol medication, a plan sponsor could save approximately $30,000.

- Drugs for MS (multiple sclerosis) patients have a monthly cost of $2,200 (wholesale). 1 in 5 members with an out-of-pocket cost > than $250 declined to fill and they were 7x more likely to decline than members with costs of <$100.

Potentially Conflicting Statements: (you have to read these things closely to find this stuff)

- On pg. 21, they recommend a $10 copay for generics, but on pg 32, they say adherence is best when your generic copay is less than $10. Maybe two different questions, but seems inconsistent.

- On pg 32, at one point they say that every $10 difference in Tier 2 copayments leads to a 2.3% higher GFR and in another point, they say a 2-3%. [I might be missing something here since the two are worded slightly different.]

- On pg 35, they say that step therapy encourages members to use a generic alternative before a “second line, usually more costly brand medication.” I think this is meant to imply that it’s usually a brand drug versus it’s usually more costly. But, then on pg 46, they say before a “more costly medication”. It’s possible to have a generic as step one (or an OTC) than a more expensive generic as a step two, but I don’t think that’s very common. [For you clinicians, think H2 before generic PPI before brand PPI from a few years ago.]

Will Paying You To Be Adherent Work?

United Healthcare is launching a new program (Refill and Save) that is a different spin on the value-based designs we’ve typically seen. In a lot of value-based healthcare programs, companies lower copayments (or waive copayments) for patients in certain conditions to drive up adherence. This has been shown to work and improve results by about 10% which is great. [Although less than some of the adherence programs we’ve done at Silverlink.]

In this case, United is paying patients $20 for every refill they fill for certain medications starting with asthma and depression. I’m very interested to see the results. There continues to be no silver bullet for adherence which is a problem which drives $290B in cost per year and results in 100,000 deaths.

“Patients with chronic diseases such as asthma and depression who take their medicines regularly and who comply with prescribed treatments are likely to stay healthier. They not only feel better, they can potentially avoid costly medical problems that could result from delaying appropriate therapy,” said Tim Heady, CEO of UnitedHealth Pharmaceutical Solutions

Evolution Of How The Big 3 PBMs Describe Themselves

A few years ago, I think it was a lot harder to differentiate the positioning of the big 3 PBMs – Medco, Caremark, and Express Scripts. Over the past few years, I think they’ve taken different positioning paths.

Look at how their corporate descriptions how evolved over the past few years. They all used to focus on the PBM core services. Now, Medco talks about making medicine smarter; CVS Caremark talks about health services; and Express Scripts talks about Consumerology.

Medco 2010

Medco Health Solutions, Inc. (NYSE: MHS) is pioneering the world’s most advanced pharmacy(R) and its clinical research and innovations are part of Medco making medicine smarter(TM) for more than 60 million members.

With more than 20,000 employees dedicated to improving patient health and reducing costs for a wide range of public and private sector clients, and 2008 revenue exceeding $51 billion, Medco ranks 45th on the Fortune 500 list and is named among the world’s most innovative, most admired and most trustworthy companies.

For more information, go to http://www.medcohealth.com.

Medco 2006

Medco Health Solutions, Inc. (NYSE: MHS) is a leader in managing prescription drug benefit programs that are designed to drive down the cost of pharmacy healthcare for private and public employers, health plans, labor unions and government agencies of all sizes. With its technologically advanced mail-order pharmacies and its award-winning Internet pharmacy, Medco has been recognized for setting new industry benchmarks for pharmacy dispensing quality. Medco serves the needs of patients with complex conditions requiring sophisticated treatment through its specialty pharmacy operation, which became the nation’s largest with the 2005 acquisition of Accredo Health. Medco, the highest-ranked prescription drug benefit manager on Fortune magazine’s list of “America’s Most Admired Companies,” is a Fortune 50 company with 2004 revenues of $35 billion. On the Net: http://www.medco.com.

CVS Caremark 2010

CVS Caremark is the largest provider of prescriptions in the nation. The Company fills or manages more than 1 billion prescriptions annually. Through its unmatched breadth of service offerings, CVS Caremark is transforming the delivery of health care services in the U.S. The Company is uniquely positioned to effectively manage costs and improve health care outcomes through its more than 7,000 CVS/pharmacy and Longs Drugs stores; its Caremark Pharmacy Services division (pharmacy benefit management, mail order and specialty pharmacy); its retail-based health clinic subsidiary, MinuteClinic; and its online pharmacy, CVS.com. General information about CVS Caremark is available through the Investor Relations section of the Company’s Web site, at www.cvscaremark.com/investors, as well as through the press room section of the Company’s Web site, at www.cvscaremark.com/newsroom.

Caremark 2005 (pre-acquisition by CVS)

Caremark Rx, Inc. is a leading pharmaceutical services company, providing through its affiliates comprehensive drug benefit services to over 2,000 health plan sponsors and their plan participants throughout the U.S. Caremark’s clients include corporate health plans, managed care organizations, insurance companies, unions, government agencies and other funded benefit plans. The Company operates a national retail pharmacy network with over 60,000 participating pharmacies, seven mail service pharmacies, the industry’s only FDA-regulated repackaging plant and 21 licensed specialty pharmacies for delivery of advanced medications to individuals with chronic or genetic diseases and disorders.

Additional information about Caremark Rx is available on the World Wide Web at www.caremarkrx.com.

Express Scripts 2010

Express Scripts, Inc., one of the largest pharmacy benefit management companies in North America, is leading the way toward creating better health and value for patients through Consumerology(SM), the advanced application of the behavioral sciences to healthcare. This approach is helping millions of members realize greater healthcare outcomes and lowering cost by assisting in influencing their behavior. Headquartered in St. Louis, Express Scripts provides integrated PBM services including network-pharmacy claims processing, home delivery services, specialty benefit management, benefit-design consultation, drug-utilization review, formulary management, and medical and drug data analysis services. The company also distributes a full range of biopharmaceutical products and provides extensive cost-management and patient-care services. More information can be found at www.express-scripts.com and www.consumerology.org.

Express Scripts 2005

Express Scripts, Inc. (Nasdaq: ESRX) is one of the largest pharmacy benefit management (PBM) companies in North America, providing PBM services to over 55 million patients through facilities in 13 states and Canada. Express Scripts serves thousands of client groups, including managed-care organizations, insurance carriers, third-party administrators, employers and union-sponsored benefit plans.

Express Scripts provides integrated PBM services, including network pharmacy claims processing, mail pharmacy services, benefit design consultation, drug utilization review, formulary management, disease management, medical and drug data analysis services, and medical information management services. The Company also provides distribution services for specialty pharmaceuticals through its CuraScript specialty pharmacy. Express Scripts is headquartered in St. Louis, Missouri. More information can be found at http://www.express-scripts.com.

A Few Adherence Examples of Communications

Express Scripts has been using Consumerology as their framework for member communications. I hadn’t heard much about what they were doing in the adherence area so I turned to the web. I found a few things that I thought people might be interested in. [Google is a wonderful tool.]

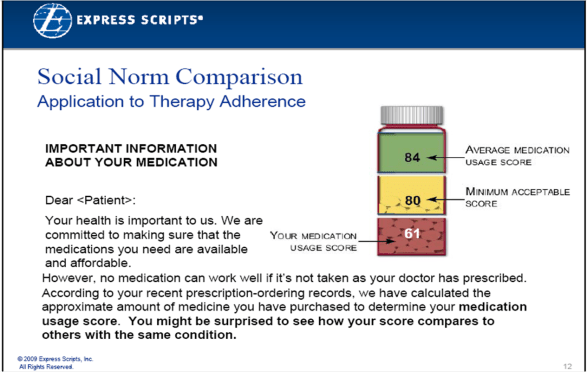

Last year, they had talked about the study in California with the power company and the influence that social norms had on power utilization. They were testing this. I found a presentation online that shows a cool graphic with some of the messaging. I’m not really sure if patients will get the concept of medication possession ratio (MPR) so I’m anxiously awaiting the results.

I also found a screenshot of sample adherence report which they’re using in a pilot with Vitality. [I’ll assume the data is mocked up and not real PHI.] I really like the report. I’m still torn on the GlowCaps concept in terms of whether consumers will use them, but they seem to have some good results. [And, I always try to remember that I’m not the average consumer so my opinion is just my opinion.]

The last thing that I found which was interesting was some FAQs on their auto-refill program. I remember pushing for this back when I was there, and I could never get the operations people and clinical people to approve it. This type of program is becoming the norm now for many mail order and retail pharmacies so I’m glad to see they have it in place.

Splitting Up CVS Caremark – Stupid – Just Learn How To Compete

The fact that the NCPA [see their press release on this] and others in the pharmacy community have chosen to push for the FTC to investigate the CVS Caremark merger and continue to encourage this is ridiculous. CVS has owned a PBM (Pharmacare) for years. Walgreens has its own PBM. Longs had a PBM (RxAmerica). Kroger’s has a PBM. Unless I’ve missed it, I don’t remember hearing about them not being able to own a PBM or seen complaints about their ownership. [And, like Adam Fein – I didn’t know this retrospective breakup was even an option.]

So, I perceive this whole FTC issue as a backhanded strategy to gain a competitive advantage over a competitor that’s beating them in the market. [Just imagine the distraction of having to split the companies up or the hassle of having to put in a bunch of additional limitations.] We know that independent pharmacies have continued to lose marketshare for years to retail chains and mail order. It’s no different than any other market where scale matters (e.g., hardware stores). If small pharmacies can compete, they should figure out how to make money and demonstrate value that people will pay for and stop focusing on crying wolf about a successful competitor. [More on what I would do another time.]

I’ve been a big believer of retail and PBM integration for years. At Express Scripts, we only thought there were a few companies that could buy us – Walgreens, Wal-Mart, or United. At this point, I don’t see that happening, but I see lots of efficiency in leveraging plan design, retail face-to-face counseling, pharmacy automation at mail, and other coordinated solutions.

Another issue that is raised [in complaining about the CVS Caremark integration] are patient complaints. These are certainly possible, but isn’t that a BBB issue or someone else’s issue. Unfortunately, I bet you can’t find a pharmacy or a PBM without some patient complaints. People take their healthcare personally and hate change. BUT, I can’t imagine that I would go to the government and point out that some clients of my competitor aren’t happy. [And the fact that politicians believe the hype and try to push stupid legislation like HR 4489 makes a mockery of our government.] I’ve talked about transparency before so I won’t harp on this here, but how many companies (in our capitalist society) are required to provide data about margins and forced into a certain business model.

Another issue you hear is about CVS Caremark “steering” people to preferred pharmacies (CVS, mail, specialty). First off, this is not a PBM decision. Limited retail networks have been an option for ever. Clients chose what plan designs to implement. The PBM’s job is to implement these plans and manage them effectively. PBMs and consultants (e.g., Hewitt, Mercer) often model out the options for the clients so they learn how to save money. And, in many cases given the pace of cost increases, if these options didn’t exist, then employers would drop benefits quicker.

Finally, the data doesn’t lie. Members are generally very happy with the PBMs and mail order (or as much as they are with any “managed care” type company). PBMs save clients money (and make money doing it). PBMs provide clients with data. Clients have lots of options for “transparent” companies and there’s been no big movement of marketshare to them. PBMs drive adherence. Mail order patients are more adherent. Specialty mail order pharmacies drive successful outcomes. The point is that the model works…stop trying to fight the model and come up with a better mousetrap.

[Enough ranting for the evening.]

Pharmacy Counseling – Mail vs. Retail Privacy

One of the other things that caught my eye in the USA Today article about the changing role of pharmacists were the comments about counseling. I’m not sure if I see that as any change. Isn’t that what most pharmacists go to school for? They want to help patients. They don’t go to school to count pills.

A few years ago when I worked on my idea of a kiosk to dispense medications that was the big discussion I had with several pharmacy leaders. I wanted to free up the counter time for counseling and let the kiosk hold the refills and acute medications which didn’t require as much pharmacist time.

Today, when you go to most pharmacies, you talk with the pharmacy technicians which in some states don’t even have to be certified and can essentially be someone with only a high school education. Not that there is anything wrong with not going to college, but I bet that most of us have high expectations for the person standing on the other side of the counter.

So, I think everyone would love the pharmacist role to evolve. BUT, I think the other question this begs is whether this is a private setting to have that discussion. Now, there are a few pharmacies that have created a quiet area for counseling, but let’s face it, the majority of the time, you’re standing at the counter with another patient right over your shoulder (or back at the yellow line 24″ behind you). How many of us really want to talk about the rash that developed as a side effect or the new diagnosis that we got from our physician or the fact that we can’t afford the medication in front of our neighbor or some miscellaneous person that might be judging us?

So, I’m always amazed when people talk about mail order as this anonymous 800# for counseling. Isn’t it more convenient to be able to call your pharmacy from your own home (or another private setting) at anytime of day or night and ask questions? Isn’t it more private?

Since less than 20% of people can even tell you the name of their pharmacist (and probably an equally low percentage of patients are known by name by the pharmacist), does this face-to-face relationship really matter?

I won’t deny that the Ashville Project worked and that the cases where the pharmacist is engaged with the patient in a long-term, trusted care relationship that it makes a difference. I only question whether that model exists, is scalable, is cost-effective, and can be staffed. (Don’t forget that just a few years ago they were forecasting massive staffing shortages around pharmacists…I don’t think that’s been solved.)

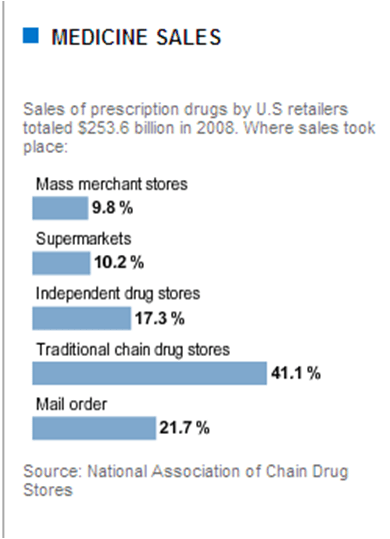

Where Do Prescriptions Get Filled?

I was reading the article in the USA Today about the changing role of pharmacists which had the following chart about where medications get filled.

Interview with Cyndy Nayer from the Center for Health Value Innovation

I had a chance yesterday to sit down and talk with Cyndy Nayer (President, CEO, and co-founder) from the Center For Health Value Innovation. For some of you, this is a new buzzword for others it has been around a while. I remember back in the early 2000s when stories of Pitney Bowes kept popping up and then working with a few of our clients (like Marriott) when I was at Express Scripts on what were being called “value-based designs”. [I even had an offer to go to ActiveHealth (now part of Aetna) and work on their Value Based offerings several years ago.]

And, it’s a small world. Several people from my past are involved: (1) Peter Hayes was a client at Express Scripts and (2) Roy Lamphier played soccer with me in high school.

What is the Center For Health Value Innovation?

The center is an “information exchange” for value based design which as she points out is much more than just a prescription benefit and not simply giving people free drugs to make them more compliant. [If only it were that easy!]

What do you mean by Information Exchange?

A place where people can share stories, trends, info, and research. They see their job as getting information out there and providing support around modeling, analysis, and identifying gaps. [And, I know they do a lot of education as you can see Cyndy at many conferences.] She talked about educating the marketplace on an “actionable format” for implementing value-based design.

Can you describe Value Based Design?

Value Based Design is a suite of insurance design, incentives, and disincentives that support prevention and wellness, chronic care management, and care delivery. It is focused on linking stakeholders across the care continuum and developing structures like outcomes-based contracting where all stakeholders benefit from better health outcomes.

She mentioned that in an upcoming edition of the Journal of Benefits and Compensation that there will be a paper that builds on some adherence concepts to discuss the 5 Cs of Value Based Design: [Noting that the first 3 come from some work from Merck.]

- Commitment

- Concern

- Cost

- Communication

- Community

We talked about the need for communications to be multi-directional and include the patient, the physician, the pharmacy, and other caregivers. We talked about community needing to expand on that to include family, the employer, and other entities. [As we all know, health care is local and value based design is no different.]

We spent a little time here talking about community, and the need for this to happen at a community level. [Much like e-prescribing and other things have found out that localized momentum is important.] One question in my mind is who is the catalyst – the hospitals, the physicians, the local managed care companies, employers, grocery stores, wellness companies, pharmacies.

We talked about the fact that this isn’t the same as Accountable Care Organizations, but like that concept, this has to be developed as part of the fabric of the community not imposed on the community.

Being from Detroit, I asked if this was a model for them to help develop around. That is an area of focus and there has been some work done in the Battle Creek, Michigan area.

Why are employers so interested in Value Based Design?

Originally, employers were interested since it was something new, but the recession forced them to look at this more seriously. But, this is a long-term process and something which they benefit from. Better health lowers absenteeism, and businesses need health communities and healthy workers for growth.

Why don’t companies implement Value Based Design programs?

Companies don’t implement them because they’re not prepared for the amount of work needed to get started and it’s not a cheap fix. [If you want to save money, just drop the benefits…not that anyone really advocates that.] We talked about that lots of people react to the urban legends of just giving out free drugs [which isn’t Value Based Design] which would be easy. Companies need to realize there is work to be done to communicate this, design it, and manage the implementation across the community. BUT, once it’s installed, it’s completely sustainable.

Is there a certification (i.e., URAC) for value-based design?

She told me that nothing exists today and that it would be hard to do. Today, there isn’t alignment in the marketplace around incentives and a standard model. They spend a lot of time working with different groups to drive education and training to link health and productivity measurement with value and functional performance.

What’s next for 2010?

In 2010, they will be bringing much more information forward on how to support and extend the work done in the 1st book (Leveraging Health…which Dr. Jan Berger, Silverlink’s Chief Medical Officer co-authored with the Center) and the decision matrix that they recently published. They will continue to serve more as a guide helping interested parties in private, invitation only events to design solutions and then bring those solutions to market.

How does someone learn more about Value Based Design?

The simple answer is to go to the Center For Health Value Innovation website. They have a whole library of information there.

How Do Physicians Want To Hear From Their Pharmacy/PBM?

In the pharmacy and PBM business, there are lots of reasons to reach out to a physician:

- Drug-drug interactions

- A chemically equivalent version of the drug prescribed is available

- A therapeutically equivalent version of the drug prescribed is available

- The prescribed drug is not covered

- A prior authorization is required

- The patient is required to try an alternative drug first (step therapy)

- The prescribed drug costs too much and the patient would like a new drug

- The prescribed drug had unplanned side effects

- The patient’s prescription has to be renewed

- The patient is required to move to mail

The question is always how to best do this. Here are some options:

-

Call the physician’s office.

- Using call center agents would be expensive, and after navigating an IVR tree and talking to the front office staff, they would simply leave a message. This would just lead to an ineffective back-and-forth in many cases.

- Automated technology won’t effectively navigate the IVR tree, sit on hold, and deliver a message.

-

Send a letter to the physician.

- This allows for the proper level of information to be provided so the physician has time to look up the patient record and respond.

- For most of the cases above, the time lag on this would be unacceptable.

-

Fax the physician.

- This is the default solution since you can deliver mail type content in a timely fashion.

- But, there is no great physician fax database.

- And, do physician’s read the faxes?

-

E-mail the physician.

- This isn’t really an option since there’s no physician e-mail database (that I know of) and you can’t send PHI via e-mail.

- Your only option here would be to send e-mails that alerted the physician to log into a portal where all these messages were waiting for them.

-

Use the EMR or eRx application.

- As physician’s get more automated and technology becomes the default workflow solution, everyone sees this as the holy grail. A pop-up can tell the physician about inbound messages for them to respond to.

- Some solutions hope to push this messaging to the time the prescription is written which I think is fascinating, but I don’t imagine a physician wants to deal with all that during the patient encounter. (Maybe I’m wrong.)

So, what I’m interested in hearing from physicians on is what works. I’m sure you want to say that most of these messages aren’t things you want to deal with, but plan design is here to stay and works to control costs. I’m sure some of you feel this is the “managed care system” telling you how to prescribe, but we know that the amount of information needed to keep current on everything is overwhelming. And, cost matters to patients which means getting them on the right drug that they can afford will impact adherence and ultimately outcomes.

So…How should PBMs and pharmacies communicate with physicians?

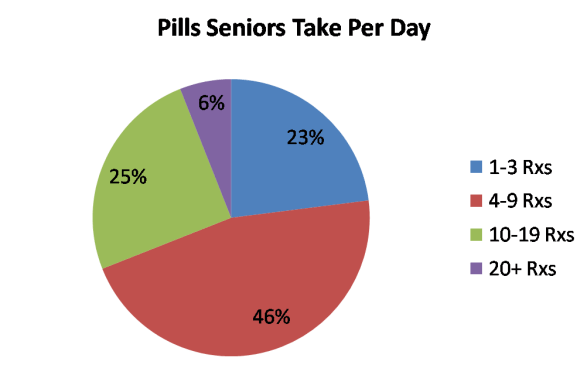

Medco: 6% of Seniors Take 20+ Rxs Per Day

From a Medco Health Solutions survey of seniors 65 and older who take medications. [Note that 20% of insured seniors did not take any medication on a regular basis.]

(Note: Chart re-created by me based on appearance in USA Today Snapshots.)

Wal-Mart Home Delivery – Will It Make A Difference

Now that Wal-Mart is pushing their home delivery direct-to-consumers via TV commercials and the web, will that have an impact on the market?

I could see a few possible reactions. The simple one would be that their investment simply proves to validate the mail pharmacy option (if that’s needed) and build more awareness of this as an option.

Another response could be that one of the big PBMs (Medco, CVS Caremark, Express Scripts) decides to compete in this “cash” or DTC market and tries to sell directly to consumers. That has lots of implications.

Like the $4 generics, it’s still limited to a small set of generic drugs that you get for $10 thru mail. But, will that drive volume? Are consumers “fooled” by the simplicity of the message or are they frustrated when they realize that their drugs aren’t $10?

Will safety groups or payors get involved to minimize to issues of having these scripts process outside the benefit and therefore not be in the member record for DUR (drug utilization review) – aka looking for drug-drug interactions?

Will PBMs change their contracts with retailers to strictly prohibit them from providing mail order DTC?

Will other retailers follow suit?

March 5, 2010

March 5, 2010