I was quoted in yesterday’s Drug Benefit News with one of my favorite people – Dr. Steve Miller from Express Scripts. This was a follow-up to talk about their predictive model for adherence. Steve confirmed what had previously been reported that it is 85% accurate in predicting the 10% of people least likely to be adherent. He says that the model takes into account past behavior, demographics, condition, and the drug. Those sound like a lot of the right variables.

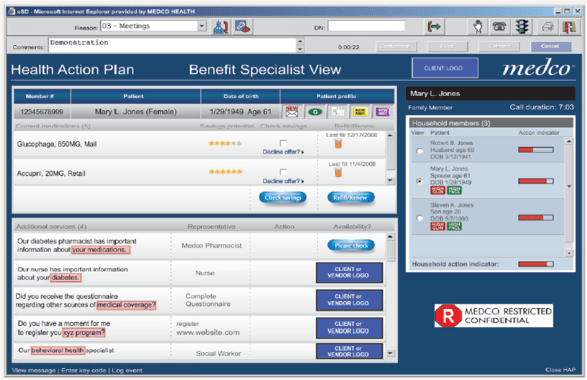

The article teases us with information that CVS Caremark is planning to publish a study in the upcoming months on their model. Medco Health Solutions comes across as more of a skeptic in the article talking about efforts from 20 years ago that were difficult and expensive to execute.

My quotes were very consistent with what I’ve shared on the blog – fascinating, somewhat skeptical, more concerned about the group that is somewhat adherent than those that are the bottom 10%, implementation of behavior change is more important that the model.

“Everybody’s trying similar efforts in terms of how to predict adherence…but there hasn’t been a model that has proven itself as being a good predictor. Maybe Express Scripts has cracked the code…I would assume that if you can accurately predict who is going to be adherent that will be a good tool.”

However, attempting to change behavior in the top 10% of patients likely to be nonadherent will be tough, Van Antwerp contends. “The industry is still waiting for that proof,” he maintains. “If we can predict that patients are adherent but can’t change behavior, then the model doesn’t do us much good.”

October 29, 2010

October 29, 2010