As I’ve talked about in the past, after working on the Express Scripts Drug Trend Report (recent copy here), I really enjoy getting the chance to read through them every year (see 2009 review or 2008 review). Over time, they’ve become less about the clinical side of the business and more about the programs used to engage the consumer with consolidated class specific data still included.

This year’s report is similar, but it is built around a new study that Express Scripts just completed with Harris Interactive. It comes to a rather surprising but interesting conclusion –

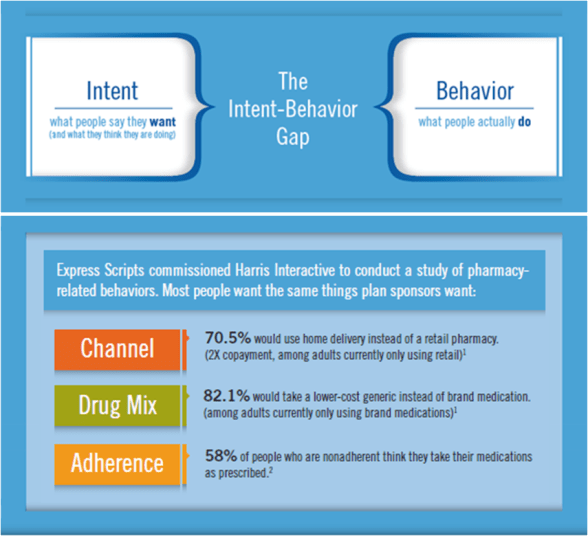

We discovered that the majority of people want to engage in the same behaviors plan sponsors seek to promote, but these desires often remain dormant. That is, there is a persistent intent–behavior gap. The key is structuring interventions that close the gap between what patients already want and what they actually do.

What’s the key point here? The point is that this says that consumers really want to move to generics and move to mail order, but they don’t do it. Is it that simple? I’d love to think so. And, for generics and mail order, I’m more likely to believe that inertia is a large factor. BUT, as I’ve talked about before, adherence has lots of complicating dimensions.

They focus on the gap between the physician and the optimal outcomes. This is certainly a major factor, but beyond consumer intent, there are issues of health literacy and physician beliefs that have to be addressed. Regardless, the point is correct…how do we engage and motivate consumers to change behavior especially if they are pre-disposed to change (when presented with the right facts).

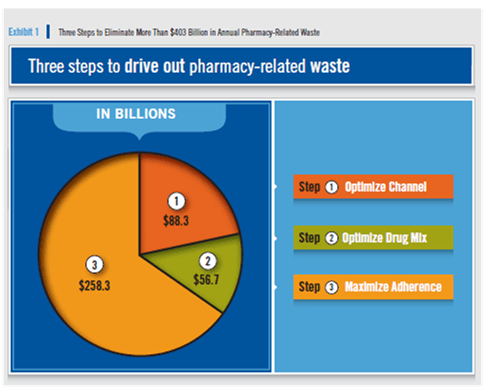

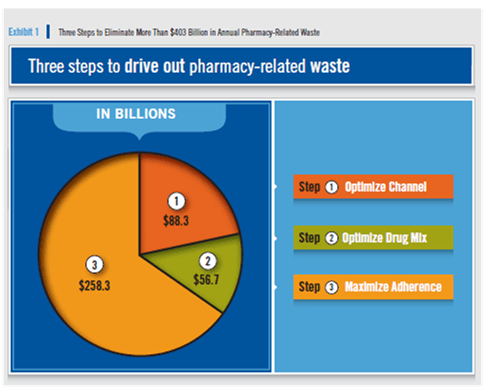

They did continue to build on last year’s focus on WASTE. They estimate that the waste in 2010 was over $403B as broken down below:

As adherence is a key issue here, they highlight the difference in adherence rates between retail pharmacy and mail pharmacy.

The focus of the report and the early press I’ve seen has been on the following chart. What it shows is some of the data from the Harris study saying that 82% of people would chose a generic (that are on a brand) and (depending on copay savings) 55-71% would chose retail.

One topic that I was glad was in the survey was limited networks. This is a topic everyone’s talking about from ReStat to Wal-Mart to Walgreens to CVS. Here’s what the research said with some explanation for what it means:

Of note is that about 40% said they would be willing to switch retail pharmacies to save their plan (or employer, or country) money. This fi gure is not as low as it fi rst appears because before a plan implements a more narrow retail network, a large fraction of members already use these pharmacies and therefore don’t have to switch pharmacies. It is not unusual, for example, for a client using a broad network to have 70% of prescriptions processed through pharmacies that are in the narrow network; members currently using these pharmacies do not have to make any changes. When a narrow network is implemented, if 40% of the users of the remaining 30% of prescriptions would willingly move to a lower-cost network pharmacy (as suggested by the survey), we estimate that the resulting overall market share within the narrow network would rise to 82% {70 % + (30% x 40%)}. (page 14 of the DTR)

All of this tees up their family of “Select” offerings (see Consumerology page) which builds on the success of Select Home Delivery and applies the concept of “Choice Architecture” from the book Nudge.

They talk about some of their work with adherence and their Adherence IndexSM. This metric is certainly one that has the industry’s attention as people wonder about the predictive value, how this is used, and how to craft solutions around such an index. My perception has been looking at studies like this one by Shrank and colleagues that past behavior remains the best predictor of future behavior, but I’m happy to be wrong.

So…what were the trend numbers?

- 1.4% in the traditional (non-specialty drugs)

- 19.6% in specialty

- 3.6% overall

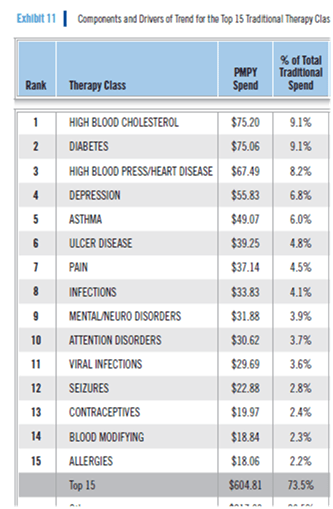

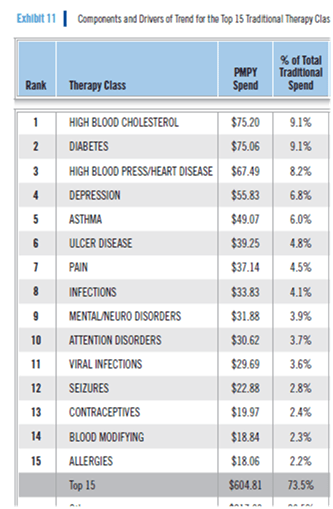

One of the other lists that I always find helpful to have is what are the top 15 drug classes and the PMPY spend.

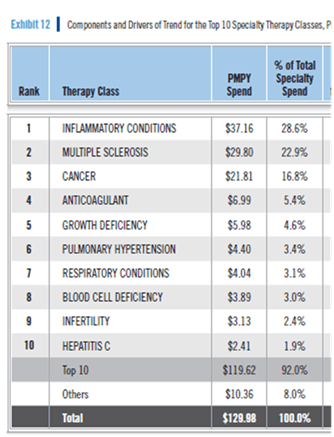

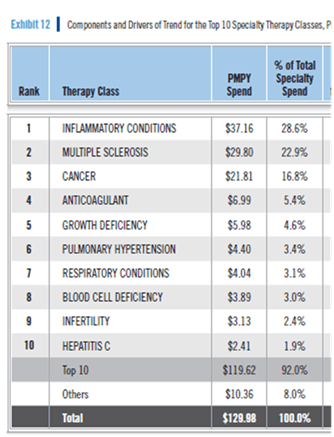

Of course, in today’s world, you really want to know this for specialty medications:

So, as always, I would recommend you read the report. Lots of great information in here. Interesting research. Good thoughts on consumer behavior and how to change it.

I think this week is their Outcomes conference which was always a good event.

April 13, 2011

April 13, 2011