This week was our [Silverlink Communication’s] annual client event – RESULTS2010 (click here to see the final agenda). I’ve talked about this before as one of the best events. It was great! Educational. Fun. Good networking.

Here’s a few of my notes along with a summary of the twitter feed (using hashtag #results2010). Unfortunately, the two of us twittering were also fairly involved so there are some gaps in coverage. And, my notes are sporadic due to the same issue.

Overall themes:

- Communications are critical to driving behavior change.

- We have to address cost and quality.

- Reform creates opportunity.

- Systemic problems require systemic solutions.

- Measure, measure, measure.

- Automated calls – while not the whole solution – work in study after study.

- People are different.

- There is a gap in physician – patient interactions.

Notes:

- Reform basics – guarantee issue, requirements for coverage, income related subsidy.

- Independent payment advisory board has an aggressive goal – get Medicare spending to equal GDP growth + 1% each year.

- ½ of the $1 trillion needed to pay for health reform comes from Medicare savings / reform…the rest from taxes.

- Everyone’s fear is that MCOs become “regulated utilities” that just process claims…unlikely.

- Need to address underuse, misuse, overuse, and limited coverage.

- Need to measure quality and cost at the person level.

- CMS pilots around shared savings are working – outcomes improved.

- Medicare Part D only got one complaint per thousand for therapeutic interchange programs / drug switching.

- The decision around defining MLR (medical loss ratio) and what fits in there is critical.

- Healthcare is like anything else…it’s not great and needs to change, but don’t touch mine cause it works ok. [frog in the pot]

- How do we make each healthcare decision an informed decision.

- Decision aids.

- Pull, push, or pay – 3 ways to drive awareness.

- Moving from information about your care to information being care.

- The incentive rebound effect…what happens when you take away an incentive.

- Social interaction affects our behavior.

- Solving for how to change consumer behavior cost effectively and in a sustainable manner is a good challenge to work on.

- How do we move people from desires to action? From “I’d like to exercise” to actually doing it.

- The fact that some European programs take 3-5 years to see an impact makes me wonder what that means for our US investment strategy given the member churn across plans.

- Great examples of ethnographic interviews

- Good McKinsey data on people’s perceptions – Annual Retail Healthcare Consumer Survey.

- Inform / Enable / Influence / Incentivize / Enforce

- One way of categorizing – willingness to change versus barriers to change (rational, emotional, psychological).

- Attitudinal segmentation – cool…but how to scale?

- Provider staffs attitudes are important.

- Design – delivery – measurement

- Readiness to coach

- A culture of health

- Have to mix up your tools (incentives, channels)

- “Communication Cures”

- The chief experience officer is a new role in plans and PBMs.

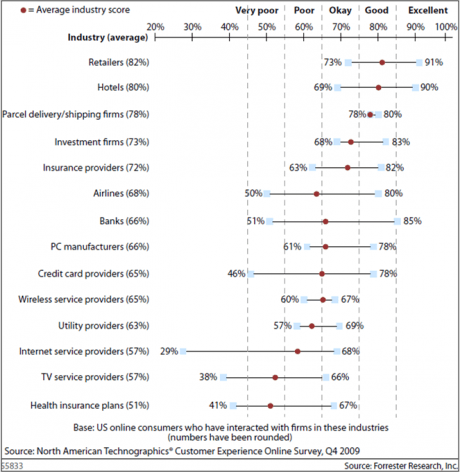

- The only experience you have with health insurance is via communications. Make it count.

- Loyalty is a result of cumulative experiences.

- People have to trust you so they listen to your message

- Communication maturity model

- Price is what you pay; value is what you get. (Warren Buffett quote…he wasn’t there)

-

Shifting paradigms:

- Consumption to sustainability

- Possessions to purpose

- Retirement to employment

- Trading up to trading off

- Perceived value to real value

-

Simple…less is more

- 1/3 of people feel their lives are out of control.

- Inflamation causes 80% of diseases (really)?

- If only 10% of outcomes are driven by costs, why do we spend 100% of our time trying to fix that problem. [tail wagging the dog] [It’s the same point on adherence.]

- There are 45M sick days per year from 5 conditions – hypertension, heart disease, diabetes, depression, and asthma.

- Have to look at clinical efficacy and elasticity of demand.

- Commitment, concern, and cost.

- Five components – plan design, program, community, communication, and provider engagement.

- Need a multi-faceted approach to create a culture of health.

- MDs much more likely to talk about pros than cons.

- There would be 25% less invasive procedures if patients fully understood the risks.

- Foundation of Informed Decision Making

- Huge gaps in patient view versus physician views around breast cancer.

- Preference-sensitive care

- Dartmouth Atlas

- Genomics tells you the probability of being on a disease curve, but not where you are in the potential severity.

- Only 60-70% of women get at least one mammogram their entire life.

-

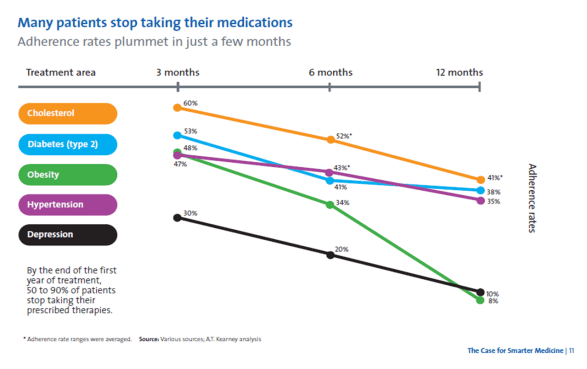

Statin study – barriers to adherence:

- 37% didn’t know to stay on the Rx

- 27% side effects

- 15% convenience

- 15% MD instructions

- 11% cost

- In healthcare, we’re all taught to speak a language that no one else understands.

- It takes a village.

- Challenge – Use communications to cure cancer.

- Collaboration. Innovation. Evaluation.

- Adherence is a great example of where everyone’s interests are aligned.

- There is no magic bullet for adherence.

- You need a multi-factorial approach to address adherence…Physicians are rather ineffective at addressing adherence.

- Evidence-based plan design works to impact adherence (although I think another speaker said no).

-

You have to think about operant conditioning. (Look at dog training manuals and kid training manuals – very similar)

- My example here is using clicker training for humans.

- Think about all the failure points in the process.

- What is the relative value to the patient.

- Reward system has to reward at the failure points not just at the end of the process.

- Using a point system successfully increased the use of a select (on-site) pharmacy by 57% at one employer.

- 75% of PBM profits are from dispensing generics…that’s why Wal-Mart was able to be a threat to the industry.

- Drugs only work in 20-80% of people.

- There are people with a gene that doesn’t break down caffeine.

- 3% of people are ultrafast metabolizers of codeine (which turns to morpheine in the body)…that can be a problem.

- Epigenetics – turning DNA switches on and off.

“Tweets”

Rebecca from ProjectHEALTH closes #results2010 with a remarkable talk on this crucial program; they work with 5,000 families/year.

Reid Kielo, UnitedHealth: 93% of members validated ethnicity data for HEDIS-related program using automated telephony #results2010

25% of Medco pt take a drug with pharmacogenetic considerations. Robert Epstein, CMO Medco #results2010

Bruce Fried: the “California model” of physician groups facilitate efficiencies that improve delivery; an oppty for M’care #results2010

Bruce Fried on Medicare: 5 star ratings have strategic econ. importance, med. mgt. and cust serv. key #results2010

Fred Karutz: members who leave health plans have MLRs 2 standard deviations below the population. #results2010

Fred Karutz: Market reform survival – retain the young and healthy #results2010

Poly-pharmacy has negative impact on adherence. #cvscaremark

#results20101 in 3 boys and 2 in 5 girls born today will develop diabetes in their life. SCARY! #results2010

20% of all HC costs associated with diabetes. #results2010. What are you doing to manage that?

Messages to prevent discontinuation of medication therapy far more effective than messages after discontinuation. CVS #results2010

25-30% of people who start on a statin don’t ever refill. #CVSCaremark

#results2010Maintenace of optimal conditions for respiratory patients increased 23.4% with evidence-based plan design. Julie Slezak, CVS. #results2010

Value-based benefits help control for cost sensitivity for medications; every 10% increase in cost = 2% – 6% reduction on use. #results2010

Pharmacists who inform patients at the point of dispensing are highly influental in improving adherence. William Shrank #results2010

The game of telephone tag in HC is broken. Pt – MD communications. #results2010

37% of Pts were nonadherent because they didn’t know they were supposed to keep filling Rx. #results2010

Last mile: 12% of Americans are truly health-literate; they can sufficiently understand health information and take action. #results2010

Only 12% of people can take and use info shared with them. #healthliteracy

#results2010

#DrJanBerger.We need to improve the last mile in healthcare… clear, effective conmunication. Jan Berger #results2010

#McClellan used paying drug or device manu based on outcomes as example of “accountable care”. #results2010

72% of those with BMI>30 believe their health is good to excellent; as do 67% of those w/ chronic condition. #McKinsey

#results2010Are incentive systems more likely to reward those that would have taken health actions anyways (i.e., waste)? #McKinsey

#results2010

Only 36% of boomers rate their health as good to excellent. #results2010

27% of people believe foods / beverages can be used in place of prescriptions. #NaturalMarketingInstitute

#results2010Why do we spend so much time on impacting health outcomes thru the system when that only explains 10%. #Dr.JackMahoney #results2010

Using auto calls vs letters led to 12% less surgeries & 16% lower PMPM costs in study for back pain. #Wennberg

#HealthDialog

#results2010MDs are much more likely to discuss pros with patients than cons. #Wennberg

#HealthDialog

#results2010Should physicians be rewarded as much for not doing surgery? How do economics influence care decisions? #results2010

Physicians were 3x as concerned with aesthetics than breast cancer patients in DECISIONS study. #results2010

Fully-informed patients are more risk-averse; 25% fewer of informed pts in Ontario choose angioplasty. #results2010

Patients trust physicians over any other source (media, social connections) but only receive 50% of key knowledge. #results2010

Informing Patients, Improving Care. 90% of adults 45 or older initiate discussions about medication for high BP or cholesterol. #results2010

What is #results2010? #Silverlink client event.

#results2010 – #Aetna Medicare hypertension program leads to 18% moved from out of control to in control using auto calls (#Silverlink) …

About 2 of 3 medicare pts have hypertension. #results2010

John Mahoney describes how he connects payors, providers, and care via research. #results2010

As information becomes commoditized in healthcare, sustainability enters the vernacular. #results2010

Segmentation innovations of today will be tomorrow’s commodities. Measurement and learning must be “last mile” IDC insights #results2010

Plans are strategically investing in bus. intel to reach wide population for wellness, not just the low-hanging fruit. #results2010

The single most significant future market success factor is measurable results. Janice Young, IDC Insights. #results2010

Knowing our attendees’ preferences could have fueled segmented, precise invitations to #results2010. Dennis Callahan from Nielsen Media.

Drivers of those sereking alternative therapies: stress, lack of sleep and energy, anxiety, inflammation. #results2010

Only 2% of people don’t believe it’s important to lead a healthy lifestyle. Their behavior could’ve fooled me. #results2010

Are purity and simplicity the new consumption? Steve French of Natural Marketing Institute explores. #results2010

Gen Y is the most stressed out generation. #results2010

Less is more. 54% say having fewer material possessions is more satisfying. Natural Mktg Institute #results2010

Loyalty is a result of a cumulative set of experiences. Individual intervention ROI is sometimes difficult. #results2010

Sundiatu Dixon-Fyle of McKinsey; understand how beliefs shape an individual’s ability to change behavior. #results2010

Don Kemper: each of 300M HC decisions made each year need to be informed. #silverlink

#results2010Medicare Part D: 40% lower cost than projected, seniors covered through tiered coverage powered by communication. #silverlink

#results2010Mark McClellan: Brookings is engaging private insurers to pool data to understand quality of care. #silverlink

#results2010Mark McClellan at RESULTS2010; bend the curves, provide quality care efficiently. HC reform >> insurance reform. #silverlink

#results2010

May 28, 2010

May 28, 2010