This is a phrase you have probably heard several times this election period. Somedays I think the same thing when I get 5-6 a day mostly from the Obama campaign. It reminds me of some education I do with a lot of companies on the technology evolution around outbound calling. Let me hit a few key points here.

First, everyone across industries is trying to figure out how to improve their access to customers (members). How do they keep them up to date with relevant information in a timely, efficient, and effective manner. Direct mail is a dying strategy. E-mail is good sometimes, but you can’t push sensitive health information out via e-mail. Text messaging has a role, but it’s not relevant for everyone. So, automated calling has become a first-line solution rather than using call center representatives which are expensive (or more often as a complement to the call center representative making them more efficient).

Historically, call center representatives would “smile and dial” just trying to catch someone at home. You might get lucky, but in most cases, you call 5-10 times just to get a person on the phone to talk with. It’s not a good use of resources and time.

The next evolution was the dialer technology which calls out to people and once it hears a voice, it transfers the respondent to a call center agent. But, the voice could be an answering machine in some cases or in many cases it might not be the right person. These are the annoying calls you get where there is a delay after you say hello and before the person at the other end responds. The technology is searching for an agent that’s not on the phone to connect you with.

People realized that using agents to call out wasn’t always necessary so they moved to “blast” or “robo-calls”. These are non-intelligent calls that simply push a message out to someone. As soon as you say hello, they start playing a recorded message and likely repeat it at the end in case it’s an answering machine they are “talking” to. There is no interaction and no personalization.

But, that technology too has evolved. You can now place highly personalized and interactive calls that leverage speech recognition technology. The calls use your name and ask you to confirm that they are speaking with the right person. The calls use the name of the company calling and potentially your employer. The calls can also provide personalized information such as the drug you are taking or the health condition you have. The voice is a recorded voice not a text-to-speech (TTS) solution.

The calls respond differently based on how you answer certain questions – i.e., different paths are dynamically generated. And, the calls start to interact with other modes of communication – would you like to transfer to an agent to talk further?, would you like a copy of this offer sent to you in a letter or e-mail?, would you like a reminder sent to you as a text message?, or would you like us to fax your physician to get a new prescription for you?

The technology focuses on the interaction with the consumer and making it a pleasant experience. In healthcare, people respond to this technology because of several factors:

- It’s highly personalized to them.

- It’s coming from a company they trust – their health insurer or pharmacy.

- It’s interactive and conversational.

- It’s important information – refill reminder, savings information, benefit change.

- They have to authenticate themselves in order to receive sensitive information.

- It adapts to them (e.g., please call me for future calls in the morning).

- It offers them an opportunity to talk to an agent by transferring.

Now, I would say most companies are evolving from individual campaigns using different modes of communication (letter vs. calls) to an integrated communication strategy which has common messaging and is based on consumer preferences. This approach allows for even better results and continues to drive personalization and customization based on historical learning and experiences with the individual.

But, mass customization does require technology and analysis. Pulling in different data elements and looking at how to best deliver a message and get someone to listen and take action is complex work. But, it’s a lot of fun watching success and outcomes improve as you move across the continuum.

March 3, 2009

March 3, 2009

Managed Care 5-Year Stock Chart

Managed Care 5-Year Stock Chart [As I have disclosed before, I do not hold any individual stocks.]

[As I have disclosed before, I do not hold any individual stocks.]

Imagine that every year for open enrollment you would simply create a file of all your claims from the prior 12 months and upload them at some website “TestMyHealthInsurance.com”. That website would show your employer sponsored options along with individual insurance options and show you what your total out of pocket costs would be under each scenario (assuming the same claims).

Imagine that every year for open enrollment you would simply create a file of all your claims from the prior 12 months and upload them at some website “TestMyHealthInsurance.com”. That website would show your employer sponsored options along with individual insurance options and show you what your total out of pocket costs would be under each scenario (assuming the same claims).

You can go to their website

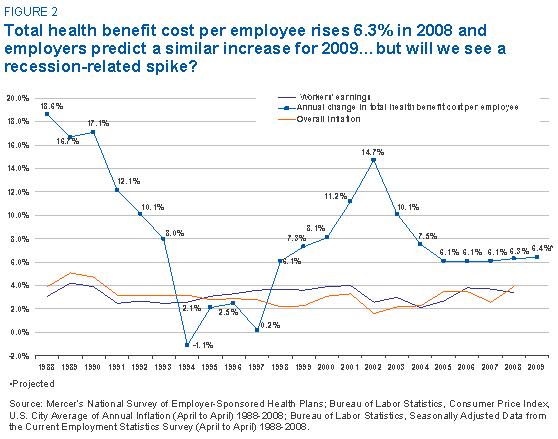

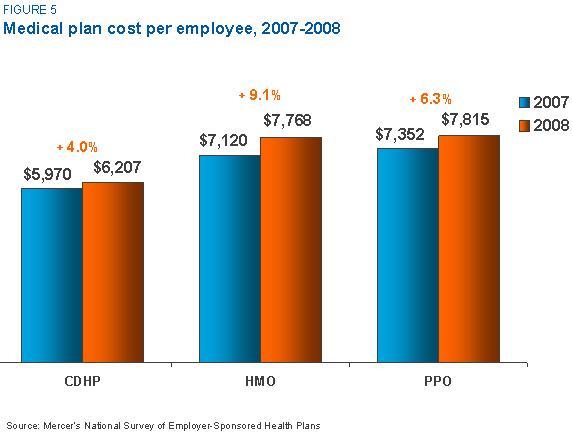

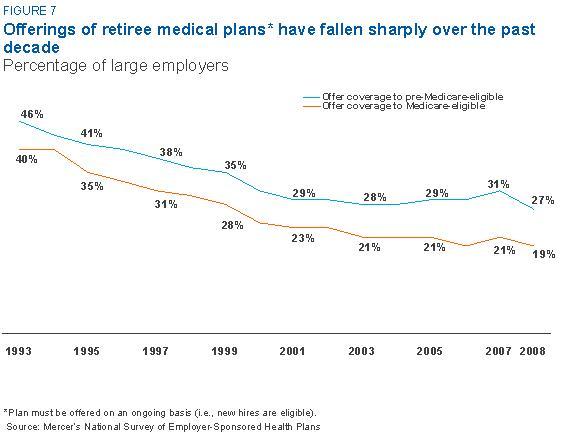

You can go to their website  The big changes they felt were bound to happen were cuts in Medicare and an expansion of the SCHIP program, and there were others that they said would be debated including being able to sell insurance across state lines, the government offering coverage, individual coverage mandates and coverage for pre-existing conditions. But the biggest part of the discussion was around healthcare costs. Costs that are out of control, who pays for services, and where will the money come from. While at an aggregate level talking about healthcare’s spiraling costs is simple, it is not the heart of the issue.

The big changes they felt were bound to happen were cuts in Medicare and an expansion of the SCHIP program, and there were others that they said would be debated including being able to sell insurance across state lines, the government offering coverage, individual coverage mandates and coverage for pre-existing conditions. But the biggest part of the discussion was around healthcare costs. Costs that are out of control, who pays for services, and where will the money come from. While at an aggregate level talking about healthcare’s spiraling costs is simple, it is not the heart of the issue.