Good deck that I found on Slideshare.net.

What’s A PAM Score?

PAMTM is the Patient Activation Measure which was developed by Dr. Hibbard, Dr. Bill Mahoney, and colleagues. It helps you gauge how much people feel in charge of their healthcare. To find out more, you can go to InsigniaHealth’s website.

Given the focus on health engagement across the industry these days, I think this is an important tool to consider. It’s been used broadly and has been validated in a lot of published studies. The questions lead people to be assigned to one of four different activation levels.

You can collect and use the PAM score for segmentation, developing customized messaging, measuring program success, and/or identifying at risk populations.

A few other interesting points from one of their FAQ documents were:

- Patients who are more activated are more likely to adopt positive behaviors regardless of plan design.

- People with higher activation levels are more likely to choose consumer directed plans.

- People with low activation often feel overwhelmed with the task of taking care of themselves.

- You increase the level of success in by breaking down change into smaller steps where the consumer has a greater likelihood of success.

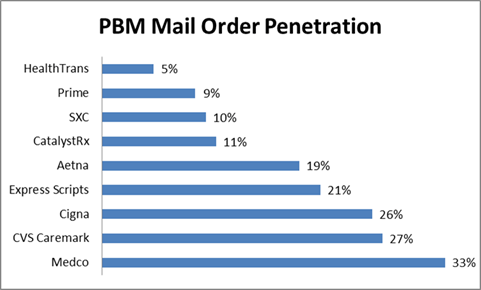

Which PBMs Have The Highest Mail Order Penetration?

I was looking at some data from earlier this year (Q1 – 2011) from the AIS quarterly survey of PBMs. I thought this was a nice summary of mail order penetration by PBM. As you can see, it identifies some areas of opportunity:

- Will Express Scripts’ mail penetration go up with the potential acquisition of Medco? Or, will Medco’s go down?

- Will anyone be able to match the Medco mail penetration?

- Will Aetna’s mail penetration go up to the CVS Caremark penetration rate?

- How will Prime Therapeutics, SXC, and CatalystRx increase their mail penetration?

Overall, the mail penetration of the industry has dropped to 16.3% which is the lowest it’s been since 2004 when it was 12.9% (according to AIS). [Note: These are based on adjusted Rxs.]

Reprint: Getting Aligned For Consumer Engagement

(This just appeared in the publication by Frost & Sullivan and McKesson called “Mastering the Art and Science of Patient Adherence“. It was written by me so I’m sharing it here also for those of you that don’t get that publication.)

According to the 15th Annual NBGH/Towers Watson Health Survey, employees’ poor health habits are the number one issue for maintaining affordable benefits. Since studies have shown that 50-to-70 percent of healthcare costs are attributed to consumer choices and adherence is one of those issues, the topic of how to engage consumers isn’t going away.

The challenge is getting the healthcare industry to use analytics and technology tools when engaging the consumer in a way that works for each individual and builds on their proven success in other industries. Healthcare has an enormous amount of consumer data ranging from demographics to claims and behavior data. Consequently, there is great opportunity to use this data to engage consumers in their health to improve clinical outcomes. While on the one hand, it’s like motivating consumers to buy a good, the reality is that healthcare is both personal and local which complicates the standard segmentation models.

This is a dynamic time where people are experimenting with different strategies for engagement. For instance, in medication adherence, people are trying everything from teaming those who have chronic conditions with community pharmacists to make sure they are taking their medications correctly to technology that monitors when the pill actually enters your body. But, there are still fundamental gaps in the process which can be addressed using interactive technology to complement the pharmacist interventions.

Consumer engagement in healthcare is increasingly moving to new channels with 59 percent of adults in the U.S. looking for health information online and 9 percent using mobile health applications according to Pew Research Center. Additionally, there is more and more participation in social media or peer-to-peer healthcare applications. Modes like SMS, which companies are starting to leverage in programs like Text4Baby or the diabetes reminder program recently launched by Aetna, are gaining popularity. Companies like Walgreens have also begun exploring the use of SMS and Quick Response (QR) codes for medication refills.

At the end of the day, consumers want preference-based marketing where they can elect how to best engage them, but that doesn’t mean that’s the most likely channel to get them to take action.They want you to learn from their past responses to improve your future outreach, but they are also skeptic about how their data is used. You have to put yourself in their shoes to create the optimal consumer experience. You have to deliver the right message to the right consumer at the right time using the right sequence and combination of channels.This is not easy.

So, if you’re going to optimize your resources and build the best consumer experience, you need an approach which is dynamic and personalizes each experience. For example, we found that creating the right sequence and timing around direct mail and automated calls improved results by as much as 100 percent in a pharmacy program. Or, in another case, at Silverlink Communications, we found that using a male voice in an automated call to Latinos got an 89 percent better engagement rate around colonoscopies. We also know that using a peer pressure message does not work in motivating seniors to take action in both a retail-to-mail program and a cancer screening program, but does work for those younger than 55-years-old?

You have to make simple messaging relevant to them—why should I get a vaccination, why is medication adherence important, how can you address my barriers? Only an ongoing test and learn approach to consumer insights will suffice, and those that figure this out will become critical in the ongoing fight for mindshare and trust. But, this isn’t a stand-alone opportunity. We have to partner with providers to improve engagement, adherence, and ultimately outcomes in different forms. We have to offer them a platform for engagement that is built upon consumer insights and provides a unique consumer experience to them based on their disease, their demographic attributes, and their plan design. All of these factor into their behavior and are important in “nudging” them towards healthcare engagement and ultimately, better health.

“Code Lavender” – Focusing On The Patient Experience

If you don’t know it yet, the consumer “experience” is rapidly becoming the hot topic. I’ve talked about it a lot beginning with companies like Cigna that have hired and staffed a consumer experience team and Chief Experience Officer. But, as the WSJ pointed out earlier this week in their article “A Financial Incentive For A Better Bedside Manner“, this is getting quantified in the provider world. One might argue that experience has always mattered more in the provider world since it’s easier to switch hospitals or physicians than insurance companies, but that is likely to continue to change as the individual insurance world and Medicare continue to create competition for the individual.

For payers, you can already see this individual market playing out with the growth of retail stores which is where the experience begins. In other cases, the PBMs and payers have to rely on many cases on their call centers as the front-end of the consumer experience. Additionally, with pharmacy being the most used benefit, this is another critical area. And, we know that pharmacy satisfaction is highly correlated with overall payer satisfaction.

But, let me pull a few things that caught my attention in the WSJ article:

Cleveland Clinic Chief Executive Delos “Toby” Cosgrove, a heart surgeon by training, says he had an epiphany several years ago at a Harvard Business School seminar, where a young woman raised her hand and told him that despite the clinic’s stellar medical reputation, her grandfather had chosen to go elsewhere for surgery because “we heard you don’t have empathy.”

-

The Cleveland Clinic calls their program HEART—for hear the concern, empathize, apologize, respond and thank. They also use the term “Code Lavender” for patients or family members who need immediate comfort.

I look forward to watching how this transforms over time. I know I’ve seen this play out in the dentist’s offices for my kids. The waiting rooms have video games and other things to keep them and their siblings busy, but I do agree with the article that this may unfairly bias the wealthier hospitals.

Highlights From the Takeda / PBMI 2011-2012 Prescription Drug Report

PBMI puts this out each year with funding support from Takeda. It is another one of those great annual reports full of lots of trend data for you to digest. Let me pull out a few of the things that stood out to me, but I recommend you read the entire thing yourself:

- Use of 4-tier plans grew by 25% in 2011.

- Specialty copays increased by 37% (to $84).

- Plans continue to offer 90-day mail at a lower copay multiple than 90-day retail.

- Nearly 60% of plans allow 90-day retail prescriptions. [Wow! This was a shocker to me.]

- 30% of respondents require specialty medications to be filled by their PBM. [Which seemed low to me.]

- Only 5% of respondents said they give their PBM responsibility for plan design.

- 18% of plans have mandatory mail (although the statistic is 26% for respondents who have pharmacy provided as a carve-out).

- 21% of plans have a limited retail network.

- 36% of plans have copay waivers.

- 7% of plans cover some form of genetic testing.

- In general, there was an equal view of all the forces impacting benefit plans.

- 64% of plans are focusing on member education to help them control costs. [exactly what we do at Silverlink everyday!]

Here’s a key chart on average copays for 3-tier plan designs.

Another summary they show from some external research is below:

Adam Fein recently pointed this out, but the use of MAC pricing at mail is pitifully low at 18% versus 42% for 30-day retail. (More from Adam on the report.)

I’m always interested in the overall use of programs by plans which is summarized here. Interestingly, there were three areas which carve-in did much less than carve-out – outbound phone calls, retro DUR, and therapeutic substitution.

They also include a summary of several research studies on adherence with a quote from me:

“In working with healthcare companies around adherence, our focus is always on how to best use data and technology to personalize interventions in a scalable way,” said George Van Antwerp, 2011-2012 Prescription Drug Benefit Cost and Plan Design Report Advisory Board member. “Medication adherence is a multi-faceted issue. While there is no silver bullet, technology can help deliver different messages to consumers based on the complexity of their condition, specific medications, and their plan design (for example). But, while technology can provide the initial nudge, the care team has to work together to address health literacy and build an understanding of the condition, the medication, and value of adherence.”

Another data point that I often use from here is the average number of Rxs PMPM:

Three Pillars of Adherence (NEHI)

I was digging through some adherence materials, and I stopped on the NEHI graphic from their report “Thinking Outside The Pillbox” which first quantified the impact of non-adherence at $290B (a number which everyone uses now).

I don’t remember every posting it on the blog so I’m sharing it now. I think it hits on the key topics that we all talk about:

- We have to get it right from the beginning with the drug regiment.

- Cost can be an issue so if possible address it.

- But, the biggest issues are with understanding (literacy), side effects, creating a habit, and many other things that require education and ongoing intervention and support for the patient.

[Note: NEHI has now releasesdd their roadmap on Medication Adherence which I’ll review in a subsequent post.]

Why Don’t Physicians Use More Information Therapy

My PCP is very good about giving me information to read every time I visit him. (Never mind that it sits in a pile on my desk.) But, I believe this is under-utilized in today’s information rich society.

I was reading an article this morning from PharmaVOICE about physicians not using certain medications or treatments because they didn’t have the time to spend with patients explaining them. Therefore, they default to the “easier” solution which requires less explaining. Is this prevalent? I don’t know.

The article talked about a survey from Sermo and Aetna Health which revealed that almost 2/3rds of the 1,000 MDs surveyed felt that “the current health care environment is detrimental to the delivery of care”. And, less than 1/5th felt that “they could make clinical decisions based on the what was best for the patient, rather than on what the payers are willing to cover”. Pretty scary and sad.

Imagine if the physician was using an electronic interface during the encounter. They could pre-create several information packets around certain diseases, drugs, and/or treatments. When the patient was diagnosed and a treatment plan agreed to, they could e-mail the package to the patient. It might include written information, links to websites, YouTube videos, or other assets. I would imagine this could be very powerful and address the common gaps that exist between what the physician says and the patient hears.

[The article was “Is the Business of Health Care Getting in the Way of Providing Good Health Care? by Ken Ribotsky in PharmaVOICE from October 2011.]

Predicting Medication Adherence

Is there a secret sauce? (Hint: past behavior)

It always important to be skeptical, but there are certainly attributes like the number of Rxs, gender, condition, copay amount, and other factors that contribute to the likelihood of a consumer being adherent.

But, one of the big discussions is around how to use other variables. FICO, the company that creates credit scores, has created an adherence score. In today’s WSJ, they shared this image about predicting adherence. Interesting…

What’s The Average Prescription Copay? (AIS Survey)

AIS conducts a quarterly survey on behalf of Drug Benefit News. For the second quarter of 2011, the average copays were:

- 1st Tier – $10.28

- 2nd Tier – $26.66

- 3rd Tier – $44.65

Will The Stars Align To Drive Adherence?

We all know that adherence to prescriptions is a problem. People don’t start on their medications. People don’t stay on their medications. But, another problem also exists which is finding the ROI on adherence. While the ROI is clear to the manufacturer or even to the pharmacy, it’s often less clear to the payer.

This is not true in every category. Diabetes and several other conditions have been shown to have an ROI associated with intervention programs that improve adherence. But what about all the others.

In the short-term, I expect you’ll see the CMS Star Ratings and bonus payments drive behavior in three critical categories that are now measured in the 2012 for MAPD and PDP plans. (see technical notes on 2012 measures)

If you’re not familiar with the Star Ratings system, you should read this. In 2012, there were three new adherence measures added. Not only are they now part of the evaluation process, but they were weighted more heavily than some of the operational measures. A good indication of focus on quality of care.

Getting more Stars is important since it is linked to bonus dollars that the plans can get. And, there aren’t many Five Star Plans. Only 9 plans received 5-Star Ratings for 2012 (see article). [Interestingly, I think one of the unique assets that Express Scripts is buying in the proposed Medco acquisition is one of the 4 Five-Star PDP plans.]

“The Medicare star quality rating system encourages health plans to improve care and service, leading to better patient experiences across the board,” Jed Weissberg, a senior vice president at Kaiser Permanente. (from 5-star article above)

The adherence measures focus on diabetes, high cholesterol, and hypertension and use Proportion of Days Covered (PDC) rather than MPR for their measurement. Certainly, one of the things we’re seeing at Silverlink with our Star Power program is that many of these Star Measures can be influenced by communications. Adherence is certainly one of those big areas of opportunity for plans to focus on.

While the benefit is obvious to the plan in terms of reimbursement, the big question is whether consumers care about Star Ratings or just focus on lowest price point and access to pharmacies or specific medications. A Kaiser study that was done seems to indicate that the answer is no.

Conducted by Harris Interactive, the survey showed that only 18 percent of Medicare-eligible seniors said that they are familiar with the government’s rating system. Of those that are familiar, less than one-third have used the system to select their health plan. Moreover, only 2 percent of respondents were aware of how their current plans rates.

Since we’re in open enrollment for Medicare right now (see Medicare.gov to evaluate options), perhaps we’ll get some data in early 2012. 2012 will also be the first year for the 5-Star plans to be able to market all year round and not be limited to the OEP (open enrollment period).

But, one of the things I found interesting as I looked on the Medicare.gov site to “select” a plan in my area is that there is an option to “Select Plan Ratings” but even I wasn’t sure what that was. It’s not intuitive to the consumer that this is a quality rating for them to pay attention to. And, it appears that the default order of options which is presented to you is based on price.

Infographic: Word Of Mouth Advertising

As healthcare moves toward a more retail model, word of mouth advertising becomes more important. This is already true in terms of physician’s influence on prescription use or in some cases distribution location. It’s also important from a Medicare perspective. But, this will continue to increase in importance in the future with health reform.

I also believe that clients will require satisfaction scores as part of their SLAs (service level agreements) in many cases in the future and/or tie bonus dollars to this. Will you be prepared? Do you understand your customers’ satisfaction with you? Do you know how to impact it?

Using Hypothetical Questions To Influence Decisions

Most people don’t realize how questions can be persuasive, according to new research from the University of Alberta. Hypothetical questions usually start with the word “if,” meaning the information may or may not be true. Our brains process that information like the “if” isn’t even there, says study author Sarah Moore, Ph.D., a marketing professor at Alberta’s School of Business. “As a result, people accept the data you present at the beginning of a question as fact,” Moore says.

This is from an article in Men’s Health. It made me think about lots of ways that hypotheticals could be used to drive consumer behavior in healthcare:

- If you were able to avoid having your kids home with the flu shot this year, would you take them to get a flu shot?

- If you were able to save $50,000 in healthcare costs over your lifetime, would you make sure to take your medications everyday?

- If you were able to spend more time with your family rather than waiting in line at the pharmacy, would you be more likely to use 90-day prescriptions?

- If you didn’t have to take any sick days next year, would you go in for your annual physical exam?

- If you decreased your likelihood of losing your foot to amputation due to diabetes, would you go get a foot exam every year?

This fits well with a lot of the behavioral economics frameworks that companies are using today.

Diabetes And Medicare Star Ratings

Do you know what the Medicare Star Ratings are? If not, you might want to review the Kaiser Family Foundation brief from last year.

Basically, the star ratings provide individuals with a quality rating across numerous dimension on a Medicare plan. And, they are helping to drive the pay-for-performance (P4P) focus across healthcare. This year’s changes include several adherence metrics and have brought the total diabetes measures up to 7. And, if you happen to be one of the few 5-star Medicare plans, you will be able to have open enrollment all year not simply during the AEP period from 10/15-12/7.

Here’s a quick summary of the seven (lots of opportunities to work with communications to improve ratings and outcomes):

| Measure | Summary |

| Cholesterol Screening | Percentage of diabetics with an LDL test |

| Eye Exam | Percentage of diabetics with an eye exam |

| Kidney Disease Monitoring | Percentage of diabetics with a kidney function test |

| Blood Sugar Controlled | Percentage of diabetics with an A1c test showing their blood sugar under control |

| Cholesterol Controlled | Percentage of diabetics with an acceptable LDL value in their cholesterol test |

| Treatment | Percentage of diabetics with both a diabetic medication and a hypertension medication that are getting an ACEI or an ARB |

| Adherence to Oral Rxs | An average Proportion of Days Covered (PDC) greater than 80% |

We all know the statistics on diabetes so hopefully this will help to improve outcomes. If you’re interested in how Silverlink helps plans with Star Ratings – go here.

Words Matter: Doodling – We Should Foster It

As someone who was trained as an architect, I understand the value of sketches in the design process and have always “doodled” as I try to conceptualize what people are describing with words. With that in mind, I really enjoyed this TED video and think it’s a good message for all of us in the communications field.

Pharmacy Adherence (Waste) And The Need for MD-RPh Collaboration

I spent the day today at the NEHI adherence event in DC. I pulled out a few of my takeaways below, but while I was riding on the plane to get here, a few things were running thru my head:

- The focus on budget and the estimates that adherence costs us $290B a year here in the US. (or as one person pointed out that’s $1.2T in a presidential term)

- The recent report estimating that chronic conditions could cost us $47T worldwide over the 20 years which is leading to the UN talking about healthcare for only the second time ever.

- The discussion by George Paz from Express Scripts the other day about how PBMs drive value by eliminating waste (see Drug Trend Report). A large piece of waste is adherence and certainly one of the forecasted benefits of the combined Express Scipts and Medco entity is the intersection of Consumerology with the Therapeutic Resource Centers (TRCs).

- The ongoing dialogue around motivational interviewing, commercial MTM, and blending face to face interventions with technology to “nudge” behaviors.

- The huge opportunity which I believe exists in leveraging technologies like Surescripts to create data exchanges with physicians around MPR and barriers.

- The exciting fact that the new STAR measures for Medicare include more adherence metrics that are weighed more heavily than some of the operational metrics.

Fortunately, these were a lot of the topics that were discussed. Here some of the discussion topics:

- The fact that there’s no “easy button” for adherence.

- How adherence is a foundational building block for quality.

- The role of HIT in sharing data bi-directionally across the care team.

- Upcoming evidence around VBID.

- The role of the pharmacist and need for them to collaborate more with the physician to discuss and manage adherence.

- The fact that the adherence solution has to be multi-factorial.

- The need to optimize the drug regiment and individualize care (aka patient-centered care).

- The role of the caregiver.

- Opportunities around PCMH, readmissions, MTM, and eRx.

- The need for patient engagement.

- The need for the patient to believe in the therapy and that it will make them better.

- Good discussion on the role of the PCMH (patient-centered medical home) versus the pharmacy as the foundation for adherence.

- Discussion on whether physicians could address adherence if time wasn’t an issue. Do they have the training and skills?

- Social media as an emerging factor.

- Reaching the consumer when they have time and are receptive to information.

- Helping prepare the consumer for the encounter (i.e., checklist or list of questions).

- What happens when the patient waits in line and then is rushed themselves in the encounter.

- The role of technology in complementing the physician and patient.

- How to share data across team members.

- The need for ROI data on interventions.

- The value of having a Dx on the Rx.

- The need to vary incentives and not keep doing the same thing.

- If prevention is long-term and adherence is short-term, should the physician focus more on adherence and less on screening and other preventative measures.

- The need for – sufficient accountability, information, and skills.

- Adherence as a solution that needs to be localized.

- Patient centered or disease centered solutions.

- The governments role in improving adherence via policy and funding demonstration projects through CMS.

- STAR ratings and the bonus payments as an incentive to motivate research and programs in this area.

Overall, it was a good discussion with a very engaged panel and audience. We didn’t come to any answers, but you certainly got to think about the topic, identify some projects that should be done, and identify some research questions.

I look forward to pulling out a few of the topics in more depth. They align well with the communications platform and intervention strategies that Silverlink provides for our clients around adherence.

Flu Shots: Stock It And They Will Come?

This is the hot topic. Everyone wants you to get a flu shot because it’s good for your health and a profit making opportunity.

- The CDC recommends flu shots for everyone over 6 months of age.

- Pharmacies have big expectations about volume but “unfortunately” (from the perspective of nudging people to act) the disease does not seem to be too prevalent yet.

According to the CDC (and thanks to Larry Marsh’s team at Barclays Capital for sending out in their Flu Clues report):

We highlight that 0.8% of patient visits to physicians were due to flu-like illness, which is down 20bps from last week’s data. We note that this is well below the peak of 8.0% in early 2010. The 0.8% rate is below the national baseline average of 2.5%. Next we note that 6.0% of all reported deaths were due to pneumonia and the flu, 10 bps below last week, and below the epidemic threshold of 6.4% for week 37.

Traditionally, only about 40% of US adults will get a flu shot meaning there’s lots of opportunity for growth in vaccinations. Tim Martin from the WSJ has talked about this in a few recent articles – Flu Shots Are A tough Sell This Year and People Have Big Plans For Flu Shots. In the second article, he quotes a recent survey showing almost 2/3rds of adults plan to get the shot this year. BUT WHY? (other than the fact that those who respond to survey’s around flu shots may be more likely to take action)

You can also look at the Google flu trends data (again thanks to Larry Marsh and team for pointing this out) which shows online searches down for flu topics:

Like last year, the number of locations for getting a flu shot has expanded exponentially driven predominantly by pharmacies (which BTW is a good thing for them in demonstrating additional value). You’re even seeing some creative programs building on last year’s programs. One new one I’ve seen is Walgreens use of Foursquare for donating flu shots.

Of course, if we can’t convince healthcare workers to get flu shots then it’s going to be really hard to convince the average consumer.

I would expect MA plans to work with their PDP provider or pharmacy partner to drive members to get flu shots. Since flu shots are a STAR measure, it’s important for plans to reach out and get consumers to get a flu shot.

But why should I get a flu shot if my likelihood of getting the flu is down? That is the question.

That’s why I’m skeptical about some of the “generic” marketing efforts. I think everyone knows that they “should” get a flu shot and now finding a location for one is easy. BUT, we need to make it relevant to them especially those of us in healthcare. Ideally, their pharmacist and physician are talking to them about it, but if not, how do “we” (as healthcare companies) engage them.

We have to make the “pitch” relevant to them. For families, make them understand the importance of keeping the family healthy and their kids in school. For pregnant moms, help them understand that it’s important and why. For people who work, stress the importance of not missing work. For people with chronic conditions, focus on their additional risk. For the elderly, explain the risks to them.

A recent Walgreens study quantified some of the costs of the flu:

A new Walgreens survey examining the effects of influenza on people’s everyday lives and the economy, suggests that last flu season resulted in 100 million lost works days, along with nearly $7 billion in lost wages and 32 million missed school days, among many other findings released today. These findings, the first of a two-part Walgreens Flu Impact Report series, underscore the ramifications the flu and ill-timed illness can have beyond people’s health – from missed work and lost income to parenting challenges.

According to the Centers for Disease Control and Prevention (CDC), on average 13 percent of the U.S. population gets the flu every year, with active flu seasons seeing closer to 20 percent, or more than 62 million Americans.

Is Your Adherence Program Leveraging Segmentation?

I was just finalizing a new marketing piece with our marketing team on Silverlink’s adherence services. I love this picture because it drives home the point of understanding the consumer.

If you don’t understand the factors that drive behavior and leverage those attributes in segmentation and personalization of your adherence program, you may be leaving opportunities on the table.

State By State Use of Rxs per Capita, Age, and Gender

(Note: This is retail only data so it’s not comprehensive, but it should be directionally accurate.)

The Kaiser Family Foundation puts out lots of data. One of their sites shows state by state analysis. Here is a map of utilization by state.

As you can see on the site, the top 5 states are (i.e., highest utilizers of prescription drugs):

- WV

- KY

- AL

- TN

- MS

The bottom 5 are:

- AK

- CO

- UT

- NM

- WA

For age breakdown, the data showed:

- 0-18 = 3.8 average Rxs

- 19-64 = 11.3

- 65+ = 31.1

For gender, the averages were 9.5 Rxs for males and 14.4 Rxs for females.

Note: All this data is available online at http://www.statehealthfacts.org/.

Primary Adherence – Technology, Kaiser Study, and EHRs

I think we all know that primary adherence is a real issue. Depending on what you read, you see that anywhere from 20-30% (or more) of patients don’t start therapy. They are prescribed a drug, but they never fill it. This is due to lots of reasons:

- They get a sample.

- The drug costs too much leading to abandonment.

- They don’t feel like they need the prescription.

- They feel better.

- The doctor tells them only to fill it if something else doesn’t work.

These issues vary based on whether it’s an acute drug or a maintenance drug. It also varys by drug class.

I’ve always been surprised that pharmaceutical manufacturers focus so much on ongoing refills leading to improved MPR rather than focusing on primary adherence which would grow their market significantly. One of the big reasons for this has been visibility. Without electronic prescriptions and mapping those to claims data, it was hard to identify who had a prescription and didn’t fill it. You could do something with data out of the PPMS (Physician Practice Management System) or through more complicated processes to get data out of their notes, but it wasn’t easy.

So, this new study by Kaiser caught my attention.

If you are a diabetic, have high cholesterol, or high blood pressure and you receive medical care at an integrated healthcare system that has electronic health records (EHRs) linked to its own pharmacy, then you are more likely to collect your new prescriptions than people who receive care in a non-integrated system, a Kaiser Permanente study shows.

That’s a strong sell for an integrated model, but perhaps more realistically for the use of EHRs. You can also see some of the data from Surescripts around this topic of electronic prescriptions and adherence.

This creates a great opportunity for pharmacies, PBMs, payers, and pharmaceutical manufacturers to leverage technology to improve primary adherence. By identifying people who don’t fill a prescription they receive, companies can help determine which of those are intentional and which of those should be addressed. This should help address the overall costs attributed to non-adherence and be a business driver for all these entities.

[Note: If you’re interested in working on primary adherence, let me know. We have several approaches for this at Silverlink.]

Highlights From the Prime Therapeutics 2010 Drug Trend Report

I just finished reading the Prime Therapeutics Drug Trend Report. As I highlighted the other day, their overall drug trend was 2.9%. Like in the past few years, they have jumped up to offer a report comparable with the other big PBMs. And, as we saw with last year’s report, the new management team is aggressive in using this to highlight research, their competitive differentiation, and point out why they are a competitive force in the market.

More interesting that just their success in drug trend was their “adjusted drug trend” for the other PBMs. You don’t often see this in your face marketing in this space, but they clearly want to show not only that their trend was better but that their methodology is better. (I don’t have the time to compare methodologies at this point.)

Fortunately, they don’t stake the argument on trend since as I’ve pointed out before – trend can be misleading. Sometimes higher trend is good as when it indicates better Medication Possession Ratio or better success at reducing gaps-in-care. They focus on five things in the document:

- Savings

- Safety

- Guidance

- Satisfaction

- Partnership

Their Generic Fill Rate (GFR) for 2010 was 69.2% which was lower than the 71% reported by Medco and the 71.5% reported by CVS Caremark. (I couldn’t find the Express Scripts numbers for whatever reason.)

The report focuses on some of the differences in the Prime model (client ownership, not public) and how that plays out in transparency and alignment.

They are now at 12 Rxs PMPY which to me still seems a little low. (I’ve mentioned this is prior reviews, but I don’t understand why their population usage is different.) To validate my hypothesis, I looked at the PBMI report from last year which shows PMPM utilization ranges by respondents (not industry averages).

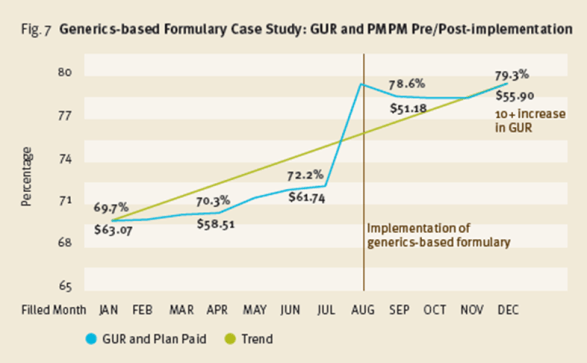

I do think their example around implementing a generics-formulary along with their new benefit plan guaranteeing cost at $47 per Rx are very interesting. They remind me of the GenericsWork product I launched at Express Scripts and should offer some clients a great way to save money. They key, as I learned, was really understanding how to manage member disruption and gain buy-in to the offering. [Amazingly, a quick Google search led me to a cached image of the PDF from my product from 2004.]

They give some good MTM numbers:

- $1.29 in return for every $1 spent

- $86 in savings to the payer over a 10 year period per MTM encounter

They also announce a new offering for 2012 which they call the GuidedHealth care engine. There’s a little information in the document, but it sounds intriguing.

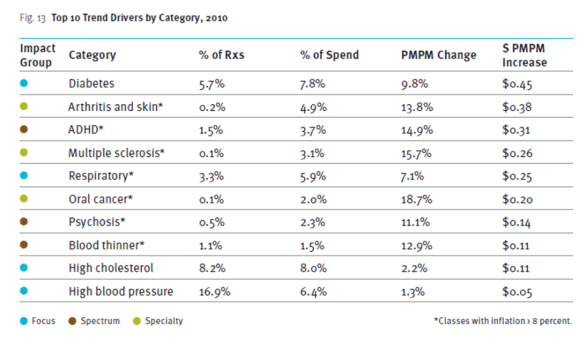

One of those typical charts that we all like to look at shows the drug classes that contributed most to driving trend.

I think their equation about overall cost…

Optimal cost = (medical cost + pharmacy cost) x health outcomes

One of my favorite charts is below which recognizes that there are two cost curves to focus on. The one for the relatively healthy which is often highly pharmacy focused cost versus the chronically ill that drive the majority of overall costs and is heavily medical and specialty medications.

Another study they share in here looks at the likelihood of hospitalization tied to adherence. Very interesting.

$7.60 PMPY savings for a limited network. Those are big numbers that they share from a case study around a client limiting their retail network by excluding one chain.

Their drug trend report looks at another hot topic – 90-day prescriptions. They share their results of a statin study looking at waste in 90-day retail and mail and 30-day retail and estimate the cost impact of the waste.

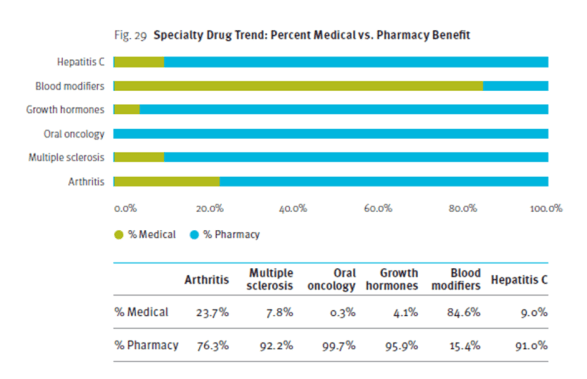

Another hot topic is the mix of specialty drug spend between medical and pharmacy. They share a chart looking at several of the large specialty drug classes.

At the end of the report, they give suggestions to clients on a spectrum of management (low to high). They also predict a few things in the next five years:

- A return to double digit trend increases after this generic wave;

- A generic fill rate in excess of 90%;

- Specialty drugs accounting for 40% of spend;

- Healthcare spending will increase 8-10% per year;

- The role of genetic testing will be validated; and

- Up to 25% of employers will drop benefit coverage.

Summary Of Drug Trends (Prime’s Report’s Out)

Prime Therapeutics published their Drug Trend Report yesterday. I haven’t had time to read it yet, but I pulled their total trend numbers and aggregated them into charts with the previously reported numbers from other PBMs. (As always, you can see detailed summary’s from Adam Fein and I on most of the reports.)

Additionally, here’s a summary from last year. AND, as always, don’t forget that these aren’t apples to apples.

(NOTE: Lower trend is better implying that the PBM is doing a better job at managing costs for their clients although as I’ve argued there may be some clinical reasons for trend going up that are good – e.g., improved adherence, identification of pre-diabetics, addressing primary adherence.)

Increasing Preferred Pharmacy Usage (3 of 3)

- Driving preferred pharmacy usage from the employer site

- Using social media

- Borrowing from other industries

The idea in all of these was to look at new ways that builds on the standard approach that we work with many clients on today. And, if you believe that the Express Scripts / Walgreens dispute won’t get resolved, we’re going to see a lot of people using limited or preferred networks very soon. This is also something that Adam Fein talked about in highlighting some of the progress Wal-Mart is making in this area.

So what are some examples of things we could borrow from other industries?

Referral Program: Why not offer incentives for people who refer their friends and family into the pharmacy? Wouldn’t this play into the social network or peer-to-peer trends out there?

Satisfaction Surveys: Why isn’t there more monitoring of the customer satisfaction to look for improvement opportunities? [Note: I know there is some, but I think it’s under-utilized as a tool.]

Tiered Service Levels: Frequent travelers get different levels of customer service. Why don’t high utilizers with lots of co-morbidities and Rxs get a better level of service?

Points: Why aren’t there more incentive systems and “points” that are used to reward consumers based on share-of-wallet or other metrics? [I think there may be some legal issues here.]

Online Order Tracking: Why can’t I watch my prescription being filled and track it around the system online?

Pharmacy Ratings: Why isn’t there a consumer and business system that ranks pharmacies based on wait time, friendliness of staff, error rates, generic fill rates, overall satisfaction, or other metrics that can then be pushed to the consumers?

Incentives / Coupons: Certainly these have been tried and there are limits here especially in government funded benefits, but it’s still few and far between.

MD Programs: Physicians can certainly influence this decision. Why isn’t there more effort to differentiate a pharmacy (mail, retail, specialty) by building relationships with high prescribers?

Check-in / Preferences: Why don’t the forms in the physician’s office (or applications) have you select a preferred pharmacy or have a pop-up with a preferred pharmacy in it to drive you there?

Credit: For some people, it’s an issue to front the money for the 90-day supply. Why haven’t the mail order pharmacies partnered with a credit card company to allow for installment payment?

If you’re going to “win” at this game, you have to think differently. You have to test and learn. You have to capture insights from your customers and translate them into product offerings. It’s not easy.

Increasing Preferred Pharmacy Usage (1 of 3)

For my purposes, I’m going to define a preferred pharmacy as one of the following:

- Mail order pharmacy

- 90-day network (e.g., Maintenance Choice, Walgreens90)

- Limited or tiered retail network (e.g., Align, Walmart, Caterpillar, Humana/Walmart)

- Specialty pharmacy

- Specialty pharmacy with exclusive distribution of a drug

- Driving preferred pharmacy usage from the employer site

- Using social media

- Borrowing from other industries

- Plan design

- Incentives

- Interventions (letters, calls)

- Reminders on the intranet

- On-site collection boxes

- Kiosks

- On-site pharmacy

- Show them a message about considering mail order

- Trigger an SMS asking someone to call them

- Send an e-mail requesting a call back about the closest preferred pharmacy

- Send them a map of the closest in-network pharmacy

- Link them to a YouTube video on getting started with mail order

- Or, in the Worker’s Compensation area, it could create a virtual card for the network

Engaging The Un-Engaged

One of the hot topics in a lot of healthcare conversations these days is engagement. There’s the “easy” engagement for the e-patients that are actively involved in their healthcare. Then there’s the much harder engagement of those that aren’t engaged. And, finally, there’s the issue of chronic engagement. I can easily get someone to engage a few times with an incentive or some other “trick”, but how do I get them to stay engaged over time. It’s not easy.

This is one of the topics that will be discussed at the upcoming Forum 11 in San Francisco. If you’re coming, look me up. I’m presenting on Friday.

Can Demographics Predict Adherence – FICO?

Several people have asked me about the FICO adherence scoring tool. I (like many of you in the adherence business) am fascinated by the concept on using data to predict adherence and subsequently customize programs around that. On the flip side, consumers may be a little paranoid about this based on comments on the NY Times article.

Ultimately, there are a few questions:

- Can you predict adherence?

- What data do you need access to?

- How accurate is the prediction?

- Does the prediction change based on drug type, duration on therapy, health literacy, etc.?

- What can you do with the prediction to influence it?

- Healthcare centric data – number of prescriptions, copay amount, formulary status

- Consumer provided information – PAM score, Merck Adherence Estimator

I highlighted some of these things in my 15 Things You Should Know About Prescription Non-Adherence post. The one item that seems to fall across both healthcare and non-healthcare data is past behavior. This could certainly play into a credit score or even some type of preventative health score. Do you get your screenings done? Have you filled other medications on a regular basis? Do you have and use a PHR?

Lots more to come on this topic over time, but this is certainly an area with many eyes on it.

Copay Cards: Don’t Throw The Baby Out With The Bathwater

Prescription Copay Cards continues to be a hot topic (see list of articles at the end here), but I see a lot of FUD (fear, uncertainty, and doubt) versus a lot of facts. At the end of the day, there are certainly a few stories about cases where costs have jumped up due to copay cards overcoming formulary positioning.

But, no one knows the total market impact. I’ve spoken with six different organizations that would be well positioned to know, but they don’t. It’s not tracked or easily available in the data. Reasonable estimates from Dr. Adam Fein over at DrugChannels put the market at about 100-125M Rxs which is about 3% of the total Rx market (assuming 3.3B Rxs/year) or 12% of the total brand market (assuming 75% GFR). [I validated those numbers with a specialty pharmacy that shared that they were seeing 13% of their claims come in with a copay card.] Certainly, the market has grown as IMS estimated in one recent article.

The question of course is whether these are good or bad and whether their use is malicious or not. My conclusions are based on talking with about 30 people in preparation for my AIS webinar on this topic today. What I concluded was:

- There is a win-win. Copay cards can improve adherence. Adherence can reduce total healthcare costs. There is a point at which the increased cost curve crosses the savings curve and is something to be considered.

- Today’s approach is a shotgun approach by which cards are available online (e.g., www.internetdrugcoupons.com) and by physicians. They’re not focused on patients with need or on patients with adherence barriers. They play into the misperception that cost is the primary barrier to adherence WHICH IT IS NOT. [Cost is an issue in <20% of the cases according to multiple barrier surveys.]

- Copay cards are really a CRM Trojan Horse for pharma to build a 1:1 patient relationship (or should be if they’re not thinking that way). Due to HIPAA, pharma doesn’t typically know who uses their drugs. If I were a brand manager, I would gladly trade some copay relief in return for increased adherence and the contact information for my patients.

I think there are several ways that industry (especially pharmacies) should collaborate with pharma on how to leverage these copay cards at the POS with patients [call me to discuss]. But, to do that, I think the broader industry is going to require some type of rules which I am sharing shortly as a proposed “pledge”.

The other thing longer-term to watch is will this further change the PBM-Pharma relationship. I think yes. If the PBMs push for legislation on this marketing tactic or the manufacturers figure out that this is a better use of their spend than rebates, this will change the relationship.

Additional Reading:

How I Would Use Generic Lipitor To Improve Mail Order Utilization

The fact that Lipitor is scheduled to go generic towards the end of 2011 is the big news many have been waiting for. The key question of course is whether payers see immediate savings in pricing or whether the price drop is only minor until there are more manufacturers providing the generic.

I keep thinking about how to leverage this event in other efforts as a PBM or a pharmacy. This seems like a great chance to drive to a preferred pharmacy (retail or mail). If it was me making decisions (and I had my pricing and copays aligned correctly), I would do something like the following:

- Reach out to all brand Lipitor users before their September / October refill.

- Offer to refill their medication at no out-of-pocket cost to them (i.e., copay waiver) if they move to mail order (or a preferred pharmacy).

- Provide them with a conceirge service (i.e., fax their physician to get the new Rx) to make it easy to do.

- Convert them to the generic when available.

Yes. This will cost some money, but the 12-months savings (payer) or increased profit (pharmacy/PBM) should outweigh the costs. It’s a great opportunity to co-mingle your messages and leverage a market event to everyone’s benefit.

Of course, this should be only part of your broader strategy around the world’s biggest drug. Your going to want something that addresses:

- Inbound IVR messaging

- Web messaging

- Mobile application messaging

- MD communications

- Messaging integrated into outbound communications (print, call, pharmacy inserts)

This is similar to the control room concept my team designed at Express Scripts years ago around Zocor.

Silverlink eBook: 13 Common Pitfalls In Consumer Health Engagement

After working on consumer communications in healthcare for most of the past decade, I realized that there were some common pitfalls that happen. Many of them are pretty straightforward, but when rushed, they may get forgotten. I worked with Dr. Jan Berger (our Chief Medical Officer) to identify a short list of them, and then the Silverlink marketing team pulled them together in a beautiful eBook.

Each of the pitfalls is set up with a quote and a great image:

Then, there is a brief description to explain the pitfall on the page across from it:

What are some of the pitfalls:

- Not knowing how to declare success

- Limiting design based on company constraints

- Forgetting about health literacy

- Not understanding the entire process

- Thinking you represent the customer

To get a copy of the entire eBook, you can register online. [Alternatively, you can e-mail me at gvanantwerp at mac dot com.]

Pharma Virtual Trial (like Remote Monitoring)

I think one of the most exciting things in pharma in the past few months has been the approval that Pfizer received to allow them to do a virtual trial. This appears to build on a lot of the momentum around remote monitoring, mobile health, telemedicine, and other trends. The key is that this opens up a gateway for broader trials at potentially lower cost.

But, I think the key with any solution like this is the blend of active and passive monitoring. In passive monitoring, you wait for the patient to not provide data and then intervene. In active monitoring, you are prompting them to provide data proactively. Different patients will respond differently, and probably, like adherence programs, you need a mix of both.

November 26, 2011

November 26, 2011