After sharing my forecasts about the PBM industry for 2012, I reached out to several people to get their perspective. One person for which I have a lot of respect is Per Lofberg. Per’s now the President of CVS Caremark’s PBM and has an impressive background at companies like Medco, BCG, and Generation Health. Everyone who’s ever worked for him has nothing but great things to say.

Given the change we all expect to see in the industry, I was glad that Per agreed to participate. Here are his answers to some of my questions:

1. 2012 is shaping up to be an exciting year in the PBM industry. Do you think this will finally be the year that limited retail networks take off?

Payers are always looking for new savings opportunities, and limited retail networks provide another avenue to increase savings without compromising access or quality. I have always believed it is quite possible to service large nationwide customers with retail networks that are smaller than the large 60,000 plus networks that are so common today. The current debate in the marketplace will only draw further attention to the topic of limited retail networks, which may result in more PBM clients, including clients who have not previously considered a limited network, engaging in a dialogue about this approach. As a result, I believe that during the 2013 selling season, benefit consultants will be quite focused during the RFP process on understanding the types of savings payers can realize with smaller networks. PBMs like CVS Caremark will need to be able to address this topic clearly with our clients and prospects so they can accurately weigh the benefits and impact of narrowing their network and consider how best to manage the natural disruption factor that will occur.

2. As the generic wave passes in the next few years, how do you expect PBMs to differentiate themselves going forward?

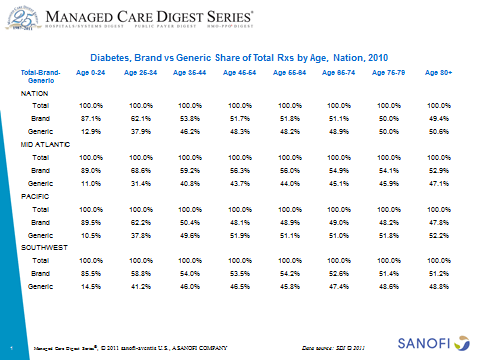

We can’t discount the importance of taking advantage of the large number of blockbuster drugs that will be going generic in the next few years. Being able to deliver strategies designed to drive generic utilization and work with clients to ensure that they appropriately move members to safe and cost-effective generic alternatives should become a best practice standard across the industry. Increasing GDRs will no longer be differentiators, but rather will be expected by clients as a basic PBM offering. As a result, during the generic tidal wave, PBMs need to sit tight, refine their standard formularies and perfect the implementation of programs that drive generic utilization.

As PBMs continue to drive GDR, those that are also successful at offering clinical solutions that support adherence, effectively manage the growing costs related to specialty pharmacy and helping clients manage the intersection of pharmacy and medical benefits to reduce waste and improve health are the ones that will stand out from the competition. Now and in the future, a best in class PBM is one that can accomplish all the basics that used to define differentiation (e.g., GDR, MDR) effortlessly, while bringing value to their clients through an integrated approach to managing the patient’s pharmacy care across the entire spectrum of care. The hallmark of a best in class PBM will be one that effectively addresses access, quality and cost for their clients.

Another consideration for PBMs will be around stricter formulary management strategies to counter increasing, and increasingly frequent, price hikes by pharmaceutical manufacturers. Brand manufacturers are using two basic strategies to protect their market share and we are seeing increased activity as generics erode the profitability of drug blockbusters. Unfortunately, these strategies – brand co-pay coupons and high and frequent price increases — ultimately raise costs and undermine the cost-controls used by employers and health plans to effectively manage their pharmacy spend. To help our clients manage pharmacy costs in this environment, PBMs will need to construct clinically appropriate formularies that provide our clients with options to manage sky-rocketing drug costs without compromising access or outcomes. CVS Caremark is combating price increases by pharmaceutical manufacturers by tightening what is offered on our recommended prescription formulary. As you know formularies are the list of approved drugs that an insurer or employer makes available to beneficiaries and, up until now, the formularies have been quite broad, including most FDA approved drugs, so that doctors and their patients have choice. However, physicians and pharmacists have long recognized that many drugs within a therapeutic class are essentially equivalent, and a “narrow” formulary can be comprehensive while also providing for substantial cost savings.

3. The role of the pharmacist continues to evolve with vaccines and their involvement in more patient management. Given your unique set of assets within the industry, how do you see CVS Caremark leveraging your POS resources to strengthen your focus on clinical outcomes and partner with clients?

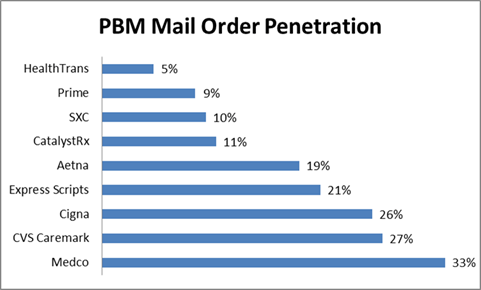

As a pharmacy innovation company, we will continue to further develop our unique clinical offerings that leverage the pharmacist interaction and intervention in order to improve the health of our PBM members and drive costs savings for our clients. Our flagship products, Maintenance Choice and Pharmacy Advisor, developed to build on the member’s relationship with their pharmacist, are gaining increasing traction in the marketplace. These programs leverage the clinical expertise and insights of our PBM business along with the broad reach and face-to-face engagement in our retail business to deliver innovative solutions that are unmatched in the marketplace today.

Moving forward we will continue to build on this model by finding ways to further expand member access to these programs. For example, in 2012 we are expanding on our successful Pharmacy Advisor program, originally launched to increase adherence and close gaps in care for diabetes patients, to encompass patients with chronic cardiovascular conditions who are at risk of becoming non-adherent. We are also enhancing Maintenance Choice to make our integrated capability more broadly available to the CVS Caremark book of business and easier for members to use. In addition to enhancing our existing programs we are also continuing to innovate as a PBM by piloting new programs, including one we are piloting in 2012 that leverages pharmacist counseling to better coordinate drug treatment for patients recently discharged from hospitals in order to reduce rehospitalization rates and finding ways to fully integrate our Specialty Pharmacy business so clients and members get the full benefit of the entire CVS Caremark enterprise—PBM, CVS/pharmacy and MinuteClinic.

4. Medicare has pushed quality to the forefront with some of the new Star ratings. Additionally, some PBMs are looking at outcomes-based contracting with pharma. How do you see the marketplace engaging and leveraging pay-for-performance structures within the PBM industry?

Pay-for-performance based on outcomes is an extension of the guarantees that most PBMs negotiate with their clients today. These guarantees are in place to specify a level of service that clients should expect from their PBM with regards to such activities as response time on calls to the customer care center and performance for measurements such as a minimum GDR or MDR to be achieved within a specified time period. Adding in a level of clinical accountability is in line with how the PBM industry is evolving from one focused on channel/access and pure pharmacy cost savings through generics to one that encompasses health outcomes, adherence and the resulting overall health care cost savings associated with these measures. As PBMs get even better at implementing clinical programs and managing adherence across the spectrum of care, I would anticipate we will see more requests by our clients for contracts that either reward or penalize PBMs for their performance in these areas.

5. There is lots of talk about the value of carve-in versus carve-out pharmacy and the integration of medical, pharmacy, and ultimately lab data to provide improved management and identification of at-risk patients. Given your relationship with Aetna and ActiveHealth, how do you see CVS Caremark leveraging these assets even when they work in a carve-out relationship to help clients?

In our current partnerships with health plan clients, our main objective is to find ways to smoothly integrate our pharmacy management activities with the health plan’s focus on solid medical management. This integrated approach—one that balances traditional utilization management with programs to improve adherence, close gaps in care, improve outcomes and reduce negative health events – can deliver better results than a carve-out model that simply focuses on minimizing pharmacy spend. As I mentioned earlier when talking about how PBMs will differentiate their offerings in the future, a best in class PBM delivers on more than increasing GDR or moving members to mail order, it is about managing the whole patient and delivering results that address access, quality and cost. Being able to integrate a full view of the patient and their health works because it makes pharmacy care an integral component of overall health management for the member

[Thank you for reading. If you enjoy reading these posts, I would encourage you to sign up for e-mails from the blog every time new content is added. It’s a convenient way to have the content delivered to your inbox for you to read and share. You can sign up in the right hand column of this site.]

January 6, 2012

January 6, 2012