I went into yesterday’s NCPDP presentation expecting that I would be an outlier in proposing a radical model for pharmacists … but others had the same ideas before I spoke. I think everyone has talked about pharmacists wanting to do more counseling with their patients for years. Some of this is fulfilled with Medication Therapy Management (MTM) which began to be a compensated service under Medicare.

But, there is a huge gap in terms of what pharmacists are trained to do and what they actually do. I remember initially running into this concept when I worked on my pharmacy kiosk model. Some people saw this as a horrible thing that would replace the pharmacist. I actually saw it as a way to free up their time to focus on the patients that needed counseling not on people filling an antibiotic or getting a refill for the 30th time. In that case, I ended up going to talk to the Head of the St. Louis College of Pharmacy to see his thoughts. I remember him talking about the gap between what the students learn and the reality of what they do.

Most pharmacists (unfortunately) become high paid pill counters for much of their day. As someone said yesterday, “I didn’t go to school to learn to count in 5’s.” Another person pointed out yesterday that the top questions at the pharmacy are “How much will this cost”, “How long do I need to take this”, and “where’s the bathroom”. These aren’t things that require clinical knowledge.

There was a healthy discussion yesterday about expecting more from pharmacy technicians. For refills (which are 55% of prescriptions filled), why can’t they handle the process with oversight from the pharmacist.

Which I think brings us around full circle…

We’ve gone from a shortage of pharmacists to an overabundance of pharmacists. This has changed the paradigm. How do we leverage them?

At the same time, we have a shortage of PCPs which is likely to get worse with more insured people. Why can’t pharmacists step in here?

The change in flu shots may be the beginning. Will this be the start of all immunizations for people over 7 (as one person suggested yesterday) moving to the pharmacy? Given the profit on these, that would be a boom for the pharmacies, but it would certainly get pushback from the physician groups.

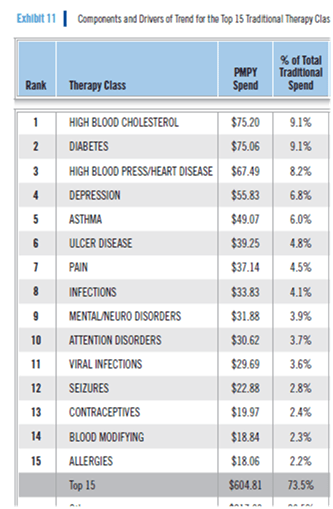

I would also suggest that the pharmacist could act as a PCP in helping manage care. Think about conditions like diabetes where the pharmacist in certain settings would have a unique ability to help the patient select food or look at devices. They could become a much more active “floor” resource for people shopping.

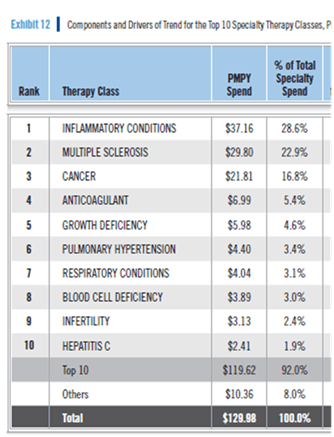

And, my radical idea that another presenter suggested yesterday was to look at focusing the pharmacist on new fills and initial titration. This of course would blow up the financial model in pharmacy. Why not pay them $10 or $15 per new fill and for the next 2 fills (of maintenance drugs) and then move everything to mail order, kiosks, central fill, and/or pharmacy technicians. We could write rules into the system to flag the technician to ask questions of people on statins every 12 months about getting lab work done or muscle pain.

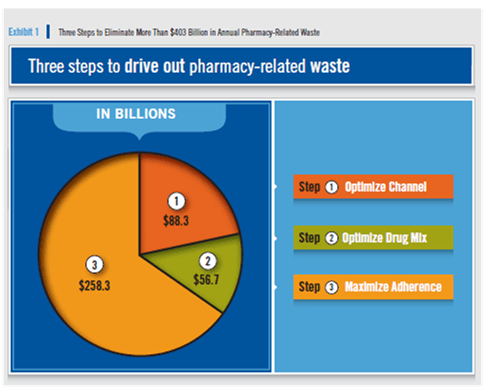

At the end of the day, I would argue that pharmacy needs a radical overhaul like the entire healthcare system, BUT since it only represents 10-15% of total healthcare spend, some would argue that improving it be 25% (which would be huge) would only impact 2-4% of our healthcare spend. The problem with this is it’s like the PBM trying to justify adherence without looking at the impact on total health, absenteeism, and other factors.

Today, prescriptions are first line therapy for 90% of diagnosis. Over 50% of patients take 1 or more maintenance drug. And, most patients drop off their maintenance prescriptions by the end of year one. This costs us $300B a year.

Finding a new role for pharmacists and pharmacies, and giving them a better seat at the table is an imperative for change not an option. At the same time, there is a role for integrating technology into what they do to automate the simplier, repetive tasks. I’m not sure who’s the champion here, but I was emboldened by the fact that I wasn’t a radical at the conference.

August 30, 2011

August 30, 2011