Guest Post by Maryjoan Ladden, Ph.D., R.N., F.A.A.N., Robert Wood Johnson Foundation Senior Program Officer

Maryjoan Ladden, PhD, RN, FAAN, is a senior program officer at the Robert Wood Johnson Foundation. A nurse practitioner whose work has focused on improving health care quality and safety through health professional collaboration, her work at the Foundation addresses: faculty recruitment and education to increase the capacity of nursing programs; developing collaborative partnerships to address local nursing issues; creating the next generation of academic nurse leaders; and building senior executive leaders in nursing. She also is senior editor for the Foundation’s quarterly publication, Charting Nursing’s Future. (full bio here)

A little over a year ago, the Institute of Medicine’s landmark Future of Nursing: Leading Change, Advancing Health report put forward a series of recommendations for transforming the nation’s health care system. Among them was a call for a system in which “interprofessional collaboration and coordination are the norm.” That’s no simple assignment in a system that often operates in silos, from schooling through practice. But a number of innovators around the nation are already making headway.

Their work is the subject of a new policy brief from the Robert Wood Johnson Foundation, part of its Charting Nursing’s Future (CNF) series. The brief delves into what the IOM recommendation means for health care systems, offers case studies of several collaborative care models already in place, and examines the implications of the recommendation for how we train nurses and other health care professionals.

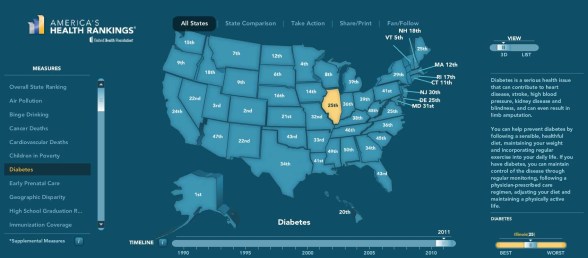

According to the brief, Implementing the IOM Future of Nursing Report–Part II: The Potential of Interprofessional Collaborative Care to Improve Safety and Quality, the “silo” approach must soon give way if we are to meet coming health care challenges. For example, chronic conditions are increasingly common—not surprising given an aging population. But the health care system is poorly structured to provide the sort of coordinated care and preventive services needed to give these patients quality care while reducing costs.

Some health care institutions are gearing up for the challenge.

-

In Boston, where Harvard Vanguard Medical Associates developed its Complex Chronic Care (CCC) program, primary care has become interprofessional, collaborative and noticeably more efficient. Each CCC patient is assigned a nurse practitioner (NP), a registered nurse with advanced education and clinical training. The NP consults with all the patient’s subspecialists and incorporates their guidance in a single plan of care. The NP then manages and coordinates that care, connecting patients to nutritionists, social workers, and other professionals as needed. The model is dynamic, allowing patients to meet more or less frequently with the NPs and their primary care physicians, who remain responsible for the patients’ overall care.

-

In New Jersey, the Camden Coalition of Health Care Providers is “revolutionizing health care delivery for Camden’s costliest patients,” according to the brief. These individuals, sometimes called super utilizers, typically rely on hospital emergency rooms for care. Not surprisingly, such patients account for an outsized share of local hospital costs, often with diagnoses that would have been more properly handled in a primary care setting. The Coalition developed its Care Management Project to reduce these unnecessary emergency room visits by treating patients where they reside, even when that means treating them on the street. A social worker, NP and bilingual medical assistant work as a team to help patients apply for government assistance, find temporary shelter, enroll in medical day programs and coordinate their primary and specialty care.

Training the Next Generation to Collaborate

Of course, the silo effect usually begins in school. In May 2011, six national education associations representing various health care professions formed the Interprofessional Education Collaborative (IPEC) and released a set of core competencies to help professional schools in crafting curricula that will prepare future clinicians to provide more collaborative, team-based care.

Such efforts are already under way at a number of institutions.

-

Maine’s University of New England has developed a common undergraduate curriculum for its health professions programs in nursing, dental hygiene, athletic training, applied exercise and science, and health, wellness and occupational studies. The curriculum includes shared learning in basic science prerequisites and four new courses aimed specifically at teaching interprofessional competencies.

-

In Nashville, Vanderbilt University is also pursuing an interprofessional education initiative that unites students from the medical and nursing schools with graduate students pursuing degrees in pharmacy and social work at nearby institutions. Students are assigned to interprofessional working-learning teams at ambulatory care facilities in the area.

-

The Veterans Health Administration (VHA) is piloting an interprofessional initiative, as well, focused on preparing medical residents and nursing graduate students for collaborative practice. As part of the initiative, five VHA facilities have been designated Centers of Excellence and received five-year grants from the U.S. Department of Veterans Affairs. Each VHA Center of Excellence is developing its own approach to preparing health professionals for patient-centered, team-based primary care.

-

In Aurora, Colorado, the University of Colorado built its new Anschutz Medical Campus with the explicit objective of creating an environment that promotes collaboration among its medical, nursing, pharmacy, dentistry and public health students. It features shared auditoriums and simulation labs, as well as student lounges and other dedicated spaces in which students from different professions can pursue common interests such as geriatrics in a collaborative fashion.

Such initiatives are clearly the wave of the future, if only because the pressures of caring for a larger, older and sicker population of patients in the years to come will drive efforts to identify efficiencies. In the words of Mary Wakefield, PhD, RN, head of the Health Resources and Services Administration, “As the health care community is looking for new strategies and new ways of organizing to optimize our efforts—teamwork is fundamental to the conversation.”

Sign up to receive future Charting Nursing’s Future policy briefs by email at www.rwjf.org/goto/cnf.

January 4, 2012

January 4, 2012

![Hospital Billing Survey [Infographic]](https://i0.wp.com/connance.com/sites/default/files/images/hospital-billing-survey.png)