As we have been working with a lot of PBMs over the past year, the question has come up many times – “where do you see the industry going?” After bouncing some ideas off a few of you, we have pulled together a whitepaper with the Silverlink Communications perspective. Certainly, each area of the whitepaper could have been its own chapter, but rather than turn this into a thesis, we are publishing it.

As I have said in a few recent articles including the one in HCPro, I think the Express Scripts acquisition of NextRx will likely accelerate a few of our predictions here.

The executive summary of the whitepaper is below. The final whitepaper is available here.

I would welcome any comments you have…

Executive Summary

In the next several years, we believe that three changes will drive the pharmacy marketplace and ultimately change the business model for PBMs. These changes will be accelerated by the current financial crisis which may drive further consolidation in the short-term. Consolidation which we believe will accelerate the “race to the bottom” where the traditional model of scale has been maxed out with parity achieved among the large PBMs.

1. The need to better engage the consumer in understanding their benefits and ultimately responsibility for their care;

2. The effort to automate and integrate data across a fragmented system and across siloed organizations; and

3. The shift from trend management to being responsible for outcomes.

Consumer Engagement

The industry-wide movement to consumerism will continue to affect plan design, but it will also thrust PBMs and pharmacies into the critical path of member engagement. With pharmacy being the most used benefit as well as the volume and accessibility of retail pharmacies, they will play a critical role in driving adherence and helping consumers understand healthcare. This will renew the focus on cognitive skills, medication therapy management and ultimately drive the desire for a more traditional “corner store” approach that can be scaled using technology.

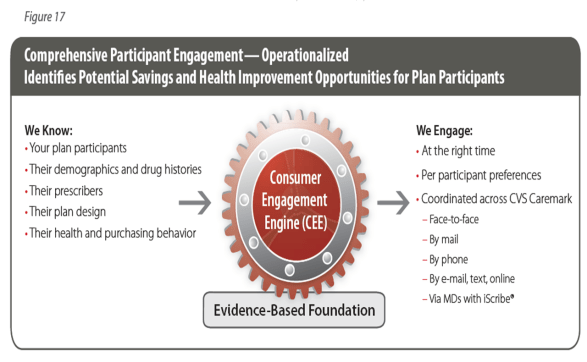

Combining this with the macro-economic forces that are driving ubiquity of technology through mobile media and the evolution of the Internet from a pull media to a push media will also challenge the PBMs and pharmacies to innovate. They will be required to look outside of healthcare models to identify the right communications to drive behavior. PBM’s and pharmacies will have to leverage behavioral economics and personalization technology to get the right message to the right consumer at the right time through the right medium.

Automation and Integration

The consumer engagement challenges will only exasperate some ongoing challenges within the PBM and pharmacy community. This will include the lack of staff to provide more cognitive services and the general fragmentation of data across organizations and functional silos. Figuring out an overall “single view of the patient” which shows all the touch points and offers a coordinated multi-channel strategy for inbound and outbound communications will become a major focus.

In addition, in order to make these solutions efficient, the development of predictive models, much like the clinical and underwriting solutions being used today, will become the norm across the industry. As these models are fine tuned and the promise of e-prescribing becomes more of a reality, the channel for engaging physicians in the member’s care will finally exist. PBMs and pharmacies will be able to use data to allow physicians to understand when patients aren’t being compliant and when there is an opportunity to drive change.

From Trend Management to Outcomes

The traditional business model for the PBMs has been based on large scale negotiations to drive rebates and efficiencies within mail service – cost to fill and acquisition costs. At the same time as those efficiencies reach a maximum discount, the traditional tools for managing trend will have run their course. Although plan design won’t “die”, comparative effectiveness may reduce (or eliminate) the need for formularies, and in general, the ability to shift cost to the consumer above the 25-30% level will be difficult.

Both of these challenges will push the PBMs and pharmacies into a role where they are focused on driving health outcomes and being part of the bigger solution across the industry. They have a strong footprint to drive this change and as theranostics (or personalized medicine) evolves there will be an opportunity to find cost effective solutions to change the prescription landscape.

November 13, 2009

November 13, 2009