I was reading a book about trust which pointed out the concept of “remembered wellness“. This concept is similar to the “placebo effect” in that it shows that patients who trust their physicians and their course of therapy are more likely to have better outcomes (e.g., HIV study). WOW!!

I’ve talked before about the gap that exists when patients leave their physician’s office with a new diagnosis and we all know that health literacy is a big issue.

So…what are you doing to address this? I’ve been talking a lot lately about “primary adherence” (i.e., getting people to start therapy) and about engaging patients when they first get a new prescription or a new diagnosis. This concept of trust only makes this a more pressing issue.

Here’s your worse case scenario:

- Patient is newly diagnosed with a chronic condition and given a new prescription.

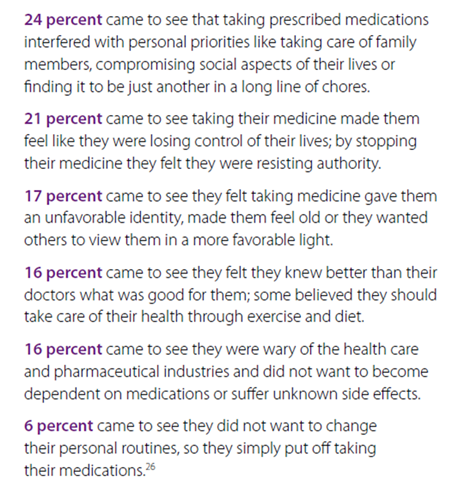

- They don’t have a great relationship with the physician and/or have limited understanding of the condition (due to literacy, fear, or other issues).

- They fill the prescription once and stop taking the medication after a few days.

How can you step in here?

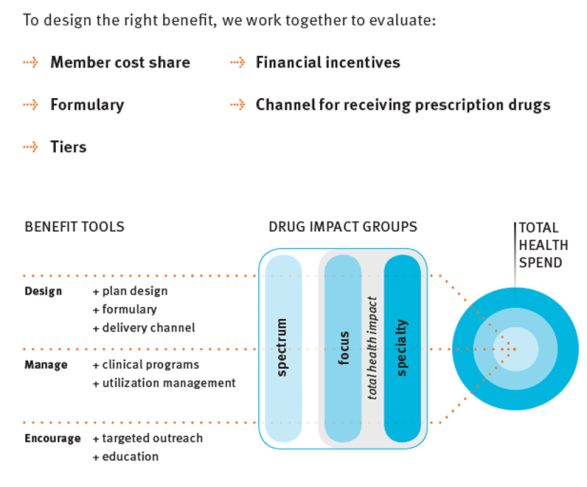

- You can trigger an outreach based on diagnosis code.

- You can assess their understanding of the condition and help them learn more by addressing their barriers.

- You can engage them when they fill their first script.

- You can follow-up with them after the first few days to make sure they stay on therapy.

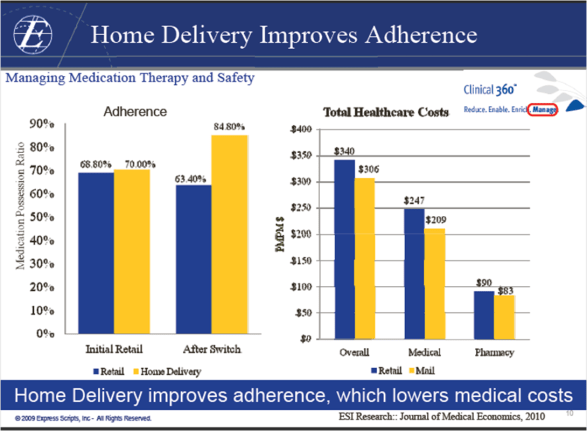

- You can enroll them in an adherence program.

- You can enroll them in a condition management program.

But, the point here is that you need to be doing something that reinforces the decision to manage the therapy and help them to understand and believe in that course of treatment. If they don’t believe and have trust, they are less likely to get to a successful outcome.

March 26, 2011

March 26, 2011