The concept of “engagement” in healthcare is a difficult one. Traditionally, we’ve had a build it and they will come approach that didn’t encourage preventative care. It also didn’t openly acknowledge the challenges that consumers have in dealing with medication adherence and even understanding the system or their physician’s instructions.

In this week’s edition of Grand Rounds, I looked at submissions and recent posts from several angles on this issue.

One of the most engaging was from the healthAGEnda blog where Amy tells her personal story about being diagnosed with Stage IV inflammatory breast cancer and trying to work though the system. Her focus on patient-centered care and support for the Campaign for Better Care make you want to jump out of your seat and shake the physician she talks about.

“It doesn’t matter if care is cutting-edge and technologically advanced; if it doesn’t take the patient’s goals into account, it may not be worth doing.”

Another submission from the ACP Hospitalist blog tells a great story about how to use the “explanatory model” to engage the patient when it’s not apparent what the problem is. I think this focus on understanding that physician’s don’t always have the answer is an important one, and one that Joe Paduda talks about when he addresses guidelines as both an art and science. Dr. Pullen also talks about this from a different perspective by describing some examples of “Wicked Bad” medicine on his blog.

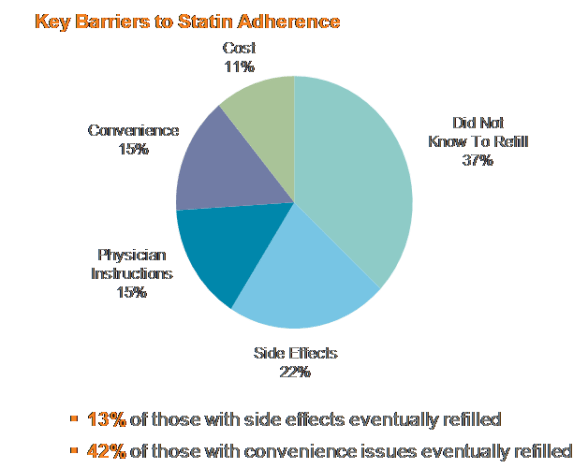

One of the common focus areas today from patient engagement is around adherence. Ryan from the ACP Internist blog talks about the recent CVS Caremark study which looks at how total healthcare costs are lowered with adherence. He goes on to point out the fact that understanding the reasons for non-adherence is important so that you can – simplify, explain, and involve.

Interestingly, my old boss from Express Scripts recently started her own blog and also talked about this same study but from a different perspective.

And, Dan Ariely briefly touched on this topic also when he shared a letter he got from a reader on getting their child to take their medications.

While I think a lot of us believe HIT might save the day, the Freakonomics blog mentions a few points about HIT to consider. And, Amy Tenderich (of DiabetesMine) who I think of as a great e-patient gives a more practical example when she talks about what diabetics need to do to stay prepared in the winter. (What’s the basic “survival kit” and where can you go to get one.) I think this has a lot of general applicability to how we plan our days and weeks and try to stay healthy. One physician I know who travels a lot always talks about the need to be prepared with healthy food on the road and at the airports.

On the flipside, we hear a lot about genomics and social networking as ways to engage the consumer and to understand their personal health decisions. To that affect, I liked Elizabeth Landau’s post on how your friend’s genes might affect you.

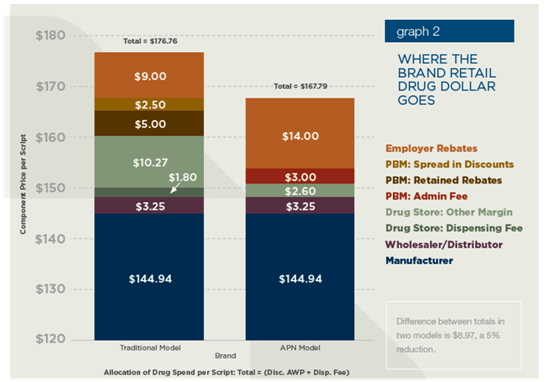

Of course, there are lots of other considerations. Louise from the Colorado Health Insurance Insider talks about the fact that we are so focused on health insurance reform rather than health care reform. She goes on to point out the lack of connectivity between the consumer and the true cost.

And, Henry from the InsureBlog points out a change in the NHS to look more like the US system and cut out one of the steps for cancer patients. Will it help?

But, at the end of the day, I think we have to address the systemic barriers while simultaneously figuring out how to better engage consumers. Julie Rosen at the Schwartz Center for Compassionate Healthcare talks about Patient and Family Advisor Councils. This was a new concept to me, but it makes a lot of sense that engaging the family in the patient’s care will lead to better outcomes and a better experience. I also heard from Will Meek from the Vancouver Counselor blog who talks about how dreams can be used as part of therapy, and Dr. Johnson who presents a story of woe about her challenges as a physician.

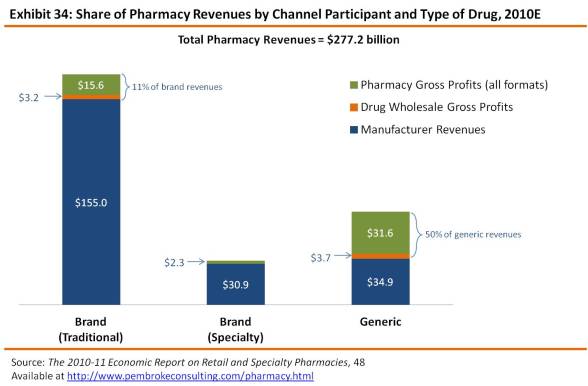

And, since many of us “experience” healthcare thru pharmacy and pharmacy thru DTC, I thought I would also include John Mack’s Pharmacy Marketing Highlights from 2010.

Next week’s Grand Rounds will be hosted by 33 charts.

January 27, 2011

January 27, 2011