I did a podcast with AHIP on adherence. I was hoping to embed it here, but I couldn’t so here’s the link.

http://www.ahiphiwire.org/Innovations/Feature.aspx?doc_id=722249

I did a podcast with AHIP on adherence. I was hoping to embed it here, but I couldn’t so here’s the link.

http://www.ahiphiwire.org/Innovations/Feature.aspx?doc_id=722249

From someone in the industry, this is going to seem like a silly question. BUT, from a customer perspective, I think it makes a lot of sense.

Is it that we’ve grown away from such niceties? Is it that we don’t think we should thank the customer? Is it that we think we deserve their business?

People often ask about topics like retention or loyalty or satisfaction. I was just thinking wouldn’t it be nice if one of my initial experiences was a quick thank you card from the provider that I just used for the first time.

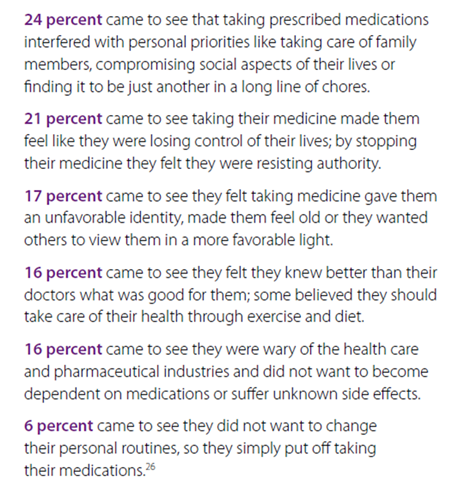

I found this nice summary document on MAPS (Medication Adherence Profiling System) which was part of the Boehringer Ingelheim Pharmacy Satisfaction 2009 Medication Adherence Study. Here are the dimensions and key issues:

The document goes on to give sample strategies and tactics for each dimension.

It looks like the concept of “Select” Home Delivery which has been one of the products to come out of the Consumerology approach at Express Scripts is about to get some cousins such as Select Step Therapy, Select Networks, and Select Specialty. Obviously, the concept of Active Choice has legs. (I understand the networks and specialty, but I’m not sure what the step therapy product will look like.)

(Here’s a good article from the Brookings Institute on choice architecture for healthcare enrollment.)

The concept of choice has to do with the decision framework with which options are presented. Making it active choice typically refers to the requirement of the consumer having to make a decision. They can’t do nothing. This doesn’t mean that the company can’t select a default recommendation, but it can’t implement that option without the consumer verifying it. (See the book Nudge for more details on this concept.)

The example that is often used for choice architecture is enrollment into 401K plans.

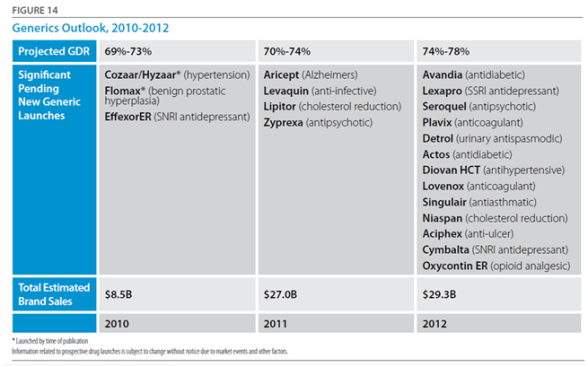

Adam Fein from Drug Channels just published his newest report – 2010-11 Economic Report On Retail And Specialty Pharmacies. If you’re going to spend money on a report, I would suggest you consider this one. You couldn’t Google the information and format it for the price.

He does a great job of aggregating data, looking at trends, creating great charts, and providing an informed perspective on the industry. Let me just pick out a few things to highlight from the report:

Here’s an example of one of his charts (exhibit 34).

My final commentary on the report is that this should be a read for people trying to work in the industry or new hires in the PBM or retail management. I’m pretty sure all the analysts on Wall Street already read it.

Enjoy!

Joy Paley is a guest blogger for An Apple a Day and a writer on online nursing classes for the Guide to Health Education.

Sports drinks have been getting a ton of bad press lately. Google the subject, and you’ll find a myriad of newspaper articles and blog posts “exposing” sports drinks for what they are—water with sugar and a little artificial coloring. But it’s no surprise that sports drinks have sugar in them; that’s something that’s never been hidden. The real question is, will that extra sugar be bad for your kid? Well, as most things, it depends.

Dental Health: One mark against sports drinks like Gatorade is that they can be bad for your teeth, if you drink them often enough. They all are relatively acidic, which can lead to enamel degradation. Juice and soda are acidic too, though, so it’s not like sports drinks are special in that regard.

Performance: The literature review of the effectiveness of sports drinks on preventing dehydration and increasing performance is mixed. In most respects, water and sports drinks perform equally well. After working out however, kids who have had the sports drink have been shown to have a higher body weight—meaning they lost less fluids during their workout. This is one potential benefit of choosing a sports drink over water.

Calories: Sports drinks are generally full of high-fructose corn syrup, providing many sugary calories to whoever drinks them. For example, 20 ounces of Gatorade Performance has 122 calories! That’s less than 20 ounces of soda, but it’s still nothing to sneeze at.

And, many studies have correlated a higher intake of sugary beverages, like soda and sports drinks, to higher body mass index and worse diet in children. It makes sense right? If a kid is drinking soda all the time, they’re consuming more calories, and drinking less of the beverages that are actually beneficial, like milk or 100% juice; greater intake of those beverages correlated to an adequate intake of calcium, vitamin C, vitamin A, and magnesium.

In Moderation: If you look at all the scientific studies I mentioned above, you might want to make a knee jerk reaction and pull that sports drink right out of your kid’s hands. Those studies aren’t about your specific child or family, however, and it’s important to realize how your particular situation could come into play here.

If you live in a house where kids rarely have soda or other sugary drinks, letting them have a Gatorade at sports practice isn’t going to make them obese. If your kid is already guzzling soda at home, then adding a sports drink isn’t going to help—but sports drinks are only one thing that should be on your list of dietary worries.

What you do want to avoid is having your kid think that sports drinks are somehow “healthy,” when the truth is that they’re not. And, you don’t want a situation where your kid drinks sports drinks in place of water, because they think the sports drink will somehow make them feel better. However, as long as the drinks are had in moderation, like being consumed only at a specific activity like sports practice, they aren’t going to make your kid unhealthy.

Other Possible Beverages: I would caution parents to avoid replacing regularly sugared sports drinks with lower-calorie artificially sweetened ones. The trouble with these? In studies, greater intake of diet soda has been linked to higher BMI. Why? People rationalize that they are consuming less calories, so they “make up” for it by eating more.

Instead, try creating your own fruit-infused water. Cut up strawberries, cucumbers, and apple slices, and let them sit overnight in a pitcher of water. The result is delicious and low-calorie. Or, pick up a low-sugar 100% fruit juice from the store.

The Bottom Line: If your kid eats a healthy diet and avoids most sugary beverages, letting them have a Gatorade at their practice or game isn’t going to hurt. Just don’t let sugary sports-drinks replace water in regular day to day activities.

I pulled together (in Prezentation Zen style) 11 Things to Consider in the Pharmacy industry. It’s certainly a matter of opinion, but it’s a point of view meant to cause you to think. I spend a lot time with clients thinking about the industry, and I thought this was a fun way to put some of those thoughts out there.

I divided these up into two areas:

The Consumer:

Business Strategy:

It’s always nice when you get on the marketing distribution list from companies. I love to get the PR and marketing materials to review. Medco recently sent me this document called “9 Leading Trends in Rx Plan Management: Findings from a National Peer Study“.

The survey was across 380 organizations plus 100 consultants and brokers. And, the survey was conducted prior to health reform passing so that’s an important timeline to keep in mind. It’s a nice quick read with lots of stats and charts from the survey with comparisons to last year’s numbers.

Executive Summary:

The 9 leading trends:

(The ones that surprised me here were #4 which I just haven’t seen significant movement on and #7 where I haven’t seen much in the way of mandates, but I’m on the outside looking in these days.)

#1: Transformative Shift in Benefit Philosophy

#2: Rising Costs as Key Affordability Issue

#3: Targeted but Limited Government Involvement

#4: Use of Integrated Data

#5: CDH Plans are Struggling

#6: Specialty Medication Management Programs are Increasing

#7: Mandates Over Incentives For Formulary Agents

#8: Stronger Mail Incentive Programs

#9: PBMs and Overall Healthcare Costs

One my flights over the holiday, I had a chance to read the 2010 Specialty Pharmaceuticals Facts, Figures and Trends. This is a publication put out by the Center For Healthcare Supply Chain Research. The data represents survey data from manufacturers and distributors from surveys sent out in March 2010. I pulled a handful of things that caught my eye into this post, but there is a lot more in the report that manufacturers and distributors would be interested in.

Overall Market:

Survey Data:

Again, I’m a little late on this story (too much work), but I was thinking about it after the CMS news recently that they were going allow plans with a 5-star rating to have an open enrollment season all year round. That’s a huge deal.

(If you’re don’t know what the Star Ratings are about, see the Kaiser Family Foundation piece on What’s In The Stars or if you’re working on improving your Star Ratings, you can see Silverlink’s Star Power solution.)

If you missed it earlier this year, Humana announced that they were partnering with Wal-Mart to offer the lowest national plan premium for 2011 for standalone PDP plans (see details). Consumers who select the plan will get a lower copayment when they use Wal-Mart pharmacies. (I’ve talked about limited networks before so it will be interesting to see if this gets more to be offered in the marketplace.)

“The basics of the preferred network – tight formulary and a low premium – offer an affordable value proposition for patients.” William Fleming, Vice President of Humana Pharmacy Solutions (from Drug Benefit News on 10/8/10)

This creates a network with 4,200 preferred pharmacies and 58,000 non-preferred pharmacies. Personally, I’m still surprised more people haven’t gone to the $0 copay for prescriptions at mail which Humana offers in this plan (for tier-one and tier-two). United Healthcare has recently rolled out a program called Pharmacy Saver which has some similar attributes to the Humana plan.

So, has it made a difference? We won’t know yet. I would expect it would. The economy is still tight. Seniors are budget conscious. Humana has good brand equity. Wal-Mart, especially in certain geographies, is frequented heavily by this population.

Medicare open enrollment is from November 15th thru December 31st. This certainly caught everyone’s attention when it launched. (You can see some of Adam Fein’s comments when it first was announced and here’s a more recent AP article on the topic.) In a few months, we will know a lot more.

This came out a few months ago, and I’ve been carrying it around for a while. (Here’s the summary.)

I read section 9 which is about the prescription drug benefits. A few facts from the report:

One of the more interesting things I saw is that average copays on first and second tier drugs are going up while the average coinsurance is going down. Not much but directionally interesting.

A new site I heard about is called VideoMD. Here’s one of the videos I found on it.

(But, I couldn’t use the embed code from their website so I used the embed code from YouTube.)

Why don’t healthcare bills get paid? Here’s a study from McKinsey. Not surprising is that it’s a mix of lack of understanding and lack of resources. It would be interesting to map that to type of costs – preventative versus emergency.

Apparently, this was one of the questions for TEDMED. You can see the Twitter results using hashtag (#ideaempowered).

How would you answer?

Here’s a few of my thoughts:

How would you finish the statement?

Adam Fein was kind enough to send me an updated chart of the one I posted yesterday that comes from his new report “The 2010-11 Economic Report on Retail and Specialty Pharmacies” which will be available December 7th here – http://www.pembrokeconsulting.com/industry-reports.html.

One of the interesting things that isn’t clear in the industry is that while mail order made significant gains in the past decade, the IMS numbers show negative growth over the past few years. On the flipside, mail order numbers and new users are still a big focus across the PBMs. It begs the question of whether mail order growth without intervention programs is negative and only those with an effective retail-to-mail strategy can replace and potentially grow mail faster than people organically leave.

It also begs more discussion on the topic of retention which while a hot topic for a while hasn’t manifested itself in many rigorous programs as of yet (to my knowledge).

Another chart in the Barclay’s report that I’ve been sharing piecemeal is from Adam Fein’s analysis. [If you don’t follow him, you should. He does some great analysis on the market.]

This chart looks at which type of pharmacy (chain, mail, …) benefited the most over the past 16 years in terms of share of growth.

The report also uses 2009 numbers to rank the top pharmacies by dollars:

These 9 companies represented 44% of the pharmacy revenues in 2009.

From an article in USA Today, it sounds like tele-prescribing or virtual prescribing is making some steps forward. It’s no longer a scam business set up to allow people to skirt the system but a legitimate set of online companies leveraging technology to make it easier for patients. It will be interesting to see how this plays out.

With big companies and start-ups working in this space, it will likely take the same route as the clinics have taken in getting physician support although most of these described in the article seem to have physician involvement. Will they protest their peers?

Eventually, this won’t even be a debate as we can use home monitoring devices that plug into our computer or smartphone or iPad app to tell temperature, blood pressure, and other key statistics. I can see some cool scenarios being explored about how to allow the physician to do a virtual physical exam to complement the patient reported data. I can also believe that an online record of the patient’s symptoms will be easier to pull into an EMR / PHR than the physician’s notes.

The one thing the article doesn’t bring up is why the physician isn’t accessing a PHR (personal health record) to conduct the exam. I would think that should be a requirement for patients to use this. Make them go thru the step of pulling their history into an online tool and adding data about OTCs and allergies. Then, the virtual consultation would have a physician with all (most) of the data readily available.

You match that with some specific symptoms, some realtime data, and you have a recipe for improved care.

The three companies that the article mentions are:

I’ve talked about it before – augmented reality. I love the concept and the technology. There are so many things you can do with it. I was reading the post the Healthcare Blog about this a few minutes ago and realized what a great healthcare use it would have in grocery shopping. Imagine that you look at different items on the shelves and it helps you see their calories and fat content. You could probably even develop an application to help you select foods that when paired with your food at home create a meal.

This could be great. I think crossing this last mile of linking healthy behaviors to shopping is critical path to helping people make smarter decisions and augmented reality could go a long way in accomplishing this.

Plus, if you add in a Yelp type rating system you can see what people and y our peers think of different products and brands. Watch out consumer products companies.

If you have detailed questions on prescriptions, would you talk to your physician or your pharmacist? I’d certainly talk to my pharmacist. That’s their job while the physician is there to diagnose and treat. I don’t think they can keep up with all the 10,000+ prescriptions in the market.

But, apparently, I’m not the norm (not a big surprise on most things).

Here’s another great analysis by my friends at Barclays Capital (contact Meredith Adler). It’s amazing to see the correlation of these two variables:

It begs the question of why those last few manufacturers get into the market.

It’s amazing to look at the increasing gap over time between the price of a brand drug and the price of a generic drug. There are a few things going on:

But, regardless of the logic behind it, it is dramatic.

(Note: Research from Meredith Adler and team at Barclays.)

Apparently, there is a trend toward smaller homes (although I don’t see it out in the burbs). The median home size has dropped from 2,300 square feet in 2007 to 2,100 square feet with more than 1/3 of Americans saying their ideal size is below 2,000 square feet. (stats from article)

This makes me wonder if having less room will encourage people to get out of the house more. Go out in the yard and play. Go out to the gym. Be more social.

Will this encourage more neighborhood interaction? Since we know that social pressures affect our decisions around smoking, eating, and exercise, this would seem like a good thing.

It would be an interesting thing to study at a macro level.

I’m catching up on a few things this week. One of those is sharing my notes from the CVS Caremark Insights 2010 publication (their drug trend report). While this year’s report outlines all of the traditional things you would expect – trend, spend by condition, market conditions, generic pipeline, I really thought the exciting information was at the end where they really begin to stitch together the retail / PBM model. I’ve talked about why I believe in this model so strongly in the past (you can also see some of their executive’s comments here). And, I think my perceptions about the future of pharmacists create lots of opportunity for a combined entity. I also think they hint at some of the insights they gained from research around non-adherence and around abandonment which is important and creates a foundation for them around predictive modeling and focused interventions.

“With overall goals of reducing health care cost and improving member outcomes, health plan respondents in our 2010 benefit planning survey placed high value on proactive member outreach (93 percent), multi-channel access for members (87 percent) and opportunities for face-to-face consultation (73 percent)—all factors that can help keep members on prescribed therapies and satisfied.” (page 14)

Member retention is critical and involves a balance of copay levels, premiums and drug coverage as well as less tangible factors. Member satisfaction plays a significant role in loyalty and re-enrollment. High-performing plans focus on effective member communication and outreach as well as added-value services such as the CVS ExtraCare Health card.

For a 1M member population, ~$12M is spent each year on 18 drugs that are administered to patients who do not respond and/or who are more likely to experience drug-induced medical complications.

“Diabetes is one of the most prevalent and expensive chronic diseases in the nation, costing the U.S. an estimated $174 billion a year,” said Troyen Brennan, MD, MPH, EVP and Chief Medical Officer of CVS Caremark. “The Pharmacy Advisor program improves clinical care because we are able to identify and address pharmacy-related care issues that if left unattended could result in disease progression and increased health care costs. We are also better able to engage the member in their care through multiple contact points, providing counsel that can improve adherence and help members optimize their pharmacy benefit and find the most cost effective options.” (quote from press release)

Overall, it was an easy read without a lot of fluff. It cuts to the chase and gives you a good perspective on how they think. You begin to get a feel for what they are doing differently, but I imagine that you’ll continue to see a lot more research and case studies come out in the next year about some of the work they are doing.

(Note: In the sense of disclosure, CVS Caremark is a stock that I own.)

Some people think I should be impartial on my blog. But, no one really wants to read posts that are just PR recast for the sake of driving hits to the blog. One of the things I did a lot at Express Scripts was to see new research, try to find flaws in it, point out the flaws, and then try to find ways to innovate around them. I enjoy doing that here. With a lot of my clients, I get to do that in meetings where they respect my bluntness around what they are or aren’t doing. In other cases where I’m not included in those dialogues, I may play out some of those thoughts here. Hopefully, it’s a helpful perspective.

I have a fine path to walk which is to protect the confidentiality that I have with lots of PBMs while at the same time providing a fresh perspective on the industry. I hope all of you view it that way. I know all the analysts and competitive intelligence people enjoy what I talk about and lots of industry veterans find the views worthy of discussion. But, I think of few people take the intellectual challenges personally. Don’t.

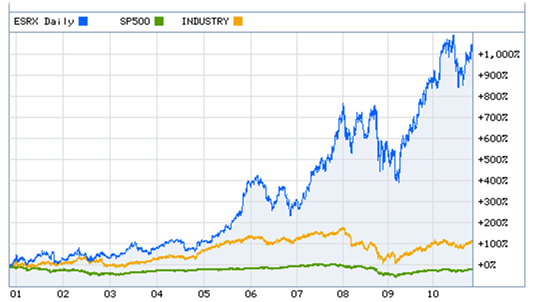

One thing that a few analysts have asked about is my thoughts on why Express Scripts stock has done so well (see below). The short answer is FOCUS. But, I’ve certainly learned from talking to them that I see things differently. I’m often looking at the edges of the strategy and the innovation versus focusing on what the day to day operations are doing. At the end of the day, the analysts and the street are pretty focused on achieving the quarterly numbers.

Some of the things that they do that have made them successful are listed below.

All the PBMs are doing interesting things. The market has become very dynamic compared to some of the “me-too” days of old. Everyone is finding their space and claiming it. The next few years will continue to be interesting.

[A point of clarification and disclosure – I do not own any individual Express Scripts stock although it may be held by some of the funds that I have invested in.]

I am way behind this year in getting thru the Drug Trend Reports and posting my comments. I think I still have to do both the CVS Caremark report and the Walgreens report…and if I can get it, the SXC report also. (You can see my thoughts from the Medco and Express Scripts Drug Trend Reports earlier.)

A few things I’ve found interesting this year were that Medco reached out via their PR group to engage me and several other bloggers in the space. And, Prime Therapeutics has always been very active in engaging me around my thoughts on their report (see comment from last year) and continued to be proactive in discussing it with me and sending me a hard copy to read on the plane.

Overall, I think their Drug Trend Report continues to improve year after year. It’s interesting in that this year I found the tone slightly more aggressive in talking about them versus their competition. Certainly, Prime is going thru some changes (if you haven’t noticed). They brought Eric Elliott on board who I think very highly of after hearing him speak and engaging him on a few topics. Eric has brought in a set of core people from Aetna, Cigna, Express Scripts, and other places to complement an existing management team that really understands the market and how to work with the Blues owners. [I personally think of them (and MedImpact or SXC) as a dark horse would could consider bidding on the Walgreen’s PBM lives while everyone is pretty focused on it being either Express Scripts or Medco.]

I came out to the Mobile Health Summit (Twitter hashtag #mhs10) in DC today, and I had the opportunity to interview Todd Park who is the Chief Technology Officer (CTO) for the US Department of Health & Human Services (HHS). Todd is a great resource for the country and perhaps a surprising bureaucrat (in the nicest sense of the word) given his background as a consultant and then co-founder of athenahealth.

It was an interesting discussion starting around what his role is. The CTO role is a new role in the US government which he describes as an internal change agent who is responsible for working with HHS leadership. He described his objective as forming virtual start-ups to advance new solutions. [A radical departure for those of us that view government as a monolithic organization which is slow to change and full of red tape.]

He said that one of the first questions people ask when they see the new initiatives such as HealthCare.gov is who were the consultants he brought in from Silicon Valley to do the work. He says that it was all internal people. We talked about that being a cultural change which he described as “creating the right vision” and a “work pathway”. That sounds exactly like what one might see a change agent being responsible for – better leveraging internal assets by changing the framework for service delivery.

We talked about several of the initiatives that HHS has worked on lately:

This is much like what you would expect from a direct-to-consumer company or your health plan.

We then went on to talk about HHS as a “reservoir of innovation mojo” which needs to collaborate with the public sector. In Todd’s words, he sees government as needing to be a catalyst and enabler. When he joined, his idea was not to fly in like aliens and change HHS, but to come in and find ways to unlock the mojo which already existed.

I asked him if he sees this as being a model for the private sector. Obviously, one of the challenges we have everywhere is figuring out the right way to balance co-opetition and competition. If we’re going to “solve” our obesity epidemic, we need to have some collective knowledge and insights rather than constantly re-creating learnings in a microcosm. On the flipside, companies want to create intellectual property and sustainable differentiation. It’s not easy to balance.

But, Todd mentions that several companies are already following in the “blue button” model such as Gallup / Healthways which is making their Well Being Survey data available publicly (for FREE) for the top 200 cities.

Of course, there is a lot of work to do here. I asked him about what the government was doing to address some things at a national level (e.g., obesity) where in my mind we almost need a reframing such as that which happened with littering, smoking, or wearing our seat belts. He brought up three things that were happening:

One of the other things that we talked about was the challenge of making changes to health outcomes with the health literacy levels in the US. I suggested that we need to address this systemically as I believe we need to address financial literacy…beginning in the schools and the home. He talked about needing to making learning fun through educational games. He mentioned that the First Lady had been promoting the creation of apps to accomplish this as part of a competition. (This made me think of the iTots article in today’s USA Today.)

We closed with a quick discussion on other things that he’s monitoring that will drive healthcare innovation. He talked a lot about improvements in the provider payment system – think Accountable Care Organizations (ACOs) and Patient Centered Medical Homes (PCMH). The goal with these is the change from “pay for volume to pay for value”.

Talking to Todd gives you a positive view on what government can do. I can see him motivating his team and his prior teams to follow his vision and embrace change. I’d have to agree with Matthew Holt’s article on Todd Park from earlier this year.

Here are my notes from the discussions and presentations at the NCPDP meeting in Portland.

I went into yesterday’s NCPDP presentation expecting that I would be an outlier in proposing a radical model for pharmacists … but others had the same ideas before I spoke. I think everyone has talked about pharmacists wanting to do more counseling with their patients for years. Some of this is fulfilled with Medication Therapy Management (MTM) which began to be a compensated service under Medicare.

But, there is a huge gap in terms of what pharmacists are trained to do and what they actually do. I remember initially running into this concept when I worked on my pharmacy kiosk model. Some people saw this as a horrible thing that would replace the pharmacist. I actually saw it as a way to free up their time to focus on the patients that needed counseling not on people filling an antibiotic or getting a refill for the 30th time. In that case, I ended up going to talk to the Head of the St. Louis College of Pharmacy to see his thoughts. I remember him talking about the gap between what the students learn and the reality of what they do.

Most pharmacists (unfortunately) become high paid pill counters for much of their day. As someone said yesterday, “I didn’t go to school to learn to count in 5’s.” Another person pointed out yesterday that the top questions at the pharmacy are “How much will this cost”, “How long do I need to take this”, and “where’s the bathroom”. These aren’t things that require clinical knowledge.

There was a healthy discussion yesterday about expecting more from pharmacy technicians. For refills (which are 55% of prescriptions filled), why can’t they handle the process with oversight from the pharmacist.

Which I think brings us around full circle…

We’ve gone from a shortage of pharmacists to an overabundance of pharmacists. This has changed the paradigm. How do we leverage them?

At the same time, we have a shortage of PCPs which is likely to get worse with more insured people. Why can’t pharmacists step in here?

The change in flu shots may be the beginning. Will this be the start of all immunizations for people over 7 (as one person suggested yesterday) moving to the pharmacy? Given the profit on these, that would be a boom for the pharmacies, but it would certainly get pushback from the physician groups.

I would also suggest that the pharmacist could act as a PCP in helping manage care. Think about conditions like diabetes where the pharmacist in certain settings would have a unique ability to help the patient select food or look at devices. They could become a much more active “floor” resource for people shopping.

And, my radical idea that another presenter suggested yesterday was to look at focusing the pharmacist on new fills and initial titration. This of course would blow up the financial model in pharmacy. Why not pay them $10 or $15 per new fill and for the next 2 fills (of maintenance drugs) and then move everything to mail order, kiosks, central fill, and/or pharmacy technicians. We could write rules into the system to flag the technician to ask questions of people on statins every 12 months about getting lab work done or muscle pain.

At the end of the day, I would argue that pharmacy needs a radical overhaul like the entire healthcare system, BUT since it only represents 10-15% of total healthcare spend, some would argue that improving it be 25% (which would be huge) would only impact 2-4% of our healthcare spend. The problem with this is it’s like the PBM trying to justify adherence without looking at the impact on total health, absenteeism, and other factors.

Today, prescriptions are first line therapy for 90% of diagnosis. Over 50% of patients take 1 or more maintenance drug. And, most patients drop off their maintenance prescriptions by the end of year one. This costs us $300B a year.

Finding a new role for pharmacists and pharmacies, and giving them a better seat at the table is an imperative for change not an option. At the same time, there is a role for integrating technology into what they do to automate the simplier, repetive tasks. I’m not sure who’s the champion here, but I was emboldened by the fact that I wasn’t a radical at the conference.

Last week, CIGNA announced the launch of a mobile version of its web site. They are not the first health plan to allow mobile users optimized access to their tools and content. For instance, Aetna launched a mobile browser and mobile app earlier this year (and Caremark released its app over the summer. According to Pew, 9% of all cell phone owners now have health apps and 17% look up health or medical information on their device. It is clear that portable health information is here to stay. What’s not so clear is whether mobile users are more inclined towards a mobile version of a website or to downloading and then using health apps.

It is interesting that CIGNA did not include a health app in its announcement last week. It is possible that a similar health app is forthcoming, but that was not mentioned. Regardless, CIGNA chose to spend resources on launching its mobile browser first. Why would they do that when apps are all the rage? Could it relate to more general stats from Pew that only two-thirds of those with apps actually use them? And that older adult cell phone users in particular do not use the apps that are already on their phone?

Lately it’s not a popular opinion, but there are some who believe that apps are overhyped. Jim Balsillie, co-CEO of Research in Motion (Blackberry) “thinks the world is wrong about apps. Many are just glorified bookmarks, he argues, that aren’t necessary if you can connect customers to the Web. “I’m not going to bring developers to the Web. I’m going to make mobility Web-friendly,” he says. “Why do you need a YouTube app if you play YouTube? Why do you need an app to follow the Tour de France if you can just follow the Tour de France?” (Business Week article)

IMO, Balsillie is on target. Perhaps CIGNA agrees also.

Guest Blogger: Jeff Abraham is a Senior Director of Pharmacy Solutions at Silverlink Communications where he works with pharmacies, PBMs, and pharmaceutical manufacturers to help them design and implement multi-modal campaigns to engage consumers around their health. Jeff brings deep industry expertise including time with WebMD and Medco Health Solutions.

Here’s the presentation that I’m going to deliver tomorrow (11/2/10) at the NCPDP education event in Portland. The question posed was what are the busines models needed to survive and thrive in the new economy. My mind immediately jumped to what are the challenges in the industry, what are the trends that got us to where we are, and how can pharmacies (or PBMs) think about turning these challenges into opportunities.

At the end of the day, I think there is still lots of white space for pharmacies to leverage technology to build relationships with their clients (consumers / customers / patients). I think technology makes that scalable.

One bias that I also have long-term is that (with the right economic model) retail pharmacies should focus on the acute drugs and new prescriptions and get compensated for the initial education and titration with the patient and the physician. After that, maintenance drugs which are essentially just refills should be handled by the lowest cost option – kiosks, central fill, mail order. I think that would encourage a different payment model centered around cognitive services and encourage greater collaboration between retail and the mail order pharmacies.